Free 1099 Template

Free 1099 Template - Rangers 3, hurricanes 2 (ot) game 4. Times are subject to change. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Web an independent contractor agreement is a legal document between a contractor that performs a service for a client in exchange for payment. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)). Web 2024 sec conference tournament schedule. Do not use this copy for your filings or you’ll be subjected to penalties by the irs. 1099s fall into a group of tax documents. It's secure and accurate and it requires no special. See your tax return instructions for where to report. There are 20 active types of 1099 forms used for various income types. Simply hit download, fill in your details, and send it in to the irs. It's secure and accurate and it requires no special. Persons with a hearing or speech disability with access to tty/tdd equipment can. From there, you can also download it to use as a. Persons with a hearing or speech disability with access to tty/tdd equipment can. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system (iris). The irs and ssa can’t provide the status of your extension request or confirm receipt. Enter all expenses on the all business expenses tab of the. Web luckily, keeper's free template will make doing your taxes a little less painful — for your soul and for your wallet. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. To recipients by january 31, 2024. You should issue all other payments to the recipient by. Web complete information. However, the issuer has reported your. It's been updated with all the latest info for you: Also known as a “1099 agreement” due to the contractor not being an employee of the client. Enter all expenses on the all business expenses tab of the free template. Web a 1099 form is a tax record that an entity or person —. Iris is available to any business of any size. Iris accepts 1099 series forms for tax year 2022 and after. See the instructions for form 8938. Web 2024 sec conference tournament schedule. It's secure and accurate and it requires no special. Web there are 6 basic steps to using this 1099 template. You may also have a filing requirement. Get free support and guidance from our experts. To the irs by february 28, 2024 if filing by mail. Iris accepts 1099 series forms for tax year 2022 and after. Enter all expenses on the all business expenses tab of the free template. From there, you can also download it to use as a 1099 excel template. There are 20 active types of 1099 forms used for various income types. Web luckily, keeper's free template will make doing your taxes a little less painful — for your soul and for. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. Web irs 1099 form. There are 20 active types of 1099 forms used for various income types. See your tax return instructions for where to report. Get free support and guidance from our experts. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Rangers 4, hurricanes 3 game 2: Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages,. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system (iris). Identify the total amount of each expense type by using the filter option. See the instructions for form 8938. Scott olson — getty images. Web an independent contractor agreement is a legal document between a contractor that performs a. Oklahoma state, tennessee and duke were the others. Get free support and guidance from our experts. The irs and ssa can’t provide the status of your extension request or confirm receipt. Web miami dolphins offseason: See the instructions for form 8938. Persons with a hearing or speech disability with access to tty/tdd equipment can. 1099s fall into a group of tax documents. You may also have a filing requirement. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)). Identify the total amount of each expense type by using the filter option. From there, you can also download it to use as a 1099 excel template. To the irs by february 28, 2024 if filing by mail. Web 2024 sec conference tournament schedule. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Also known as a “1099 agreement” due to the contractor not being an employee of the client. Currently, iris accepts forms 1099 only for tax year 2022 and later.

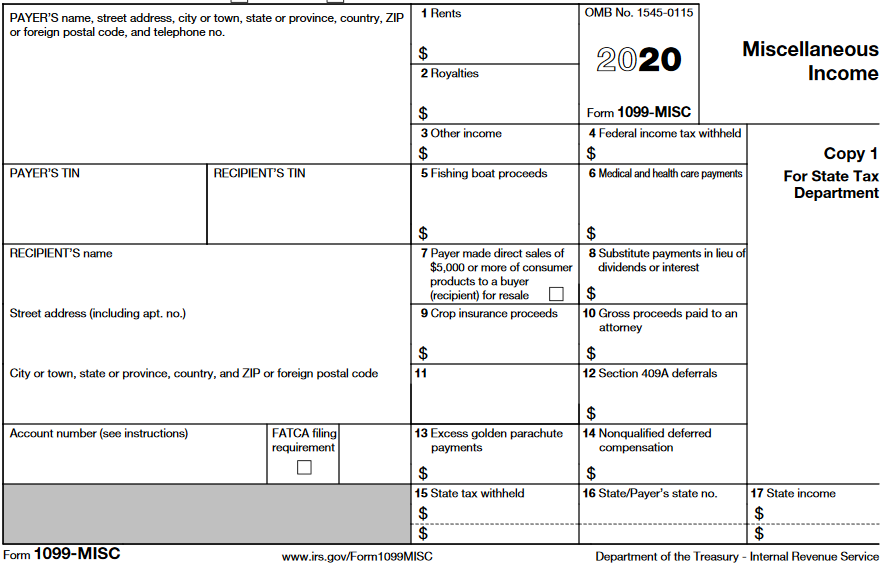

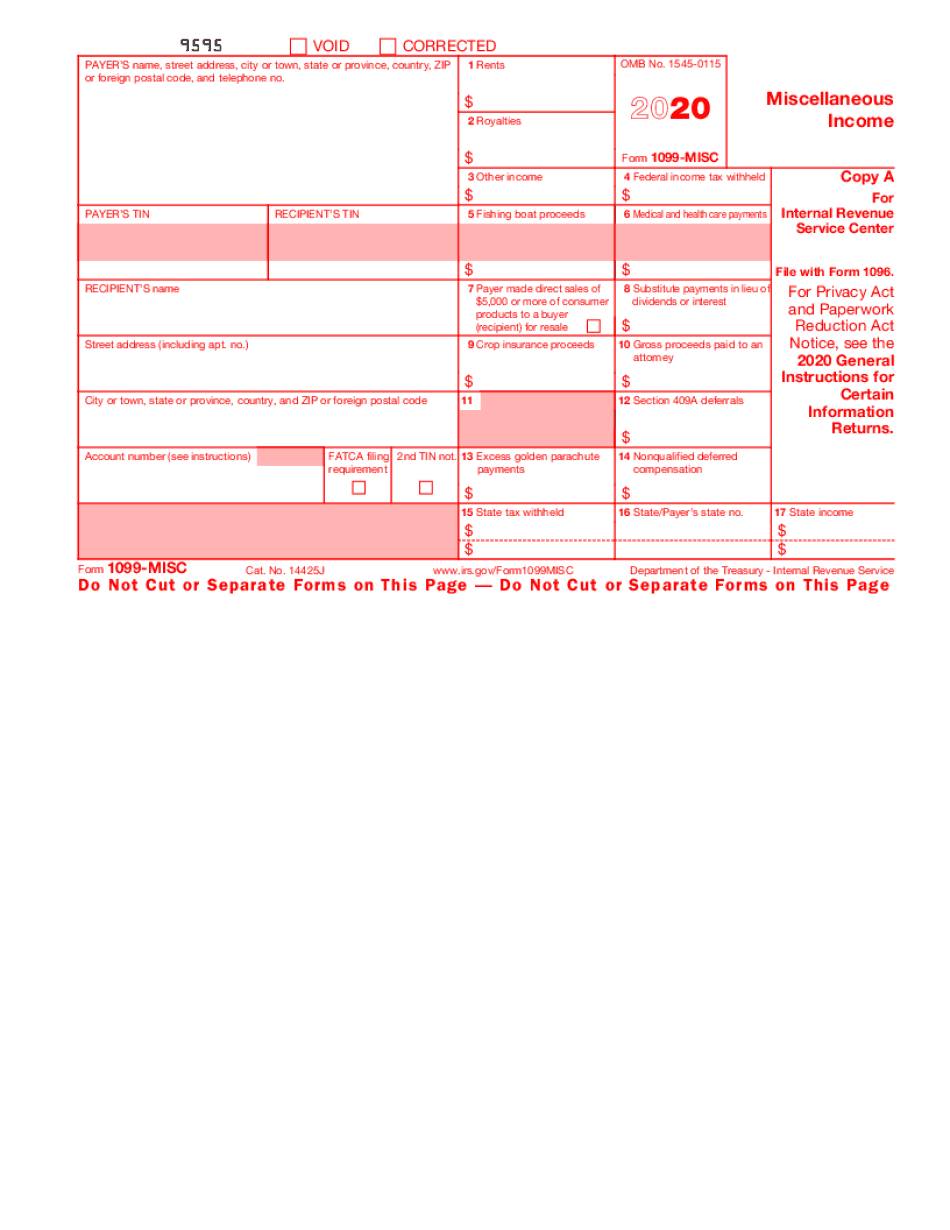

1099 Form Template. Create A Free 1099 Form Form.

Microsoft Word 1099 Tax Form Printable Template Printable Templates

Free 1099 Template Excel (With StepByStep Instructions!)

1099 Template Free

1099 Templates Get Free Templates

Free 1099 Template Excel (With StepByStep Instructions!)

Print Blank 1099 Form Printable Form, Templates and Letter

Free 1099 Pay Stub Template Database

Blank 1099 Form Blank 1099 Form 2021 eSign Genie

Free Blank 1099 Form 2023 Printable Blank Printable vrogue.co

Web New York Rangers (1M) Vs.

File Your 1099 With The Irs For Free Using Freetaxusa.

Just Click On The Link Above And Make A Copy In Google Sheets.

A Bottle Of Total Eclipse Moonshine, Which Was Distilled To Commemorate The Solar Eclipse, At Casey Jones Distillery In Kentucky.

Related Post: