Hammer Candle Pattern

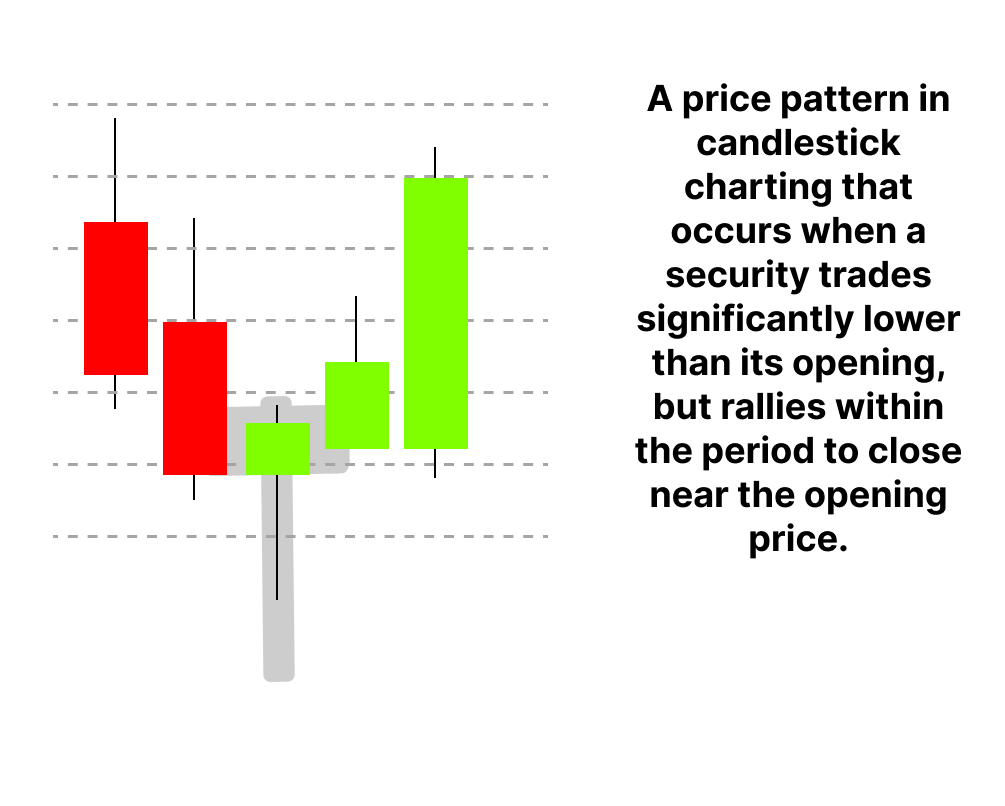

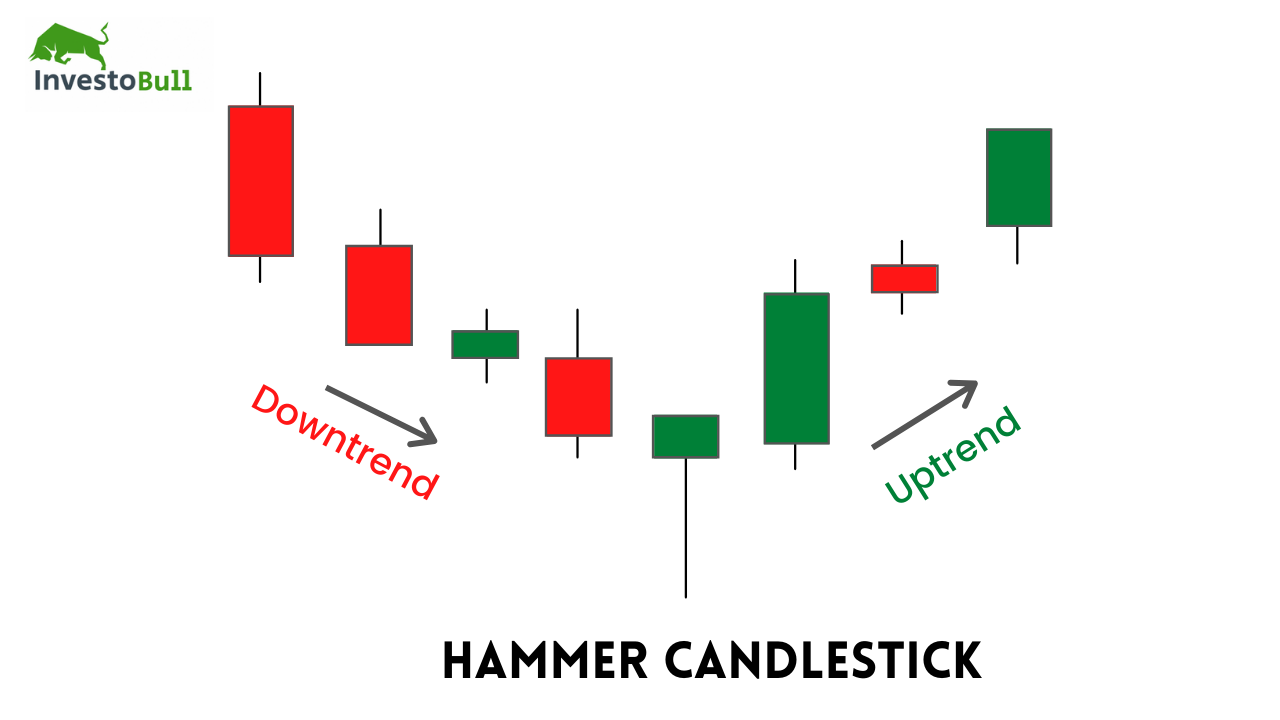

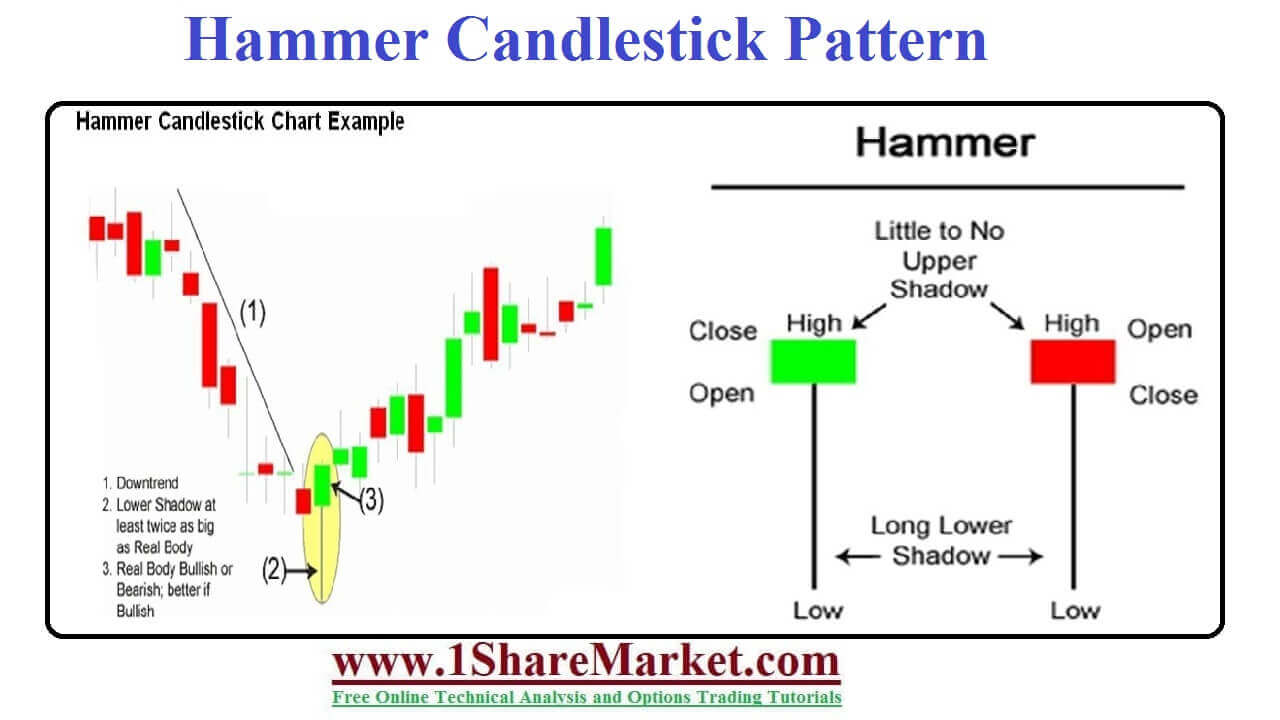

Hammer Candle Pattern - “hammer” is often combined with other trading strategies and analysis tools. It’s a bullish reversal candlestick pattern, which indicates the end of a downtrend and the start of a new uptrend. You will improve your candlestick analysis skills and be able to apply them in trading. Web by leo smigel. The inverted hammer appears as a single candlestick at the end of a downtrend. Web hammer candlestick formation in technical analysis: Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. After the appearance of the hammer, the prices start moving up. Web what is a hammer chart and how to trade it? Derived from japanese candlestick chart analysis methods, this single candle pattern exhibits a distinct. The hammer candlestick pattern is viewed as a potential reversal signal when it appears after a trend or during a downtrend. The inverted hammer appears as a single candlestick at the end of a downtrend. Derived from japanese candlestick chart analysis methods, this single candle pattern exhibits a distinct. The hammer candlestick is a bullish reversal pattern that signals a. Enjoy your finished candles at home, or place them in nifty gift bags for a unique and memorable keepsake. The information below will help you identify this pattern on the charts and predict further price dynamics. Web the hammer candlestick pattern is a technical analysis tool used by traders to identify potential reversals in price trends. Examples of use as. Lower shadow more than twice the length of the body. Web by leo smigel. Web what is a hammer chart and how to trade it? Web the hammer is a classic bottom reversal pattern that warns traders that prices have reached the bottom and are going to move up. Enjoy your finished candles at home, or place them in nifty. While the stock has lost 5.8% over the past week, it could witness a trend reversal as a hammer chart. The hammer candlestick pattern is viewed as a potential reversal signal when it appears after a trend or during a downtrend. The information below will help you identify this pattern on the charts and predict further price dynamics. We can. This pattern appears at the end of a downtrend, signaling that the market might be on the verge of a bullish reversal. It appears during the downtrend and signals that the bottom is near. Web the hammer is a japanese candlestick pattern. Web hammer candlestick formation in technical analysis: The hammer candlestick is a bullish reversal pattern that signals a. It’s a bullish pattern because we expect to have a bull move after a hammer appears at the right location. The hammer candlestick is a bullish reversal pattern that signals a potential price bottom and ensuing upward move. Illustrated guide to hammer candlestick patterns. Web a hammer candlestick is a chart formation that signals a potential bullish reversal after a. Making handmade candles with our quality products is easy—no fragrance oils, dangerously hot wax pours, or long setting times needed. This pattern is typically seen as a bullish reversal signal, indicating that a downward price swing has likely reached its bottom and is poised to move higher. Derived from japanese candlestick chart analysis methods, this single candle pattern exhibits a. It appears during the downtrend and signals that the bottom is near. Web the hammer candlestick pattern is considered as one of the key candlestick patterns used by traders to analyse price action trading. Web the inverted hammer candlestick pattern is a notable formation in technical analysis, often interpreted as a potential signal for a bullish reversal, particularly in a. Web the hammer is a japanese candlestick pattern. Hammer candlestick has a unique shape. A minor difference between the opening and closing prices forms a small candle body. Web the hammer candlestick pattern is a bullish reversal pattern that indicates a potential price reversal to the upside. The hammer candlestick pattern is viewed as a potential reversal signal when it. Hammer candlestick has a unique shape. Web by leo smigel. After the appearance of the hammer, the prices start moving up. Web the hammer candlestick pattern is a bullish reversal pattern that indicates a potential price reversal to the upside. This pattern is typically seen as a bullish reversal signal, indicating that a downward price swing has likely reached its. Find a studio near you. After the appearance of the hammer, the prices start moving up. It usually appears after a price decline and shows rejection from lower prices. “hammer” is often combined with other trading strategies and analysis tools. This is one of the popular price patterns in candlestick charting. Hammer candlestick has a unique shape. Shop online or in store unique handmade products made in poland include six polish pottery factories, hand blown glass ornaments, woodcarvings, polish food, watercolor paintings and folk items. Web the hammer candlestick pattern is considered as one of the key candlestick patterns used by traders to analyse price action trading. While the stock has lost 5.8% over the past week, it could witness a trend reversal as a hammer chart. The opening price, close, and top are approximately at the same price, while there is a long wick that extends lower, twice as big as the short body. Derived from japanese candlestick chart analysis methods, this single candle pattern exhibits a distinct. We can most likely spot this candlestick on support levels where prices decline and show rejection from lower levels. Web nifty daily chart hammer candle pattern nifty trade setup निफ्टी डेली चार्ट पर हैमर कैंडल बनी, बायर्स ज़ोर लगा रहे हैं, देखिये मंगलवार को निफ्टी को कैसे ट्रेड करें Small candle body with longer lower shadow, resembling a hammer, with minimal (to zero) upper shadow. You will improve your candlestick analysis skills and be able to apply them in trading. It’s a bullish pattern because we expect to have a bull move after a hammer appears at the right location.

Hammer Candlestick Pattern Meaning, Examples & Limitations Finschool

Candle Patterns Picking the "RIGHT" Hammer Pattern YouTube

Hammer Candlestick Pattern The Complete Guide 2022 (2022)

What is Hammer Candlestick Pattern January 2024

Candlestick Patterns The Definitive Guide (2021)

Hammer Candlestick Pattern Trading Guide Candlestick patterns, Stock

How to Trade the Hammer Candlestick Pattern Pro Trading School

Hammer Candlestick Patterns (Types, Strategies & Examples)

Hammer Candlestick Pattern Trading Guide

Hammer candlestick pattern Defination with Advantages and limitation

Web The Hammer Candlestick Pattern Is A Technical Analysis Tool Used By Traders To Identify Potential Reversals In Price Trends.

Web The Hammer Is A Japanese Candlestick Pattern.

More Polish Pottery Is Your Source For Famous Boleslawiec Polish Pottery In The Usa.

This Pattern Is Typically Seen As A Bullish Reversal Signal, Indicating That A Downward Price Swing Has Likely Reached Its Bottom And Is Poised To Move Higher.

Related Post: