Gartley Pattern

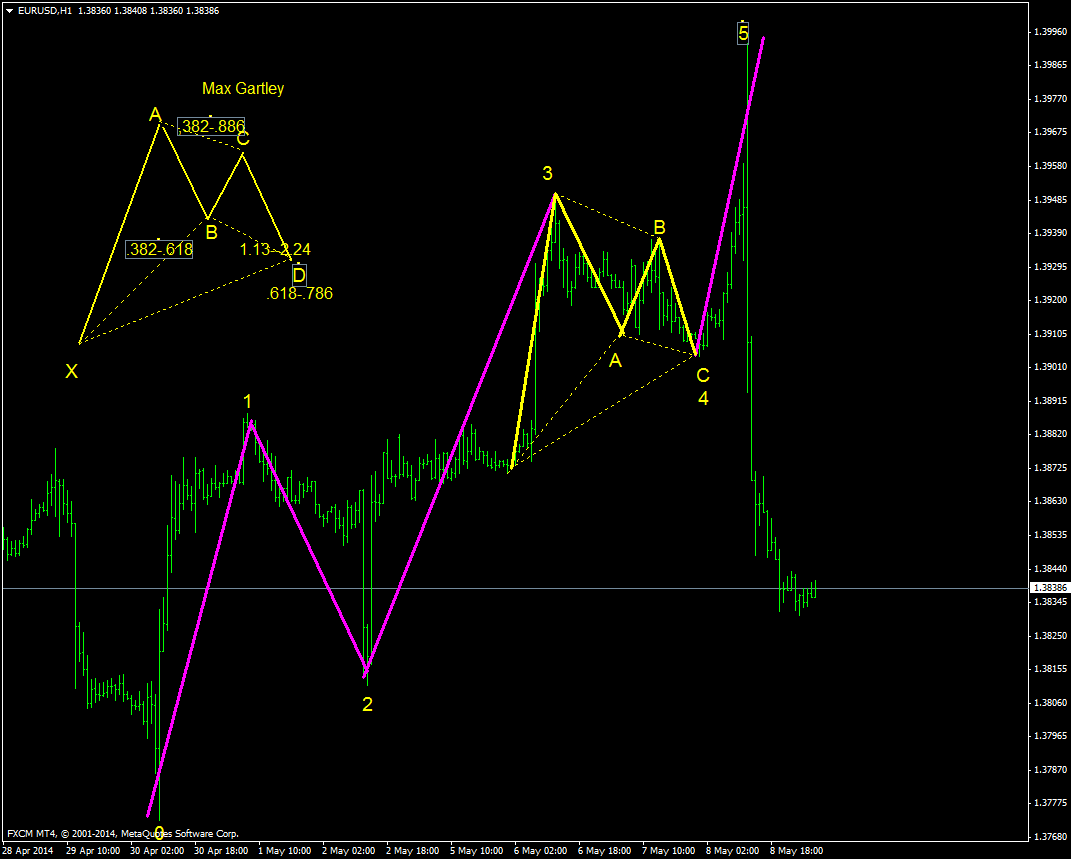

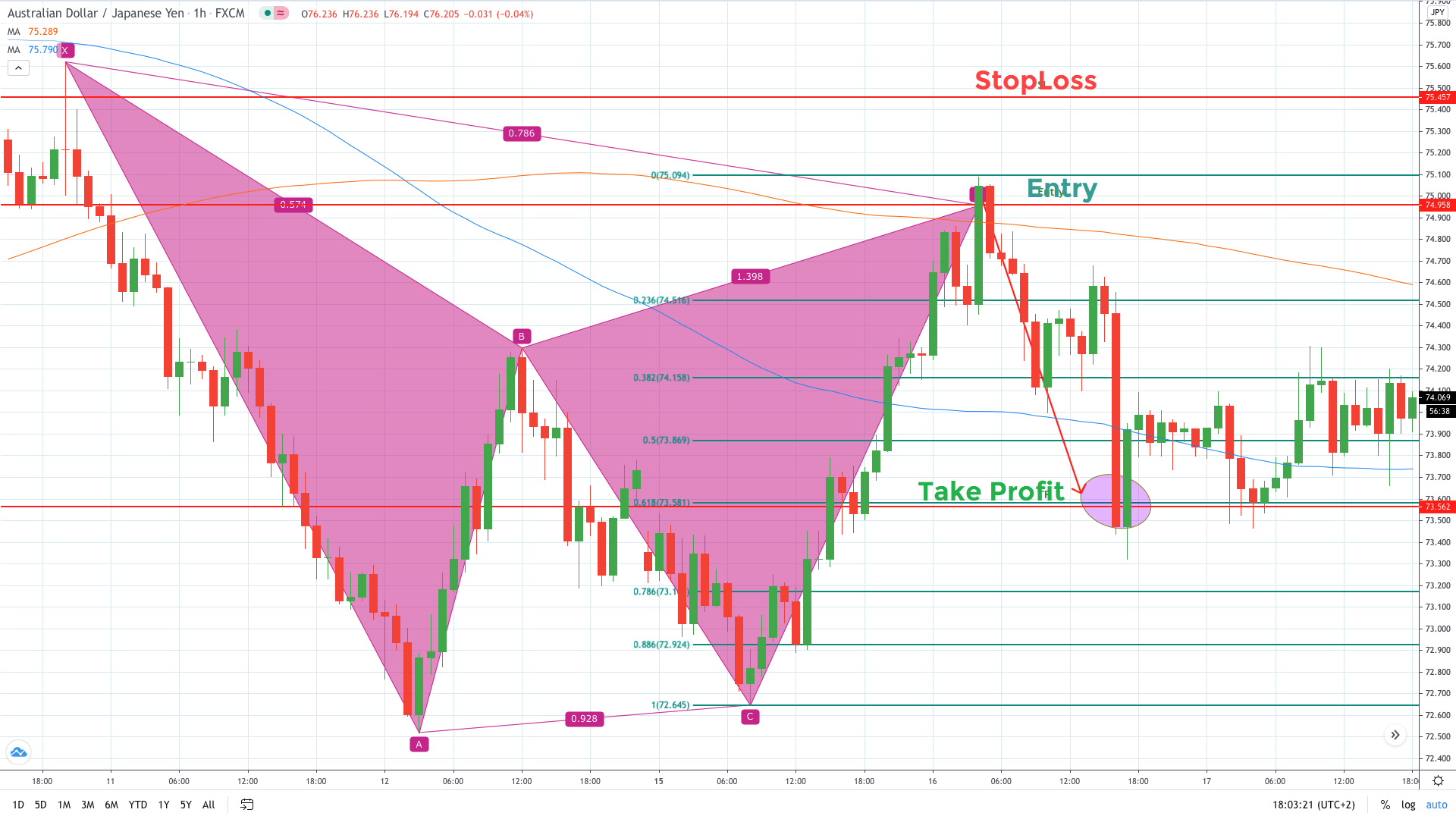

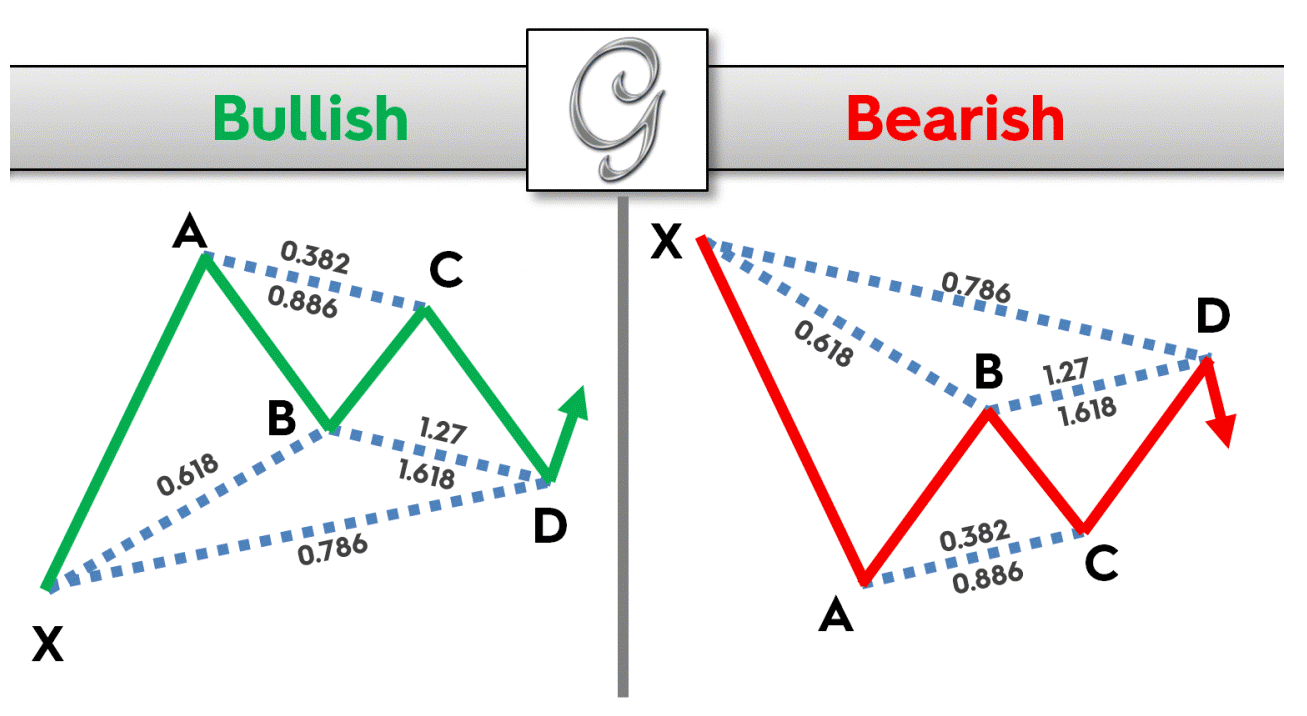

Gartley Pattern - Web the gartley pattern is one of the most traded harmonic patterns and can be applied to many markets and timeframes. Web what is gartley pattern? All of these swings are interrelated and associated with fibonacci ratios. Web the gartley pattern is a harmonic pattern that can provide valuable insights into potential market reversals. To draw the gartley pattern, you need to follow the next steps: This pattern offers assistance to traders in identifying reaction highs and lows. Web the gartley pattern is a simple xabcd pattern that consists of four waves and five swing points — points x, a, b, c, and d. These legs form the framework of the pattern, with fibonacci ratios guiding the lengths and proportions of each segment. The important features of the gartley are the specific location of the various points: Gartley and detailed further by scott carney. Web i will simply refer to this pattern as the “gartley.”. The pattern starts from point x and swings through points a, b, and c, eventually ending at point d. These patterns resemble “m” or “w” patterns and are defined by 5 key pivot points. Examples of gartley pattern with entry rules. Web learn how forex traders use the gartley. Web the gartley pattern is a harmonic pattern that can provide valuable insights into potential market reversals. Gartley patterns are the most commonly used harmonic patterns in technical analysis. Web what is the gartley pattern in forex. Web trading the gartley pattern — the full guide. Here is how they are structured: Web the gartley pattern is a bullish or bearish abcd pattern page consisting of four consecutive price moves. Web the gartley pattern is the most commonly used harmonic pattern that is based on fibonacci numbers and ratios. Web the gartley pattern is a harmonic chart pattern, based on fibonacci numbers and ratios, that helps traders identify reaction highs and lows.. The four waves are the xa, ab, bc, and cd swings. Gartley and detailed further by scott carney. The garley pattern can be either bullish or bearish. Web the gartley pattern is the most commonly used harmonic pattern that is based on fibonacci numbers and ratios. In this guide, i’m going to breakdown how you can find the gartley pattern. Gartley who introduced it in his book ‘profits in the stock market’ in 1935, can be considered as a powerful harmonic chart pattern that traders can use to identify potential reversals in the market. Web i will simply refer to this pattern as the “gartley.”. Gartley and detailed further by scott carney. The garley pattern can be either bullish or. Web the gartley pattern is one of the most traded harmonic patterns and can be applied to many markets and timeframes. Web learn how forex traders use the gartley pattern to identify major turning points in the market. Web the gartley pattern is a bullish or bearish abcd pattern page consisting of four consecutive price moves. When you spot a. This pattern offers assistance to traders in identifying reaction highs and lows. Web the gartley pattern is the most commonly used harmonic pattern that is based on fibonacci numbers and ratios. Web the gartley pattern is a technical indicator used to establish definitive levels of support and resistance, based on the fibonacci sequence of numbers. Examples of gartley pattern with. Gartley and detailed further by scott carney. Web the gartley pattern is one of the most traded harmonic patterns and can be applied to many markets and timeframes. The garley pattern can be either bullish or bearish. The four waves are the xa, ab, bc, and cd swings. All of these swings are interrelated and associated with fibonacci ratios. This is an impulse wave in the direction of the trend preceding the formation of the pattern. Web i will simply refer to this pattern as the “gartley.”. Web what is gartley pattern? And as with the other harmonic trading patterns, it must meet its own specific fibonacci levels in order to qualify as a valid formation. Web the gartley. The important features of the gartley are the specific location of the various points: The pattern starts with an initial impulse swing (xa), followed by a retracement swing (ab). Presenting and trading the gartley harmonic pattern. This is an impulse wave in the direction of the trend preceding the formation of the pattern. Web the gartley pattern is a harmonic. Web the gartley pattern is a harmonic pattern that can provide valuable insights into potential market reversals. Examples of gartley pattern with entry rules. Gartley and elaborated upon by scott carney, this pattern is widely applied across various markets and timeframes. Web the gartley pattern is one of the most popular harmonic patterns and can be used across many markets in multiple timeframes. Web what is the gartley pattern in forex. These patterns resemble “m” or “w” patterns and are defined by 5 key pivot points. Web the gartley pattern is a harmonic chart pattern, based on fibonacci numbers and ratios, that helps traders identify reaction highs and lows. Web the gartley pattern is one of the most traded harmonic patterns and can be applied to many markets and timeframes. Web the gartley pattern is a simple xabcd pattern that consists of four waves and five swing points — points x, a, b, c, and d. All of these swings are interrelated and associated with fibonacci ratios. Web the gartley pattern. Gartley patterns are the most commonly used harmonic patterns in technical analysis. And as with the other harmonic trading patterns, it must meet its own specific fibonacci levels in order to qualify as a valid formation. The pattern starts with an initial impulse swing (xa), followed by a retracement swing (ab). Gartley and detailed further by scott carney. When you spot a gartley, it is usually a sign that a prevailing trend is about to continue.

Trading the Gartley Pattern Ratios, Rules and Best Practices Forex

Trading The Gartley Pattern FX Access

What Is The Gartley Pattern And Why You Must Master Trading It?

:max_bytes(150000):strip_icc()/GartleyPattern-5541ce000da34023a20348e5681bbffb.png)

Gartley Pattern Definition

How to Trade the Gartley Pattern ForexBoat Trading Academy

Advanced Trading The Bearish Gartley Pattern Blueberry Markets

How to Trade the Gartley Pattern Pro Trading School

How to Trade the Gartley Pattern ForexBoat Trading Academy

Gartley Pattern Steps to Identify it with entry rules

.png)

What is the Gartley Pattern? How to Use it in Your Trading IG

Web Learn How Forex Traders Use The Gartley Pattern To Identify Major Turning Points In The Market.

Gartley Pattern Is One Of The Most Commonly Used Harmonic Patterns And Can Be Used In Various Timeframes.

Web The Gartley Pattern Is The Most Commonly Used Harmonic Pattern That Is Based On Fibonacci Numbers And Ratios.

Presenting And Trading The Gartley Harmonic Pattern.

Related Post: