Form 1040 Template

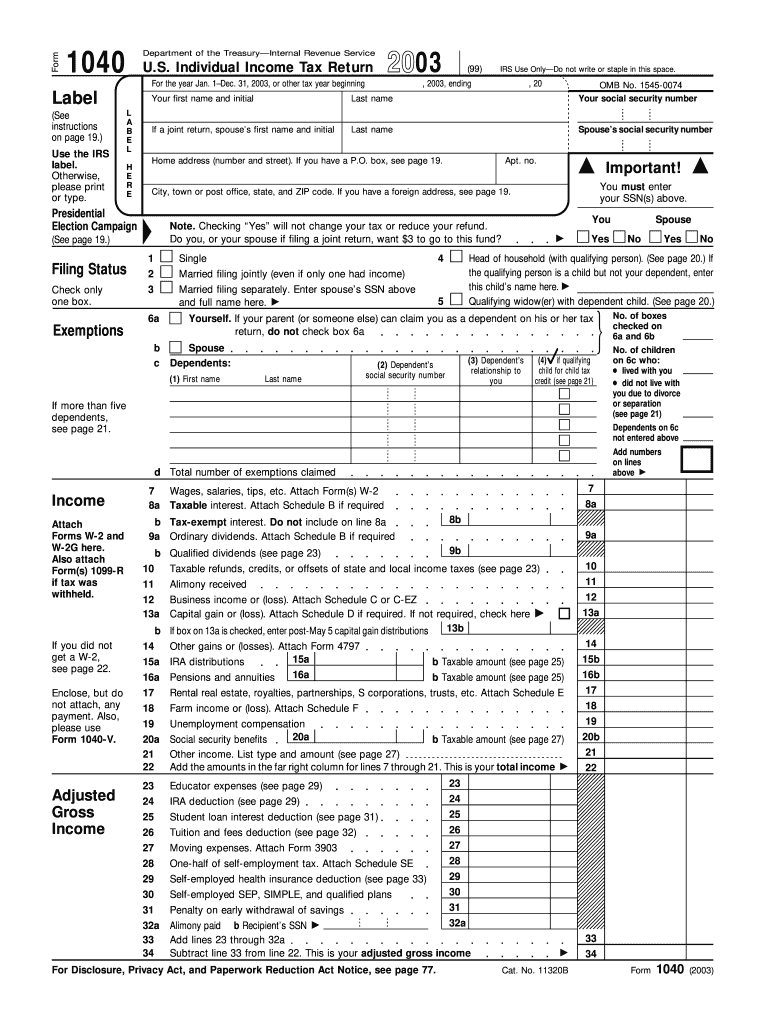

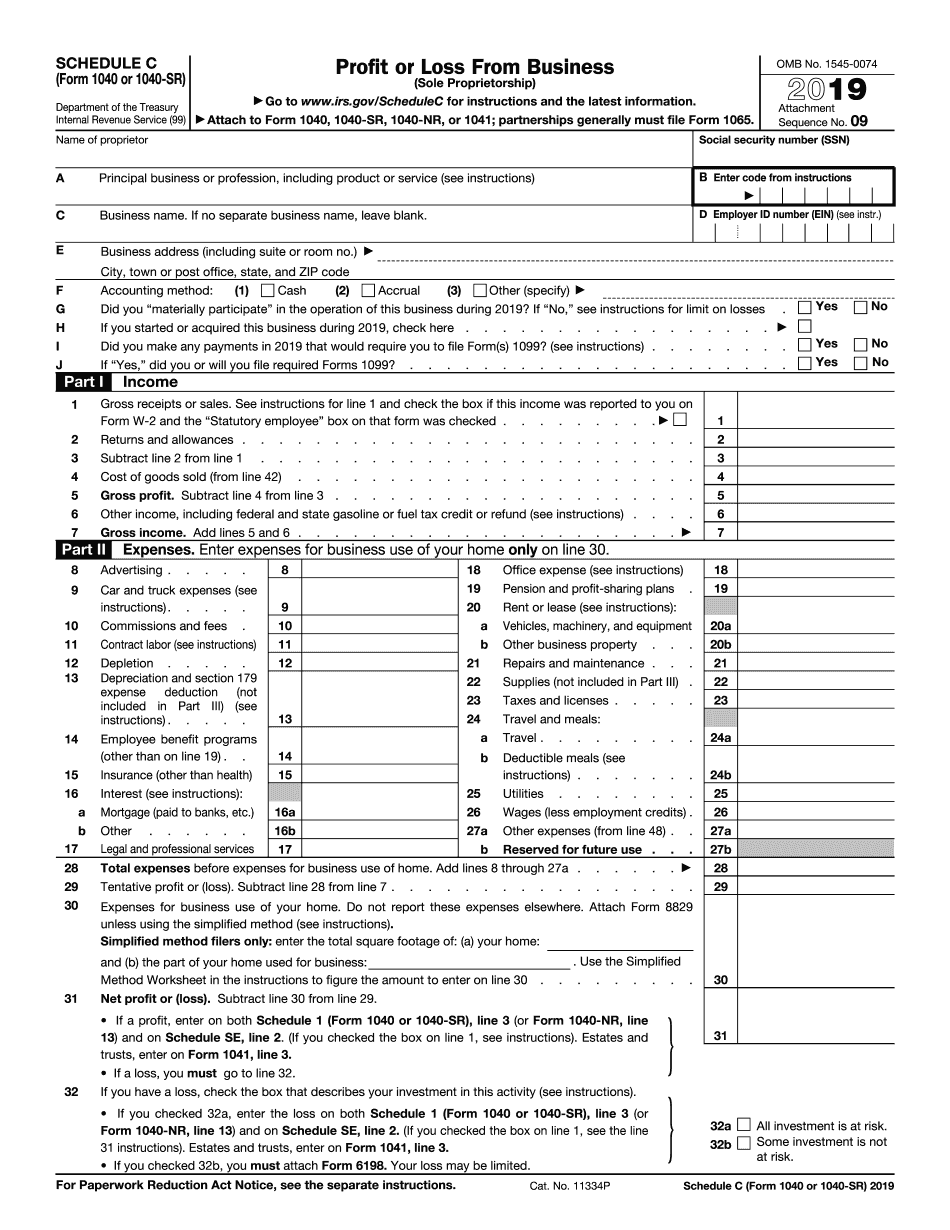

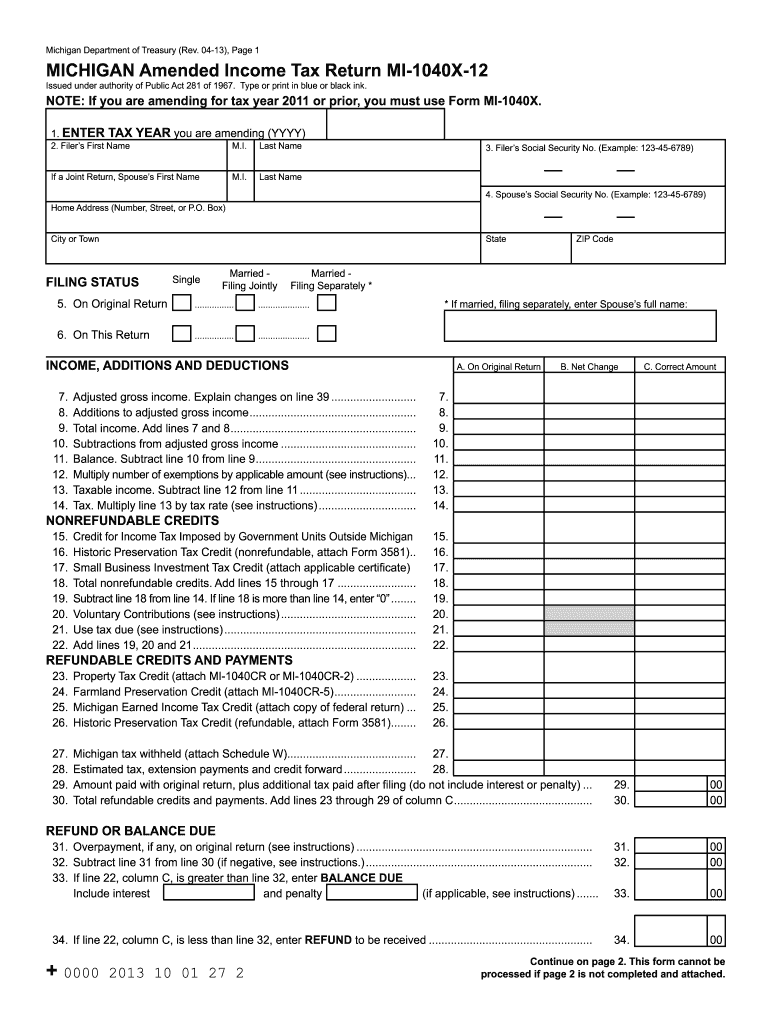

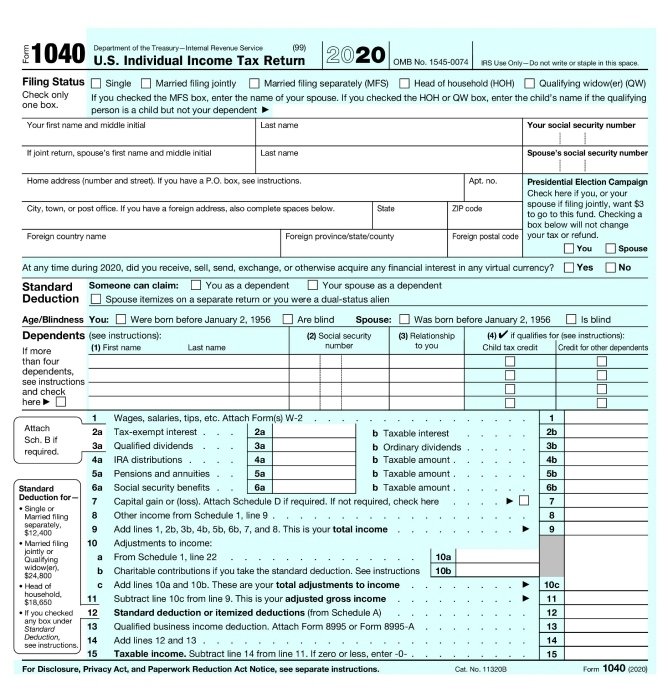

Form 1040 Template - Request for taxpayer identification number (tin) and certification. However, the fillable forms don’t come with any additional guidance. The internal revenue service (irs) releases an updated version of form 1040 each filing year. If you checked the hoh or qw box, enter the child’s name if the qualifying person is a child but not your dependent. The form ends with helping you to determine your refund or how much you owe. Web line 11 if you filed a form 1040; Web form 1040, officially, the u.s. Microsoft excel spreadsheet for us federal income tax form 1040. If you are using the irs free file guided tax software and you are filing using the married filing jointly filing status, the $79,000 agi eligibility amount applies to your combined agi. More about the federal form 1040 corporate income tax ty 2023. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw) if you checked the mfs box, enter the name of your spouse. Profit or loss from business. Web line 11 if you filed a form 1040; If you are using the irs free file guided tax software and you are filing using the married filing. The internal revenue service (irs) releases an updated version of form 1040 each filing year. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw) If you checked the hoh or qss box, enter the child’s name if the qualifying person is a child but not your dependent: With our fillable form 1040 individual income. Individual income tax return,” is the irs tax form you use to report all types of income and expenses, claim tax deductions and credits, and calculate your tax bill or refund for the tax year. The irs is highlighting seven suspicious signs and urging businesses to seek a trusted tax professional to resolve an incorrect claim if they need to.. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw) Web form 1040, officially, the u.s. With our fillable form 1040 individual income tax return form, you can easily record your tax information from any device and save your entry as. Employers engaged in a trade or business who pay compensation. Your agi is calculated. Tax table from instructions for form 1040 pdf. The form ends with helping you to determine your refund or how much you owe. If you are using the irs free file guided tax software and you are filing using the married filing jointly filing status, the $79,000 agi eligibility amount applies to your combined agi. With our fillable form 1040. Irs use only—do not write or staple in this space. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw) if you checked the mfs box, enter the name of your spouse. If you checked the hoh or qw box, enter the child’s name if the qualifying person is a child but not your dependent.. The irs has released a new tax filing form for people 65 and older. Employers engaged in a trade or business who pay compensation. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw) if you checked the mfs box, enter the name of your spouse. The form calculates the total taxable income of the. More about the federal form 1040 corporate income tax ty 2023. Individual income tax return, is an irs tax form used for personal federal income tax returns filed by united states residents. No matter your income level, you can use free file fillable forms for your federal tax return. The form is optional and uses the same schedules, instructions, and. Employer's quarterly federal tax return. The internal revenue service (irs) releases an updated version of form 1040 each filing year. Your agi is calculated before you take your standard or itemized deduction, on form 1040. Web form 1040 is the basic form for filing your federal income taxes. Web what are free file fillable forms? Form 1040 is an irs tax form used by united states residents to file their personal federal income taxes. More about the federal form 1040 corporate income tax ty 2023. Irs use only—do not write or staple in this space. Profit or loss from business. Request for transcript of tax return. The irs has released a new tax filing form for people 65 and older. Information about form 1040, u.s. Microsoft excel spreadsheet for us federal income tax form 1040. Web form 1040, formally known as the “u.s. If you are using the irs free file guided tax software and you are filing using the married filing jointly filing status, the $79,000 agi eligibility amount applies to your combined agi. If you’ve ever filed a federal income tax return, chances are you used irs form 1040. Capital gains and losses (along with its worksheet) Individual income tax return 2023 department of the treasury—internal revenue service. 31, 2023, or other tax year beginning , 2023, ending , 20. Filing status check only one box. The internal revenue service (irs) releases an updated version of form 1040 each filing year. The form calculates the total taxable income of the taxpayer and determines how much is to be paid to or refunded by the government. These are identical to irs paper forms, so this option is like the old “pencil and calculator” method of filing. Request for transcript of tax return. Web form 1040, formally known as the “u.s. Your first name and middle initial.

Fillable IRS Form 1040 (Schedule 8812) 2018 2019 Online PDF Template

Form 1040 Fill Out and Sign Printable PDF Template signNow

Create Fillable Schedule C 1040 Or 1040sr Form And Cope With Bureaucracy

1040 X 12 Form Fill Out and Sign Printable PDF Template SignNow

Form 1040 IRS Form 1040 Instructions Free Template

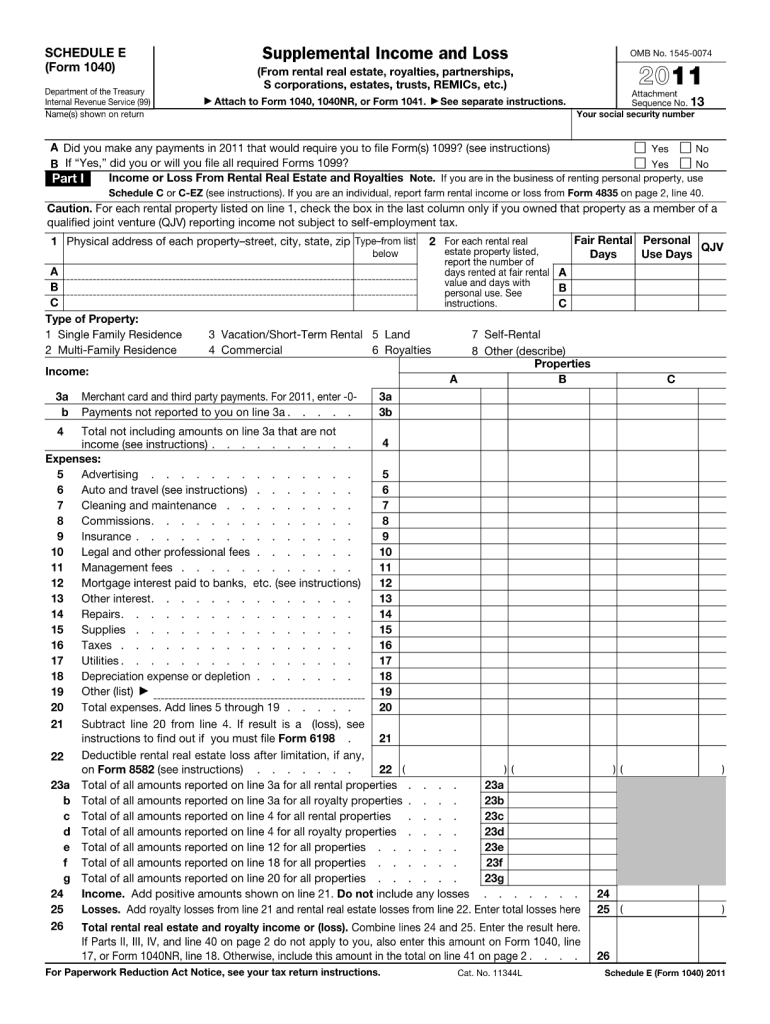

IRS 1040 Schedule E 2011 Fill out Tax Template Online US Legal Forms

Printable 1040 Form

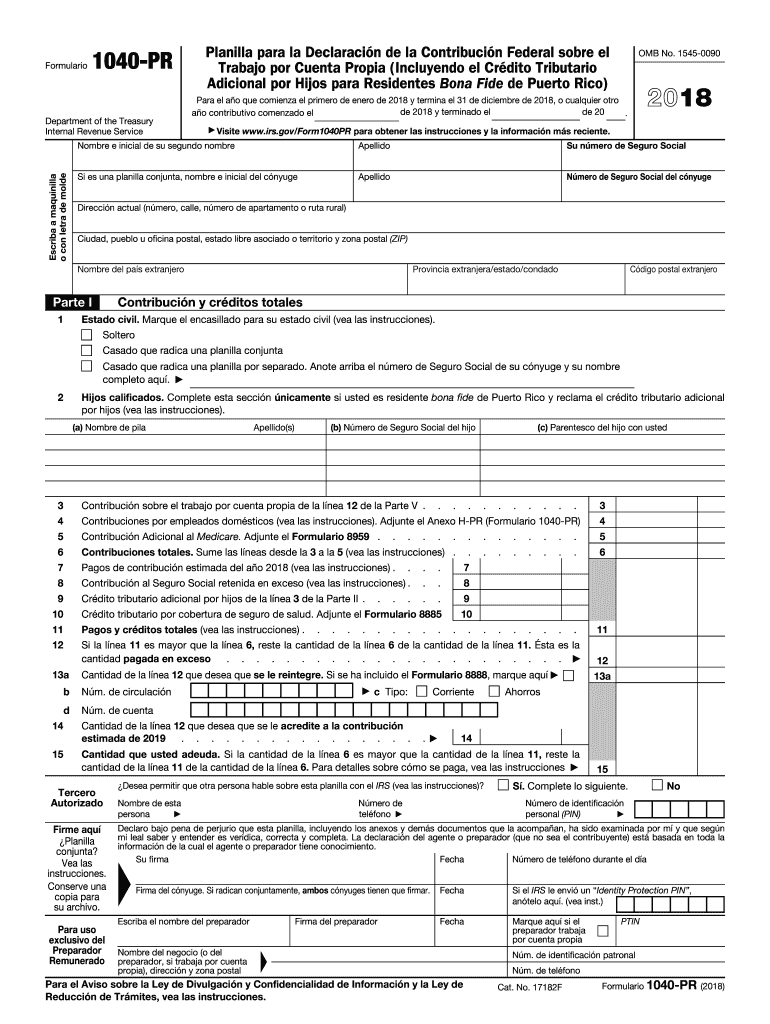

IRS 1040PR 2018 Fill and Sign Printable Template Online US Legal Forms

IRS 1040 Form Template Create and Fill Online Tax Forms

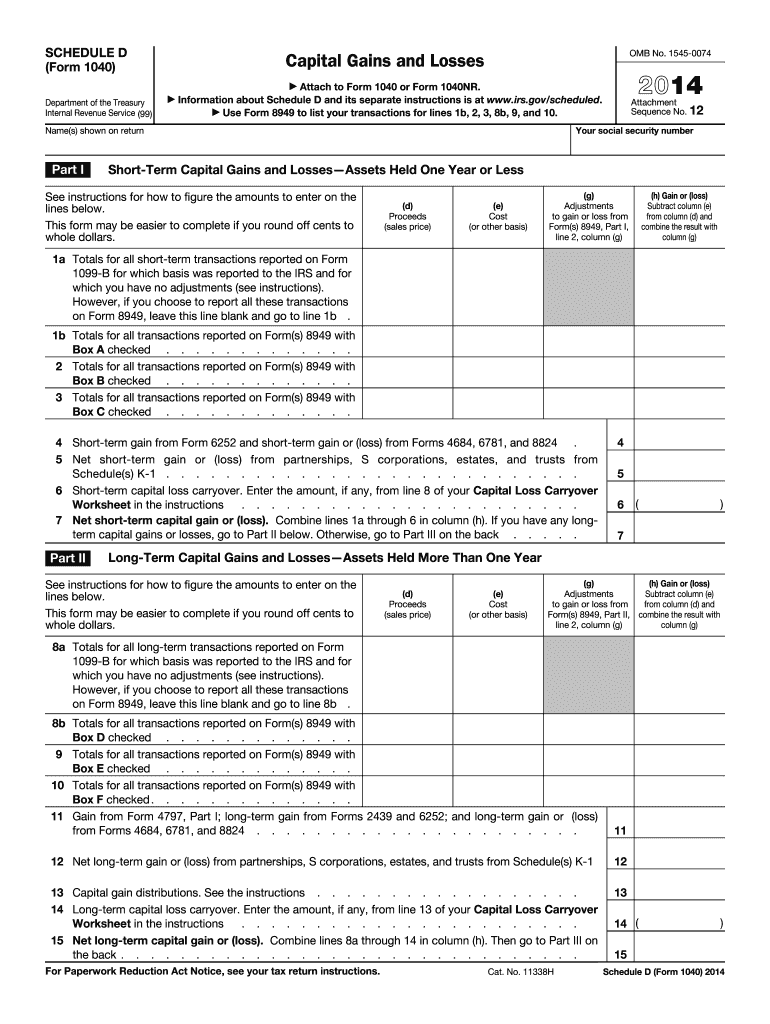

Form 1040 Schedule D Fill Out and Sign Printable PDF Template

Your Agi Is Calculated Before You Take Your Standard Or Itemized Deduction, On Form 1040.

No Matter Your Income Level, You Can Use Free File Fillable Forms For Your Federal Tax Return.

Request For Taxpayer Identification Number (Tin) And Certification.

Web Follow These Five Steps To Fill Out Irs Form 1040 For The 2022 Tax Year.

Related Post: