Hammer Pattern Chart

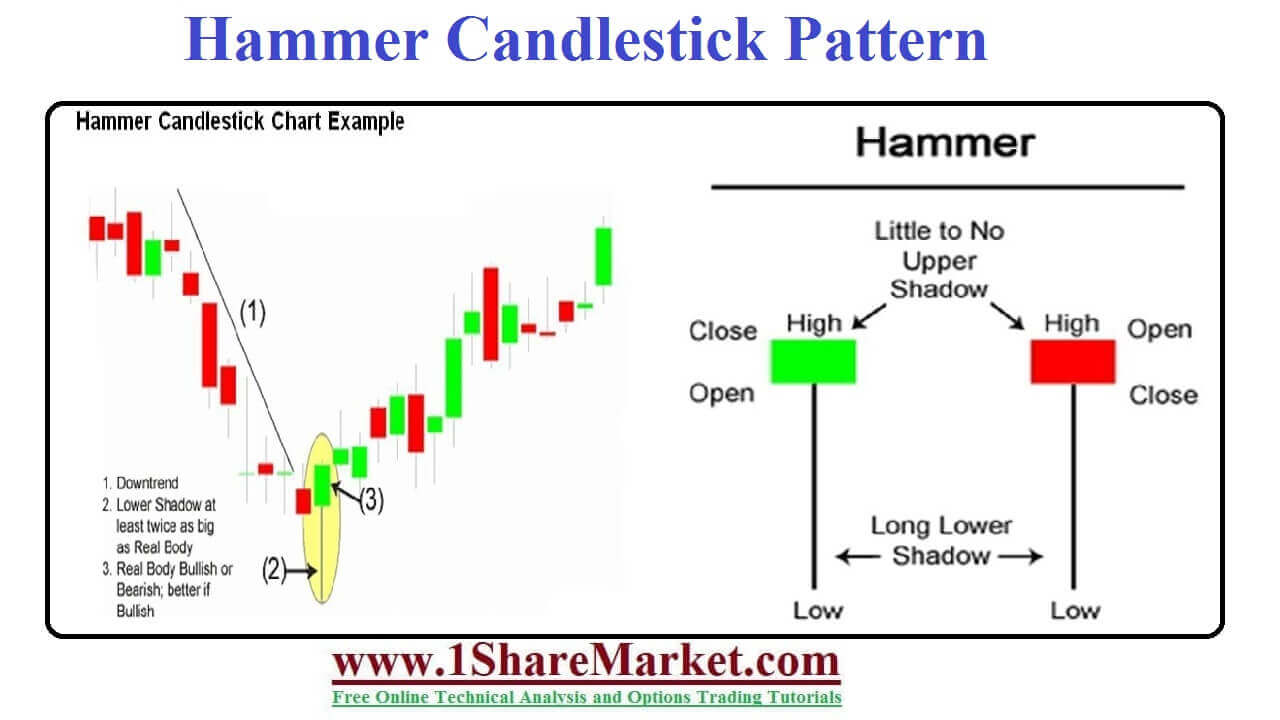

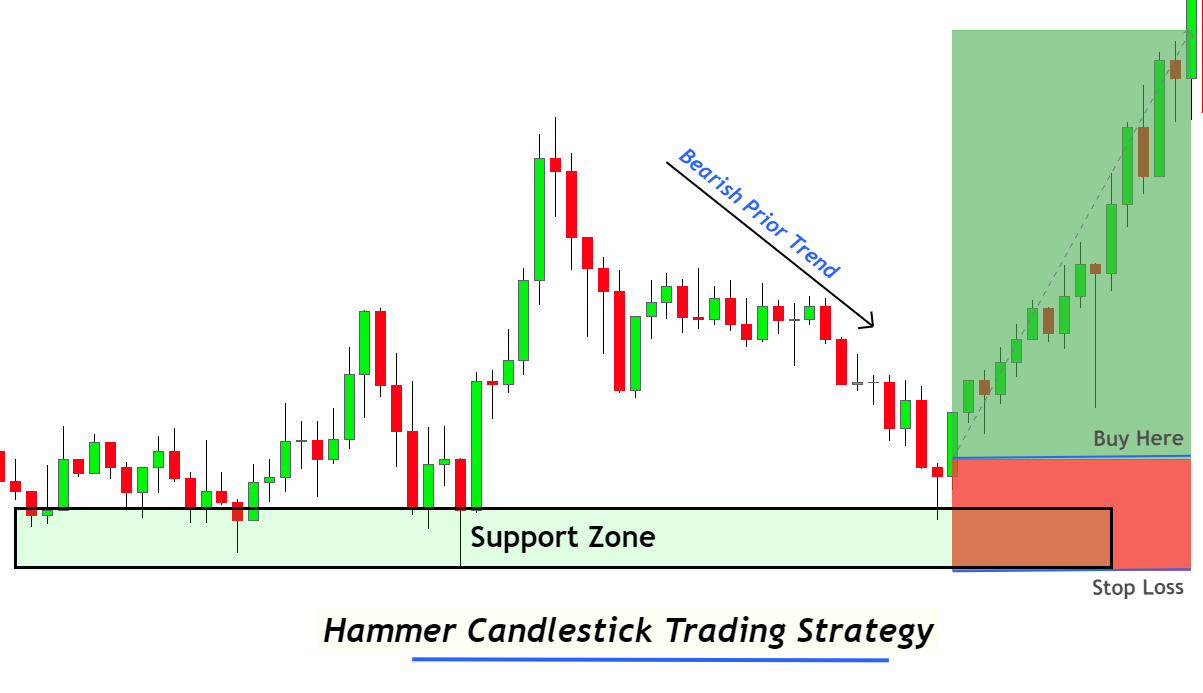

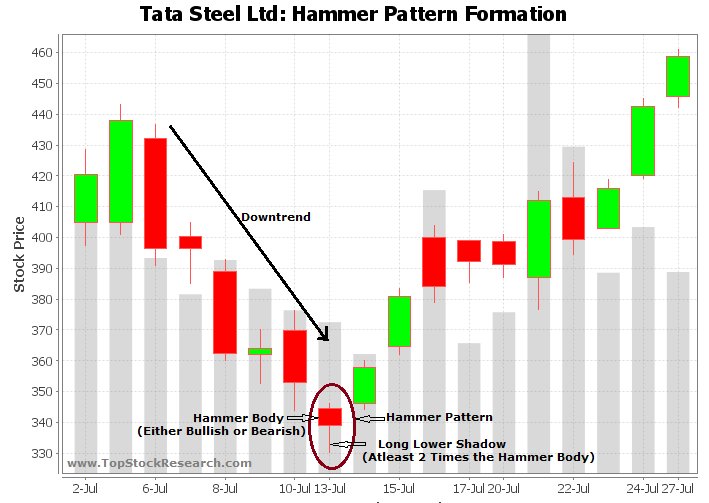

Hammer Pattern Chart - It consists of a lower shadow which is twice long as the real body. In short, a hammer consists of a small real body that is found in the upper half of the candle’s range. What is the hammer pattern? This candlestick is formed when the open and close prices are almost the same. With the broader trend still weak, traders can keep an eye on the high of the bullish reversal hammer. Web a downtrend has been apparent in definitive healthcare corp. Web below are some of the key bullish reversal patterns with the number of candlesticks required in parentheses. Steve nison is credited with bringing japanese candlestick charting to the west. In his book japanese candlestick charting techniques he describes hammer patterns with the following characteristics: We can most likely spot this candlestick on support levels where prices decline and show rejection from lower levels. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. Web understanding hammer chart and the technique to trade it. What does a hammer signal? Web below are some of the key bullish reversal patterns with the number. The marked black candle occurrence is preceded by a number of black candles formed at a high trading volume, creating a significant resistance zone. As it is a bullish reversal candlestick pattern, it occurs at the bottom of a downtrend. Hanging man vs hammer candlestick pattern. Like any other candlestick pattern, it can be particularly useful in tracking price action. As it is a bullish reversal candlestick pattern, it occurs at the bottom of a downtrend. It’s crucial that traders understand that there is more to the. The hammer candlestick pattern is viewed as a potential reversal signal when it appears after a trend or during a downtrend. Web below are some of the key bullish reversal patterns with the. A minor difference between the opening and closing prices forms a small. In japanese, it is called takuri meaning feeling the bottom with your foot or trying to measure the depth. the hammer is a classic bottom reversal pattern that warns traders that prices have reached the bottom and are going to move up. Web a hammer is a price. Candlesticks display a security's high, low,. Web illustrated guide to hammer candlestick patterns last updated: Candlesticks are graphical representations of price movements for a given period of time. It signals that the market is about to change trend direction and advance to new heights. Web the aspects of a candlestick pattern. Like any other candlestick pattern, it can be particularly useful in tracking price action for the purpose of setting up trades. Steve nison is credited with bringing japanese candlestick charting to the west. How to identify a hammer candlestick chart pattern. While the stock has lost 24.3% over the past week, it could witness a trend reversal as a hammer. Web a downtrend has been apparent in definitive healthcare corp. Web the hanging man is a type of candlestick pattern that refers to the candle's shape and appearance and represents a potential reversal in an uptrend. Little to no upper shadow. Bullish engulfing (2) piercing pattern (2) bullish harami (2) hammer (1) inverted hammer (1) morning star (3) bullish abandoned. Web the hammer candle is another japanese candlestick pattern among these 35 powerful candlestick patterns. Hammer patterns don’t always work. With the broader trend still weak, traders can keep an eye on the high of the bullish reversal hammer. Hanging man vs hammer candlestick pattern. The first half of the chart presents a clear downtrend. Web the hammer pattern | candlestick patterns| chart formations. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. It’s crucial that traders understand that there is more to the. Web the hammer candle is another japanese candlestick pattern among these 35 powerful candlestick patterns. Web a hammer is a bullish. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. Traders use this pattern as an early indication that the previous is about to reverse and to identify a reliable price level to open a buy trade. Example. A small body at the upper end of the trading range. Web the hanging man is a type of candlestick pattern that refers to the candle's shape and appearance and represents a potential reversal in an uptrend. On the next day, the market almost cancelled the. Traders use this pattern as an early indication that the previous is about to reverse and to identify a reliable price level to open a buy trade. Web the hammer candlestick pattern is frequently observed in the forex market and provides important insight into trend reversals. It’s a bullish reversal candlestick pattern, which indicates the end of a downtrend and the start of a new uptrend. Web candle patterns that appear on the intraday page and the weekly page are stronger indicators of the candlestick pattern. Web the aspects of a candlestick pattern. Like any other candlestick pattern, it can be particularly useful in tracking price action for the purpose of setting up trades. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. Web the bullish hammer is a single candle pattern found at the bottom of a downtrend that signals a turning point from a bearish to a bullish market sentiment. The hammer candlestick pattern is viewed as a potential reversal signal when it appears after a trend or during a downtrend. How to trade the hammer candlestick. The opening price, close, and top are approximately at the same price, while there is a long wick that extends lower, twice as big as the short body. Web understanding hammer chart and the technique to trade it. How to identify a hammer candlestick chart pattern.

Hammer Patterns Chart 5 Trading Strategies for Forex Traders

Hammer candlestick pattern Defination with Advantages and limitation

Hammer Candlestick Example & How To Use 2023

Hammer Candlesticks Chart Patterns ThinkMarkets UK

Hammer Candlestick Pattern Trading Guide

Bullish Hammer Candlestick Pattern A Trend Trader's Guide ForexBee

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

Hammer Candlestick Pattern Trading Guide

Tutorial on Hammer Candlestick Pattern

Web A Hammer Candlestick Pattern Is A Bullish Reversal Pattern That Is Used To Indicate A Potential Reversal Of A Downward Trend In Price.

While The Stock Has Lost 24.3% Over The Past Week, It Could Witness A Trend Reversal As A Hammer Chart Pattern Was Formed.

Candlesticks Are Graphical Representations Of Price Movements For A Given Period Of Time.

The Following Characteristics Can Identify It:

Related Post: