Hanging Man Stock Pattern

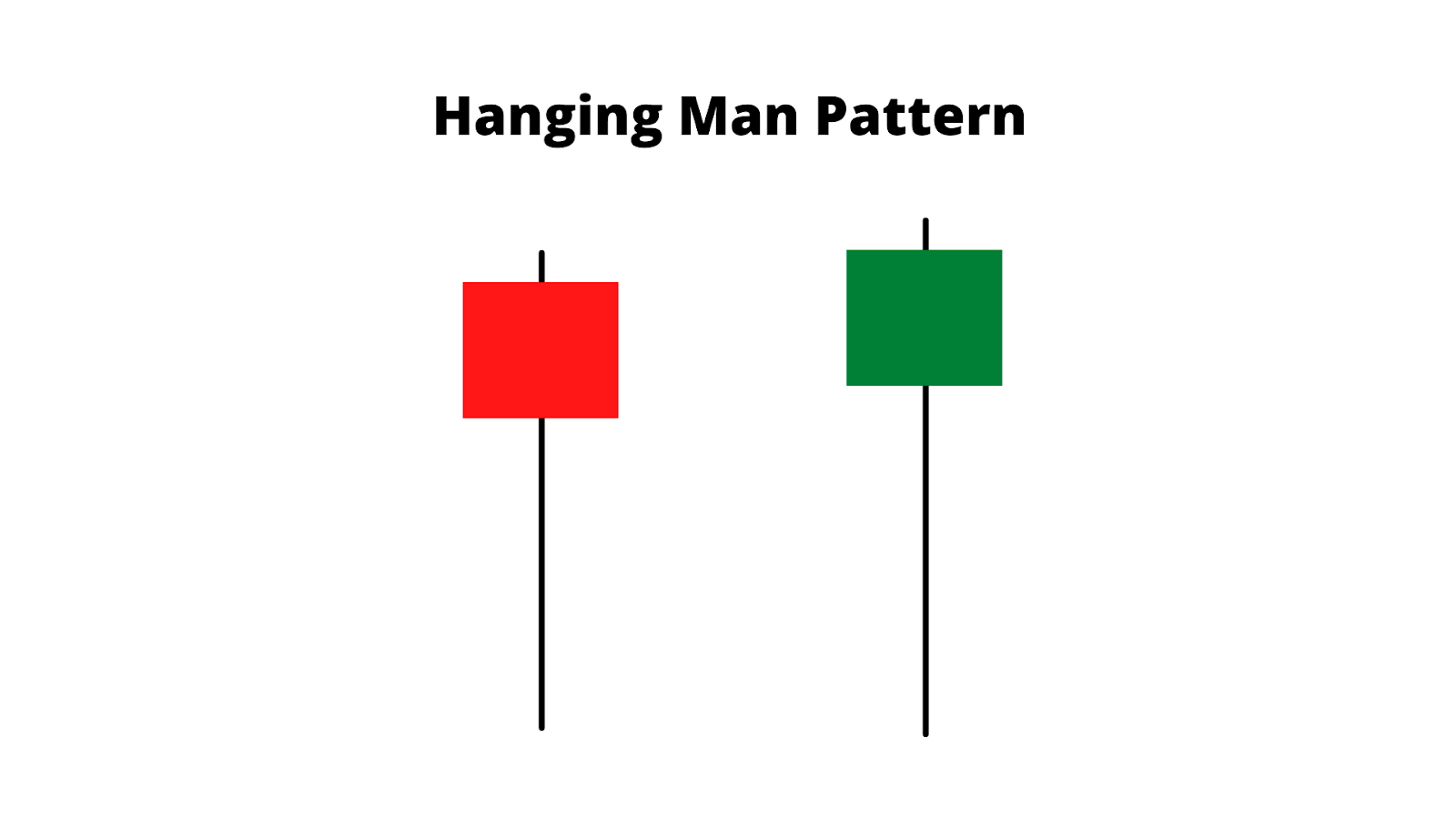

Hanging Man Stock Pattern - The hanging man is a single candlestick pattern that appears after an uptrend. The hanging man candlestick can be used to identify a short trade (bearish view of the market) as the long shadow indicates massive. Due to the uptrend reaching its peak, a reversal is likely to occur. A long lower shadow or wick The hanging man pattern is a type of candlestick pattern that typically signals a potential reversal in an uptrend. Investors use technical analysis to predict stock price movements based on historical trends. The pattern is bearish because we expect to have a bear move after a hanging man appears at the right. It’s a bearish reversal pattern. If the candlestick is green or white,. It forms at the top of an uptrend and has a small real body, a long lower shadow, and little to no upper shadow. It indicates that sellers may be gaining momentum against buyers and could potentially lead to a price decline. Web the “hanging man” is a bearish financial candlestick pattern that represents a potential reversal in an uptrend. This candlestick pattern appears at the end of the uptrend indicating weakness in. While the reversal might not occur soon, the fact that the. Web like the hammer pattern, the hanging man pattern consists of a single candlestick that is called an umbrella line. If the candlestick is green or white,. This candlestick pattern appears at the end of the uptrend indicating weakness in. Web what is the hanging man pattern? A long lower shadow or ‘wick’, at least two. Web the hanging man candlestick pattern, as one could predict from the name, is viewed as a bearish reversal pattern. If the candlestick is green or white,. Web the hanging man is a bearish reversal candlestick pattern as it shows bears are increasingly fighting the bulls on price moving up significantly. All one needs to do is find a market. A long lower shadow or ‘wick’, at least two. The pattern is bearish because we expect to have a bear move after a hanging man appears at the right. If the candlestick is green or white,. Web the hanging man candlestick pattern is characterized by a short wick (or no wick) on top of small body (the candlestick), with a. Web what is the hanging man candlestick pattern? Web what is the hanging man pattern? Web identifying hanging man candlestick trading signals. Web the hanging man candlestick pattern is characterized by a short wick (or no wick) on top of small body (the candlestick), with a long shadow underneath. A long lower shadow or ‘wick’, at least two. The candlestick pattern is a popular method that examines the shape and color of individual candlesticks to identify past reactions and predict future stock price movements. In particular, a hanging man pattern forms at the end of an uptrend. It signals a weak bull and strong bear presence in the market at the far end of an uptrend. Web the. Web in technical analysis, the hanging man patterns are a single candlestick patterns that forms primarily at the top of an uptrend. The candlestick pattern is a popular method that examines the shape and color of individual candlesticks to identify past reactions and predict future stock price movements. While the reversal might not occur soon, the fact that the bears. Named for its resemblance to a hanging figure, this pattern is identified by a small body at the top of the trading range and a long wick below, indicating that selling pressure is starting to outweigh buying momentum. Specifically, the hanging man candle has: This pattern resembles a figure hanging from its head, hence the name hanging man. It is. It is a reversal pattern characterized by a small body in the upper half of the range, a long downside wick, and little to no upper wick. Web the “hanging man” is a bearish financial candlestick pattern that represents a potential reversal in an uptrend. Web identifying hanging man candlestick trading signals. Specifically, the hanging man candle has: Candlesticks reflect. Hanging man is a bearish reversal candlestick pattern that has a long lower shadow and a small real body. Candlesticks reflect the impact of investor' emotions on security prices and are used by some technical traders to determine when to enter and exit trades. Web hanging man candles can be recognized by two features, a real body at the upper. Web like the hammer pattern, the hanging man pattern consists of a single candlestick that is called an umbrella line. An umbrella line is a long candlestick with a short real body located at the top end of the trading range, a long lower shadow, and very little or no upper shadow. This pattern is popular amongst traders as it is considered a reliable tool for predicting changes in the trend direction. In particular, a hanging man pattern forms at the end of an uptrend. Web what is a hanging man candlestick pattern? The hanging man candlestick can be used to identify a short trade (bearish view of the market) as the long shadow indicates massive. The hanging man is one of the best crypto and forex candlestick patterns. Web the hanging man candlestick chart pattern is characterised by a small body near the top of the candlestick, a long lower shadow, and little to no upper shadow. Candlesticks reflect the impact of investor' emotions on security prices and are used by some technical traders to determine when to enter and exit trades. Due to the uptrend reaching its peak, a reversal is likely to occur. A long lower shadow or ‘wick’, at least two. Web what is the hanging man candlestick pattern? Web trading the hanging man candlestick pattern is easy once a bullish trend is identified and a hanging man candle formation appears. The hanging man candlestick pattern is shown below: This pattern occurs mainly at the top of uptrends and can act as a warning of a potential reversal downward. The pattern is bearish because we expect to have a bear move after a hanging man appears at the right.

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

How to Trade the Hanging Man Candlestick ForexBoat Trading Academy

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

How to Identify Perfect Hanging Man Hanging Man Candlestick Pattern

![Hanging Man Candlestick Patterns Complete guide [ AZ ] YouTube](https://i.ytimg.com/vi/IgS8pO3g71U/maxresdefault.jpg)

Hanging Man Candlestick Patterns Complete guide [ AZ ] YouTube

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

Hanging Man Candlestick Pattern Trading Strategy

Hanging Man Candlestick Pattern Trading Strategy

Hanging Man Candlestick Pattern Complete Overview, Example

Web What Is The Hanging Man Pattern?

Web In Technical Analysis, The Hanging Man Patterns Are A Single Candlestick Patterns That Forms Primarily At The Top Of An Uptrend.

Web The Hanging Man Candlestick Pattern Is Characterized By A Short Wick (Or No Wick) On Top Of Small Body (The Candlestick), With A Long Shadow Underneath.

Specifically, The Hanging Man Candle Has:

Related Post: