Free 501C3 Donation Receipt Template

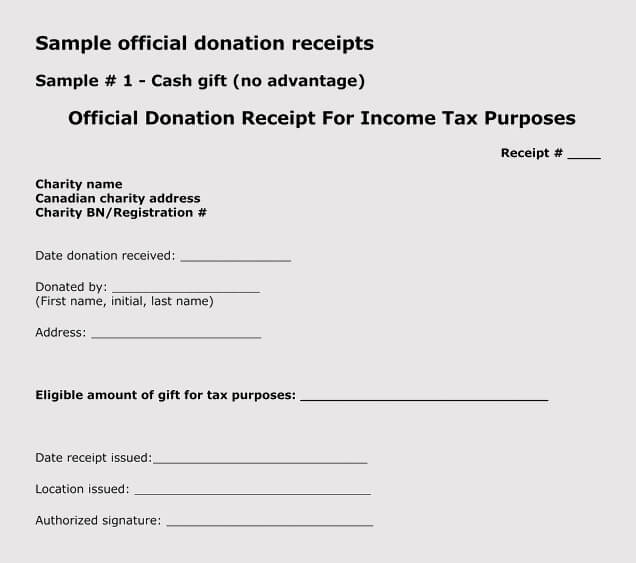

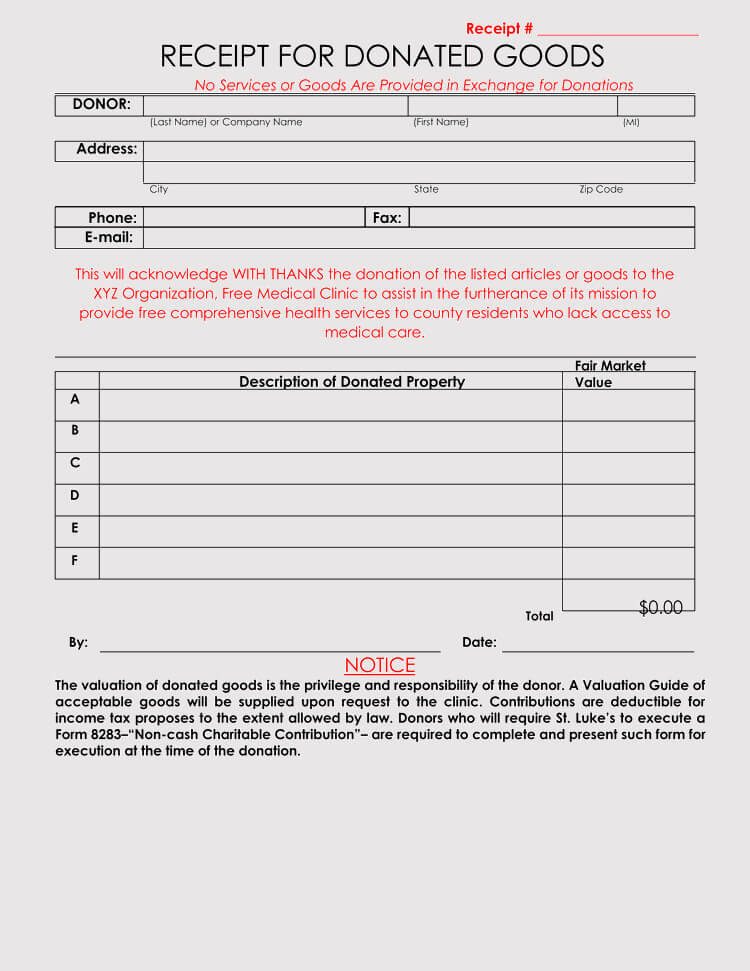

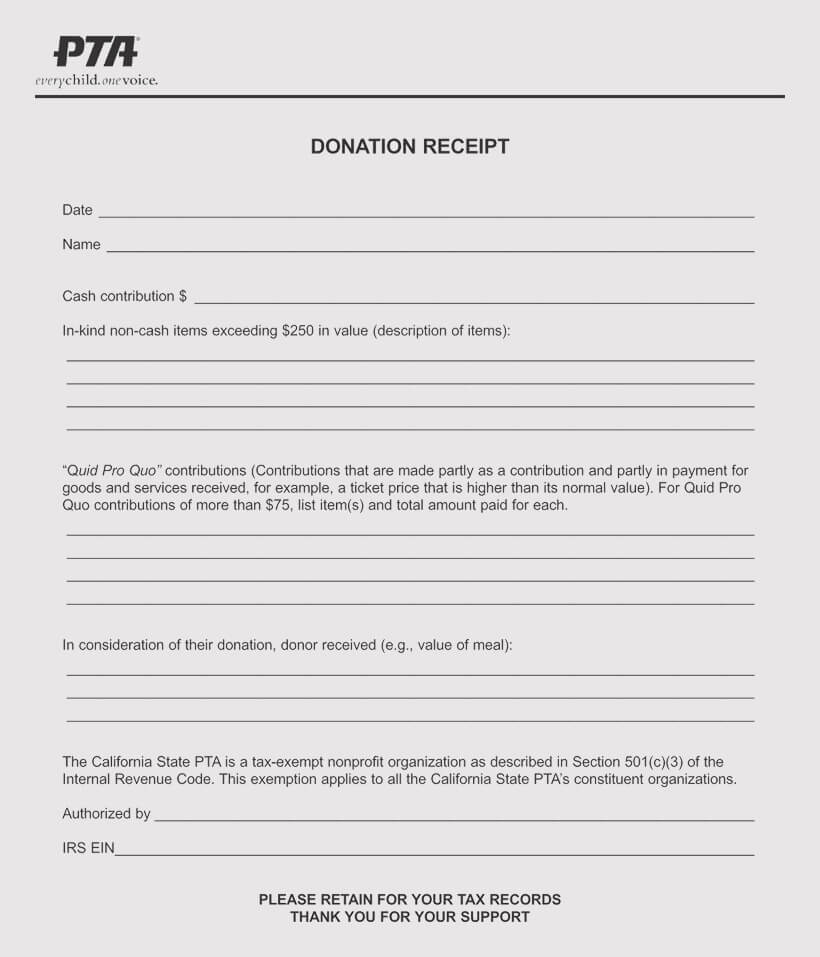

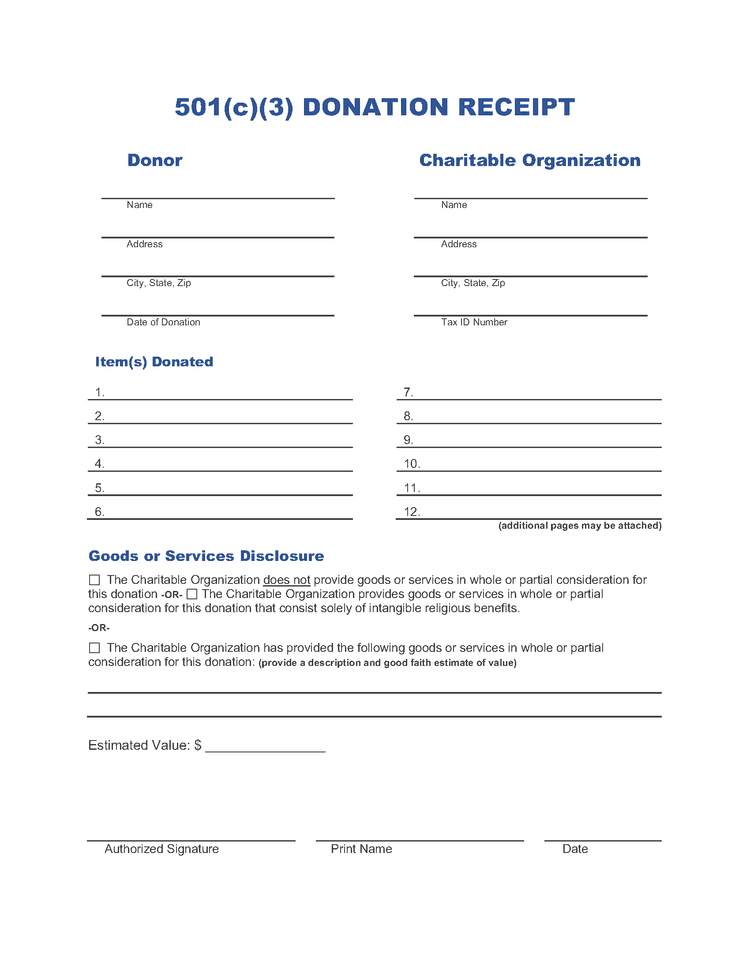

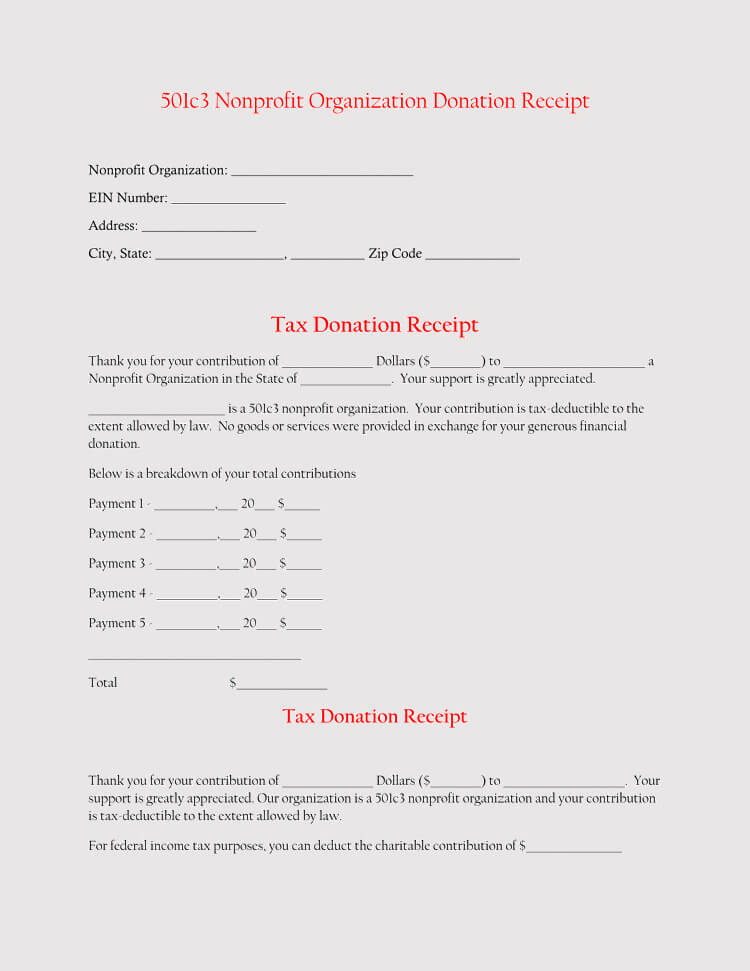

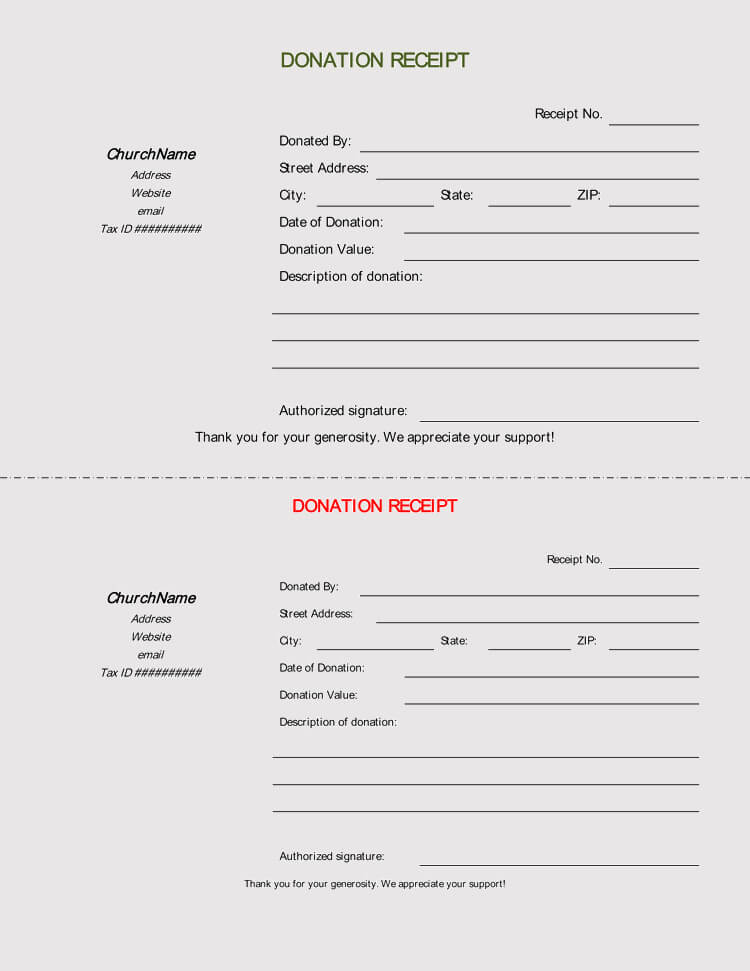

Free 501C3 Donation Receipt Template - Donorbox tax receipts are highly editable and can be customized to include important details regarding the donation. There are legal requirements for what information must be included on a nonprofit donation receipt. Web 50+ free donation receipt templates (word | pdf) when accepting donations, there are various requirements that your organization needs to meet in order to be compliant with the rules of your area. Web cash donation receipt template. Web get a standardized 501 (c) (3) donation receipt template below. Charities are only required to submit 501c3 donation receipts for amounts greater than $250, but it is good practice to issue a 501c3 donation. Web use this free donation receipt template to get started! 501c3 donation receipt template download: These email and letter templates will help you create compelling donation receipts without taking your time away from your donors: Year end donation receipt template. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. You’ll want to make sure you include everything necessary for their taxes. Web 50+ free donation receipt templates (word | pdf) when accepting donations, there are various requirements that your organization needs to meet. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. If you need help, you can review tips for using adobe printables. Nonprofit receipts are given to the donor when he donates to a nonprofit organization. Rachel ayotte september 13, 2023 subscribe Web your. Charities are only required to submit 501c3 donation receipts for amounts greater than $250, but it is good practice to issue a 501c3 donation. The organization must be exempt at the time of the contribution in order for the contribution to be deductible for the donor. To do this, make sure you include your charity’s information, the donor’s name, a. You’ll want to make sure you include everything necessary for their taxes. Donation receipt template 01 (94.65 kb) donation receipt template 02 (37.96 kb) donation receipt template 03 (50.00 kb) Web free nonprofit (donation) receipt templates (forms) a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary.. Charities are only required to submit 501c3 donation receipts for amounts greater than $250, but it is good practice to issue a 501c3 donation. Donorbox tax receipts are highly editable and can be customized to include important details regarding the donation. The receipt shows that a charitable contribution was made to your organization by the individual or business. Microsoft word. Web general charitable donation receipt template. 501c3 donation receipt template download: Web nonprofit strategies delight donors with this free donation receipt template take the stress out of acknowledgment with this guide to writing and sending the perfect donation receipt. Web a nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Get the template what should a donation receipt template include? Microsoft word (.docx) clothing donation receipt template download:. To do this, make sure you include your charity’s information, the donor’s name, a summary of. Microsoft word (.docx) clothing donation receipt template download:. Charities are only required to submit 501c3 donation receipts for amounts greater than $250, but it is good practice to issue a 501c3 donation. Web general charitable donation receipt template. This simple receipt works perfectly for a wide variety of situations. Web sample 501(c)(3) donation receipt (free template) all of these rules. You’ll want to make sure you include everything necessary for their taxes. Donorbox tax receipts are highly editable and can be customized to include important details regarding the donation. Web your receipt may be used by your donor to show they made charitable donations throughout the year. Web just make sure you update them with the custom fields that your. The receipt shows that a charitable contribution was made to your organization by the individual or business. The organization must be exempt at the time of the contribution in order for the contribution to be deductible for the donor. You’ll want to make sure you include everything necessary for their taxes. Web your receipt may be used by your donor. This simple receipt works perfectly for a wide variety of situations. When you make a charitable donation, it’s your responsibility to make sure to obtain the donation receipt, or you may. Web use this free donation receipt template to get started! Web here are some free 501 (c) (3) donation receipt templates for you to download and use; What is a donation receipt? Donorbox tax receipts are highly editable and can be customized to include important details regarding the donation. Web get a standardized 501 (c) (3) donation receipt template below. Web it would be wiser, though, to give out donation receipts and acknowledge the donations a lot sooner so that donors or benefactors would be encouraged to make contributions again in the future. Microsoft word (.docx) church donation receipt template download: Web nonprofit strategies delight donors with this free donation receipt template take the stress out of acknowledgment with this guide to writing and sending the perfect donation receipt. Charities are only required to submit 501c3 donation receipts for amounts greater than $250, but it is good practice to issue a 501c3 donation. Microsoft word (.docx) clothing donation receipt template download:. Rachel ayotte september 13, 2023 subscribe Web 50+ free donation receipt templates (word | pdf) when accepting donations, there are various requirements that your organization needs to meet in order to be compliant with the rules of your area. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Web sample 501(c)(3) donation receipt (free template) all of these rules and regulations can be confusing.

46 Free Donation Receipt Templates (501c3, NonProfit)

46 Free Donation Receipt Templates (501c3, NonProfit)

45+ Free Donation Receipt Templates (501c3, NonProfit, Charity)

Free 501C3 Donation Receipt Template

Printable 501C3 Donation Receipt Template

501(c)(3) Organization Donation Receipts (6) Invoice Maker

FREE 5+ Donation Receipt Forms in PDF MS Word

Free Donation Receipt Template 501(c)(3) PDF Word eForms

46 Free Donation Receipt Templates (501c3, NonProfit)

46 Free Donation Receipt Templates (501c3, NonProfit)

Web Cash Donation Receipt Template.

501C3 Donation Receipt Template Download:

Web A 501(C)(3) Donation Receipt Is Required To Be Completed By Charitable Organizations When Receiving Gifts In A Value Of $250 Or More.

Web A Nonprofit Receipt Template Is A Helpful Document Used To Create A Form Of Receipt States That A Benefactor Has Been Donated A Certain Value To A Beneficiary.

Related Post: