Forex Pattern Triangle

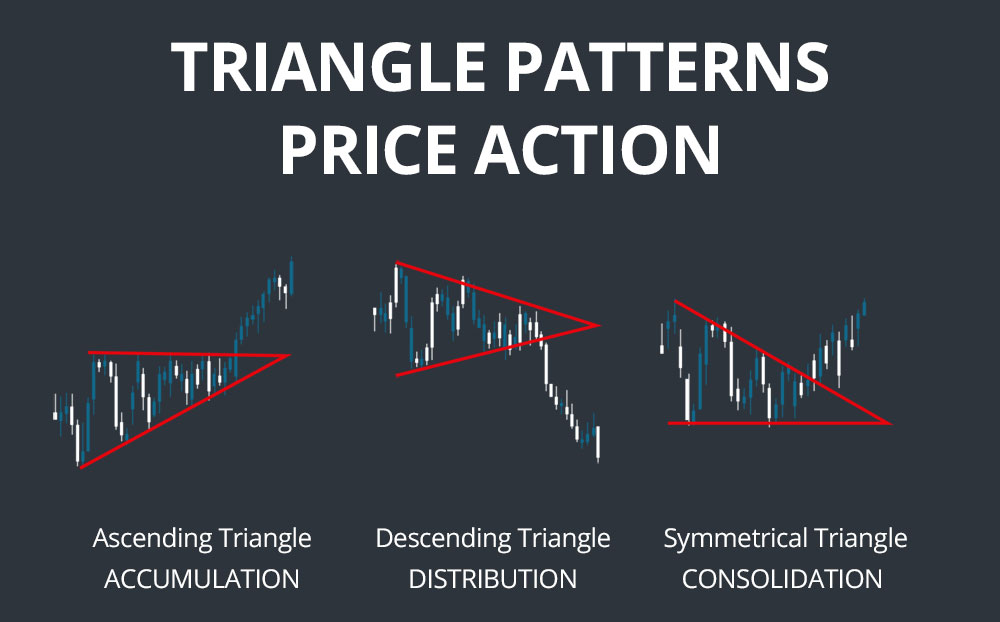

Forex Pattern Triangle - The triangle is a continuation pattern. Similarly, if the price breaks through the triangle to the upside, there may be a large move up. However, the trend pauses as the market fails to hit new highs on the upside. Web the descending triangle pattern is considered a bearish pattern, and traders interpret it as a sign of an impending breakout to the downside. ️ the lower trend line must be a rising trend line. However, the rising and the falling wedges have no flat side. Web understanding the triangle forex pattern: Therefore, a break in the support prompts the price to fall. What happens during this time is that there is a certain level that the buyers cannot seem to exceed. As a forex trader, comprehending these patterns is crucial to making informed trading decisions. The strategy is based on the “three indians” pattern. Both sides of the wedges are sloping in the same direction. Ascending triangle, descending triangle, and symmetrical triangle. Enter the market (1) at the point where the price touches the. Asset managers and large speculators were much quicker to close short bets last week than the week prior, with a notable. Each type has its own characteristics and trading. Trading forex, cfds and cryptocurrencies is highly speculative, carries a. The triangle is a continuation pattern. Web this triangle pattern has lower highs and higher lows, which is a sign of declining volatility and price stability. What happens during this time is that there is a certain level that the buyers cannot. Web the ascending triangles form when the price follows a rising trendline. Web descending triangles are considered continuation patterns. The april employment change was more than 4 times higher than predicted and the unemployment rate was lower than predicted. Web mastering forex triangle patterns: Trading long on silver (xagusd). However, the trend pauses as the market fails to hit new highs on the upside. The triangle chart pattern is formed by drawing two converging trendlines as price temporarily moves in a sideways direction. Web the triangle pattern in forex is a price formation that signals a potential trend continuation after a brief consolidation. Web these trendlines form the boundaries. In general, there are three types of triangle patterns: Technical analysts meticulously analyze these patterns to identify trend continuations or reversals, thereby making informed trading decisions. Web one of the easiest chart patterns to spot is the triangle. Let’s describe the two kinds of wedges you will find on the price chart. By understanding the different types of triangle patterns,. The triangle chart pattern is formed by drawing two converging trendlines as price temporarily moves in a sideways direction. The rising and falling wedges are similar to the ascending and the descending triangle patterns. Exposure to it is being trimmed by bulls and bears. Let’s describe the two kinds of wedges you will find on the price chart. Web the. There are three main types of forex triangles: In a symmetrical triangle, this pattern occurs when the slope of both the support and resistance lines are converging, forming a triangle with roughly equal highs and lows. One such pattern is the triangle pattern, which is widely recognized for its ability to provide. Symmetrical triangle patterns occur when two trend lines. However, they are gradually starting to push the price up as evidenced by the higher lows. However, the trend consolidates, failing to make new highs. Triangles are similar to wedges and pennants and can be either a continuation pattern, if. The symmetrical triangle can signal a few different things, depending on market conditions. ️ the upper trend line should be. The strategy is based on the “three indians” pattern. How to trade with confidenceforex trading is a complex and dynamic market with multiple patterns and trends. By understanding the different types of triangle patterns, how to identify them, and how to trade them effectively, traders can improve their chances of success in the forex market. Similarly, if the price breaks. By understanding the different types of triangle patterns, how to identify them, and how to trade them effectively, traders can improve their chances of success in the forex market. The triangle chart pattern is formed by drawing two converging. Web a triangle pattern in technical analysis is a price formation characterized by converging trend lines, forming the shape of a. There are 4 types of triangle. Similarly, if the price breaks through the triangle to the upside, there may be a large move up. The triangle pattern is a chart pattern formed by converging trend lines, which. Web usdcad in descending triangle. Features that help to identify the ascending triangle: Each type has its own characteristics and trading. Ascending triangles, descending triangles, and symmetrical triangles. This guide explores the definition, importance, and variations of triangle patterns in the forex market. Technical analysts meticulously analyze these patterns to identify trend continuations or reversals, thereby making informed trading decisions. The triangle pattern takes a long time to break out, until that you can keep buying or selling inside the highs and lows of the triangle. Triangles are similar to wedges and pennants and can be either a continuation pattern, if. Web the descending triangle pattern is considered a bearish pattern, and traders interpret it as a sign of an impending breakout to the downside. Triangle shape formed in the chart when the market is making consolidation or correction. A comprehensive guide for tradersintroduction:in the world of forex trading, there are various chart patterns that traders use to identify potential trends and make informed trading decisions. There are three main types of forex triangles: Exposure to it is being trimmed by bulls and bears.

3 Triangle Patterns Every Forex Trader Should Know

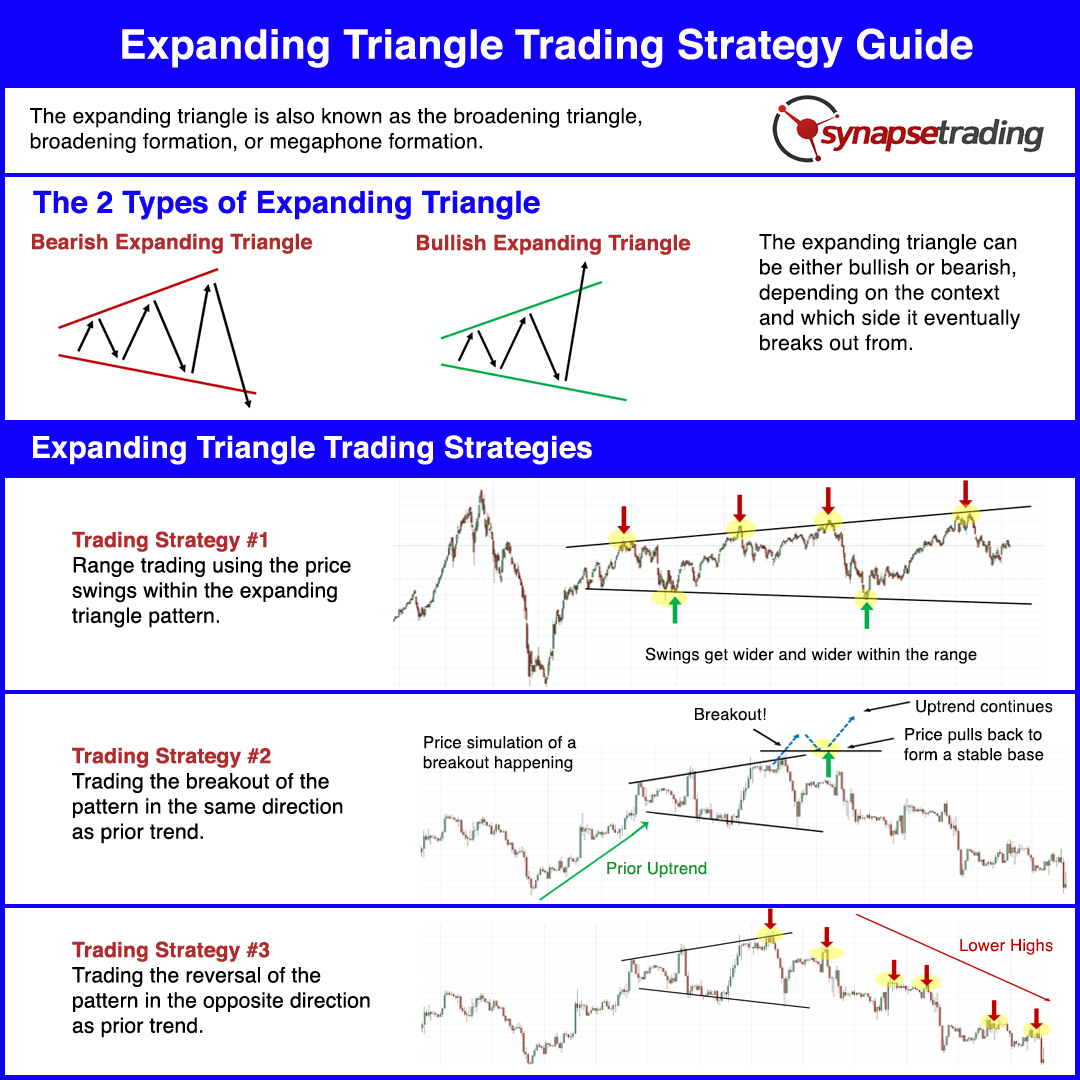

Expanding Triangle Pattern Trading Strategy Guide (Updated 2024

Triangle Pattern Characteristics And How To Trade Effectively How To

How to Trade Triangle Chart Patterns in Forex FBS Trade (2023)

Triangle Pattern Characteristics And How To Trade Effectively How To

3 Triangle Patterns Every Forex Trader Should Know

Triangle Pattern Characteristics And How To Trade Effectively How To

3 Triangle Patterns Every Forex Trader Should Know LiteFinance

Triangle Chart Patterns Complete Guide for Day Traders

3 Triangle Patterns Every Forex Trader Should Know

In A Symmetrical Triangle, This Pattern Occurs When The Slope Of Both The Support And Resistance Lines Are Converging, Forming A Triangle With Roughly Equal Highs And Lows.

One Such Pattern Is The Triangle Pattern, Which Is Widely Recognized For Its Ability To Provide.

As A Forex Trader, Comprehending These Patterns Is Crucial To Making Informed Trading Decisions.

Be Mindful Of The Trend Direction Previous To The Triangle Formation.

Related Post: