H Pattern Stocks

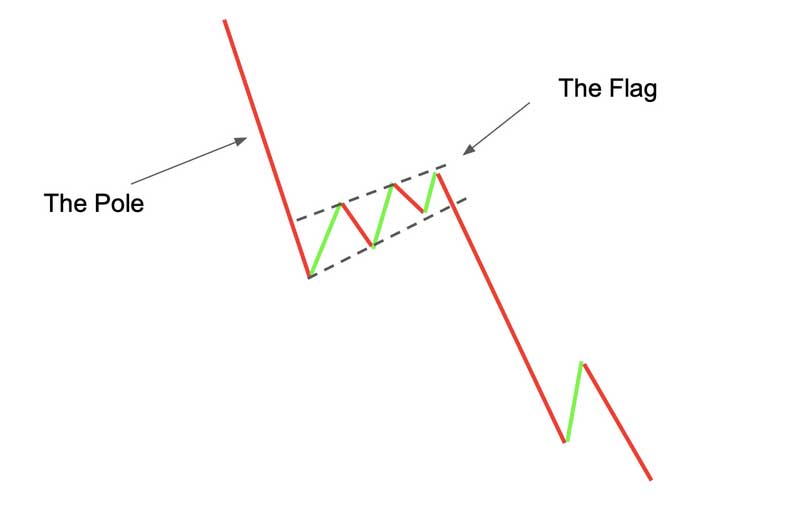

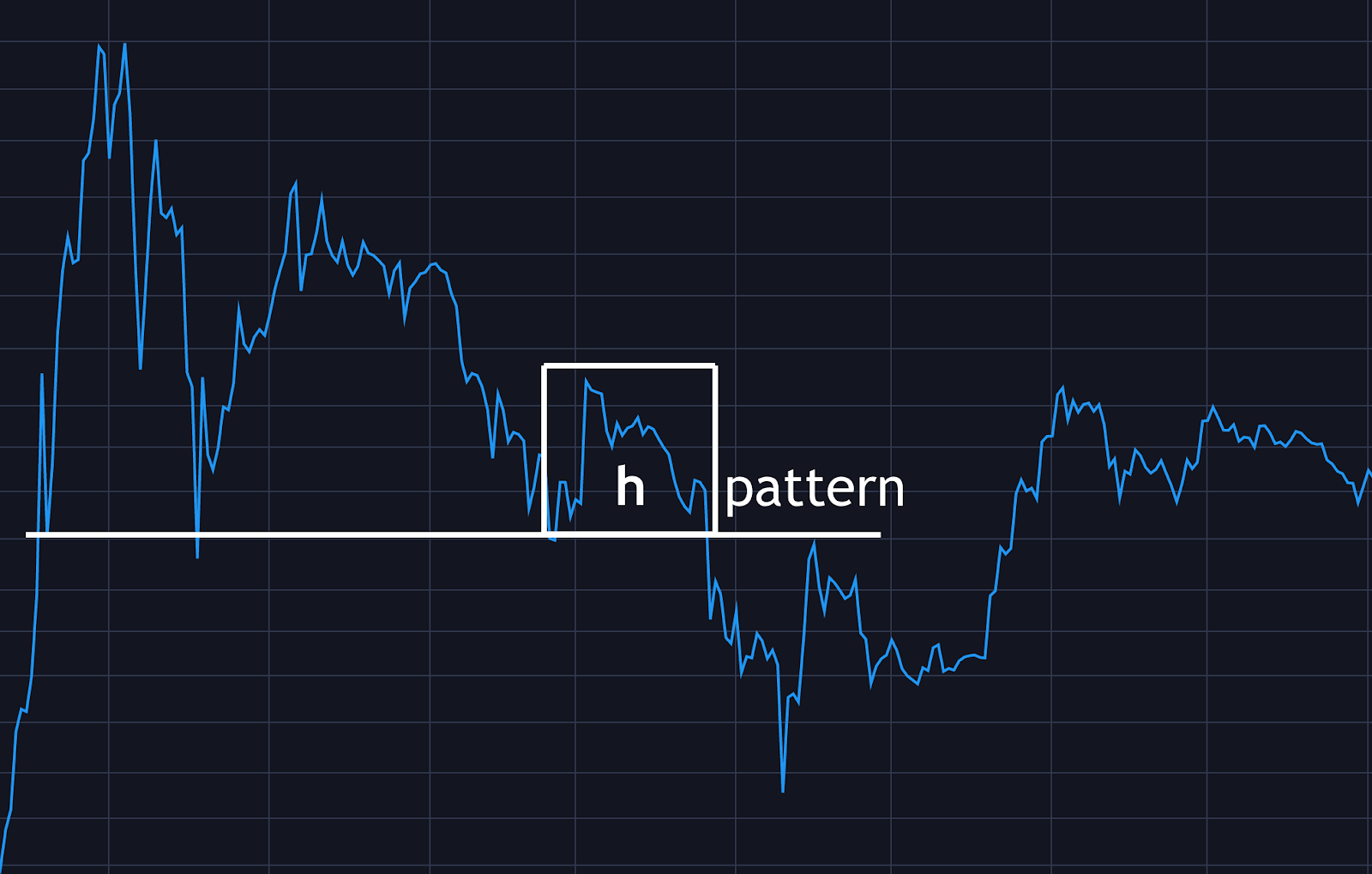

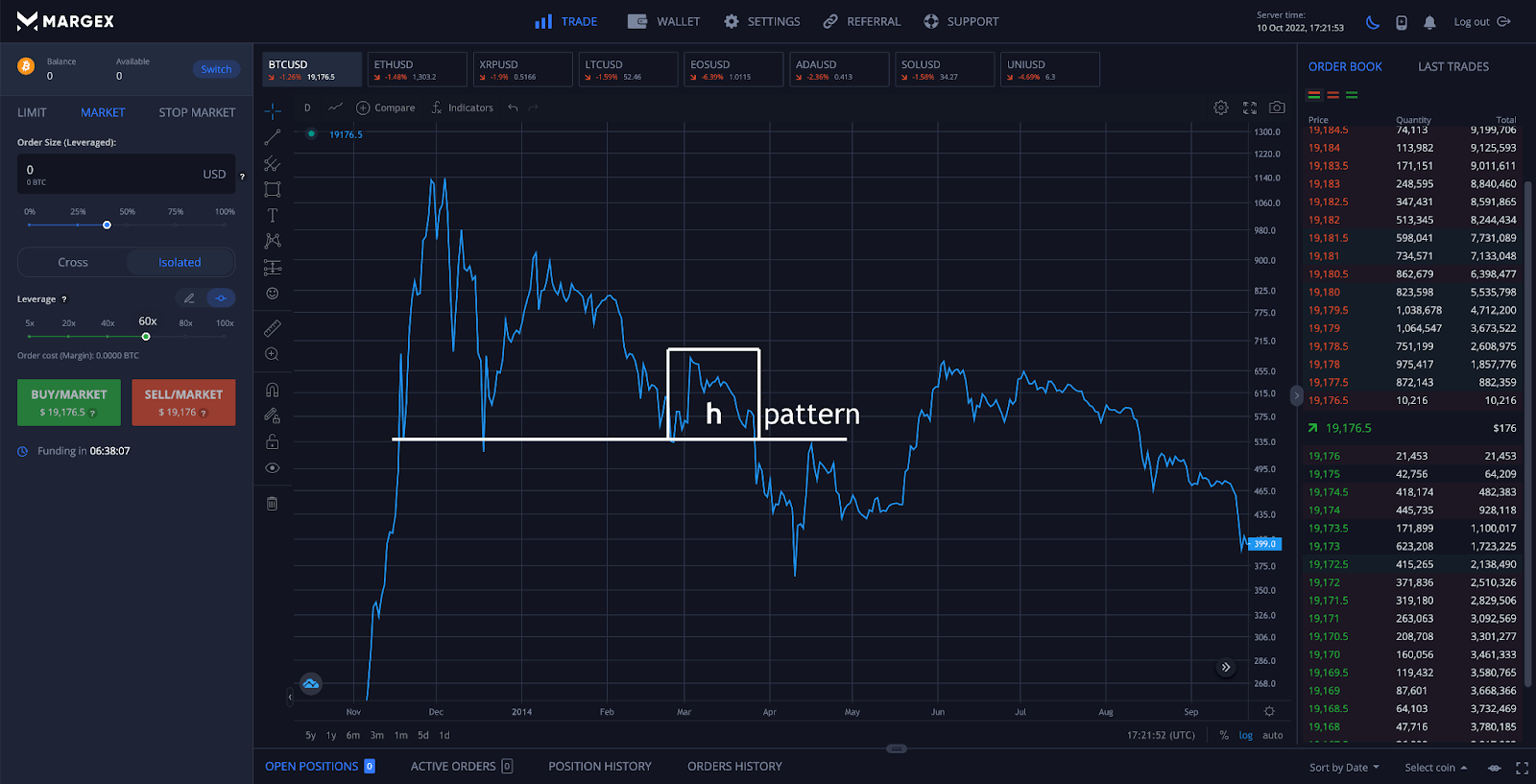

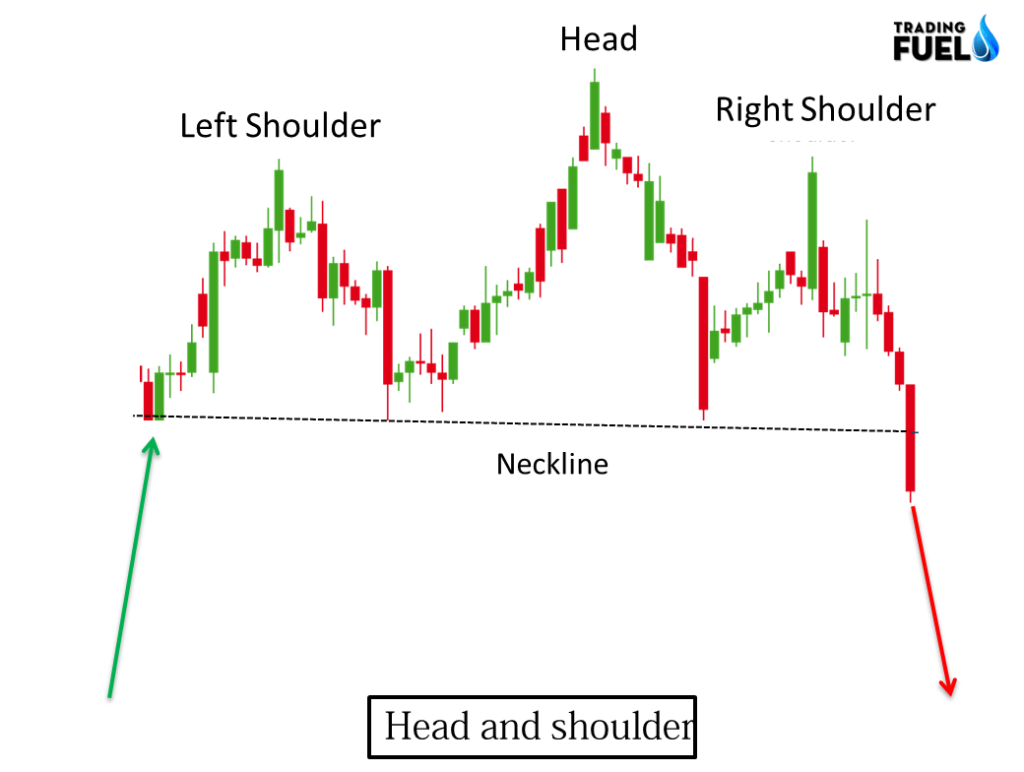

H Pattern Stocks - The pattern consists of four. Chart patterns play a pivotal role in trading, offering insights into market sentiments and future price movements. With the h pattern, you will enter the short at the top/curve of the highs, with a stop way above the. The pattern appears as a baseline with three peaks: Web there are many stock chart patterns to behold, but one that appears from time to time is an “h” pattern. Web this bearish setup is one that has done very well in this market! In stock analysis, an “h pattern” refers to a technical chart pattern that resembles the letter “h” when plotted on a price chart. The outside two are close. Web the h pattern, a distinctive formation on stock price charts, serves as a harbinger of potential trend reversals after a significant price decline. Web we like to enter a trade before the break of support. Web we like to enter a trade before the break of support. Web it’s called the “h” pattern, it’s rarely used amongst other traders, however i can spot this pattern on any time frame. Investors typically enter into a long position when the price rises above the. Chart patterns play a pivotal role in trading, offering insights into market sentiments. 9.7k views 3 years ago futures/forex trading. The pattern consists of four. We find great success when we recognize this particular pattern before it even occurs. With the h pattern, you will enter the short at the top/curve of the highs, with a stop way above the. When the stock market starts pulling back and all we see is bearish. Web this bearish setup is one that has done very well in this market! Web h pattern stocks, explained. Web learn how to spot and trade the h pattern, a bullish reversal formation that can be applied to stocks, forex and futures markets. The pattern consists of four. When the stock market starts pulling back and all we see is. 9.7k views 3 years ago futures/forex trading. Web we like to enter a trade before the break of support. With the h pattern, you will enter the short at the top/curve of the highs, with a stop way above the. When the stock market starts pulling back and all we see is bearish setup, this bearish h pattern. Web by. With the h pattern, you will enter the short at the top/curve of the highs, with a stop way above the. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close. See examples, tips and strategies for. Web an inverse head and. Investors typically enter into a long position when the price rises above the. Patterns are the distinctive formations created by the movements of security prices on a chart and are the foundation of technical analysis. We find great success when we recognize this particular pattern before it even occurs. Chart patterns play a pivotal role in trading, offering insights into. Web the h stands for “hell for shorts” as most traders mistakenly short the retest of the initial low and are then frustrated when prices fail to move lower. Web we like to enter a trade before the break of support. Web this bearish setup is one that has done very well in this market! Web learn how to spot. Patterns are the distinctive formations created by the movements of security prices on a chart and are the foundation of technical analysis. It’s my bread and butter for easy money. The pattern consists of four. Investors typically enter into a long position when the price rises above the. See examples, tips and strategies for. Web there are many stock chart patterns to behold, but one that appears from time to time is an “h” pattern. With the h pattern, you will enter the short at the top/curve of the highs, with a stop way above the. Web by caryl v. Due to the fact that one shoulder is larger than. It’s my bread and. Web it’s called the “h” pattern, it’s rarely used amongst other traders, however i can spot this pattern on any time frame. Web this bearish setup is one that has done very well in this market! Web the h pattern, a distinctive formation on stock price charts, serves as a harbinger of potential trend reversals after a significant price decline.. Investors typically enter into a long position when the price rises above the. Patterns are the distinctive formations created by the movements of security prices on a chart and are the foundation of technical analysis. Web we like to enter a trade before the break of support. Web a head and shoulders pattern is a chart formation used by technical analysts. Web it’s called the “h” pattern, it’s rarely used amongst other traders, however i can spot this pattern on any time frame. We find great success when we recognize this particular pattern before it even occurs. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close. Web this bearish setup is one that has done very well in this market! Web h pattern stocks, explained. Chart patterns play a pivotal role in trading, offering insights into market sentiments and future price movements. Trade full extended hours$0 options fees$0 commission trading Web there are many stock chart patterns to behold, but one that appears from time to time is an “h” pattern. The outside two are close. It’s my bread and butter for easy money. With the h pattern, you will enter the short at the top/curve of the highs, with a stop way above the. Web updated may 14, 2021.:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Trade_the_Head_and_Shoulders_Pattern_Jul_2020-01-d955fe7807714feea05f04d7f322dfaf.jpg)

Comment échanger le modèle de tête et d'épaules

What are H Pattern Stocks? Lunch Break Investing

HOW TO TRADE THE H PATTERN! DAY TRADING BEARISH PATTERNS DURING A

H Pattern Trading Guide How To Identify And Trade The H Pattern In Crypto

H Pattern Trading Guide How To Identify And Trade The H Pattern In Crypto

h pattern Shadow Trader

Chart Patterns Cheat Sheet Stock trading, Stock chart patterns, Stock

H Pattern Trading Guide How To Identify And Trade The H Pattern In Crypto

Head And Shoulders Pattern What Is It And How Does It Work

How To Trade the "hpattern" This Pattern Works with Stocks Futures

Web According To The Issued Ratings Of 16 Analysts In The Last Year, The Consensus Rating For Hyatt Hotels Stock Is Hold Based On The Current 10 Hold Ratings And 6 Buy.

See Examples, Tips And Strategies For.

This Requires Educating Yourself On Understanding The Market You Are.

Web By Caryl V.

Related Post: