Hammer Stock Pattern

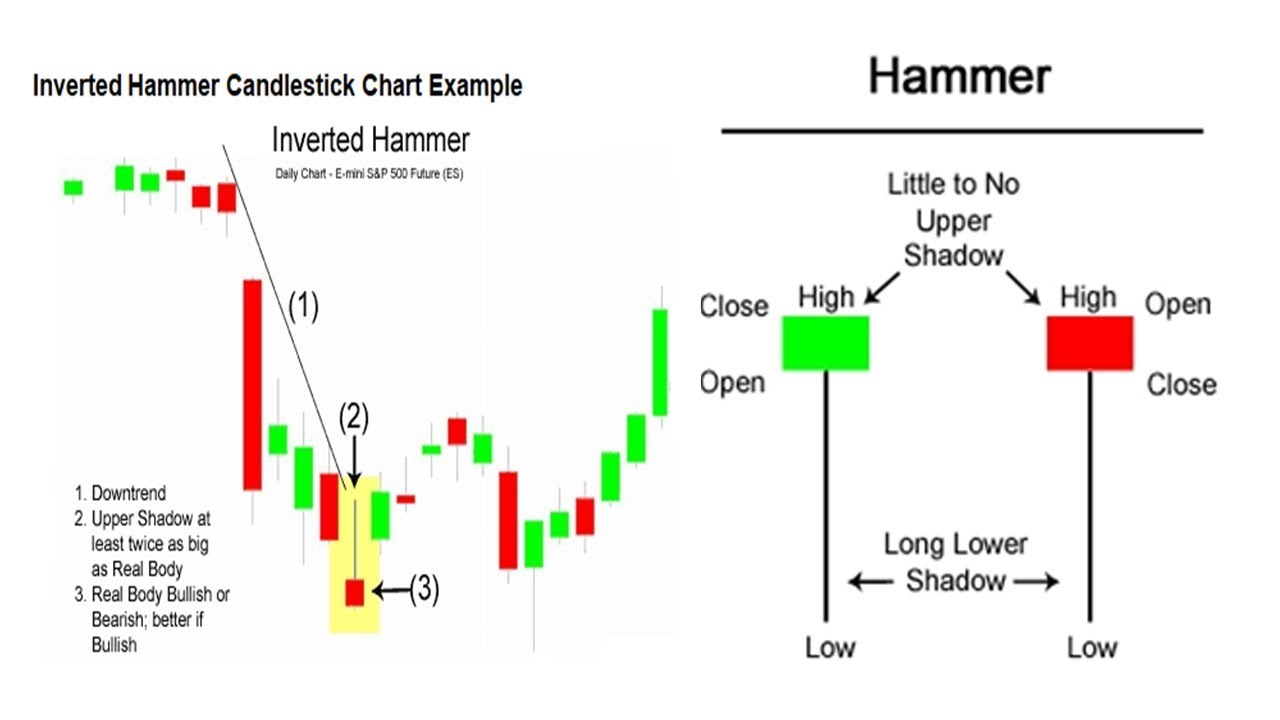

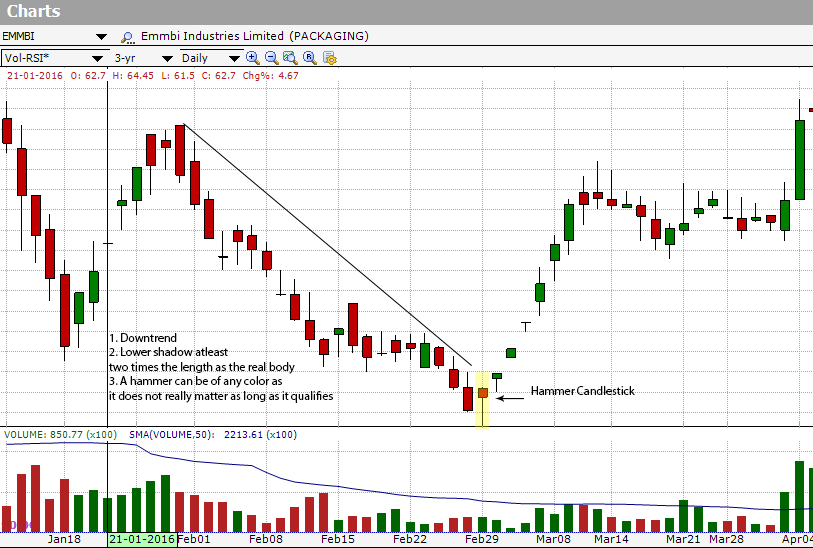

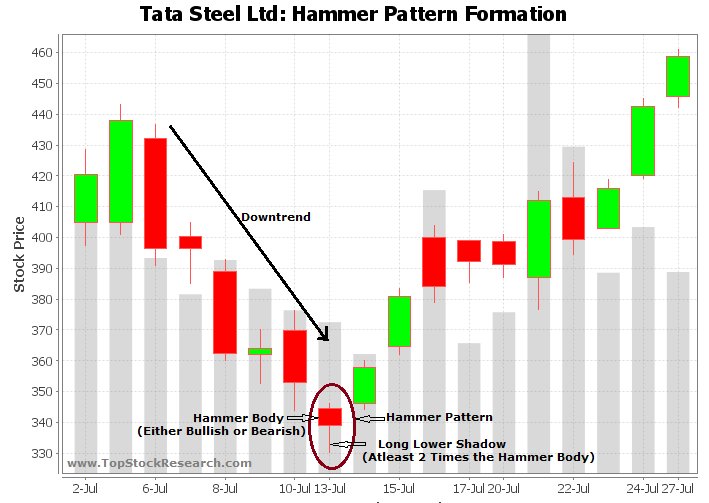

Hammer Stock Pattern - If you are viewing flipcharts of any of the candlestick patterns page, we. The long lower shadow of the hammer shows that the stock attempted to sell off during the. Web the hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. Web a hammer candle is a popular pattern in chart technical analysis. The candle is formed by a long lower. Web technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Web the hammer pattern is a significant candlestick pattern that traders frequently use in technical analysis to identify potential reversals in market trends. This pattern appears like a hammer, hence its name: Web a downtrend has been apparent in definitive healthcare corp. Web the hammer candlestick is a bullish reversal pattern that signals a potential price bottom and ensuing upward move. Web a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. This pattern appears like a hammer, hence its name: If you are viewing flipcharts of any of the candlestick patterns page, we. Learn how to identify, use, and limit hammer candlesticks with examples and psychology. The. The long lower shadow is a strong indication. Web a downtrend has been apparent in definitive healthcare corp. The following characteristics can identify it: Web a downtrend has been apparent in utz brands (utz) lately. It consists of a small real body that emerges after. It consists of a small real body that emerges after. Web this page provides a list of stocks where a specific candlestick pattern has been detected. Web in this guide to understanding the inverted hammer candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to. This pattern appears like a hammer, hence its. Web a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. While the stock has lost 5.8% over the past week, it could witness a trend reversal as a hammer chart pattern was. Web technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts,. Web the hammer is a single candlestick pattern that forms during a downtrend and signals a potential trend reversal. Web the hammer pattern is a significant candlestick pattern that traders frequently use in technical analysis to identify potential reversals in market trends. While the stock has lost 24.3% over the past week, it could witness a trend reversal as. This. Learn how to identify, use, and limit hammer candlesticks with examples and psychology. It consists of a small real body that emerges after. Web technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Web the hammer pattern consists of one candlestick with a small body, a long. On the call side, the maximum. Web the hammer candlestick is a bullish reversal pattern that signals a potential price bottom and ensuing upward move. Web in this blog post, we are going to explore the hammer candlestick pattern, a bullish reversal candlestick. While the stock has lost 24.3% over the past week, it could witness a trend reversal as.. If you are viewing flipcharts of any of the candlestick patterns page, we. Web the hammer candlestick is a bullish reversal pattern that signals a potential price bottom and ensuing upward move. Web a downtrend has been apparent in utz brands (utz) lately. The long lower shadow is a strong indication. The opening price, close, and top are approximately at. Web a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. The long lower shadow of the hammer shows that the stock attempted to sell off during the. Learn what it is, how to identify it, and how to use it for. Web in this blog post,. Learn how to identify, use, and limit hammer candlesticks with examples and psychology. Web a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. The opening price, close, and top are approximately at the same. Web the hammer pattern is a significant candlestick pattern that traders frequently. Web a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. Web the hammer candlestick is a bullish reversal pattern that signals a potential price bottom and ensuing upward move. The long lower shadow of the hammer shows that the stock attempted to sell off during the. This pattern appears like a hammer, hence its name: A hammer is a price pattern in candlestick charting that occurs when a security trades lower than its opening, but rallies near the opening price. Web the hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. Web a hammer candle is a popular pattern in chart technical analysis. Web hammer technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. The following characteristics can identify it: While the stock has lost 24.3% over the past week, it could witness a trend reversal as. Web a downtrend has been apparent in utz brands (utz) lately. Web technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Learn how to identify, use, and limit hammer candlesticks with examples and psychology. Web a downtrend has been apparent in definitive healthcare corp. Web the hammer pattern is a significant candlestick pattern that traders frequently use in technical analysis to identify potential reversals in market trends. Web in this guide to understanding the inverted hammer candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to.

How to Trade the Hammer Candlestick Pattern Pro Trading School

Tutorial on How to Trade the Inverted Hammer signalHammer and inverted

Trading The Hammer CandleStick Pattern Quick Tutorial YouTube

Hammer Patterns Chart 5 Trading Strategies for Forex Traders

Hammer, Inverted Hammer & Hanging Man Candlestick Chart Patterns

Hammer Candlestick Chart Pattern Candlestick Pattern Tekno

Candle Patterns Picking the "RIGHT" Hammer Pattern YouTube

Hammer Candlestick Pattern A Powerful Reversal Signal Forex

How To Trade Blog What Is Hammer Candlestick? 2 Ways To Trade

Inverted Hammer Candlestick Pattern Quick Trading Guide

The Candle Is Formed By A Long Lower.

Learn What It Is, How To Identify It, And How To Use It For.

Web The Hammer Is A Single Candlestick Pattern That Forms During A Downtrend And Signals A Potential Trend Reversal.

Web In This Blog Post, We Are Going To Explore The Hammer Candlestick Pattern, A Bullish Reversal Candlestick.

Related Post: