Hammer Pattern Stocks

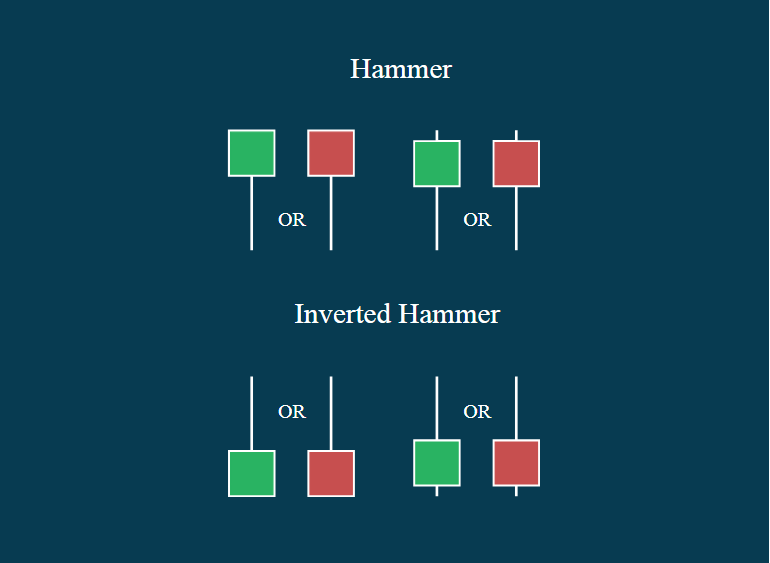

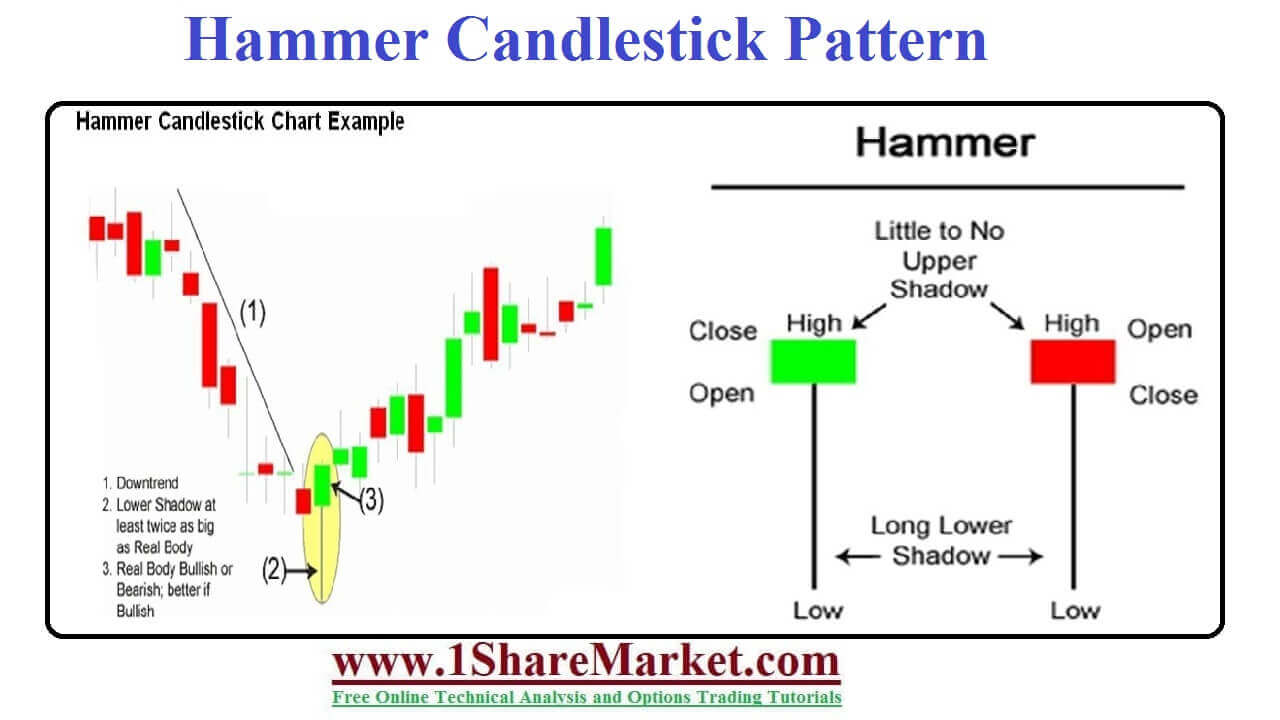

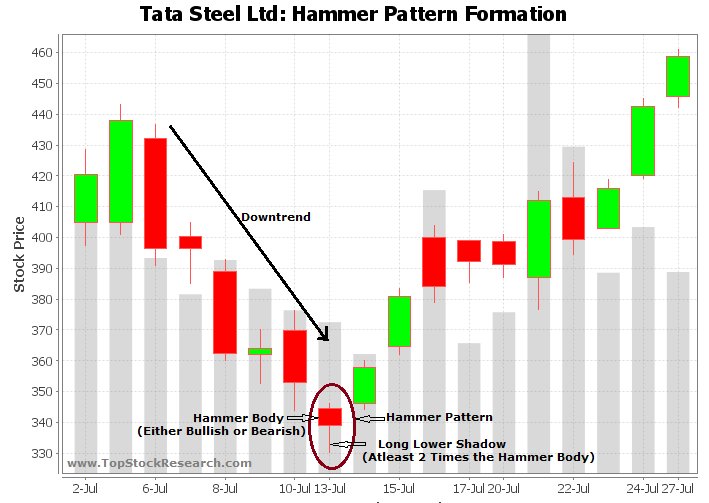

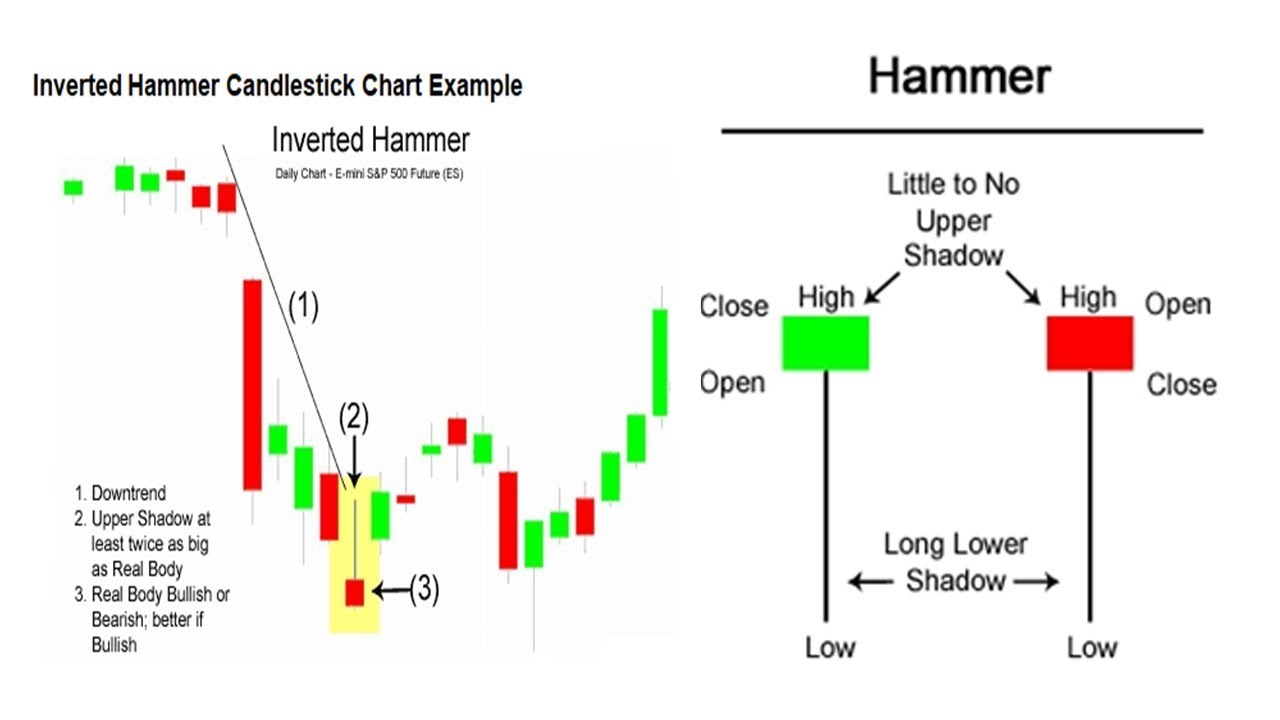

Hammer Pattern Stocks - This formation suggests a battle between buyers. Scanner guide scan examples feedback. Economists and traders analyze hammer. Web the ultimate guide to hammer candlestick patterns. Web the hammer is a popular candlestick pattern that, not surprisingly, resembles a hammer. Web the hammer candlestick pattern is considered a bullish reversal pattern in technical analysis. Web hammer candlestick formation in technical analysis: While the stock has lost 24.3% over the past week, it could witness a trend reversal as a hammer chart. Web hammer technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. If you are viewing flipcharts of any of the candlestick patterns page, we recommend. Scanner guide scan examples feedback. A hammer is a one day price pattern that occurs when a security trades significantly lower than its opening, but rallies later in the day to close either above or. If you are viewing flipcharts of any of the candlestick patterns page, we recommend. Stock passes any of the. Web hammer (1) inverted hammer (1). If you are viewing flipcharts of any of the candlestick patterns page, we recommend. Web a downtrend has been apparent in utz brands (utz) lately. Web hammer (1) inverted hammer (1) morning star (3) bullish abandoned baby (3) the hammer and inverted hammer were covered in the article introduction to candlesticks. Web the ultimate guide to hammer candlestick patterns. Web. Economists and traders analyze hammer. Web a downtrend has been apparent in utz brands (utz) lately. Scanner guide scan examples feedback. Aug 9, 2022 • 2 min read. What the pattern means in stock trading. The hammer is an unreliable and risky pattern with a low accuracy rate of 52.1%, which is hardly better than flipping a coin. Web a downtrend has been apparent in definitive healthcare corp. Economists and traders analyze hammer. It indicates the potential for the market to reverse from a downtrend to an. Web the hanging man is a type of. Web hammer (1) inverted hammer (1) morning star (3) bullish abandoned baby (3) the hammer and inverted hammer were covered in the article introduction to candlesticks. The opening price, close, and top are approximately. While the stock has lost 24.3% over the past week, it could witness a trend reversal as a hammer chart. There can be varied candlestick patterns. Updated on october 13, 2023. Web the hammer candlestick pattern is considered a bullish reversal pattern in technical analysis. Web the ultimate guide to hammer candlestick patterns. If you are viewing flipcharts of any of the candlestick patterns page, we recommend. The hammer is an unreliable and risky pattern with a low accuracy rate of 52.1%, which is hardly better. Web what is a hammer candlestick pattern? Web the hammer or the inverted hammer image by julie bang © investopedia 2021 the hammer is a bullish reversal pattern, which signals that a stock is nearing the bottom in. The hammer’s head), the top wick is very short. Web the ultimate guide to hammer candlestick patterns. This formation suggests a battle. Open & transparentover 90 currency pairsforex & cfd tradingbest forex broker There can be varied candlestick patterns in terms of formation, each with its own interpretation and implications for price direction. This pattern appears like a hammer, hence its name: Economists and traders analyze hammer. Web hammer candlestick formation in technical analysis: Aug 9, 2022 • 2 min read. It’s a bullish reversal candlestick pattern, which indicates the end. It indicates the potential for the market to reverse from a downtrend to an. Web the hammer candlestick pattern is considered a bullish reversal pattern in technical analysis. Web a hammer is a price pattern in candlestick charting that occurs when a security. This screener gives us a. Web this page provides a list of stocks where a specific candlestick pattern has been detected. Web the ultimate guide to hammer candlestick patterns. There can be varied candlestick patterns in terms of formation, each with its own interpretation and implications for price direction. It indicates the potential for the market to reverse from a. Web the hammer is a popular candlestick pattern that, not surprisingly, resembles a hammer. Web the ultimate guide to hammer candlestick patterns. Web a downtrend has been apparent in utz brands (utz) lately. Web the hammer pattern is a significant candlestick pattern that traders frequently use in technical analysis to identify potential reversals in market trends. This pattern appears like a hammer, hence its name: The opening price, close, and top are approximately. While the stock has lost 24.3% over the past week, it could witness a trend reversal as a hammer chart. Web hammer candlestick formation in technical analysis: Web the hammer candlestick pattern is frequently observed in the forex market and provides important insight into trend reversals. Open & transparentover 90 currency pairsforex & cfd tradingbest forex broker The hammer is an unreliable and risky pattern with a low accuracy rate of 52.1%, which is hardly better than flipping a coin. A hammer is a one day price pattern that occurs when a security trades significantly lower than its opening, but rallies later in the day to close either above or. It’s crucial that traders understand that there is. Web what is a hammer candlestick pattern? It’s a bullish reversal candlestick pattern, which indicates the end. While the stock has lost 5.8% over the past week, it could witness a trend reversal as a hammer chart pattern was.

Hammer Candlestick What Is It and How to Use It in Trend Reversal

Hammer candlestick pattern Defination with Advantages and limitation

Inverted Hammer Candlestick Pattern Quick Trading Guide

Hammer Candlestick Chart Pattern Candlestick Pattern Tekno

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

Tutorial on How to Trade the Inverted Hammer signalHammer and inverted

How to Trade the Hammer Candlestick Pattern Pro Trading School

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

Hammer Candlestick Pattern A Powerful Reversal Signal Forex

Hammer Candlestick Pattern Trading Guide

Web Hammer Technical & Fundamental Stock Screener, Scan Stocks Based On Rsi, Pe, Macd, Breakouts, Divergence, Growth, Book Vlaue, Market Cap, Dividend Yield Etc.

This Screener Gives Us A.

Economists And Traders Analyze Hammer.

Web Hammer (1) Inverted Hammer (1) Morning Star (3) Bullish Abandoned Baby (3) The Hammer And Inverted Hammer Were Covered In The Article Introduction To Candlesticks.

Related Post: