Hammer Chart Pattern

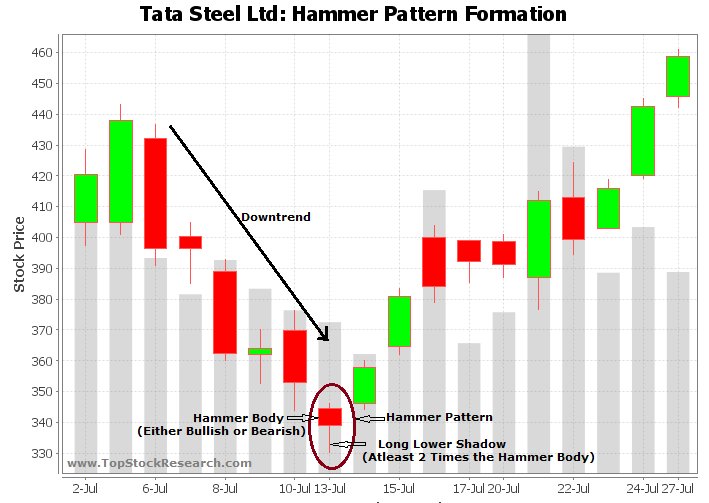

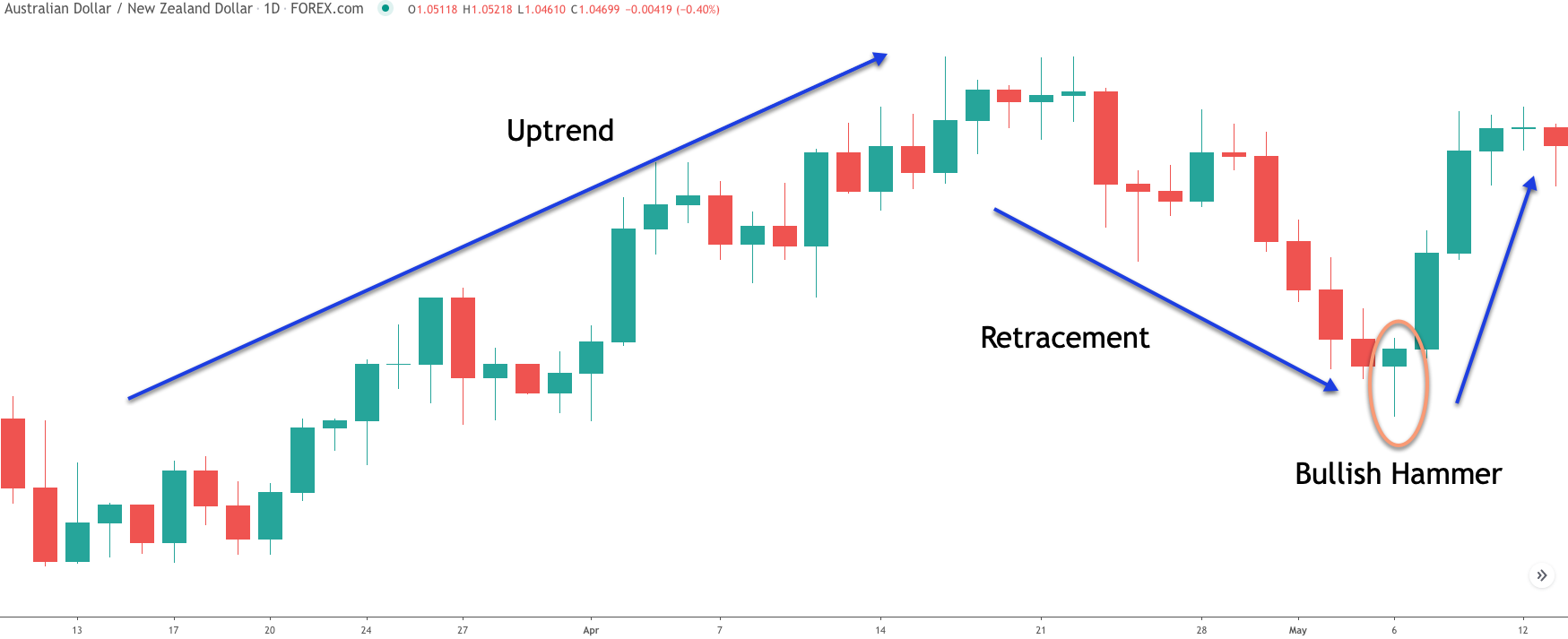

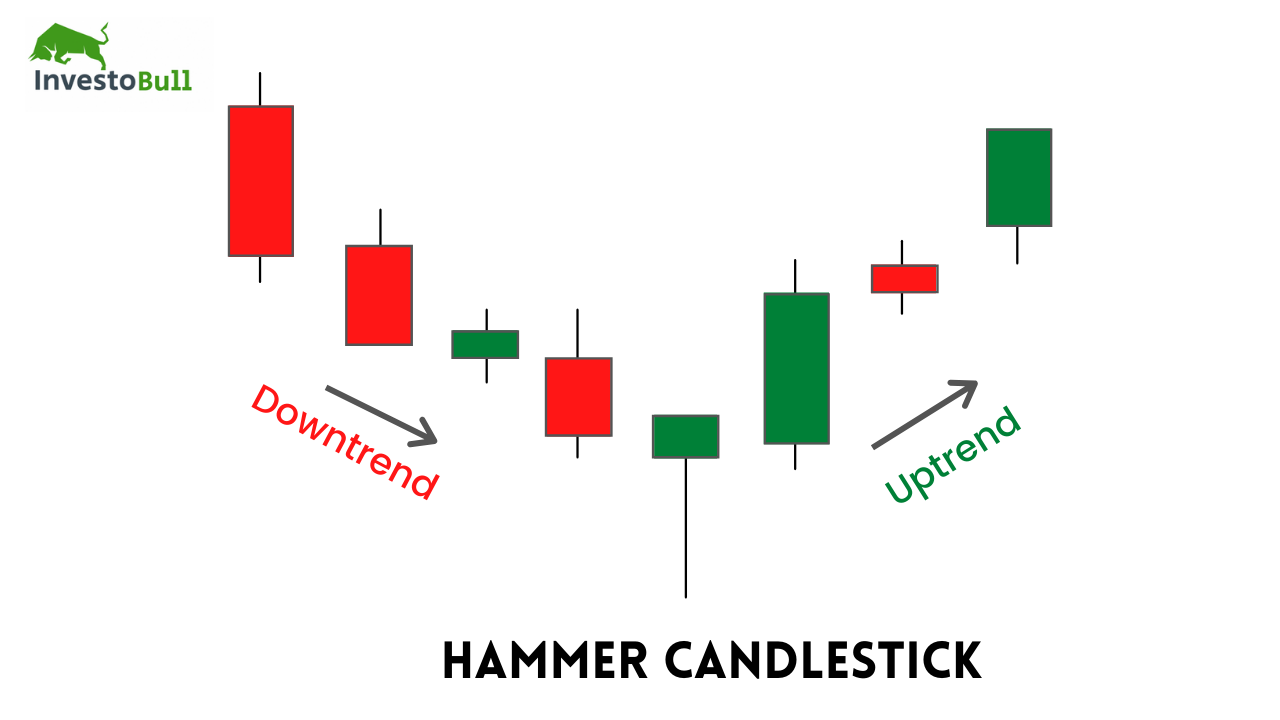

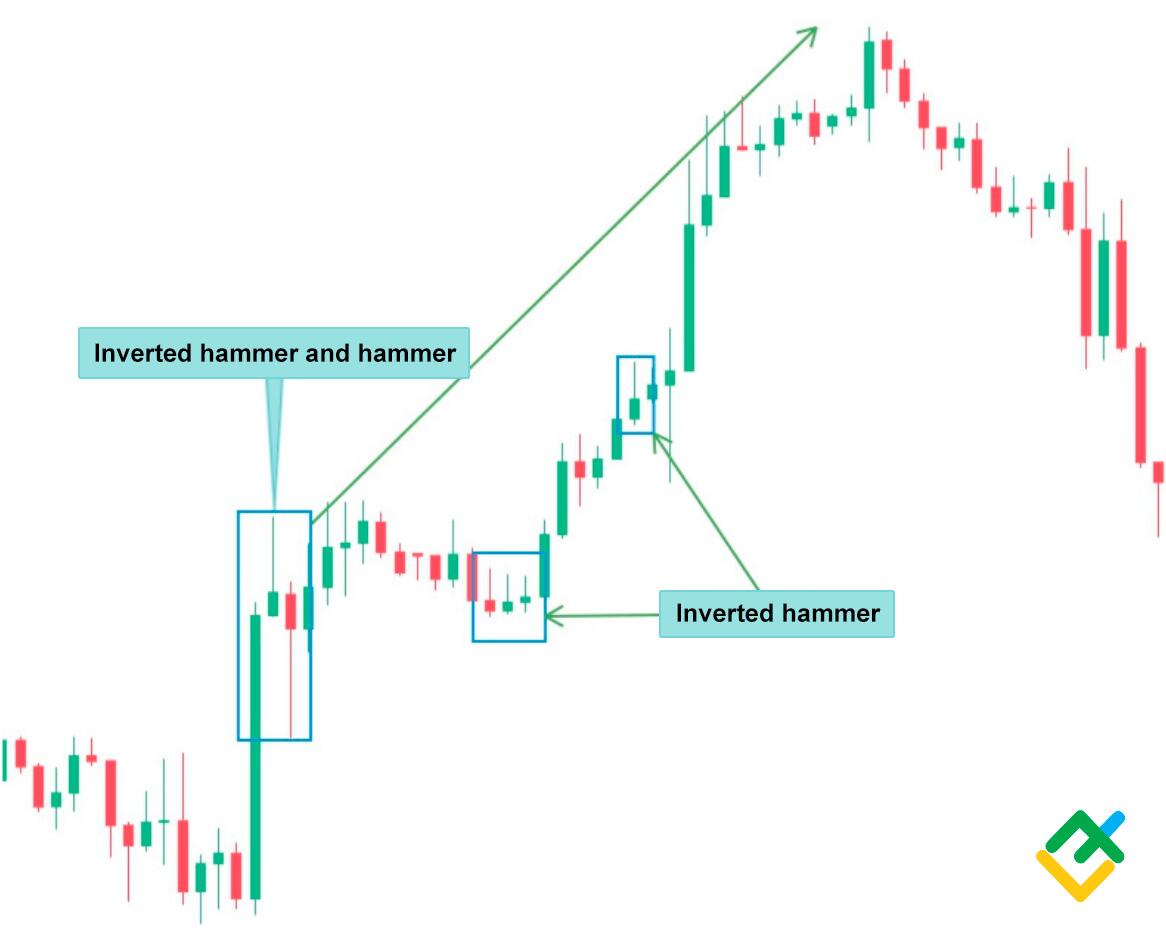

Hammer Chart Pattern - Most traders go bullish when seeing this pattern, but they’re likely to hammer their portfolio profits into oblivion with this strategy. The opening price, close, and top are. Web if the pattern appears in a chart with an upward trend indicating a bearish reversal, it is called the hanging man. In the chart above, you can see the two trade setups formed by the hammer candlestick pattern when the price pulled back to the trendline (which is a dynamic support level). This is one of the popular price patterns in candlestick charting. Price closing in the top ¼ of the candlesticks range Or look for a series of lower highs and lower lows. For investors, it’s a glimpse into market dynamics, suggesting that despite initial selling pressure, buyers are regaining control. 202 additional species this year. Web as mentioned in yesterday's blog, the index closed above the inverted hammer pattern formed on the 9 may, forming a bullish hammer pattern on the daily chart. If it appears in a downward trend indicating a bullish reversal, it is a hammer. A hammer candlestick is a chart formation that signals a potential bullish reversal after a downtrend, identifiable by its small body and long lower wick. A long lower candle wick; Here are two example trades on the apple, inc. In some cases, you’ll be able. This is one of the popular price patterns in candlestick charting. Web this is the third time that malmo, a city of 360,000 people on sweden’s southwest coast, has hosted the eurovision song contest. 374,682 ebirders contributed data—a 20% increase from last year. Last week bitcoin found support at 56,500 (low of retracement) and then rallied to end the week. For a complete list of bullish (and bearish) reversal patterns, see greg morris' book, candlestick charting explained. You find this one candlestick pattern on all time frames and in many different markets. Web the hammer candlestick is a popular chart pattern that suggests bullish sentiment after a day of trading volatility. A hammer candlestick is a chart formation that signals. Web the hammer candlestick pattern is very common on price charts. You find this one candlestick pattern on all time frames and in many different markets. Web the hammer candlestick appears at the bottom of a down trend and signals a bullish reversal. If it appears in a downward trend indicating a bullish reversal, it is a hammer. Identifying such. Last week bitcoin found support at 56,500 (low of retracement) and then rallied to end the week with a bullish hammer candlestick pattern. Although it is most recognized as a bullish reversal candlestick pattern, the bullish hammer candle is either a trend reversal or a continuation pattern. Web a global view —global relative abundance and range maps for 1,009 species;. Web the hammer candlestick is a bullish reversal pattern that signals a potential price bottom and ensuing upward move. 36.1 million ebird checklists —a 28% increase in number of checklists. Web what is the hammer candlestick formation? This is one of the popular price patterns in candlestick charting. 11 million unique locations— an additional 4 million. In some cases, you’ll be able to identify the. Web the hammer is a classic and easily identifiable candlestick chart pattern that often foreshadows a bullish reversal. 374,682 ebirders contributed data—a 20% increase from last year. A hammer candlestick is a chart formation that signals a potential bullish reversal after a downtrend, identifiable by its small body and long lower. 36.1 million ebird checklists —a 28% increase in number of checklists. A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies later in the day to close either above or near its. To identify the hammer candlestick pattern, consider the following points: This pattern is most often used. Web the hammer candlestick is a popular chart pattern that suggests bullish sentiment after a day of trading volatility. Web identifying the hammer candlestick is easy. Here are two example trades on the apple, inc. A hammer candlestick is a chart formation that signals a potential bullish reversal after a downtrend, identifiable by its small body and long lower wick.. A hammer candlestick has a long lower shadow, a small body at the top of the candle, and no or a tiny upper shadow. Last week bitcoin found support at 56,500 (low of retracement) and then rallied to end the week with a bullish hammer candlestick pattern. The hammer candlestick formation is viewed as a bullish reversal candlestick pattern that. They are commonly formed by the opening, high,. This is one of the popular price patterns in candlestick charting. Web the aspects of a candlestick pattern. Little to no upper shadow. The hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. In some cases, you’ll be able to identify the. A minor difference between the opening and closing prices forms a small. A small body at the upper end of the trading range. Web this is the third time that malmo, a city of 360,000 people on sweden’s southwest coast, has hosted the eurovision song contest. Identifying such patterns on a chart is like winning the lottery, especially if the pattern appears on a daily or weekly chart. Web what type of chart pattern is the bullish hammer pattern? 202 additional species this year. Web first, scan charts to find hammer patterns that emerge after a prolonged downtrend. Web the hammer is a highly significant bullish reversal candlestick pattern in technical analysis that can signal a potential reversal in price trends. Web the hammer and the inverted hammer candlestick patterns are among the most popular trading formations. Ebirders filled in data gaps.

Tutorial on Hammer Candlestick Pattern

What is a Hammer Candlestick Chart Pattern? NinjaTrader

Hammer Candlestick Pattern Trading Guide

Hammer Patterns Chart 5 Trading Strategies for Forex Traders

Hammer Candlesticks Indicators ThinkMarkets

HAMMER Candlestick Chart Pattern Charts BitcoinTAF

Hammer Candlestick Pattern A Powerful Reversal Signal Forex

What is Hammer Candlestick Pattern January 2024

Candlestick Charts and Patterns Guide for Active Traders (2023)

What is a Hammer Candlestick Chart Pattern? LiteFinance

Most Traders Go Bullish When Seeing This Pattern, But They’re Likely To Hammer Their Portfolio Profits Into Oblivion With This Strategy.

A Hammer Candlestick Is A Chart Formation That Signals A Potential Bullish Reversal After A Downtrend, Identifiable By Its Small Body And Long Lower Wick.

Web The Hammer Candlestick Pattern Is Very Common On Price Charts.

Here Are Two Example Trades On The Apple, Inc.

Related Post: