Forex Graph Patterns

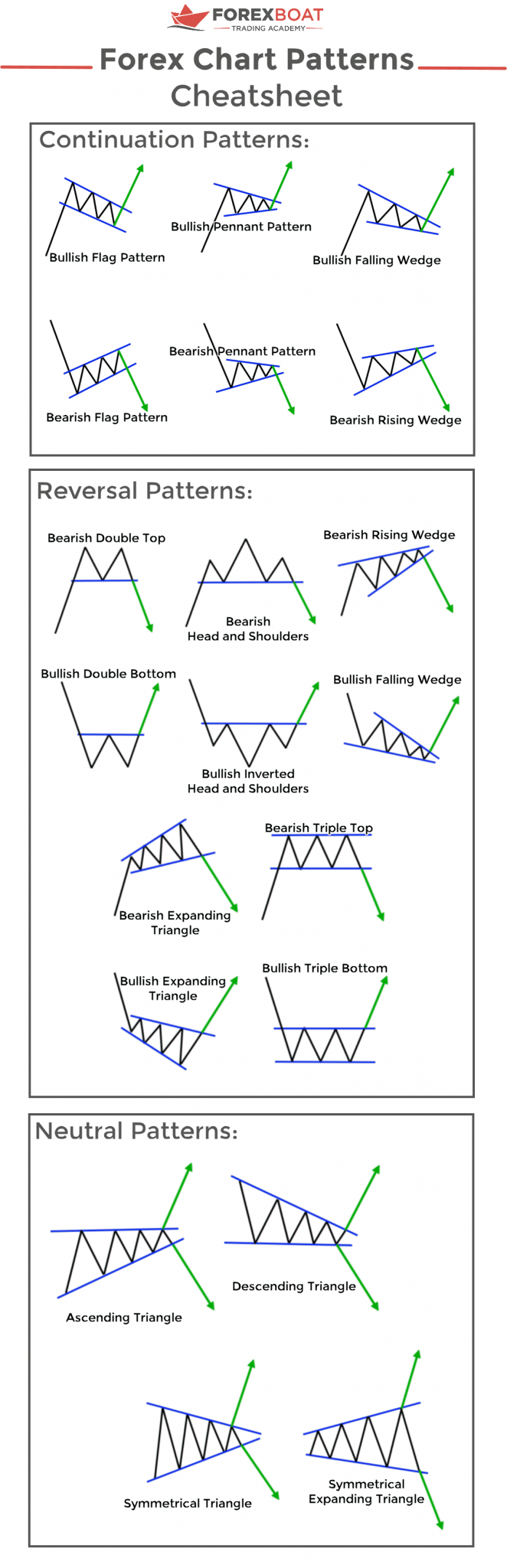

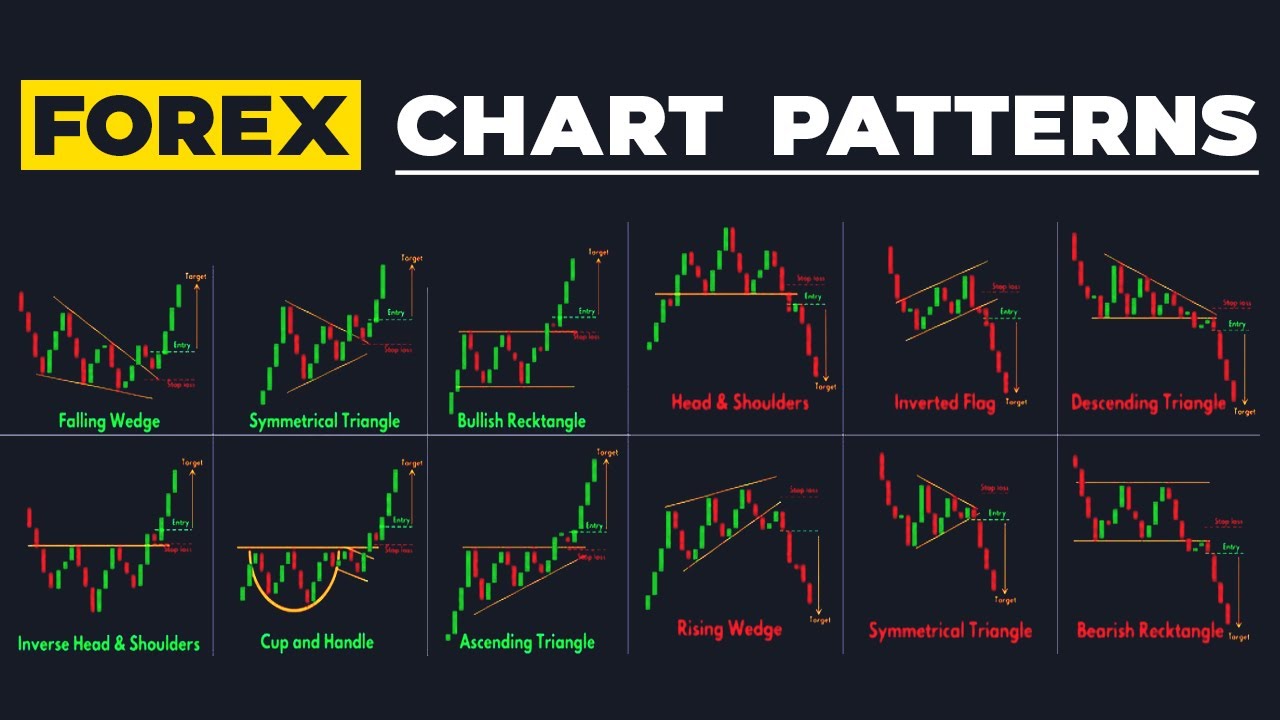

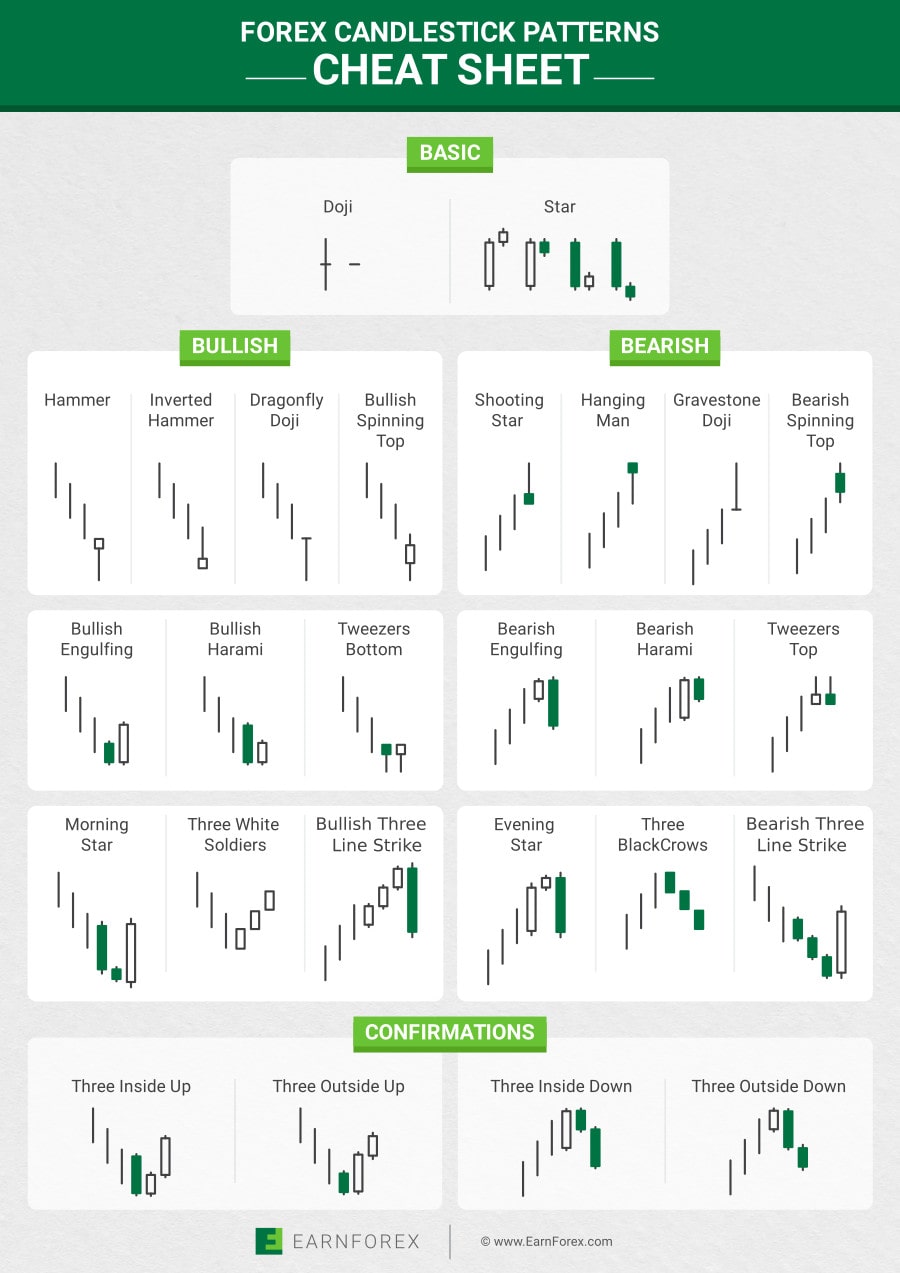

Forex Graph Patterns - However, there is more than one kind of triangle to find, and there are a couple of ways to trade them. Note that wedges can be considered either reversal or continuation patterns depending on the trend on which they form. Signals link in bio #buyandsell #forexsignals #groupsignal #charts #pattern #tradingview #metatrader5 #. In this guide, you’ll learn how to read these patterns. The upper side of this pattern was at 1.0807, near its highest swing on may 3rd. Each chart pattern indicator has a specific trading potential. A noticeable downward breakout through the pattern's lower boundary at approximately 0.8660 signals a potential bearish continuation. 27 time frames including tick charts and. A specific price action which has been formed before repeated times. Web the technical analysis of markets involves studying price movements and patterns. Web forex chart patterns are patterns in past prices that are supposed to hint at future trends. Web the technical analysis of markets involves studying price movements and patterns. Web chart patterns are made up of price waves or swings on the candlestick chart, such as head and shoulder, double top, and triple top patterns. Web a triangle chart pattern. Web first, here’s our chart patterns cheat sheet with all the most popular and widely used trading patterns among traders. Patterns are born out of price fluctuations, and they each represent chart figures with their own meanings. Here are some of the more basic methods to both finding and trading these patterns. But they’re still important to know if you’re. Web most commonly used forex chart patterns. But they’re still important to know if you’re interested in identifying and trading trends. Typically, a forex trader will spot the formation of a known chart pattern and will then place an order based on the price's expected exit from the pattern. We’ve listed the basic classic chart patterns, when they are formed,. Discuss with real traders on our forum. Web forex chart patterns are graphical representations of price movements in the foreign exchange market. Symmetrical triangles, flags, and wedges. It is based on identifying supply and demand levels on price charts by observing various patterns and indicators. Patterns are born out of price fluctuations, and they each represent chart figures with their. 27 time frames including tick charts and. Web common types of chart patterns. Understanding and mastering these patterns is crucial for. You can print it and stick it on your desktop or save it in a folder and use it whenever needed. It is based on identifying supply and demand levels on price charts by observing various patterns and indicators. With so many ways to trade. Each chart pattern indicator has a specific trading potential. Understanding and mastering these patterns is crucial for. The upper side of this pattern was at 1.0807, near its highest swing on may 3rd. Web first, here’s our chart patterns cheat sheet with all the most popular and widely used trading patterns among traders. A noticeable downward breakout through the pattern's lower boundary at approximately 0.8660 signals a potential bearish continuation. Signals link in bio #buyandsell #forexsignals #groupsignal #charts #pattern #tradingview #metatrader5 #. Web spotting chart patterns is a popular hobby amongst traders of all skill levels, and one of the easiest patterns to spot is a triangle pattern. Web diamond pattern in forex. Learn what is forex patterns and how to perform technical analysis based on forex charts. Take a look at any market, and you’ll notice that price action is rarely linear. Web common types of chart patterns. Web diamond pattern in forex in the chart before us, the pattern has been meticulously formed, indicating volatility and potential trend reversal points. Web. Web identify patterns and trends and respond to price action more effectively by typing in your chosen asset and applying moving averages, bollinger bands and other technical indicators to enhance. To trade these patterns, simply place an order above or below the formation (following the direction of the ongoing trend, of course). Web forex chart patterns are an essential tool. Web we’ve covered several continuation chart patterns, namely the wedges, rectangles, and pennants. These patterns are formed by the repetitive behavior of market participants, such as buyers and sellers, and indicate potential future price directions. There are many different patterns, with various suggestions depending on the situation. Forex chart showcasing a diamond pattern. A noticeable downward breakout through the pattern's. Web chart patterns are made up of price waves or swings on the candlestick chart, such as head and shoulder, double top, and triple top patterns. They provide valuable insights into the price action and help traders make informed decisions. Web most commonly used forex chart patterns. Web improve your forex trading by learning how to spot basic chart patterns and formations. Web chart patterns are a crucial part of the forex technical analysis. Chart patterns are based on technical analysis, which involves analyzing past market data to identify trends and patterns. To trade these patterns, simply place an order above or below the formation (following the direction of the ongoing trend, of course). Web the technical analysis of markets involves studying price movements and patterns. Web forex chart patterns are visual representations of the movement of currency prices over a given period of time, they can be based on various factors such as market trends, price levels, and trading volume. Double tops often form towards the top of a move up during an uptrend. Note that wedges can be considered either reversal or continuation patterns depending on the trend on which they form. Chart patterns cheat sheet pdf [download] why do you need a chart pattern cheat sheet? Here are some of the more basic methods to both finding and trading these patterns. Web a triangle chart pattern involves price moving into a tighter and tighter range as time goes by and provides a visual display of a battle between bulls and bears. Understanding and mastering these patterns is crucial for. Web like we promised, here’s a neat little cheat sheet to help you remember all those chart patterns and what they are signaling.:max_bytes(150000):strip_icc()/dotdash_Final_Most_Commonly_Used_Forex_Chart_Patterns_Jun_2020-01-a6be7f7fd3124918a519946fead796b8.jpg)

The Forex Chart Patterns Guide With Live Examples Forexboat Riset

Chart Patterns Cheat Sheet r/FuturesTrading

The Forex Chart Patterns Guide (with Live Examples) ForexBoat

The Forex Chart Patterns Guide (with Live Examples) ForexBoat

Forex Chart Patterns (part 1) YouTube

:max_bytes(150000):strip_icc()/dotdash_Final_Most_Commonly_Used_Forex_Chart_Patterns_Jun_2020-02-f9a2aa69cf4f4546b2ed3857797e8be8.jpg)

Most Commonly Used Forex Chart Patterns

:max_bytes(150000):strip_icc()/dotdash_Final_Most_Commonly_Used_Forex_Chart_Patterns_Jun_2020-04-a7e9347ca7bc4f3f8e253eb3bd4e493f.jpg)

Most Commonly Used Forex Chart Patterns

:max_bytes(150000):strip_icc()/dotdash_Final_Most_Commonly_Used_Forex_Chart_Patterns_Jun_2020-03-29920f0f2e9346cf9bf84104a4d614b3.jpg)

Most Commonly Used Forex Chart Patterns

The Forex Chart Patterns Guide (with Live Examples) ForexBoat

Forex Candlestick Patterns Cheat Sheet

Web Chart Patterns Forex Trading.

We’ve Listed The Basic Classic Chart Patterns, When They Are Formed, What Type Of Signal They Give, And.

27 Time Frames Including Tick Charts And.

Web A Forex Chart Pattern Is A Sequence That Repeats Throughout The Forex Chart And Plays Out In A Specific Way That Is Reliable Enough To Predict Price Movement.

Related Post: