Hanging Man Candlestick Pattern

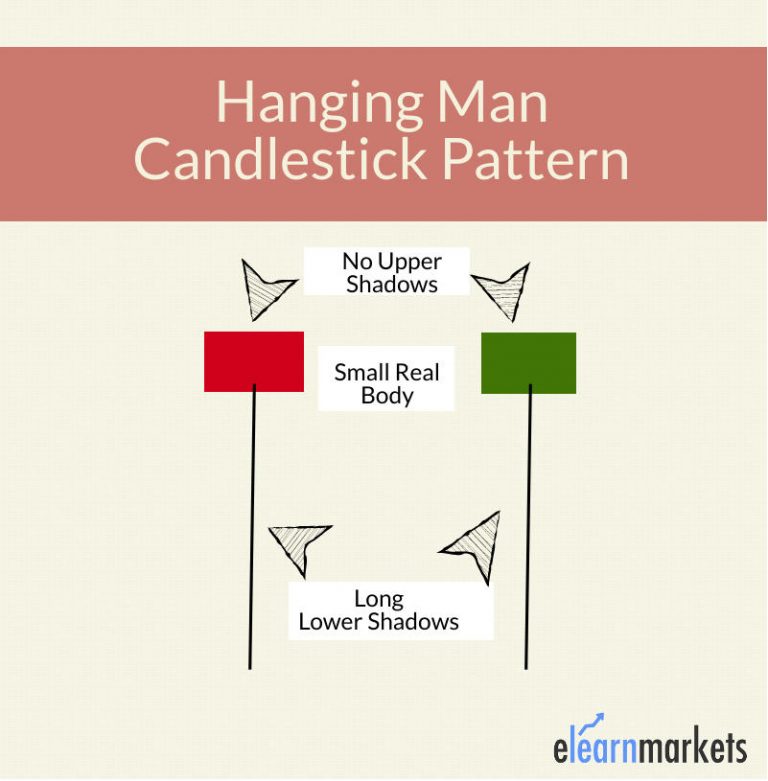

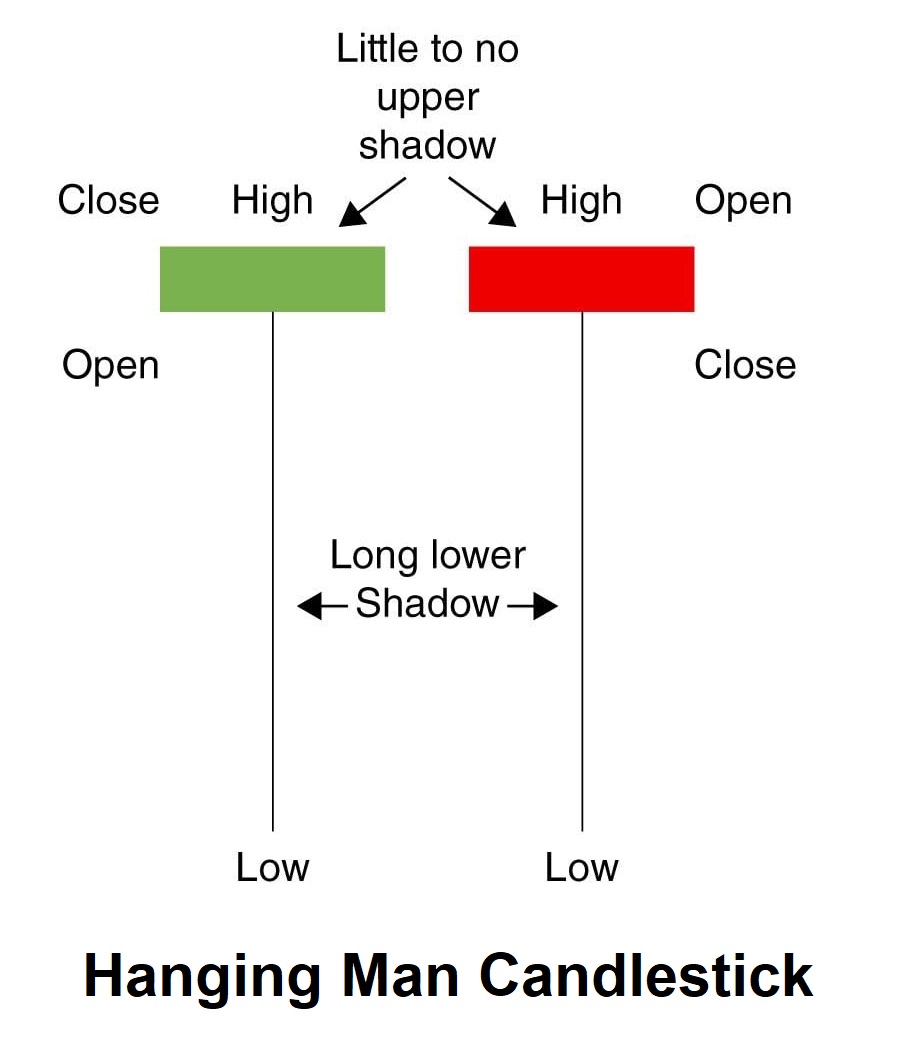

Hanging Man Candlestick Pattern - Web hanging man candlestick pattern is a single candlestick pattern that if formed at an end of an uptrend. See our patterns dictionary for other patterns. As the hanging man candle is a type of candlestick, they only appear on. Web 6 min read. Updated on october 13, 2023. Hanging man candlesticks are found near resistance levels or at the top of uptrends. This article will cover identifying, interpreting, and trading the hanging man. Web what is the hanging man pattern? If the candlestick is green or. Web want to identify potential trend reversals with ease? Hanging man candlesticks are found near resistance levels or at the top of uptrends. How to identify and use the hanging man candlestick? The pattern is bearish because we expect to have a bear move after a hanging man appears at the right location. Here are the key characteristics of the hanging man pattern: Web the hanging man candlestick pattern. The hanging man pattern is a type of candlestick pattern that typically signals a potential reversal in an uptrend. It is a reversal pattern characterized by a small body in the upper half of the range, a long downside wick, and little to no upper wick. This pattern occurs mainly at the top of uptrends and can act as a. As the hanging man candle is a type of candlestick, they only appear on. Web in technical analysis, the hanging man patterns are a single candlestick patterns that forms primarily at the top of an uptrend. The hanging man is a single candlestick pattern that appears after an uptrend. They are shaped like a hammer with a long shadow and. Web 6 min read. An umbrella line is a long candlestick with a short real body located at the top end of the trading range, a long lower shadow, and very little or no upper shadow. Look no further than the hanging man candlestick pattern! Fact checked by lucien bechard. Web the hanging man is a japanese candlestick pattern. Web the hanging man is a japanese candlestick pattern that signals the reversal of an uptrend. A hanging man candle (aptly named) is a candlestick formation that reveals a sharp increase in. It forms at the top of an uptrend and has a small real body, a long lower shadow, and little to no upper shadow. The hanging man pattern. It signals a market trend reversal in combination with another hanging candlestick pattern formed just after the first one. Look no further than the hanging man candlestick pattern! Web in technical analysis, the hanging man candle is a bearish candlestick that suggests a trend reversal is on the horizon. Web a hanging man is a bearish reversal candlestick pattern that. This pattern occurs mainly at the top of uptrends and can act as a warning of a potential reversal downward. It is formed during an upward price trend and indicates that sellers are starting to gain control and may push prices lower. Web the hanging man pattern is a single candle formation that is easily recognizable by its distinctive shape.. The advance can be small or large, but should be composed of at least a few price bars moving. Web like the hammer pattern, the hanging man pattern consists of a single candlestick that is called an umbrella line. The following features characterize it: It signals a market trend reversal in combination with another hanging candlestick pattern formed just after. It is a bearish reversal pattern that signals that the uptrend is going to end. Look no further than the hanging man candlestick pattern! Web the hanging man candlestick pattern is one pattern that affirms the seller’s footprint after a long bullish swing. Web by leo smigel. This also indicates that the bulls have lost their strength in moving the. See our patterns dictionary for other patterns. The following features characterize it: Hanging man candlesticks are found near resistance levels or at the top of uptrends. Specifically, the hanging man candle has: Web the hanging man appears frequently in a historical price series, but the trend after the breakout is dismal, ranking 87 out of 103 candle patterns where 1. They are shaped like a hammer with a long shadow and little to no upper wick. Check our candlescanner software and start trading candlestick patterns! A hanging man candlestick pattern forms during an uptrend at the far end of the phenomenon where security’s opening, high, and closing prices are equal. Web what is the hanging man pattern? How to identify and use the hanging man candlestick? They are a bearish reversal pattern. Usually, it appears after a price move to the upside and shows rejection from higher prices. The hanging man pattern is a type of candlestick pattern that typically signals a potential reversal in an uptrend. It is formed during an upward price trend and indicates that sellers are starting to gain control and may push prices lower. Web like the hammer pattern, the hanging man pattern consists of a single candlestick that is called an umbrella line. Fact checked by lucien bechard. It’s recognized for indicating a potential reversal in a bullish market, suggesting that the ongoing uptrend might be weakening. What is the hanging man candlestick? Web a hanging man candlestick is a technical analysis bearish reversal pattern that indicates a potential trend reversal from an uptrend to a downtrend. These candles are typically red or. Web the hanging man candlestick pattern is characterized by a short wick (or no wick) on top of small body (the candlestick), with a long shadow underneath.

How to Trade the Hanging Man Candlestick ForexBoat Trading Academy

![Hanging Man Candlestick Patterns Complete guide [ AZ ] YouTube](https://i.ytimg.com/vi/IgS8pO3g71U/maxresdefault.jpg)

Hanging Man Candlestick Patterns Complete guide [ AZ ] YouTube

:max_bytes(150000):strip_icc()/UnderstandingtheHangingManCandlestickPattern1-bcd8e15ed4d2423993f321ee99ec0152.png)

Understanding the 'Hanging Man' Candlestick Pattern

Hanging Man Candlestick Pattern Trading Strategy

Hanging man candlestick chart pattern. Trading signal Japanese

Hanging Man candlestick pattern with FREE PDF Download Trading PDF

What Is Hanging Man Candlestick Pattern With Examples ELM

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

Hanging Man Candlestick Pattern Complete Overview, Example

Hanging Man Candlestick Pattern

Look No Further Than The Hanging Man Candlestick Pattern!

Web By Leo Smigel.

This Pattern Is Popular Amongst Traders As It Is Considered A Reliable Tool For Predicting Changes In The Trend Direction.

The Advance Can Be Small Or Large, But Should Be Composed Of At Least A Few Price Bars Moving.

Related Post: