Forex Reversal Patterns

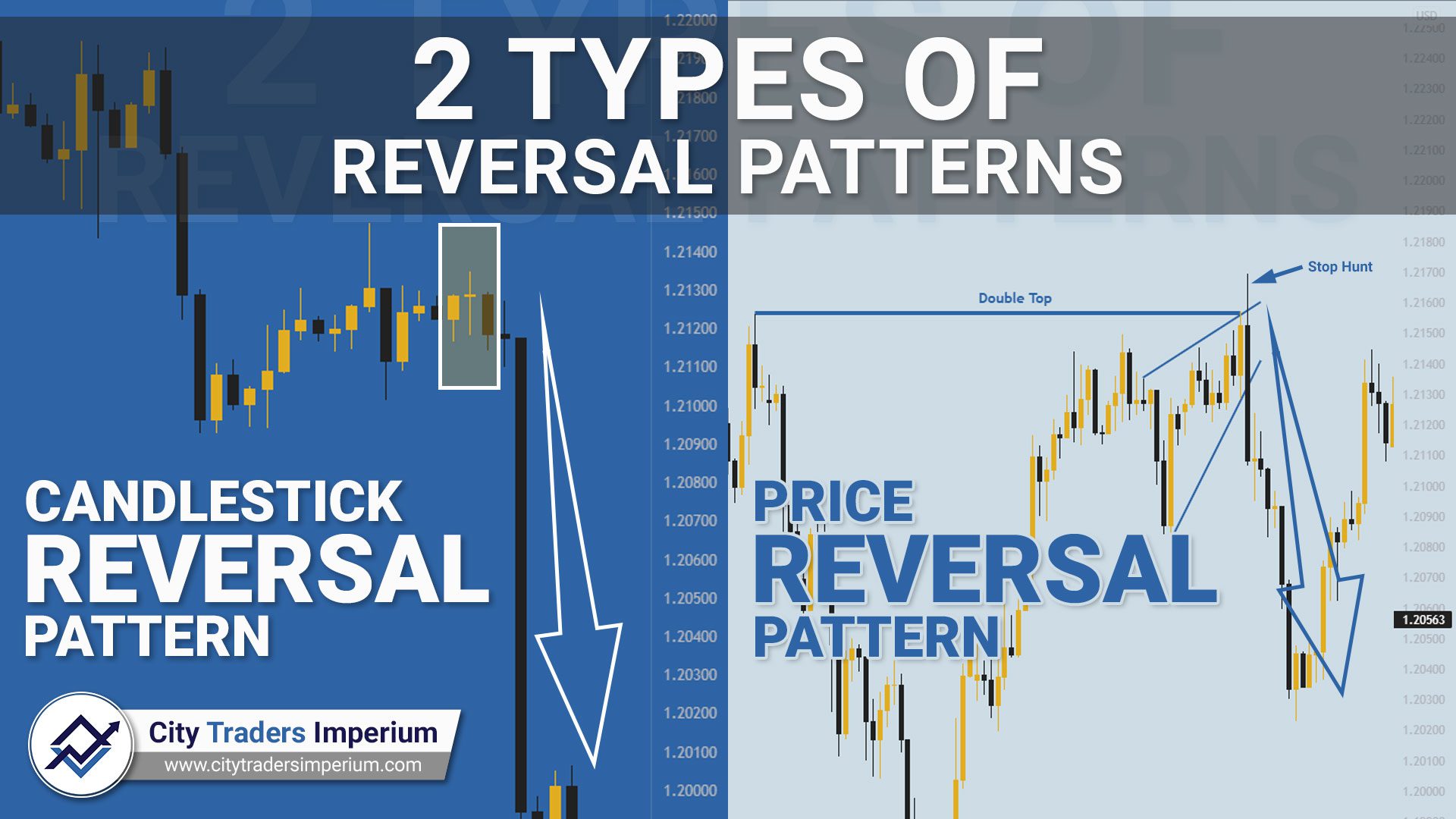

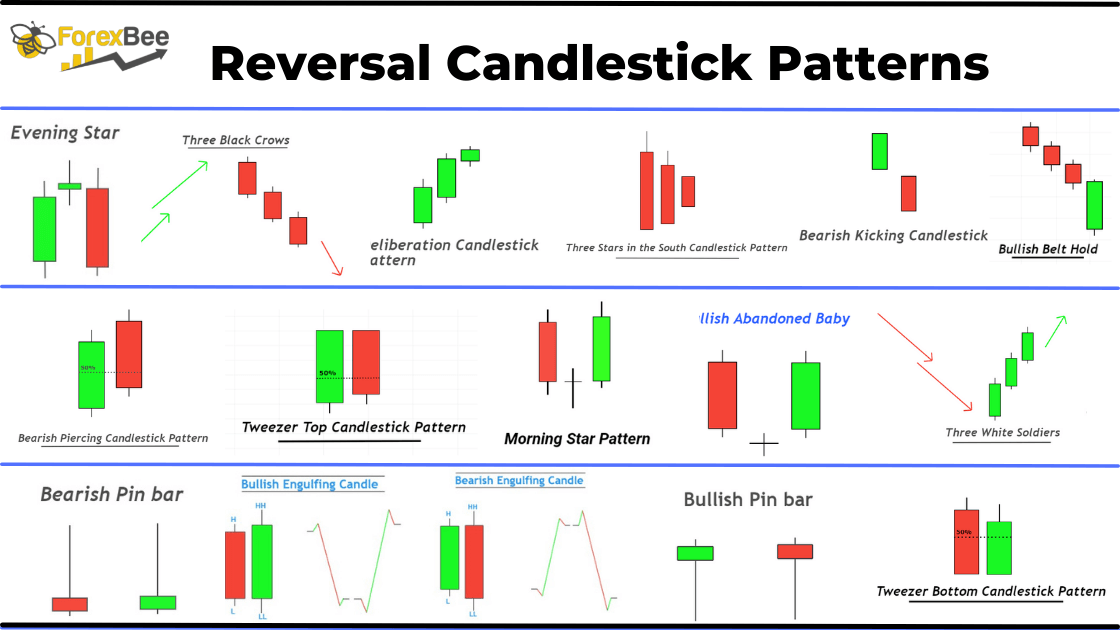

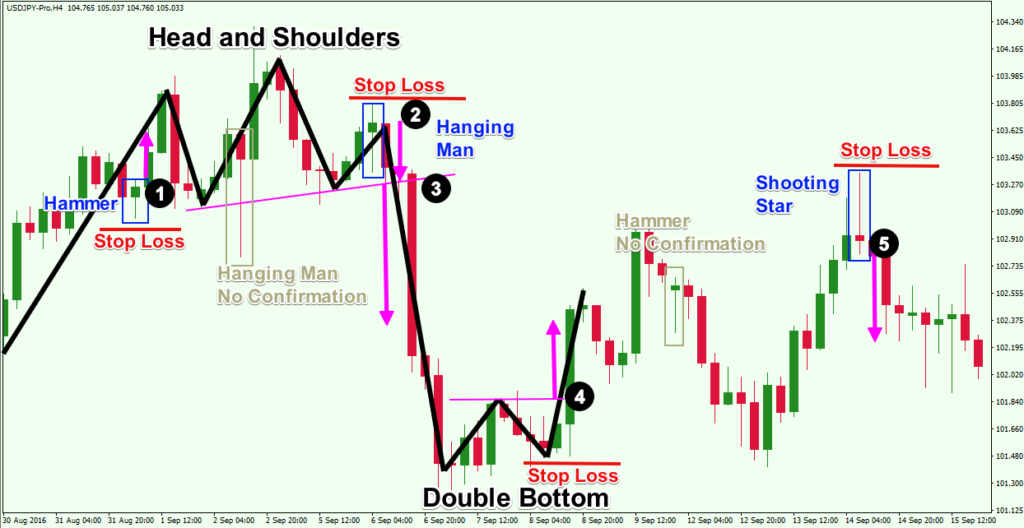

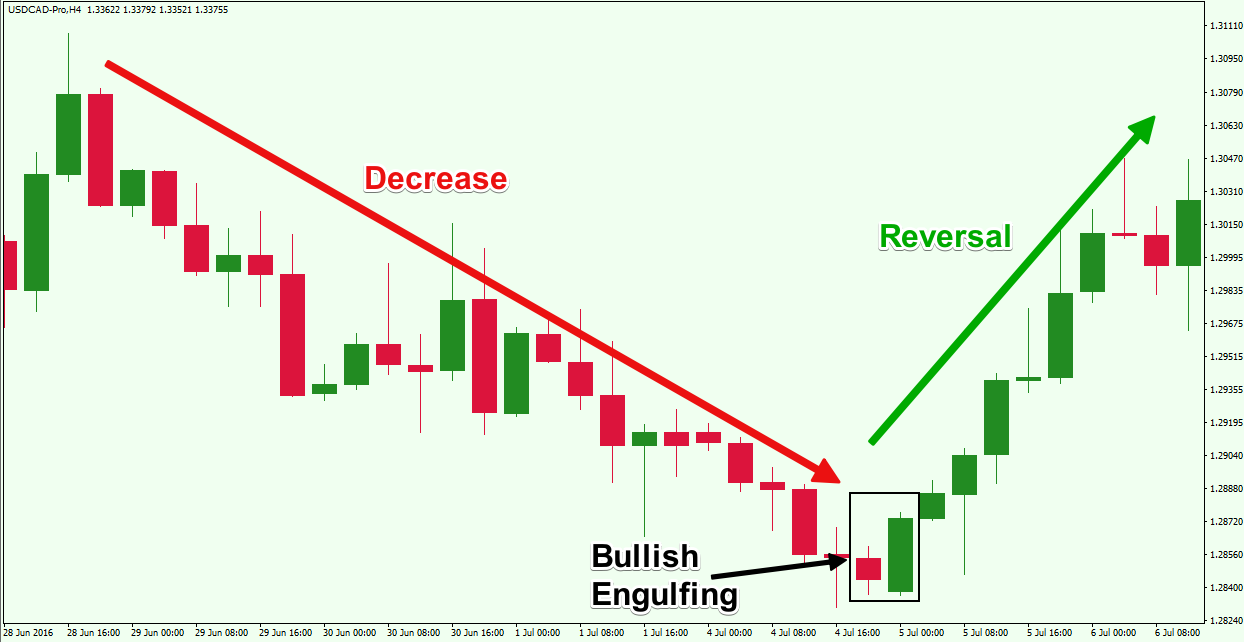

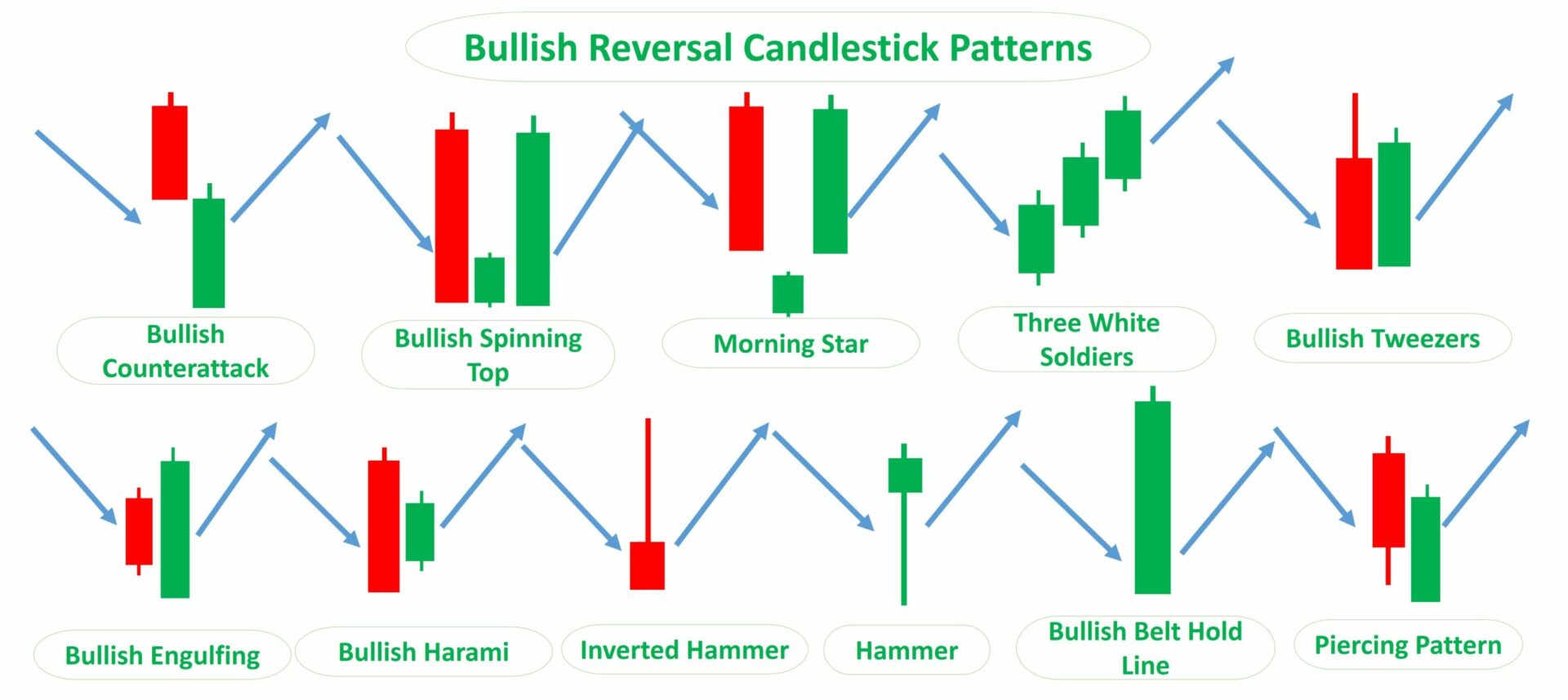

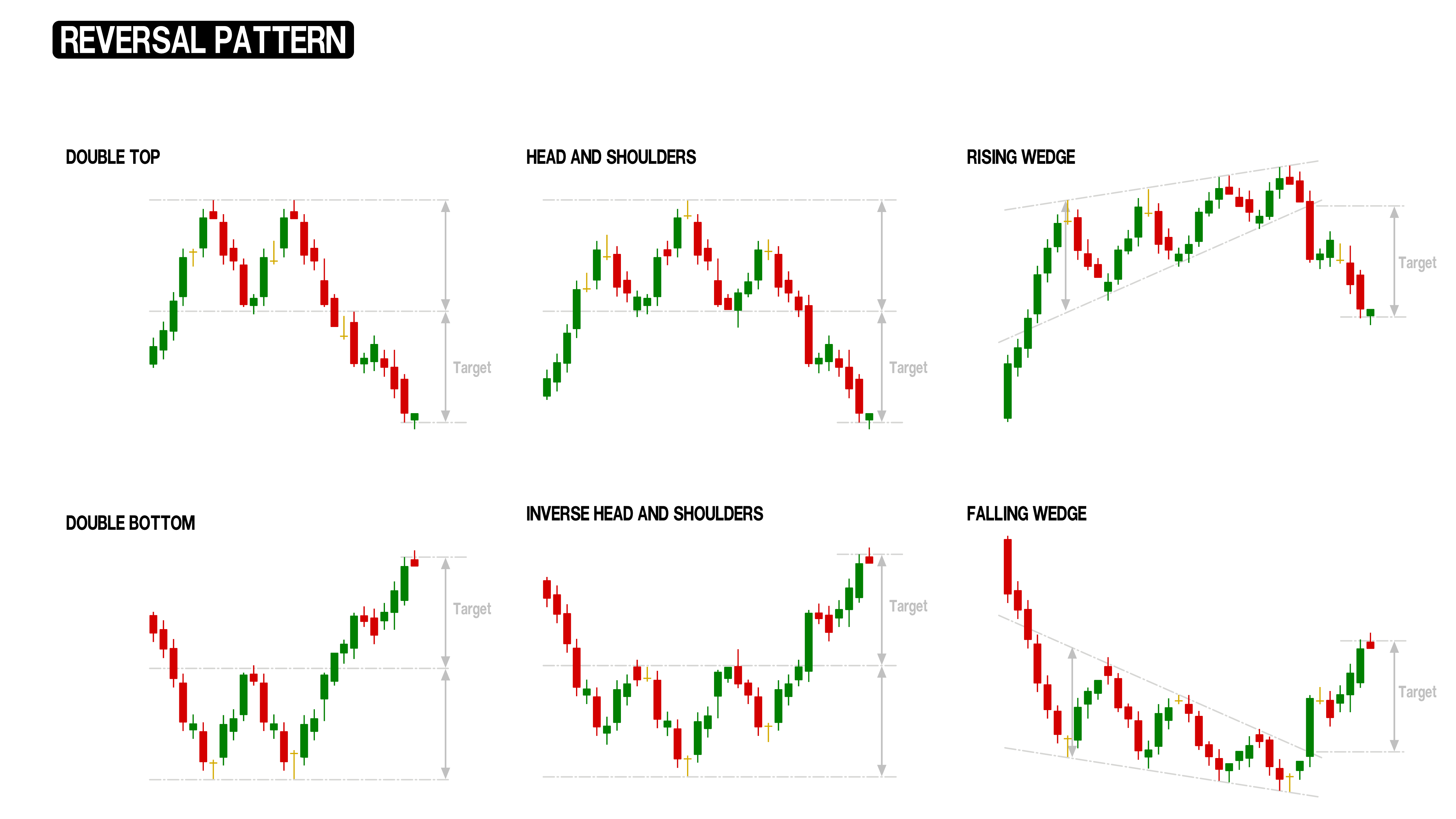

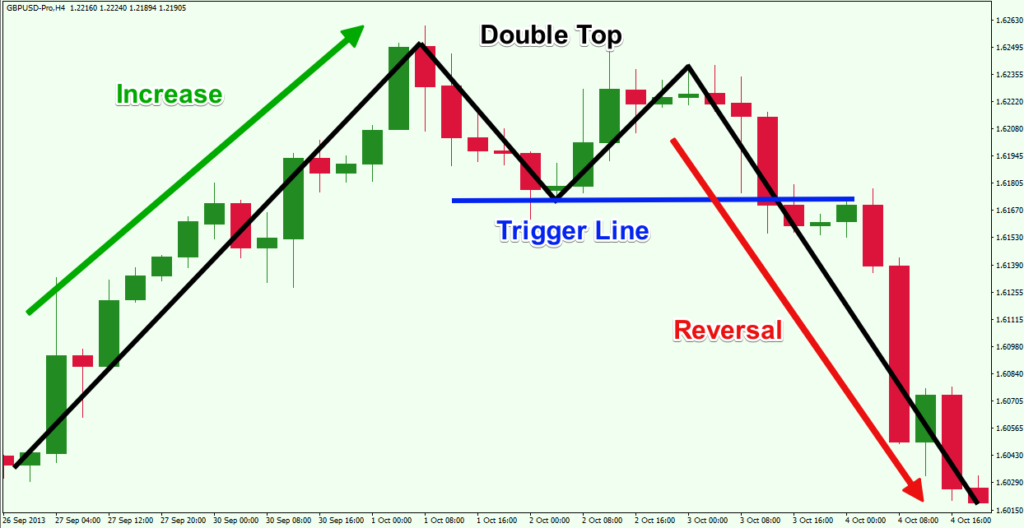

Forex Reversal Patterns - Download the short printable pdf version summarizing the key points of this lesson…. Pypl) stock price implode has been painful to see. By using this technical tool in conjunction with candlestick chart patterns discussed earlier, a forex trader may be able to get a high probability of a reversal. Web there are two types of reversal chart patterns: Web whether you’re forex trading, trade stocks, or cryptocurrency, these bearish and bullish chart reversal patterns apply across any financial market, not just the forex market. The bottoming pattern is a low (the shoulder), a retracement followed by a. When the market is in an uptrend, a reversal pattern provides price levels to exit or short the trade due to an expected downtrend. Did you look at the pattern? A “ neckline ” is drawn by connecting the lowest points of the two troughs. It is formed by a peak (shoulder), followed by a higher peak (head), and then another lower peak (shoulder). By using this technical tool in conjunction with candlestick chart patterns discussed earlier, a forex trader may be able to get a high probability of a reversal. Web forex chart patterns are patterns in past prices that are supposed to hint at future trends. Web when a major trend line is broken, a reversal may be in effect. We can. You see a reversal pattern, and you close your trade. While these methods can identify reversals, they aren’t the only way. Web there are 12 reversal candlestick patterns cheat sheet so far that are used in technical analysis to predict a trend reversal. Web when a major trend line is broken, a reversal may be in effect. The 123 chart. As a continuation signal, it is formed during an uptrend, implying that the upward price action would resume. Reversal patterns are those chart formations that signal that the ongoing trend is about to change course. Web this poster covers harmonic patterns such as gartley, butterfly, bat, crab, cypher, and shark patterns. We’ve listed the basic classic chart patterns, when they. We’ll also look at their role in designing a. Web understanding the different forex reversal patterns and how they work is crucial for beginners. The bottoming pattern is a low (the shoulder), a retracement followed by a. Web like we promised, here’s a neat little cheat sheet to help you remember all those chart patterns and what they are signaling.. Web there are two types of reversal chart patterns: The 123 chart formation is quite common and appears at the beginning of many every price reversals. There are many different patterns, with various suggestions depending on the situation. We’ve listed the basic classic chart patterns, when they are formed, what type of signal they give, and. It refers to patterns. We can use this pattern to predict the upcoming movement and open or close our. As a continuation signal, it is formed during an uptrend, implying that the upward price action would resume. There are many different patterns, with various suggestions depending on the situation. We’ll also look at their role in designing a. Fisher defines the sushi roll reversal. Each pattern happens at a reversal point, giving you the know that the trend is now ending. The bottoming pattern is a low (the shoulder), a retracement followed by a. Web when a major trend line is broken, a reversal may be in effect. Maybe you are wondering how to identify each of these patterns. The head and shoulders pattern. Web watching paypal’s ( nasdaq: As a continuation signal, it is formed during an uptrend, implying that the upward price action would resume. Web this poster covers harmonic patterns such as gartley, butterfly, bat, crab, cypher, and shark patterns. Chart patterns are essential parts of forex trading technical analysis. A stock that was trading at $310.40 in 2021 has crashed. The 123 chart formation is quite common and appears at the beginning of many every price reversals. Web there are 12 reversal candlestick patterns cheat sheet so far that are used in technical analysis to predict a trend reversal. It consists of three peaks, with the middle peak being the highest (the head), and the other two peaks on. Chart. If a reversal chart pattern forms during an uptrend, it hints that the trend will reverse and that the price will head down soon. What are reversal patterns & how to trade with them. Maybe you are wondering how to identify each of these patterns. Web this poster covers harmonic patterns such as gartley, butterfly, bat, crab, cypher, and shark. Unlike the rising wedge, the. Chart patterns are essential parts of forex trading technical analysis. The top candlestick reversal patterns are: Pypl) stock price implode has been painful to see. By using this technical tool in conjunction with candlestick chart patterns discussed earlier, a forex trader may be able to get a high probability of a reversal. Maybe you are wondering how to identify each of these patterns. What are reversal patterns & how to trade with them. Did you look at the pattern? Web there are 12 reversal candlestick patterns cheat sheet so far that are used in technical analysis to predict a trend reversal. Reversal patterns are those chart formations that signal that the ongoing trend is about to change course. For forex traders looking to add strategies to their arsenal, learning about market reversal trading can provide yet another way to capitalize on market moves. Web forex chart patterns are patterns in past prices that are supposed to hint at future trends. As a continuation signal, it is formed during an uptrend, implying that the upward price action would resume. Web this poster covers harmonic patterns such as gartley, butterfly, bat, crab, cypher, and shark patterns. Tweezer top & tweezer bottom candlestick. If a reversal chart pattern forms during an uptrend, it hints that the trend will reverse and that the price will head down soon.

Bearish Reversal Candlestick Patterns The Forex Geek

The Most Powerful Reversal Patterns In Forex You Must Know

Reversal Candlestick Patterns Complete Guide ForexBee

Trading Forex With Reversal Candlestick Patterns » Best Forex Brokers

Top Forex Reversal Patterns that Every Trader Should Know Forex

Top Forex Reversal Patterns that Every Trader Should Know Forex

Top Reversal Candlestick Patterns

Chart Patterns Continuation and Reversal Patterns AxiTrader

📚Reversal Patterns How To Identify & Trade Them 📚 for FXEURUSD by

Top Forex Reversal Patterns that Every Trader Should Know Forex

Now That We Know The Basics, Let's Look At Some Of The Most Common Chart Patterns In Technical Analysis.

Web When A Major Trend Line Is Broken, A Reversal May Be In Effect.

These Are Formations Where The Price Direction Is Unknown.

Analyzing These Patterns Using Technical Analysis Tools,.

Related Post: