Goodwill Itemized Donation List Printable

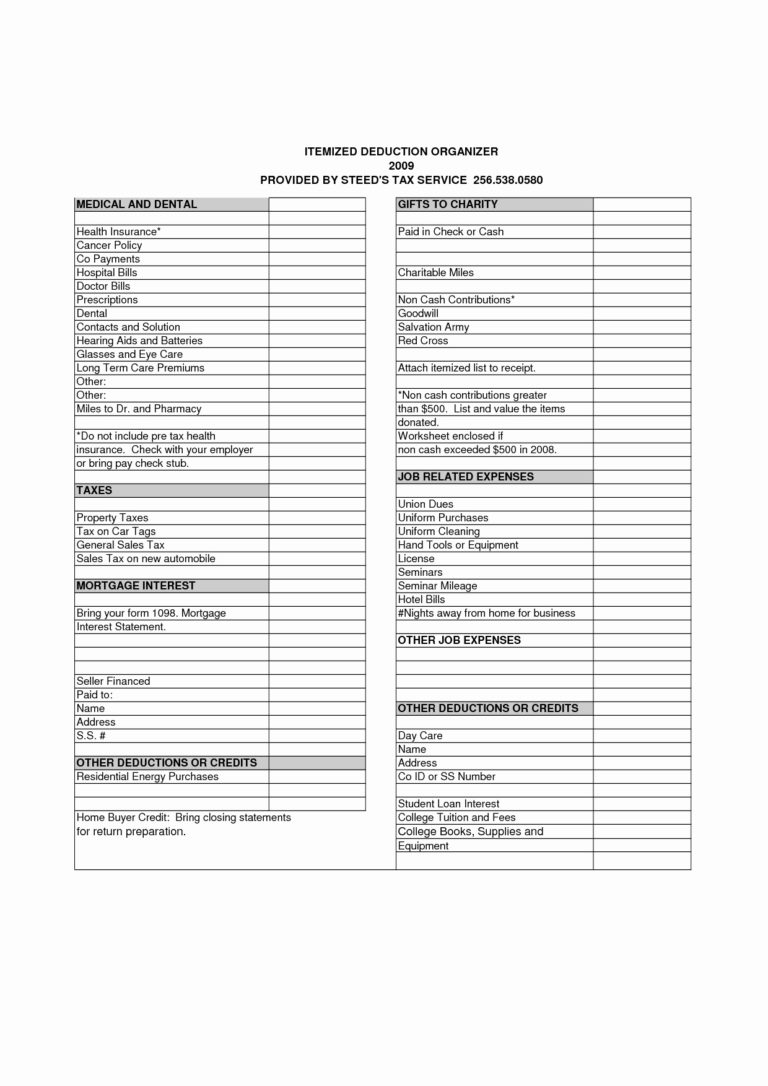

Goodwill Itemized Donation List Printable - The donation impact calculator is a great way to see how your donations support your goodwill’s programs and services. Web if you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. Often requested by goods donors for tax purposes. If you itemize deductions on your federal tax return, you are entitled to claim a charitable. The donor determines the fair market value of an item. Use the price ranges as a general guide to assess. Clothing sleepwear children $1.50 clothing sleepwear men & women $2.99 clothing suit children $2.99 clothing suit men & women $9.99 clothing. Web how to donate your gently used items to goodwill. Below is a donation value guide of what items generally sell for at goodwill locations. To help guide you, goodwill industries international has. Donations can be made at our retail stores and attended donation centers. If you itemize deductions on your federal tax return, you are entitled to claim a charitable. Web valuation guide for goodwill donors. Web use the slider to estimate the fair market value of an item. Below is a donation value guide of what items generally sell for at. We happily accept donations of new or gently used items, including: Web valuation guide for goodwill donors. Web simply enter the number of donated items into the form below to calculate the total value of your donation. Web a donation receipt is an itemized list of the items that you donated, that includes the item, fair market value, and basic. Internal revenue service (irs) requires donors to value their items. Web a donation receipt is an itemized list of the items that you donated, that includes the item, fair market value, and basic personal information (name, city, address,. We happily accept donations of new or gently used items, including: Simply select the types of. To help guide you, goodwill industries. The donor determines the fair market value of an item. To help guide you, goodwill industries international has compiled a list. According to the internal revenue. Simply select the types of. The list should include the name of the organization, the date of. Web guide for goodwill donors to estimate the value of their donation. Donations can be made at our retail stores and attended donation centers. Web valuation guide for goodwill donors. The donor determines the fair market value of an item. Simply select the types of. To help guide you, goodwill industries international has compiled a list. If you itemize deductions on your federal tax return, you are entitled to claim a charitable. Web donating gently used items to goodwill makes a real difference in your community. Donations can be made at our retail stores and attended donation centers. Web how to donate your gently used. Often requested by goods donors for tax purposes. Web the list below gives approximate values for how much items typically sell for at goodwill of central and northern arizona stores. According to the internal revenue. Use the price ranges as a general guide to assess. Below is a donation value guide of what items generally sell for at goodwill locations. Simply select the types of. Thanks for donating to goodwill. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. When you’re done, print the form and take it, along with your donations,. Use the price ranges as a general guide to assess. To determine the fair market value. To help guide you, goodwill industries international has compiled a list. Tax benefits are available to taxpayers that itemize deductions. Use the price ranges as a general guide to assess. We happily accept donations of new or gently used items, including: Donations can be made at our retail stores and attended donation centers. Web valuation guide for goodwill donors. Web a donation receipt is an itemized list of the items that you donated, that includes the item, fair market value, and basic personal information (name, city, address,. Web valuation guide for goodwill donors. According to the internal revenue. Web how to donate your gently used items to goodwill. Web a donation receipt is an itemized list of the items that you donated, that includes the item, fair market value, and basic personal information (name, city, address,. We happily accept donations of new or gently used items, including: Web valuation guide for goodwill donors. Web if you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. When you’re done, print the form and take it, along with your donations,. Edit on any device24/7 tech supportpaperless solutions Thanks for donating to goodwill. Often requested by goods donors for tax purposes. The list should include the name of the organization, the date of. Simply select the types of. Donations can be made at our retail stores and attended donation centers. Web valuation guide for goodwill donors. Web donating gently used items to goodwill makes a real difference in your community. Below is a donation value guide of what items generally sell for at goodwill locations. Internal revenue service (irs) requires donors to value their items to obtain a charitable donations itemized tax.

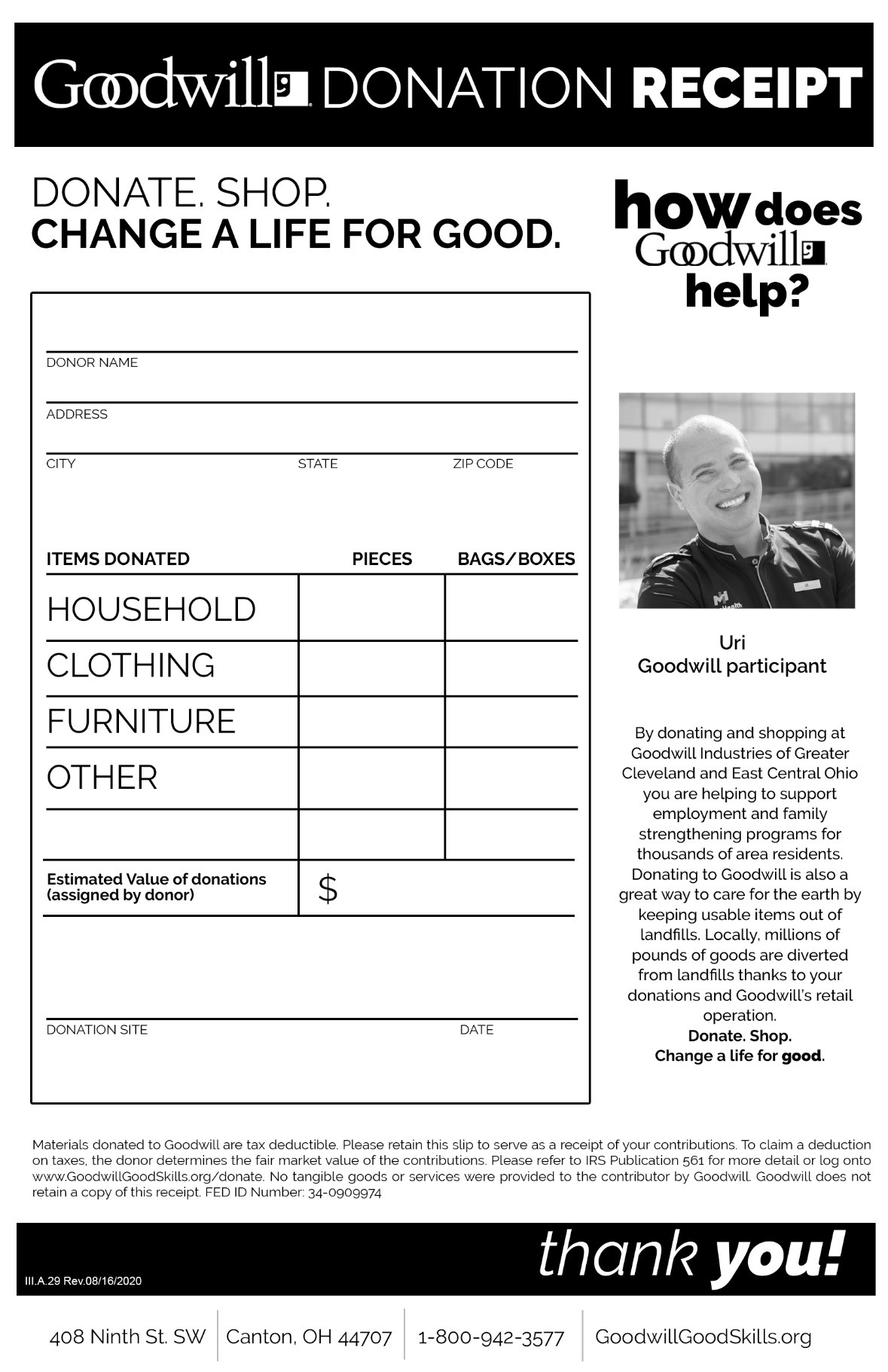

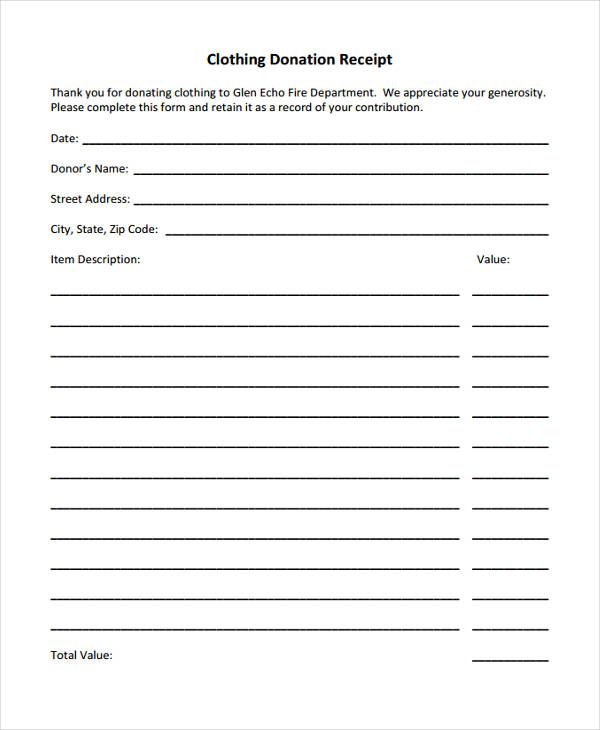

GoodWill Donation Receipt Template Invoice Maker

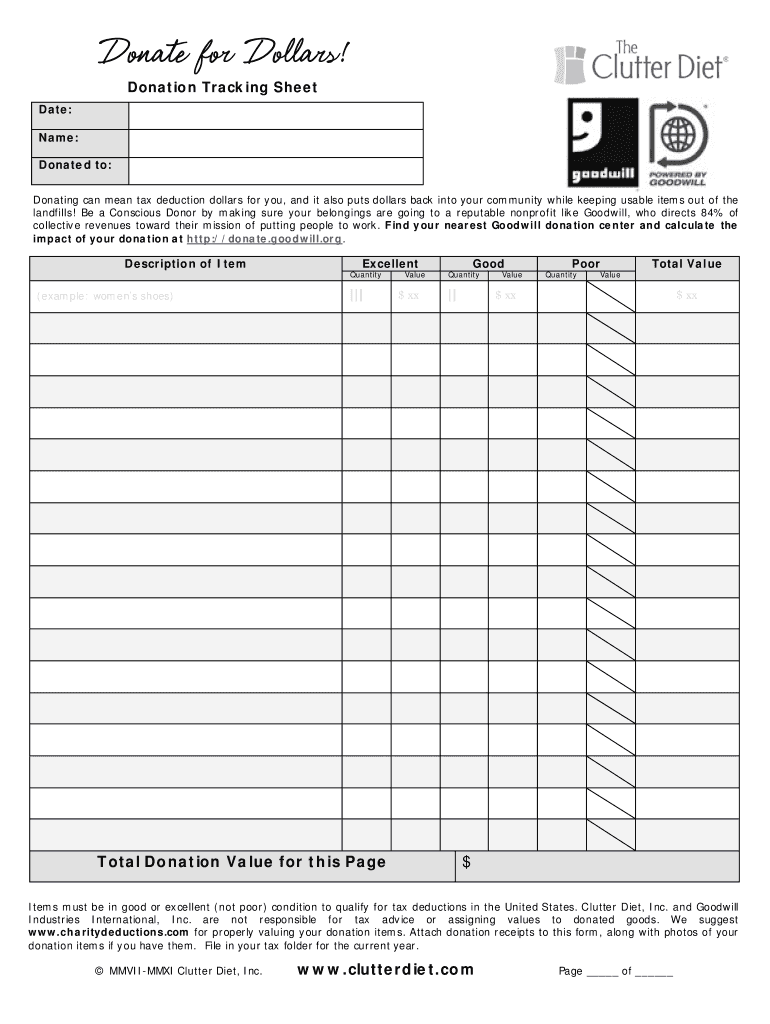

Donation Sheet Template 8+ Free Samples , Examples , Format

Goodwill Printable Donation Receipt

Itemized Donation List Printable Goodwill

Blank Printable Goodwill Donation Form Complete with ease airSlate

Free Goodwill Donation Receipt Template PDF eForms

Goodwill Itemized Donation List Printable

![25 Free Donation List Templates [Tracker Templates] (Word, Excel, PDF)](https://www.listtemplate.net/wp-content/uploads/2022/04/Donation-List-Template-07.png)

25 Free Donation List Templates [Tracker Templates] (Word, Excel, PDF)

free goodwill donation receipt template pdf eforms free goodwill

Goodwill Donation Spreadsheet Template 2017 with Irs Donation Value

Donating To Goodwill Is Easy!

Clothing Sleepwear Children $1.50 Clothing Sleepwear Men & Women $2.99 Clothing Suit Children $2.99 Clothing Suit Men & Women $9.99 Clothing.

To Determine The Fair Market Value.

To Help Guide You, Goodwill Industries International Has Compiled A List.

Related Post: