Hanging Man Pattern Stocks

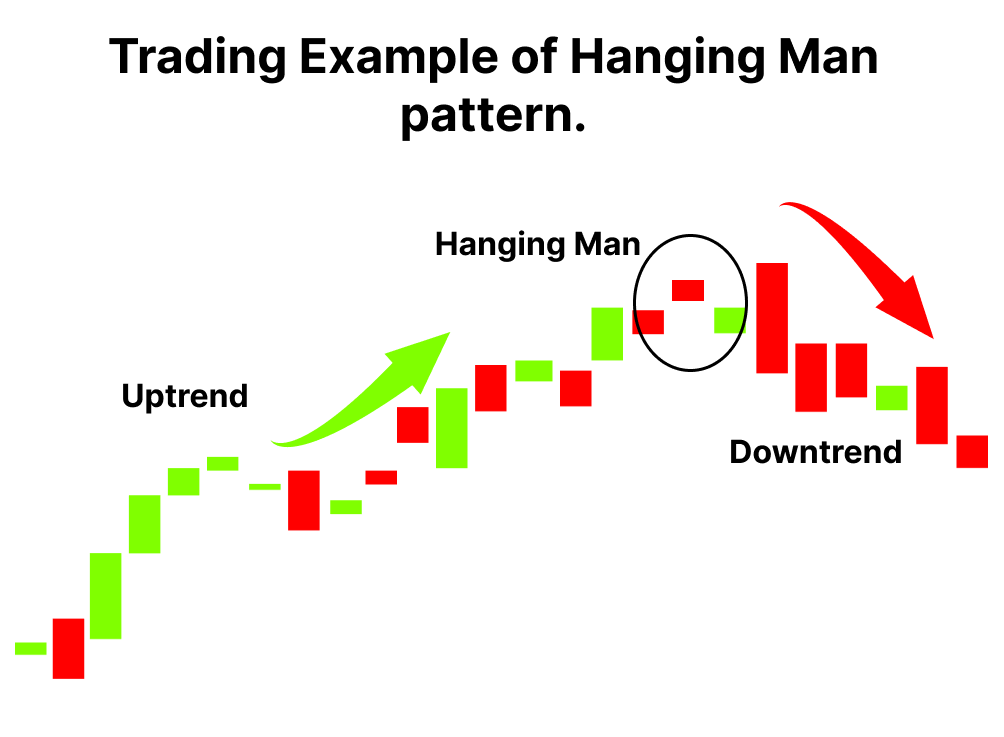

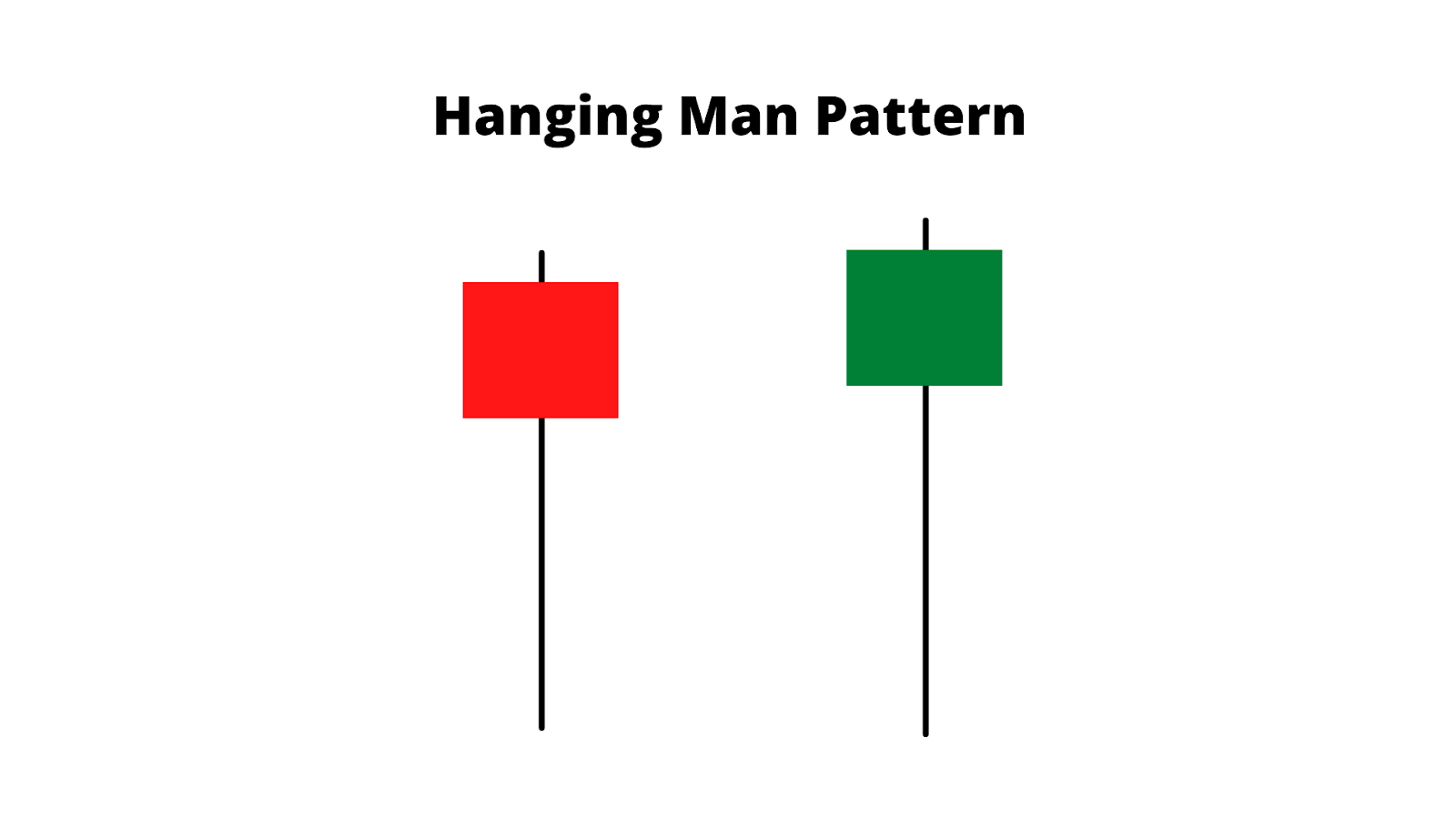

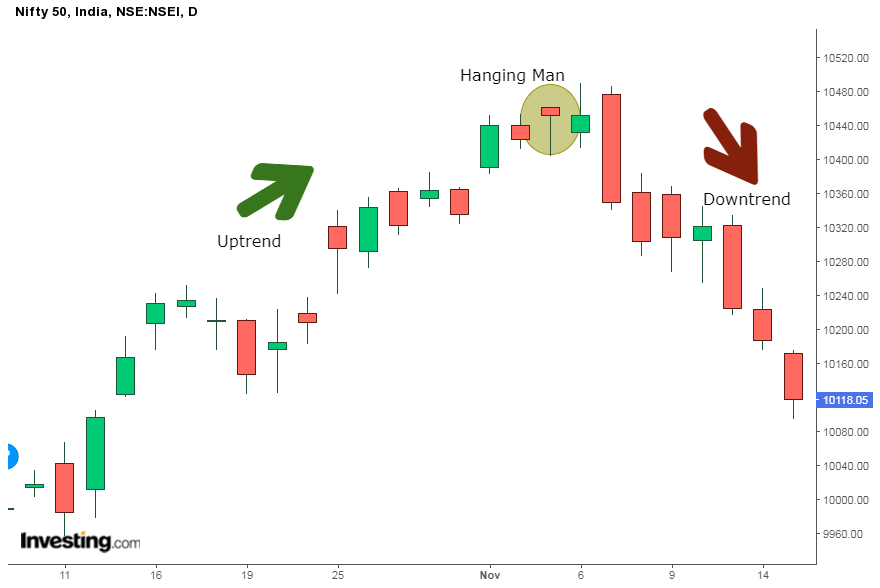

Hanging Man Pattern Stocks - Back to all stocks candlestick patterns. For a hanging man to be a hanging man, it must be. It’s recognized for indicating a potential reversal in a. The lower wick is at least twice the size of the real body. Hanging man candlestick pattern is a single candlestick pattern that if formed at an. Usually, it appears after a. Look for an existing uptrend: What is a hanging man pattern? It signifies a potential trend. If the candlestick is green or white, the asset closed higher than it opened. Web the hanging man candlestick pattern is one pattern that affirms the seller’s footprint after a long bullish swing. Usually, it appears after a. Web the hanging man pattern is bearish, and the hammer pattern is relatively bullish. If the candlestick is green or white, the asset closed higher than it opened. A paper umbrella is characterized by a long. For a hanging man to be a hanging man, it must be. Hanging man is a bearish reversal candlestick chart. The hanging man is a japanese candlestick pattern. Web the hanging man candlestick pattern is a critical chart formation that signals a potential reversal in an uptrend. Whenever it does, it usually sends a signal that a reversal is about. If the paper umbrella appears at the bottom end of a downward rally, it is called the ‘hammer’. Hanging man is a bearish reversal candlestick chart. If it is red or black, it closed lower than it opened. The hanging man is a type of candlestick pattern. Web to spot a hanging man pattern in stock or other financial instruments,. Web what does hanging man mean in stocks? Web the hanging man is a notable candlestick pattern in trading, signaling a possible shift from bullish to bearish market trends. It forms at the top of an uptrend. Web to spot a hanging man pattern in stock or other financial instruments, you may follow these key steps: Web the hanging man. Web the hanging man candlestick pattern is one pattern that affirms the seller’s footprint after a long bullish swing. It forms at the top of an uptrend. The hanging man is a type of candlestick pattern. If it is red or black, it closed lower than it opened. As you will see below, it is earily similar to the hammer. A real hanging man pattern has a wick that is. Usually, it appears after a. In distinguishing a real hanging man candlestick from an impostor, it’s important to note the length of the wick. Web the hanging man pattern is a single candlestick pattern, recognized as a bearish reversal pattern that often occurs after an uptrend. It signifies a potential. Web the hanging man candlestick pattern is a critical chart formation that signals a potential reversal in an uptrend. It’s a bearish reversal pattern. The hanging man is a japanese candlestick pattern. What is the hanging man candlestick pattern. Web the bottom line. Hanging man is a bearish reversal candlestick chart. It’s a bearish reversal pattern. Web the hanging man candlestick pattern is a critical chart formation that signals a potential reversal in an uptrend. Candlesticks displays the high, low, opening and closing prices for a security for a specific time frame. The hanging man is a type of candlestick pattern. Web the hanging man is a notable candlestick pattern in trading, signaling a possible shift from bullish to bearish market trends. Back to all stocks candlestick patterns. As you will see below, it is earily similar to the hammer. Use it to trade reversals [learn how with example charts] last updated: Web updated jun 25, 2018. Use it to trade reversals [learn how with example charts] last updated: Web a hanging man candlestick is a technical analysis bearish reversal pattern that indicates a potential trend reversal from an uptrend to a downtrend. As the name suggests, it is a candlestick pattern that happens when the financial asset is in an upward trend. Web the hanging man. Web the upper wick is tiny or absent. A real hanging man pattern has a wick that is. Look for an existing uptrend: What is a hanging man pattern? Start by identifying a prevailing. Candlesticks displays the high, low, opening and closing prices for a security for a specific time frame. The hanging man is a japanese candlestick pattern. In distinguishing a real hanging man candlestick from an impostor, it’s important to note the length of the wick. The hanging man candlestick pattern is characterized by a short wick (or no wick) on top of small body (the candlestick), with a long shadow underneath. A paper umbrella is characterized by a long lower shadow with a small upper body. It’s a bearish reversal pattern. Web the hanging man candlestick pattern is a critical chart formation that signals a potential reversal in an uptrend. Web the hanging man pattern is a single candlestick pattern, recognized as a bearish reversal pattern that often occurs after an uptrend. Web a hanging man candlestick is a technical analysis bearish reversal pattern that indicates a potential trend reversal from an uptrend to a downtrend. If it is red or black, it closed lower than it opened. Web the hanging man is a notable candlestick pattern in trading, signaling a possible shift from bullish to bearish market trends.How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

:max_bytes(150000):strip_icc()/dotdash_Final_Hanging_Man_Candlestick_Definition_and_Tactics_Nov_2020-01-0a9ec4d589e7421783e202dc28a6ec85.jpg)

Hanging Man Candlestick Definition and Tactics

What Is Hanging Man Pattern & How to Trade Using It Finschool

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

Hanging Man Candlestick Pattern Trading Strategy

What Is Hanging Man Candlestick Pattern With Examples ELM

How to Trade the Hanging Man Candlestick ForexBoat Trading Academy

How to Identify Perfect Hanging Man Hanging Man Candlestick Pattern

![Hanging Man Candlestick Patterns Complete guide [ AZ ] YouTube](https://i.ytimg.com/vi/IgS8pO3g71U/maxresdefault.jpg)

Hanging Man Candlestick Patterns Complete guide [ AZ ] YouTube

As You Will See Below, It Is Earily Similar To The Hammer.

If The Candlestick Is Green Or White, The Asset Closed Higher Than It Opened.

It Signifies A Potential Trend.

What Is The Hanging Man Candlestick Pattern.

Related Post: