Free Irs Mileage Log Template

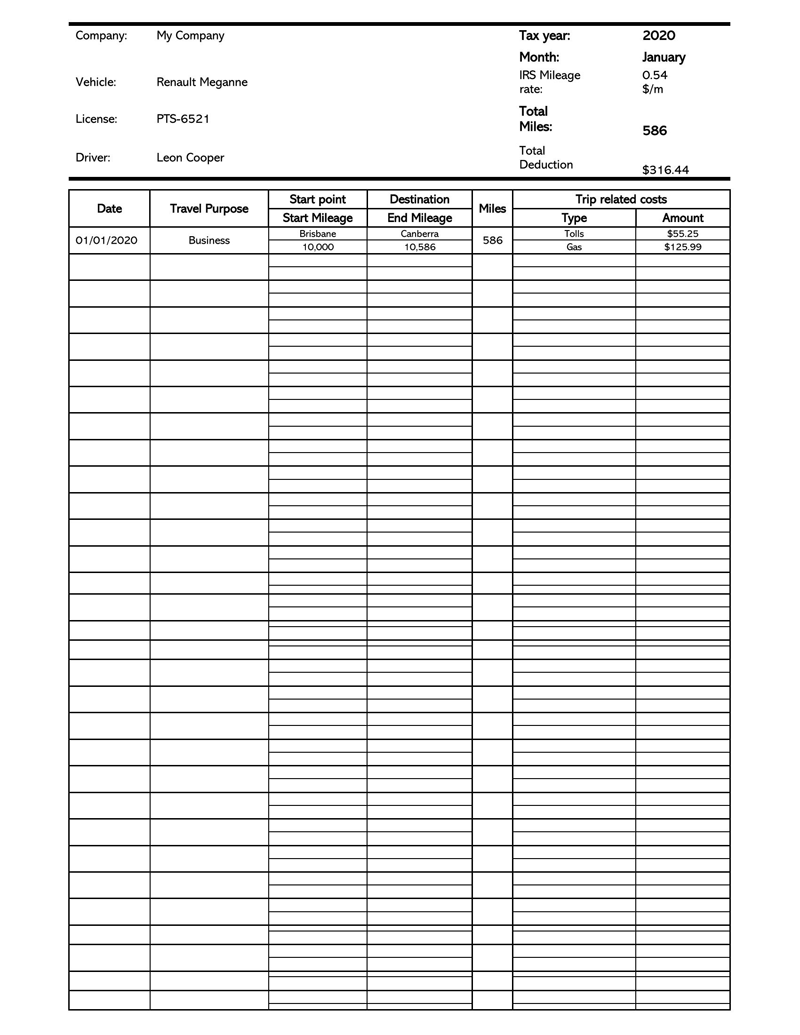

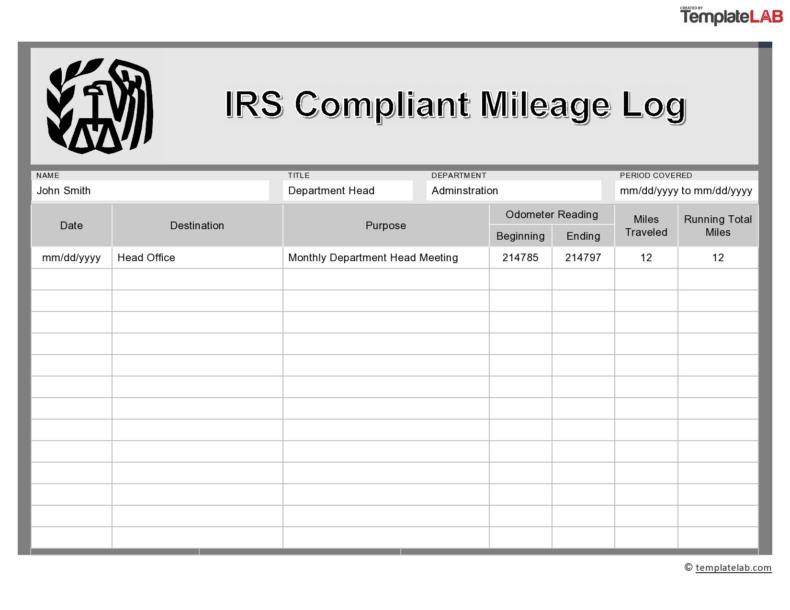

Free Irs Mileage Log Template - Whether you're an employee or a business owner, it's important to keep good business mileage. For 2020, the irs lets you deduct 57.5 cents per business mile. This free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Well track mileage reimbursements with our open printable mileage compensation form. Web free mileage log template for taxes. A paper log is a simple, written record of your business miles driven. You can use the following log as documentation for your mileage deduction. While you’re certainly better off using a mileage tracker app, some people just prefer a more old. Web a mileage log template for excel: Web you can record the miles you travel and the gas you buy or record your mileage to claim your expenditure using the irs standard rate in a mileage log for instance. You can use the following log as documentation for your mileage deduction. Learn how to organize, store, and maximize the potential. Web a mileage log template for excel: Free in pdf, word, excel, and google. Web the easiest way to keep records is to use a mileage log template that will have spaces for you to record your mileage for. Web free mileage log template for excel. Web how the keeper mileage log works. Web gofar mileage tracker device and a free app to log your miles and expenses automatically with no hassle at all or. Free in pdf, word, excel, and google. Paper logs and digital logs. Web then this irs mileage log template is for you. Web the easiest way to keep records is to use a mileage log template that will have spaces for you to record your mileage for each trip you take. For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per. The irs has been known to disqualify. Download the free 2024 mileage log. Web you can record the miles you travel and the gas you buy or record your mileage to claim your expenditure using the irs standard rate in a mileage log for instance. Web a mileage log template for excel: Web free mileage log template for taxes. Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses. While you’re certainly better off using a mileage tracker app, some people just prefer a more old. Web gofar mileage tracker device and a free app to log your miles and expenses automatically with. Free in pdf, word, excel, and google. You can use the following log as documentation for your mileage deduction. Well track mileage reimbursements with our open printable mileage compensation form. Web you can use it as a free irs mileage log template. Some people just prefer to input their trips manually. Switch to the #1 mileage tracking &. Web the easiest way to keep records is to use a mileage log template that will have spaces for you to record your mileage for each trip you take. Well track mileage reimbursements with our open printable mileage compensation form. Web free mileage log template for taxes. Whether you're an employee or a. Web the easiest way to keep records is to use a mileage log template that will have spaces for you to record your mileage for each trip you take. The irs has been known to disqualify. Web free mileage log template for taxes. Learn how to organize, store, and maximize the potential. Download the free 2024 mileage log. Some people just prefer to input their trips manually. Web download a free mileage reimbursement and tracking log for microsoft excel®. Web a mileage log template for excel: Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses. The irs has been known to. Car expenses and use of the. Web free mileage log template for taxes. Learn how to organize, store, and maximize the potential. Whether you're an employee or a business owner, it's important to keep good business mileage. Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct. Web you can record the miles you travel and the gas you buy or record your mileage to claim your expenditure using the irs standard rate in a mileage log for instance. Web then this irs mileage log template is for you. Learn how to organize, store, and maximize the potential. Web free mileage log template for taxes. Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses. Web download a free mileage reimbursement and tracking log for microsoft excel®. Web gofar mileage tracker device and a free app to log your miles and expenses automatically with no hassle at all or. Free in pdf, word, excel, and google. These free excel mileage logs contain everything you need for a. Some people just prefer to input their trips manually. Web how the keeper mileage log works. Download the free 2024 mileage log. Web a mileage log template for excel: While you’re certainly better off using a mileage tracker app, some people just prefer a more old. Switch to the #1 mileage tracking &. Car expenses and use of the.

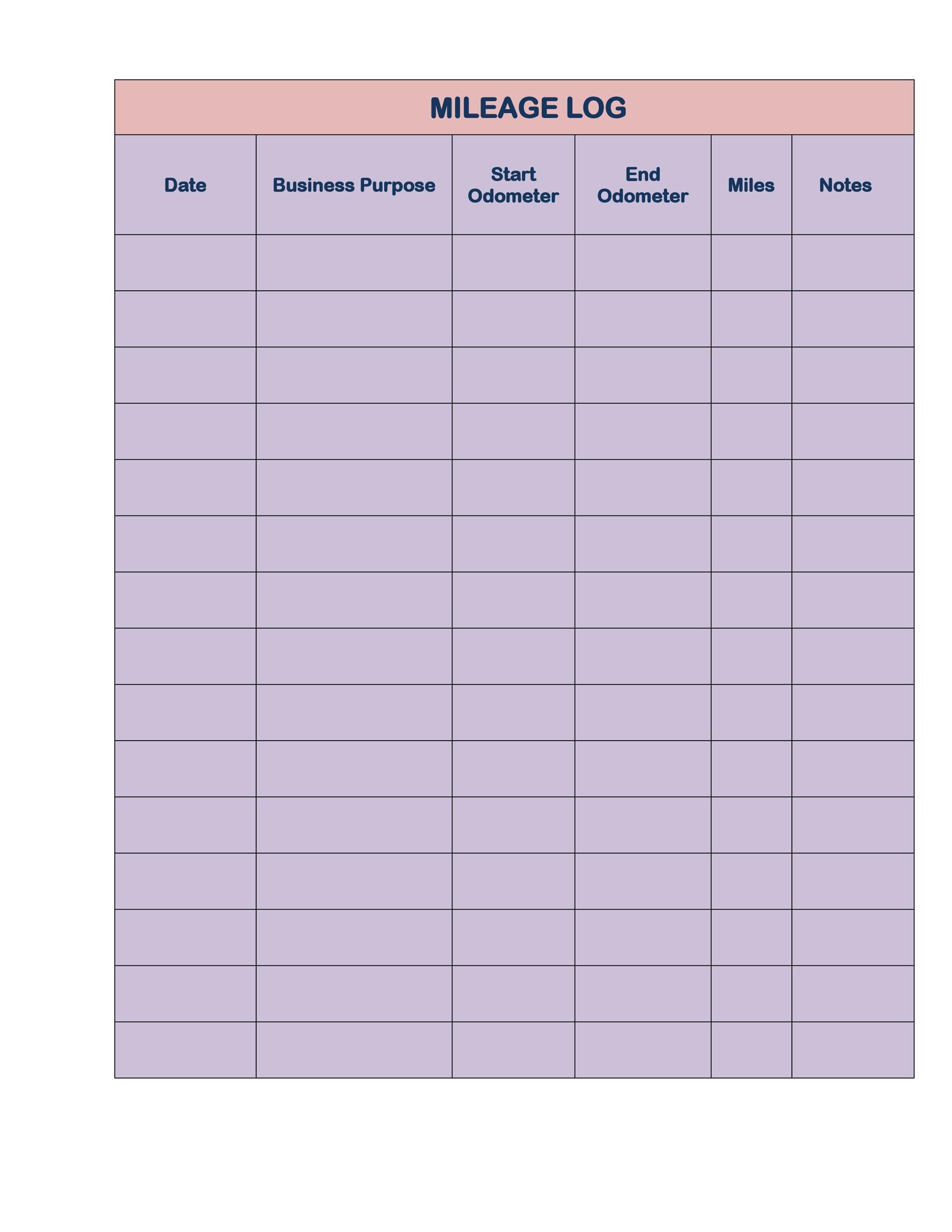

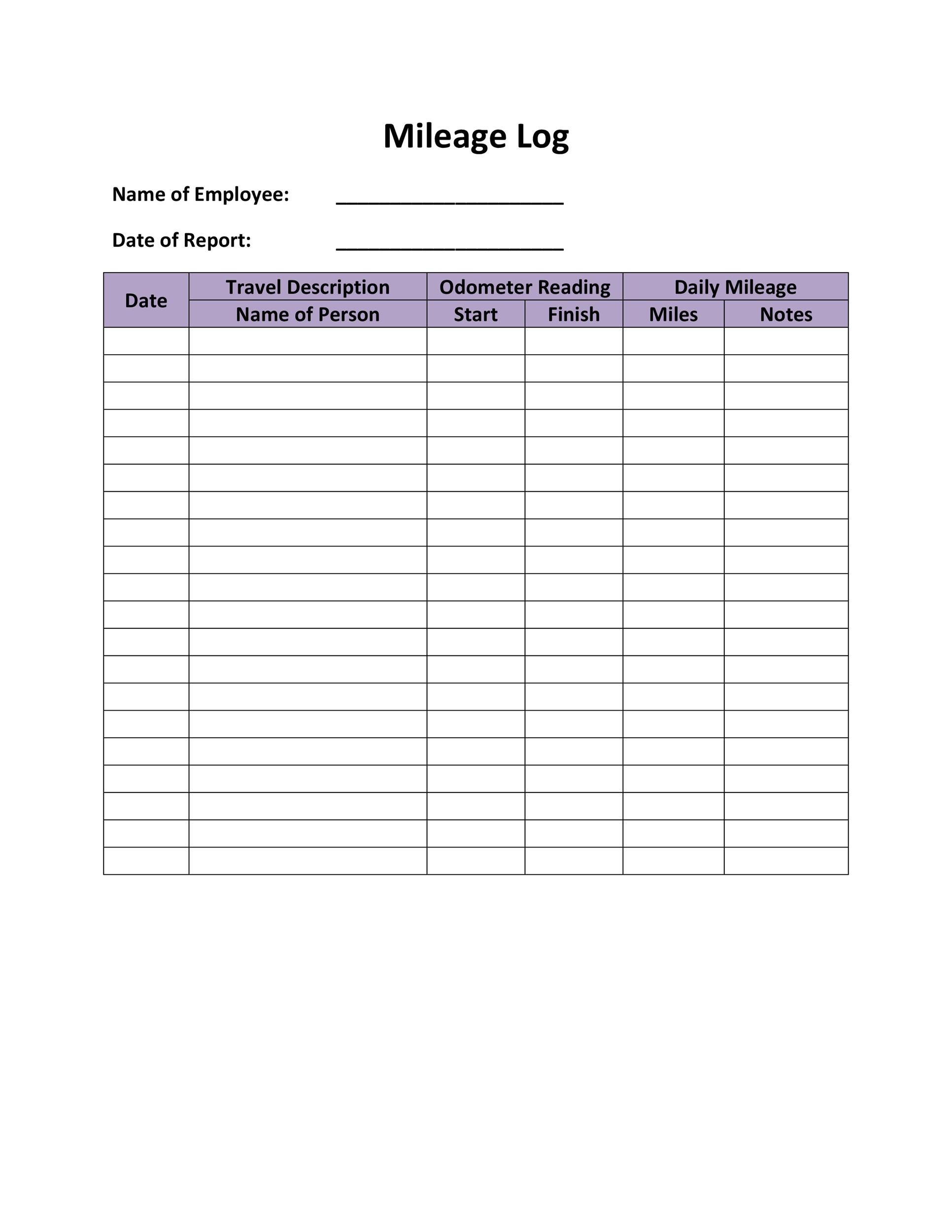

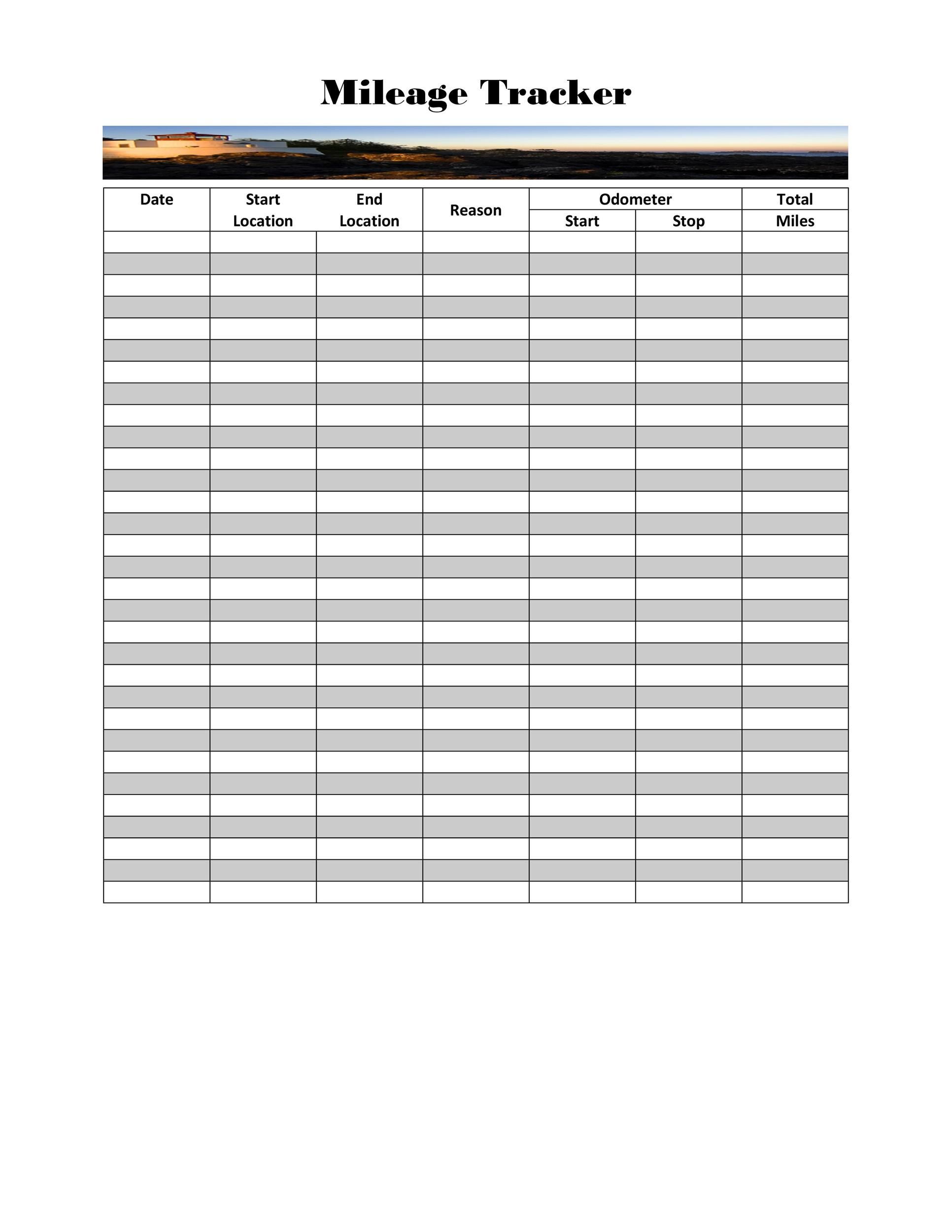

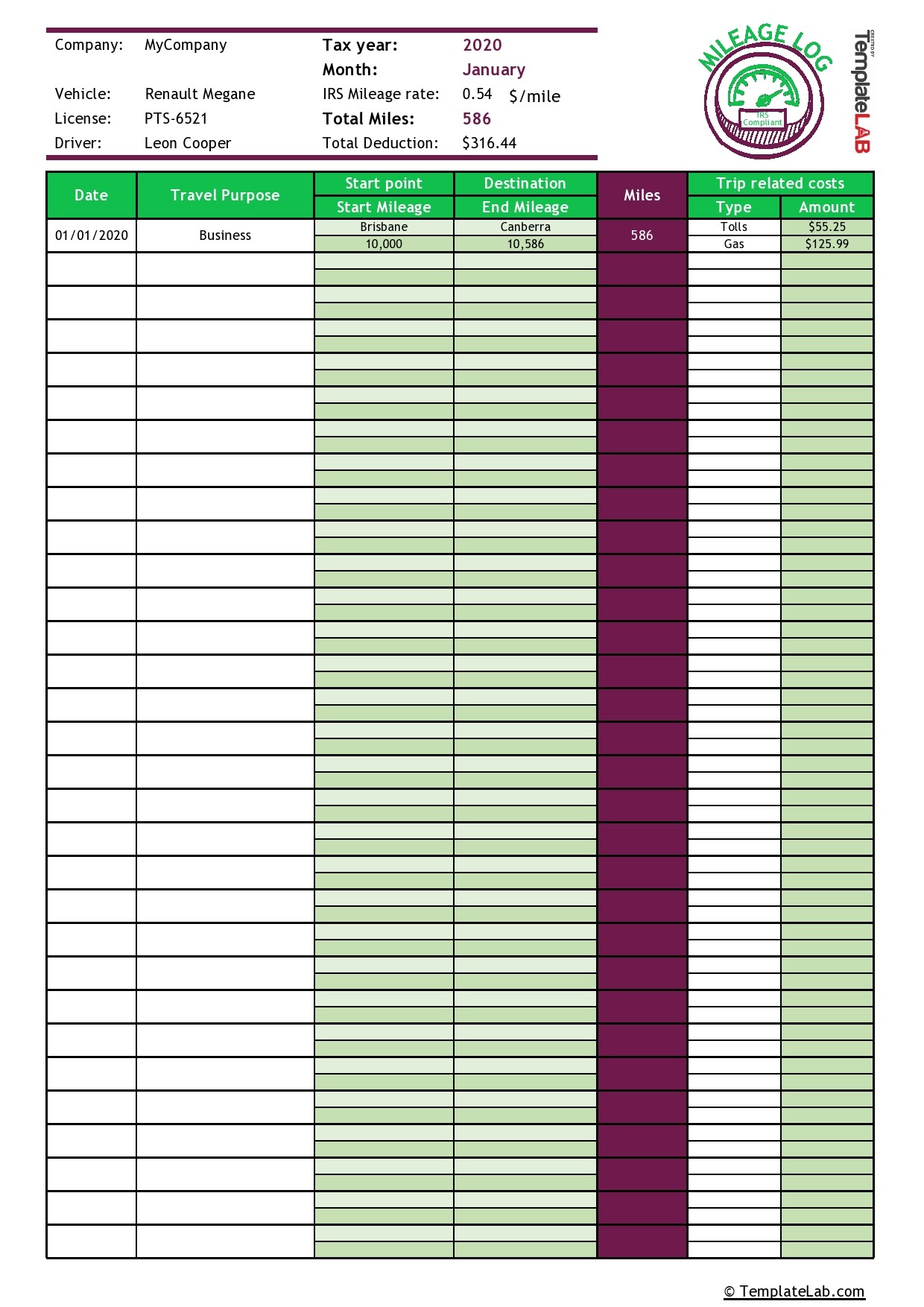

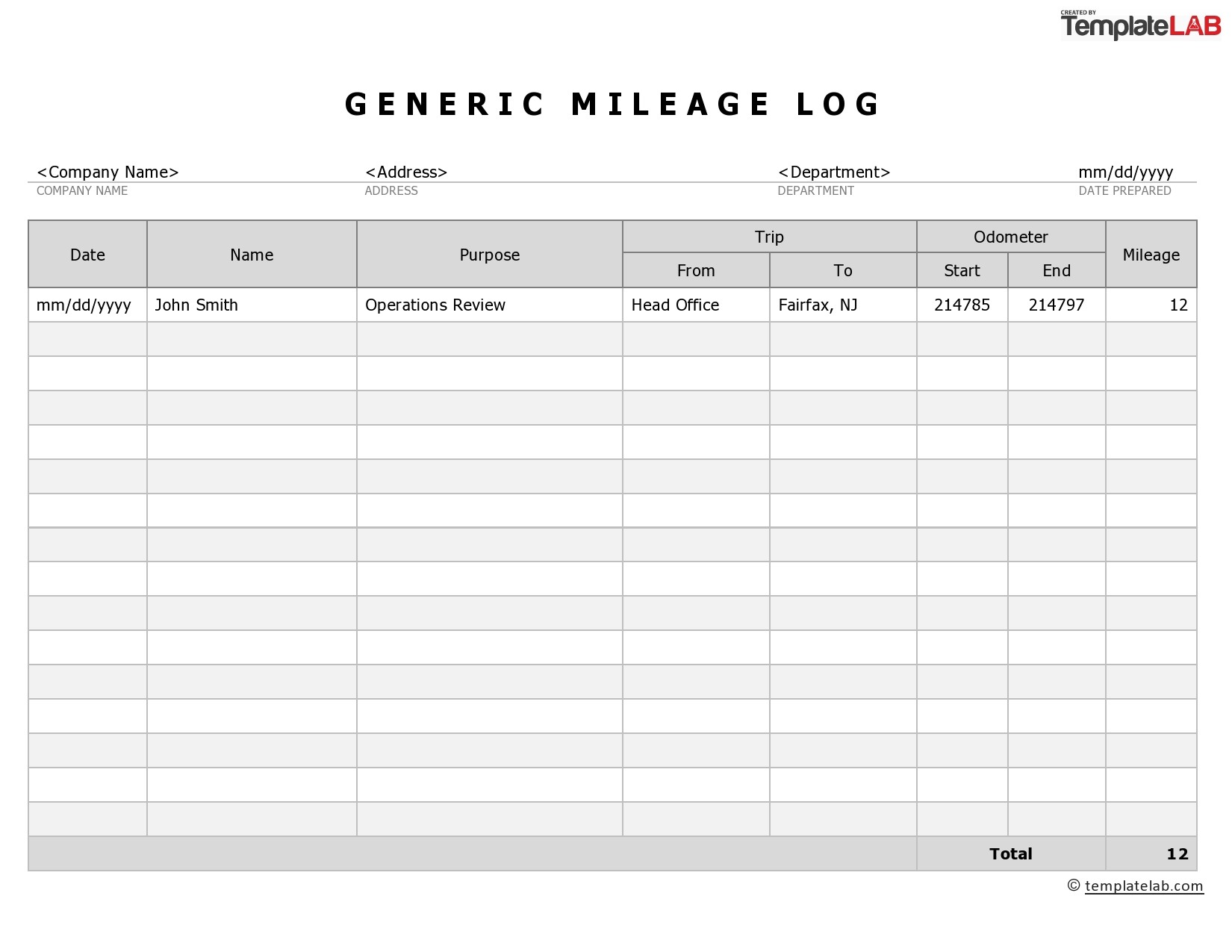

30 Printable Mileage Log Templates (Free) Template Lab

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

21+ Free Mileage Log Templates (for IRS Mileage Tracking)

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

25 Printable IRS Mileage Tracking Templates GOFAR

![]()

25 Printable IRS Mileage Tracking Templates GOFAR

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

25 Printable IRS Mileage Tracking Templates GOFAR

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

For 2023, The Standard Mileage Rate For The Cost Of Operating Your Car For Business Use Is 65.5 Cents ($0.655) Per Mile.

Whether You're An Employee Or A Business Owner, It's Important To Keep Good Business Mileage.

Well Track Mileage Reimbursements With Our Open Printable Mileage Compensation Form.

The Snippet Below Shows All The Above Mentioned Details, Except For The Odometer And The Summary Data, Which We’ll Show On.

Related Post: