Hammer Pattern Candlestick

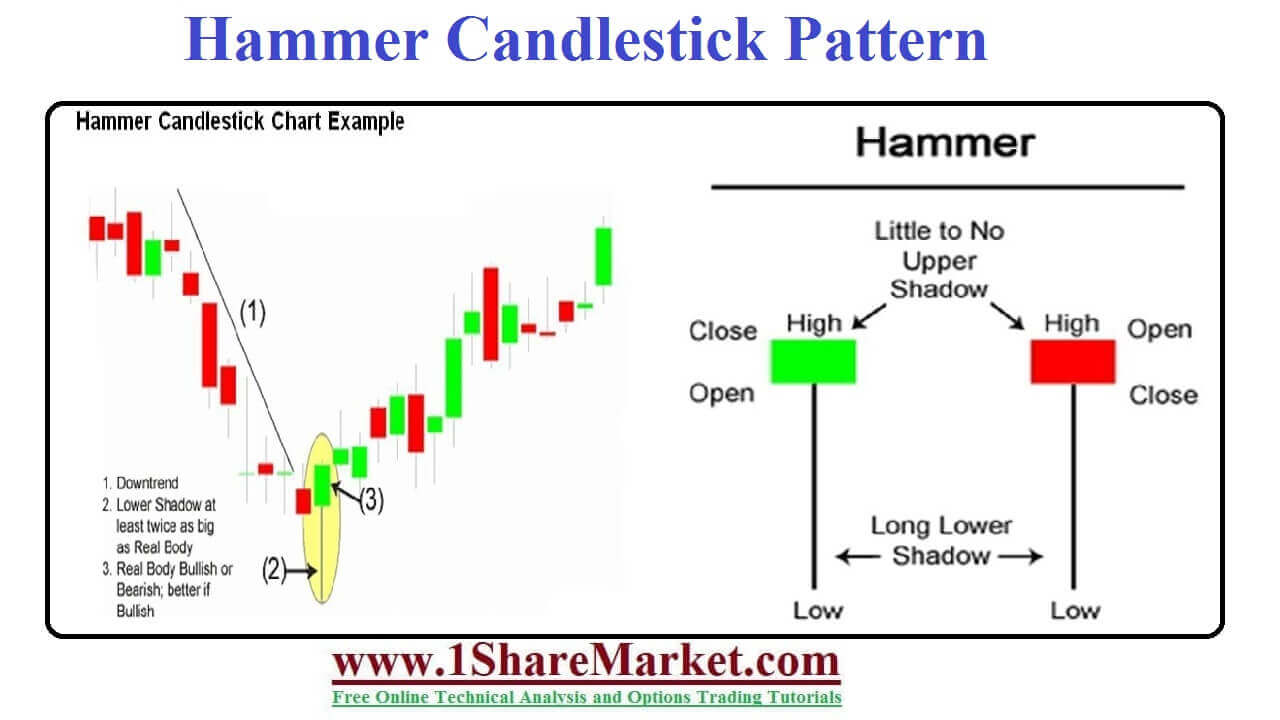

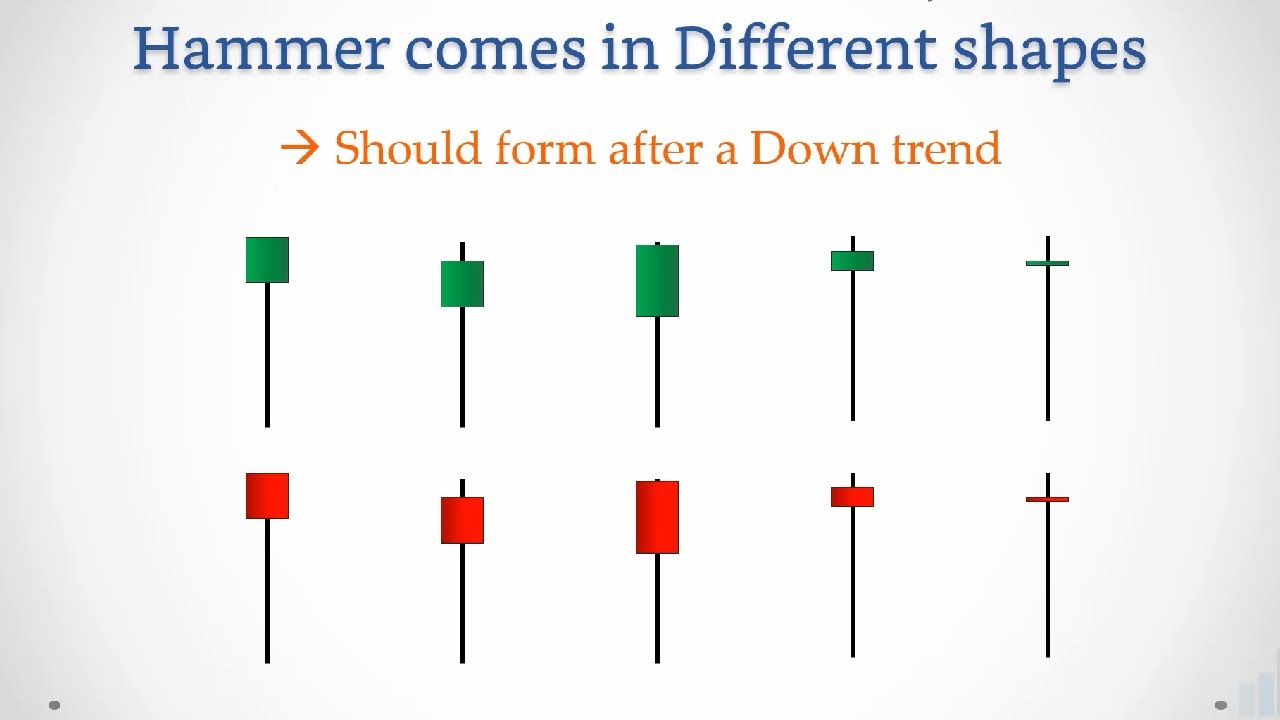

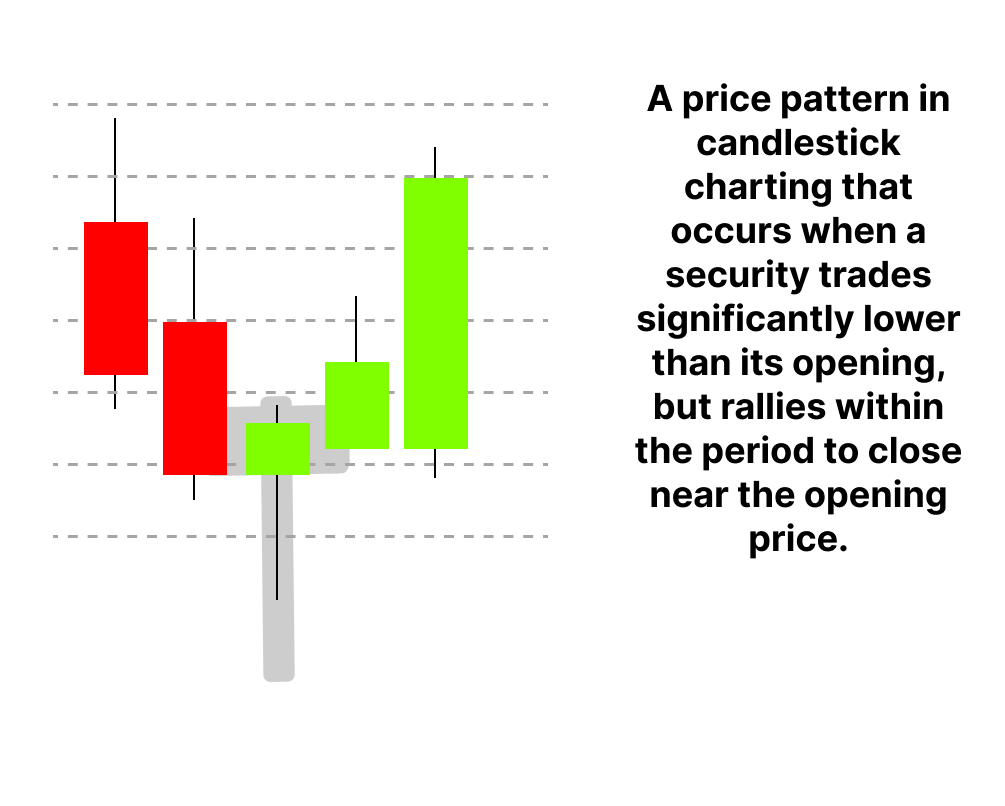

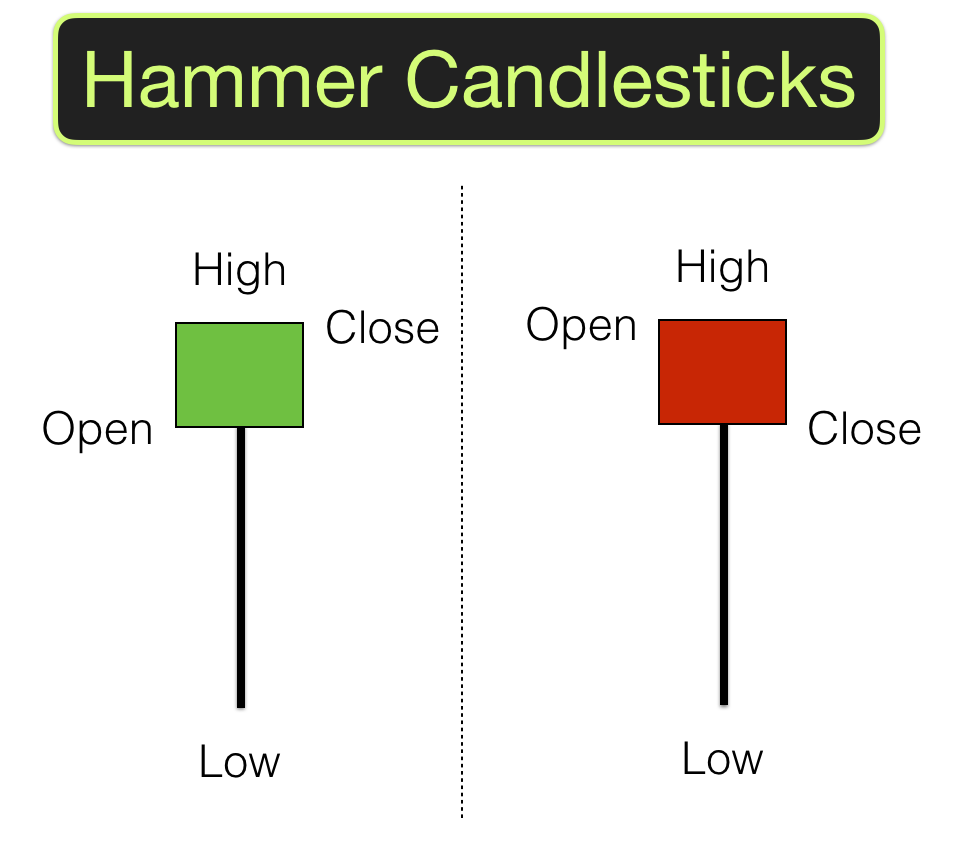

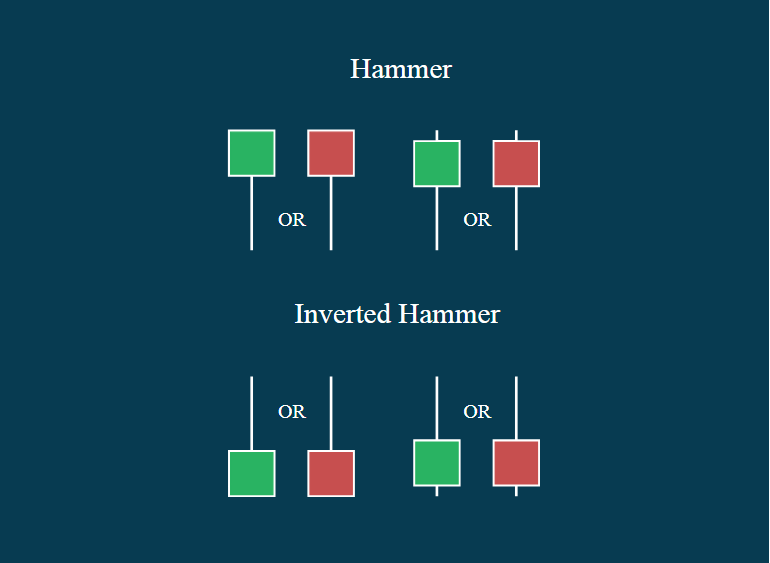

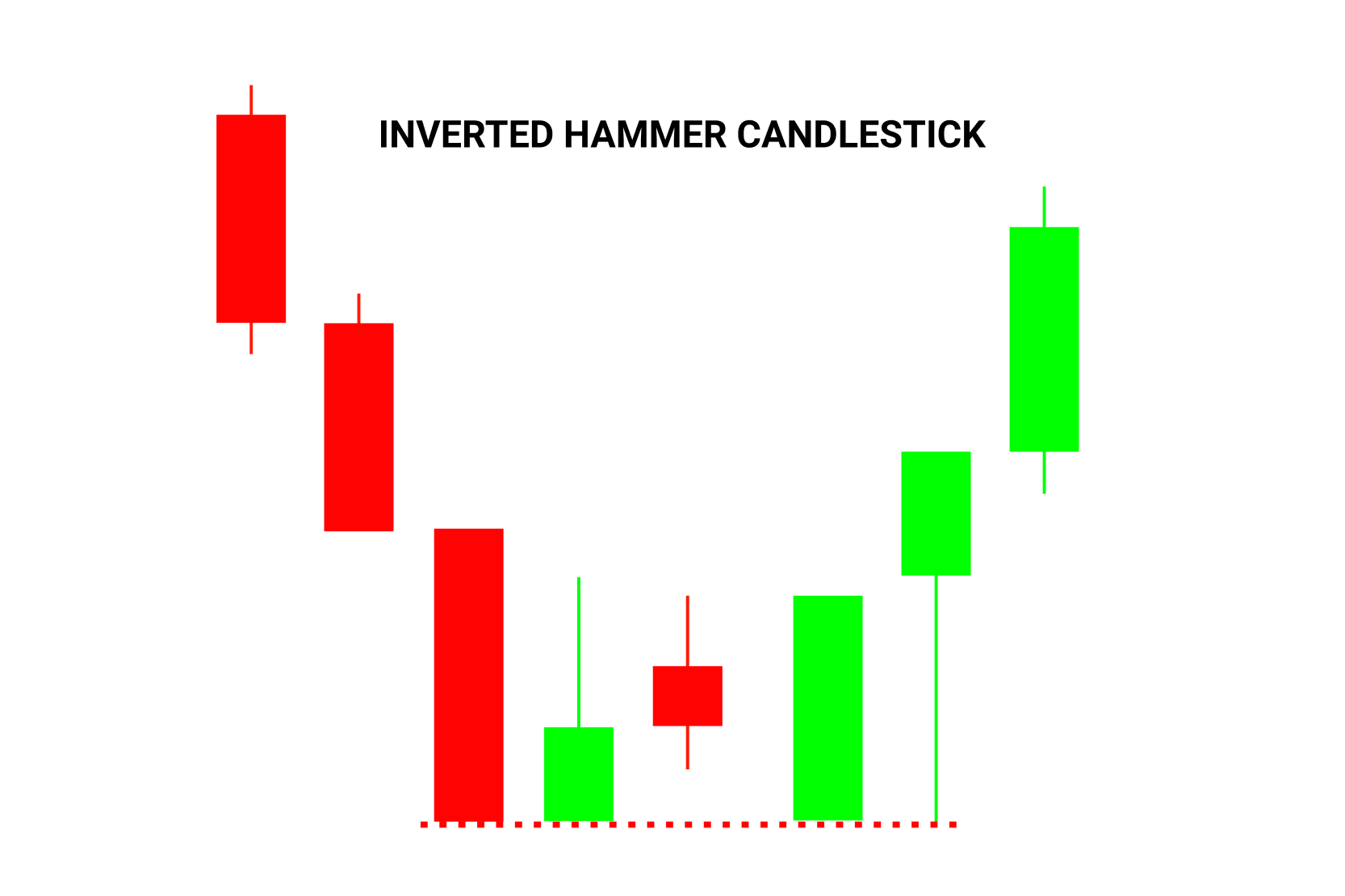

Hammer Pattern Candlestick - It is normally found at the end of a. Others include doji, shooting star, engulfing, and hanging man. Web learn how to trade the hammer and the inverted hammer patterns, two bullish reversal patterns that occur at the bottom of a downtrend. Web zacks equity research may 10, 2024. This is one of the popular price patterns in candlestick charting. Web a recognised candlestick pattern is the hammer. Web for instance, one of the bullish candlestick patterns is known as the ‘hammer’ and is formed of a short body with a long lower wick. A hammer is a price pattern in candlestick charting that occurs when a security trades lower than its opening, but rallies near the opening price. Web understanding hammer chart and the technique to trade it. Web hammer a black or white candlestick that consists of a small body near the high with little or no upper shadow and a long lower tail. A hammer shows that although. Web japanese candlestick charting techniques a contemporary guide to the ancient investment techniques of the far east. The long lower shadow of the hammer shows that the stock attempted to sell off during the. Web a recognised candlestick pattern is the hammer. Web the hammer candlestick pattern refers to the shape of a candlestick that. A hammer is a price pattern in candlestick charting that occurs when a security trades lower than its opening, but rallies near the opening price. It indicates a potential price reversal to the upside, but confirmation is required. Sold for $300 on mar 07, 2015 Web zacks equity research may 10, 2024. Web a hammer candle is a popular pattern. Learn how to identify, use, and limit hammer candlesticks with examples and. Considered a bullish pattern during a. It indicates a potential price reversal to the upside, but confirmation is required. Web the hammer candlestick pattern refers to the shape of a candlestick that resembles that of a hammer. Web a recognised candlestick pattern is the hammer. Web hammer candlestick pattern occurs when a stock trades lower than its opening price but goes up to the opening price. Web the hammer is a highly significant bullish reversal candlestick pattern in technical analysis that can signal a potential reversal in price trends. Know how to identify hammer. Web the hammer candlestick pattern is considered a bullish reversal pattern. A minor difference between the opening and. It is normally found at the end of a. Web a recognised candlestick pattern is the hammer. Web a hammer candlestick pattern is a reversal structure that forms at the bottom of a chart. This pattern appears like a hammer, hence its name: Sold for $300 on mar 07, 2015 Learn how to identify, use, and limit hammer candlesticks with examples and. Web japanese candlestick charting techniques a contemporary guide to the ancient investment techniques of the far east. It is characterized by a small body and a long lower wick, resembling a hammer, hence its. Web hammer a black or white candlestick. Web hammer a black or white candlestick that consists of a small body near the high with little or no upper shadow and a long lower tail. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. While the stock has lost 5.8% over the past week, it could witness a trend. Sold for $300. Web zacks equity research may 10, 2024. A minor difference between the opening and. Web the hammer is a highly significant bullish reversal candlestick pattern in technical analysis that can signal a potential reversal in price trends. Web understanding hammer chart and the technique to trade it. It indicates the potential for the market to reverse from a downtrend. The long lower shadow of the hammer shows that the stock attempted to sell off during the. Web hammer candlestick pattern occurs when a stock trades lower than its opening price but goes up to the opening price. Web learn how to identify, trade, and use the hammer candlestick pattern, a bullish reversal signal that indicates the end of a. These patterns signal a potential. Learn how to identify, use, and limit hammer candlesticks with examples and. A minor difference between the opening and. Web a hammer candlestick pattern is a reversal structure that forms at the bottom of a chart. Know how to identify hammer. It indicates the potential for the market to reverse from a downtrend. The long lower shadow of the hammer shows that the stock attempted to sell off during the. Web understanding hammer chart and the technique to trade it. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. It is normally found at the end of a. Sold for $300 on mar 07, 2015 This pattern forms when a market moves significantly lower after the. Know how to identify hammer. Web learn how to trade the hammer and the inverted hammer patterns, two bullish reversal patterns that occur at the bottom of a downtrend. Web zacks equity research may 10, 2024. Considered a bullish pattern during a. A minor difference between the opening and. Web hammer a black or white candlestick that consists of a small body near the high with little or no upper shadow and a long lower tail. Web the hammer candlestick pattern is considered a bullish reversal pattern in technical analysis. Web a hammer candlestick pattern is a reversal structure that forms at the bottom of a chart.

Hammer Candlestick Pattern Trading Guide

Hammer candlestick pattern Defination with Advantages and limitation

Hammer Candlestick Pattern Trading Guide

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

Hammer Candlestick Pattern Meaning, Examples & Limitations Finschool

Hammer Candlestick Patterns (Types, Strategies & Examples)

Candlestick Patterns The Definitive Guide (2021)

Hammer Candlesticks Shooting Star Candlesticks

Hammer Candlestick What Is It and How to Use It in Trend Reversal

How to Read the Inverted Hammer Candlestick Pattern? Bybit Learn

A Hammer Is A Price Pattern In Candlestick Charting That Occurs When A Security Trades Lower Than Its Opening, But Rallies Near The Opening Price.

Web The Hammer Candlestick Pattern Refers To The Shape Of A Candlestick That Resembles That Of A Hammer.

Learn How To Identify, Use, And Limit Hammer Candlesticks With Examples And.

This Pattern Appears Like A Hammer, Hence Its Name:

Related Post: