Form 1096 Template

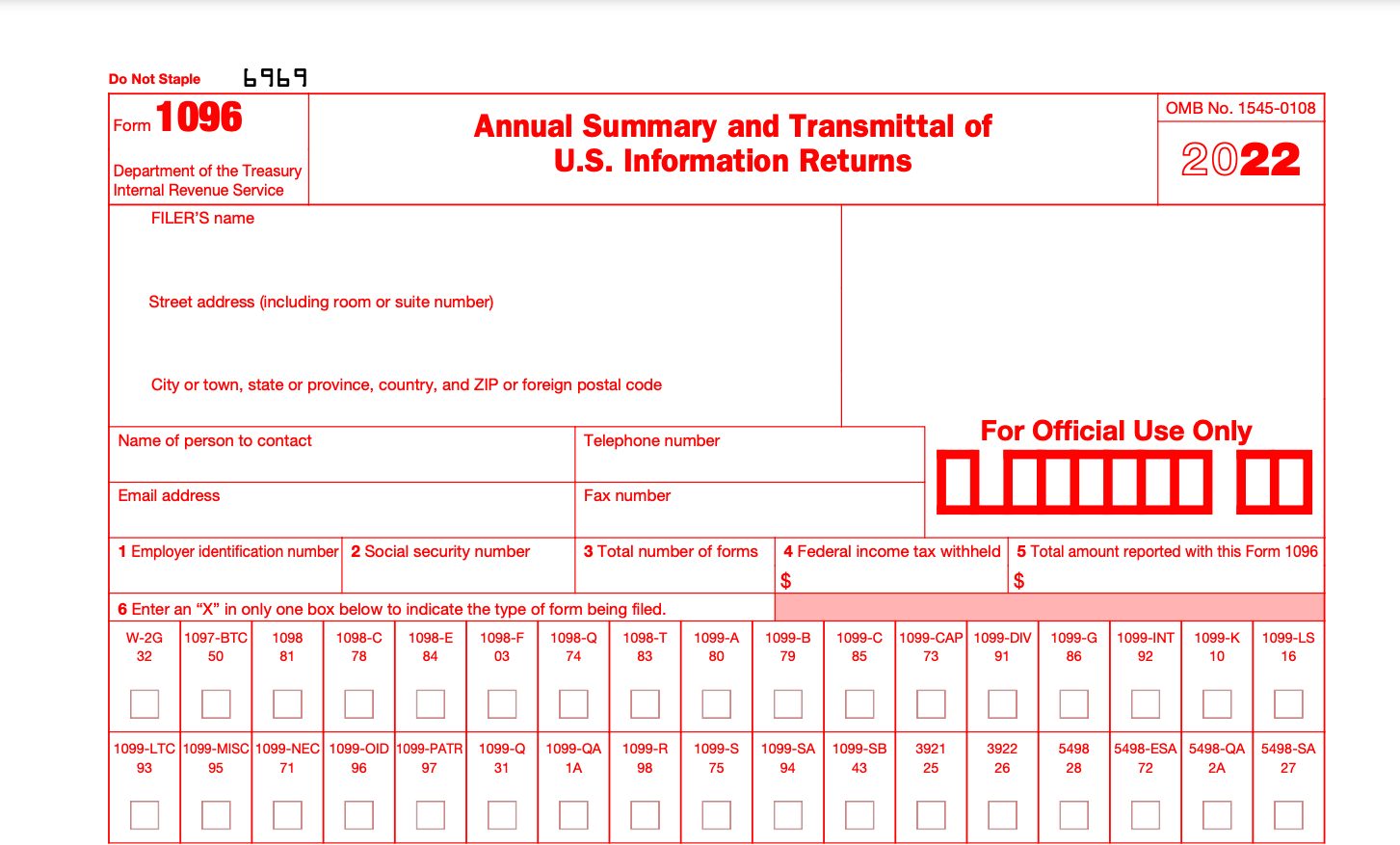

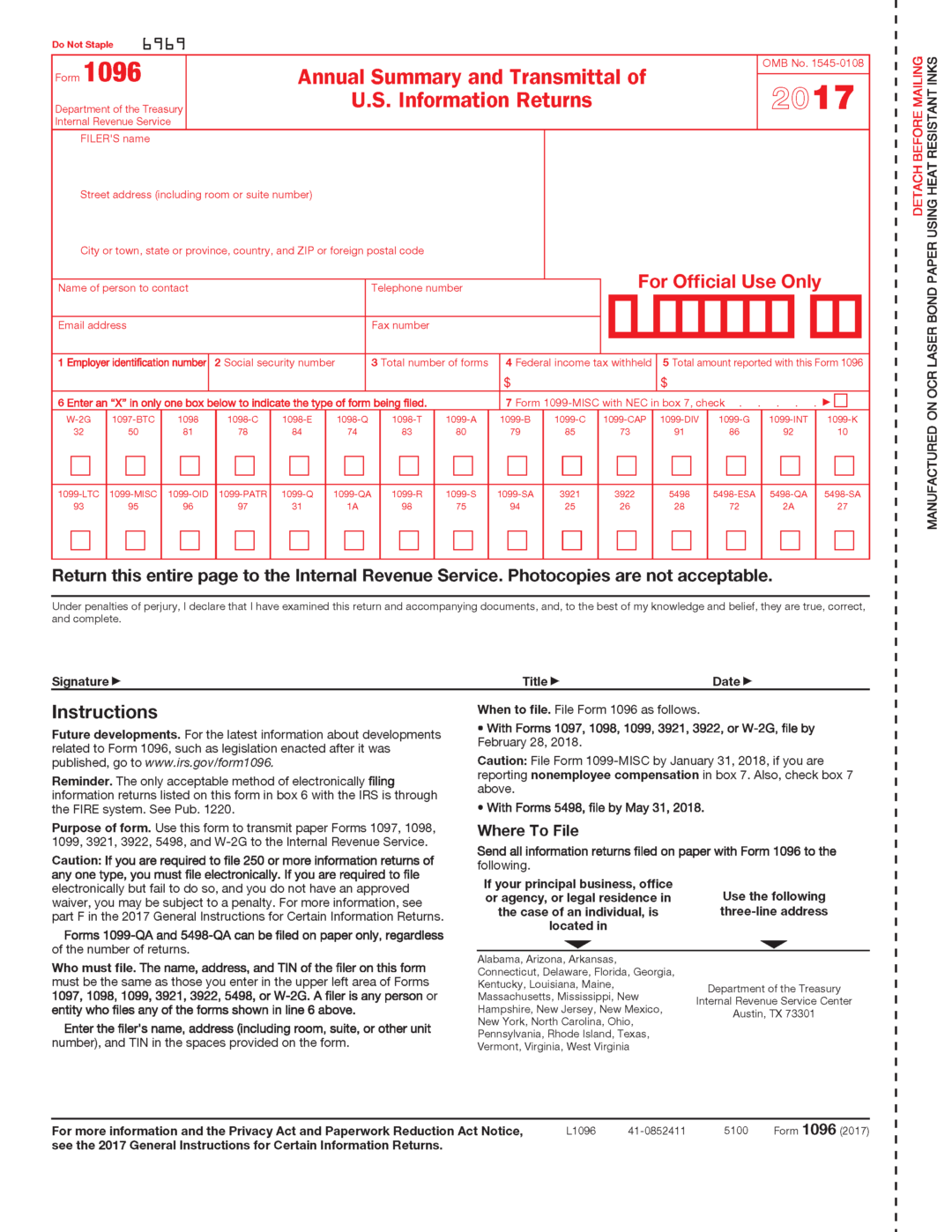

Form 1096 Template - Does anyone have a template they have created. It serves as an accompanying cover sheet that provides the irs with a quick overview of the information returns you’re submitting. Web form 1096 is used when you're submitting paper 1099 forms to the irs. Do you operate or own a small business that employs independent contractors throughout the year? This form is provided for informational purposes only. Form 1096 is only necessary if you are submitting paper forms, not if you are submitting your forms electronically. Select view 1099 to view a pdf copy. Enter the number of correctly completed forms, not the number of pages, being transmitted. You need not submit original and corrected returns separately. Do not include blank or voided forms or the form 1096 in your total. Web a form 1096 is also known as an annual summary and transmittal of u.s. Summary information for the group of forms being sent is entered only in boxes 3, 4, and 5 of form 1096. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included with the 1096 form. Do not. Web printing and filling out your form 1096 is unavailable in quickbooks online (qbo) and quickbooks contractor payments since qbo doesn't provide form 1096 complying with irs guidelines. Web word template for irs form 1096. Do you operate or own a small business that employs independent contractors throughout the year? Small business resource center small business tax prep. Tax forms. Information returns by the irs. Small business resource center small business tax prep. To get started, from the dashboard, click “filings.” next, click the form for which you want to generate a 1096. Enter the number of correctly completed forms, not the number of pages, being transmitted. Fill out online for free. Select view 1099 to view a pdf copy. The official printed version of this irs form is scannable, but a copy, printed from this website, is not. It's used to summarize details about other tax forms that you are submitting, but only if you are submitting them in paper form. Web printing and filling out your form 1096 is unavailable. This guide aims to demystify form 1096, making it accessible and understandable for anyone who needs to file it. Do not include blank or voided forms or the form 1096 in your total. Choose the scenario that fits your situation. How to use the 1096 form for contractor compensation. Web updated over a week ago. Information returns by the irs. Summary information for the group of forms being sent is entered only in boxes 3, 4, and 5 of form 1096. Web irs form 1096, officially known as the “annual summary and transmittal of u.s. Attention filers of form 1096: Do not include blank or voided forms or the form 1096 in your total. Information returns,” is a summary document used when filing certain irs information returns by mail. Irs form 1096 often goes unnoticed amidst the plethora of tax documents, but it plays a critical role in tax reporting. Select view 1099 to view a pdf copy. In business, form 1096 is most commonly used to summarize nonemployee compensation (payments made to independent. Choose the scenario that fits your situation. This guide aims to demystify form 1096, making it accessible and understandable for anyone who needs to file it. Do not include blank or voided forms or the form 1096 in your total. Fill out online for free. Web irs form 1096 is officially named the annual summary and transmittal of u.s. Thus, you'll have to print this form outside qbo. To get started, from the dashboard, click “filings.” next, click the form for which you want to generate a 1096. Do not include blank or voided forms or the form 1096 in your total. Web updated over a week ago. In business, form 1096 is most commonly used to summarize nonemployee. Summary information for the group of forms being sent is entered only in boxes 3, 4, and 5 of form 1096. The official printed version of this irs form is scannable, but a copy, printed from this website, is not. You need not submit original and corrected returns separately. Also, see part f in the 2023 general instructions for certain. From your dashboard, go to “filings.” next, select the 1099s that you want to create a 1096 summary form for, such as the nec, misc, etc. Small business resource center small business tax prep. Thus, you'll have to print this form outside qbo. It serves as an accompanying cover sheet that provides the irs with a quick overview of the information returns you’re submitting. Information returns,” is a summary document used when filing certain irs information returns by mail. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included with the 1096 form. To get started, from the dashboard, click “filings.” next, click the form for which you want to generate a 1096. Also, see part f in the 2023 general instructions for certain information returns. Web form 1096 is used when you're submitting paper 1099 forms to the irs. Web a form 1096 is also known as an annual summary and transmittal of u.s. Form 1096 is only necessary if you are submitting paper forms, not if you are submitting your forms electronically. Select view 1099 to view a pdf copy. In business, form 1096 is most commonly used to summarize nonemployee compensation (payments made to independent contractors) reported on. I would be most appreciative. Does anyone have a template they have created. Information returns by the irs.

USA 1096 Form Template United Templates

Printable 1096 Form 2021 Customize and Print

Form 1096 Word Template Templates Nzg4ODQ Resume Examples

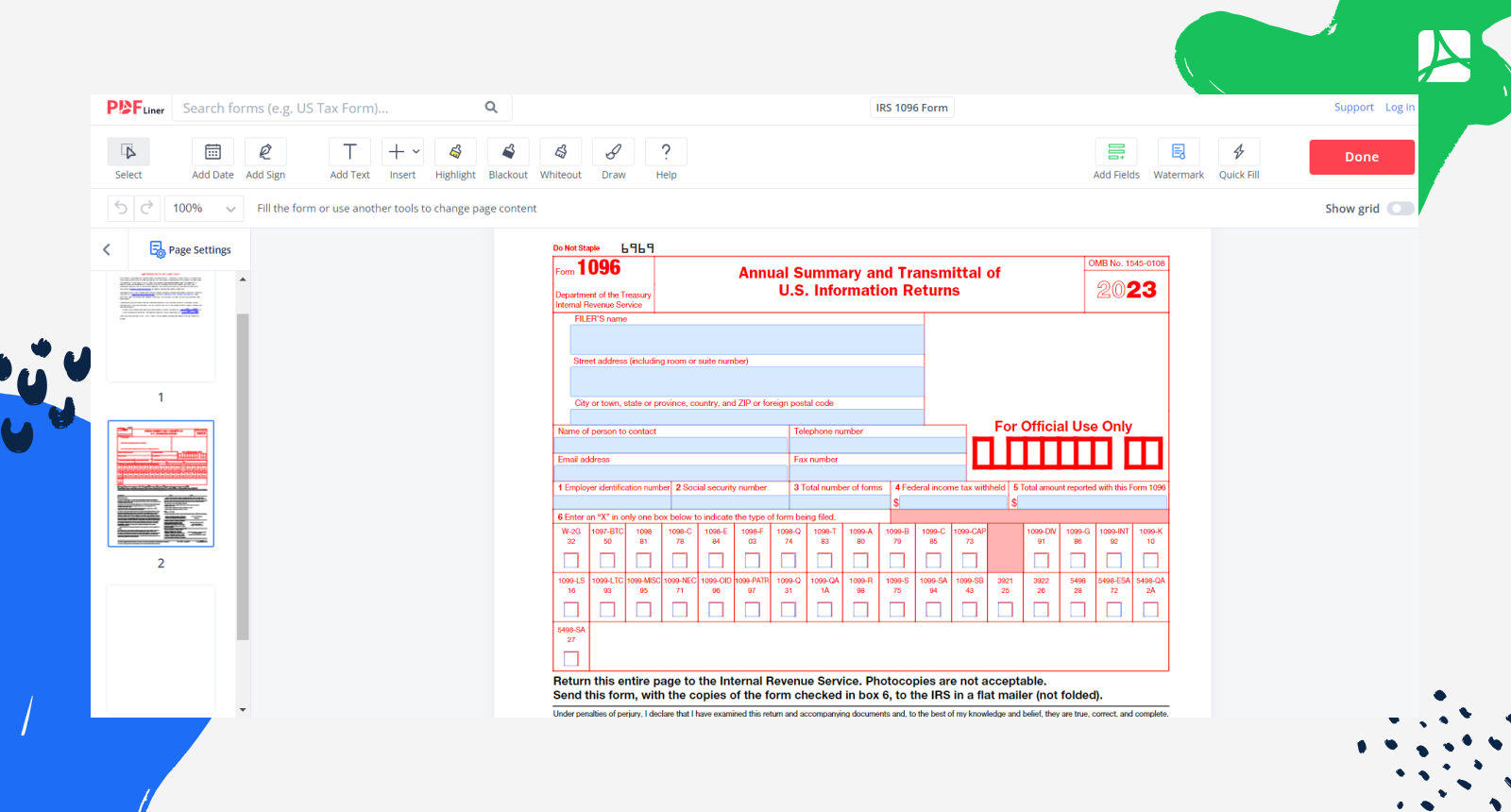

IRS 1096 Form 2023 Printable blank, sign forms online — PDFliner

2020 1099MISC/1096 IRS Copy A Form Print Template for Word or PDF

Form 1096 A Simple Guide Bench Accounting

Document Form 1096 Internal Revenue Service IRS tax forms, blank Ticket

1096 Annual Summary Transmittal Forms & Fulfillment

Free irs form 1096 template horintl

Mastering Form 1096 The Essential Guide The Boom Post

It Appears In Red, Similar To The Official Irs Form.

You May Reach Out To The Irs To Get This Form Or Manually Download The Form 1096 From Their Site.

Without Registration Or Credit Card.

I Am Looking For Either A Word Or Excel Template To Complete Irs Form 1096.

Related Post: