Forex Chart Pattern

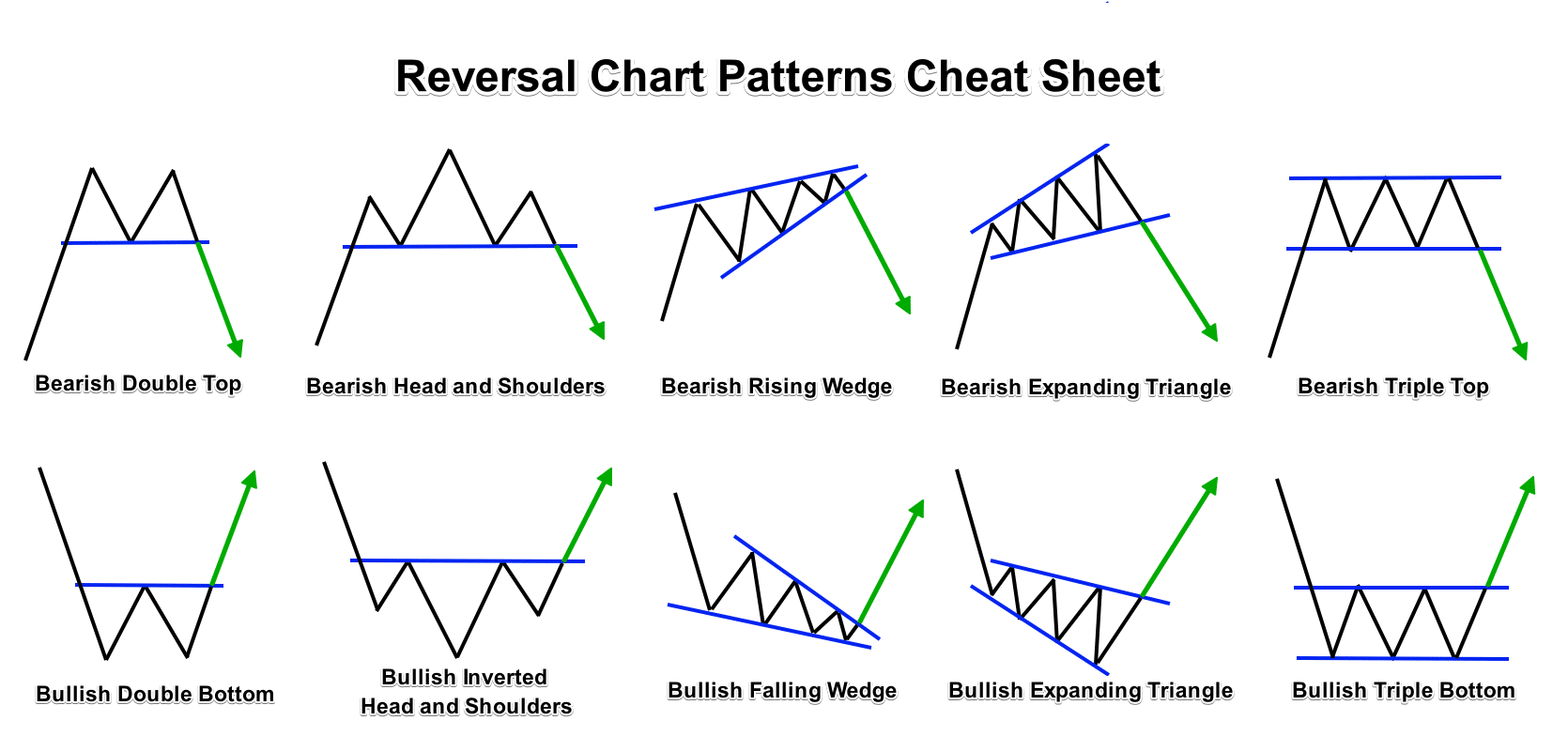

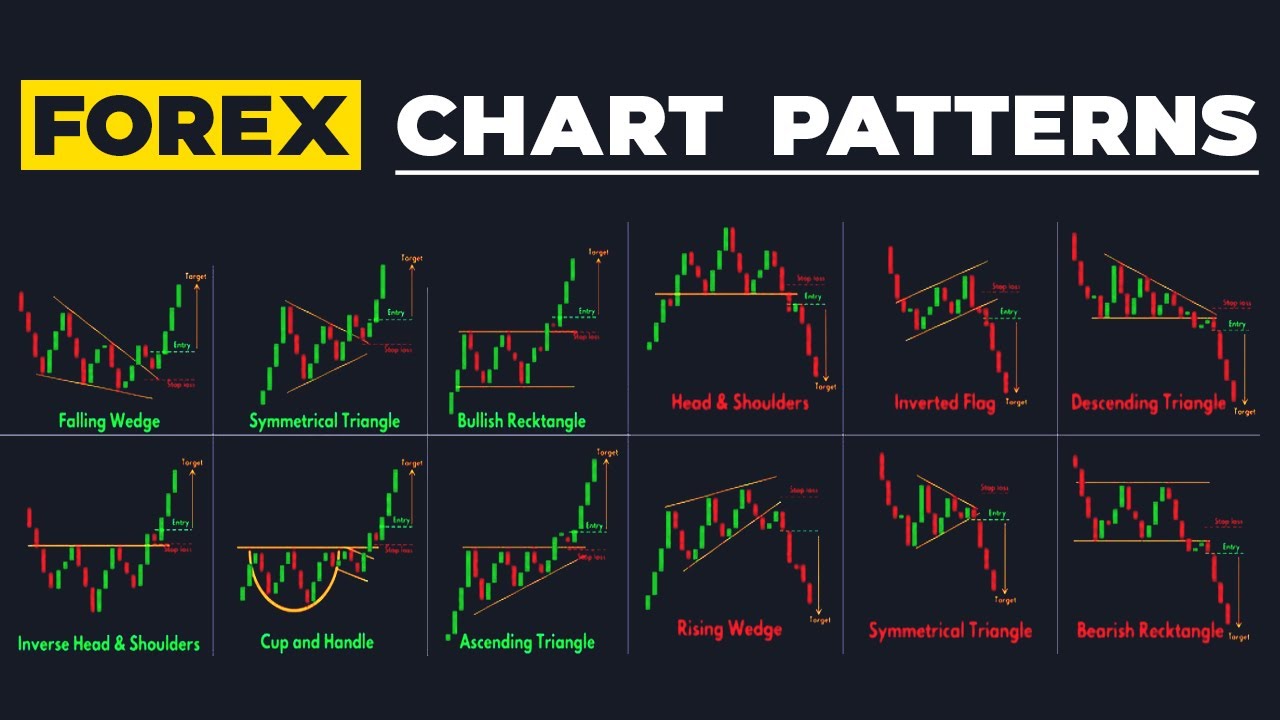

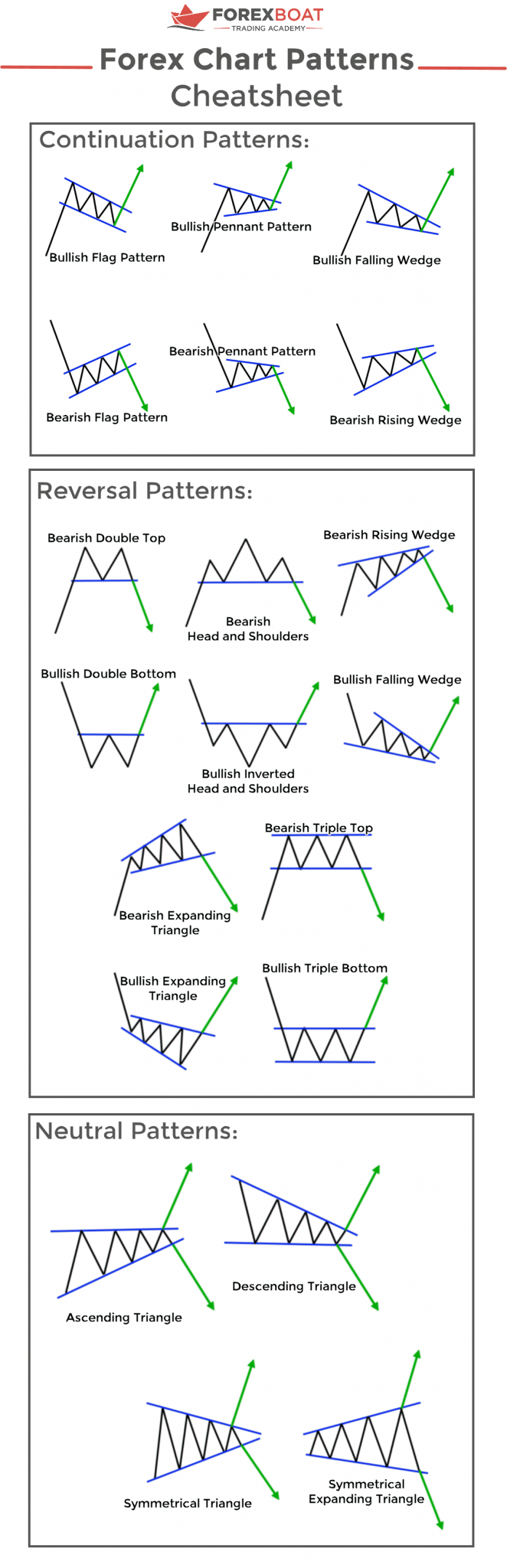

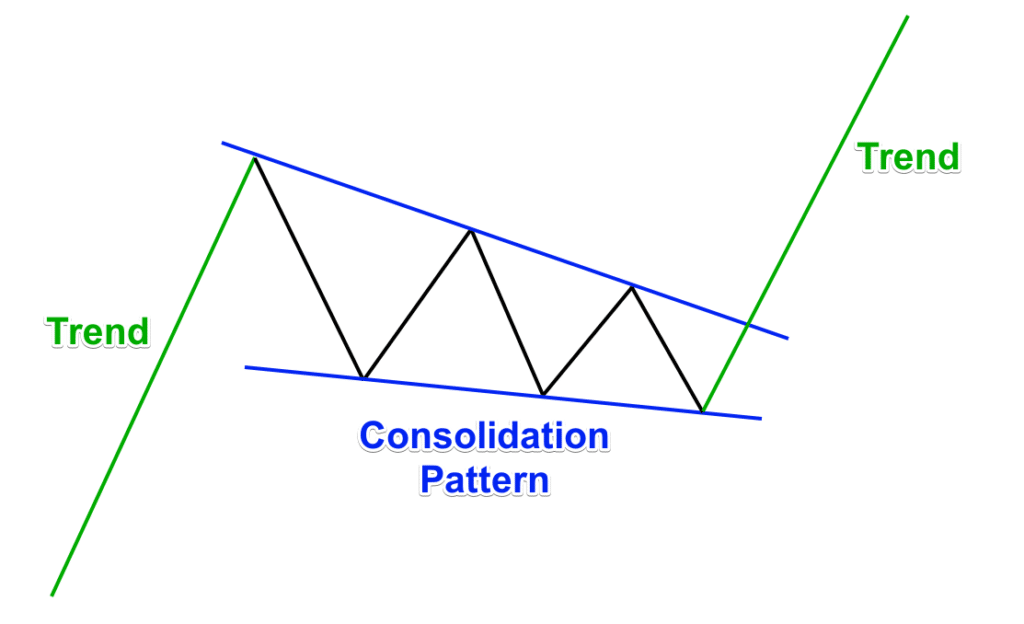

Forex Chart Pattern - A breakout below the lower trendline is a clarion call to sell. Web chart patterns are visual representations of price movements on a forex chart. Web forex chart patterns are an essential tool for traders in the foreign exchange market. Web like we promised, here’s a neat little cheat sheet to help you remember all those chart patterns and what they are signaling. Continuation chart pattern appears when the market is moving in an uptrend or downtrend. Web nzdusd is setup for a bullish breakout! They provide valuable insights into the price action and help traders make informed decisions. Web improve your forex trading by learning how to spot basic chart patterns and formations. Forex chart patterns are visual representations of the movement of currency prices over a given period of time, they can be based on various factors such as market trends, price levels, and trading volume. The purpose of technical analysis of chart patterns is to identify forex price movements that repeat frequently over time. Then go for a target that’s almost the same as the height of the formation. It refers to patterns where the price direction reverses like the double top or bottom, the head and shoulders or triangles. Typically, a forex trader will spot the formation of a known chart pattern and will then place an order based on the price's expected. Web forex chart patterns are an essential tool for traders in the foreign exchange market. To trade these chart patterns, simply place an order beyond the neckline and in the direction of the new trend. In this guide, you’ll learn how to read these patterns. In technical analysis, patterns are used to predict. The purpose of technical analysis of chart. Ascending and descending staircases are probably the most basic chart patterns. They are formed by the interaction between supply and demand in the market and can be categorized into two main types: Web nzdusd is setup for a bullish breakout! These patterns are formed by the repetitive behavior of market participants, such as buyers and sellers, and indicate potential future. It is based on identifying supply and demand levels on price charts by observing various patterns and indicators. Web common types of chart patterns. By this time, the trader should already have a plan for entering the trade ready. Forex chart patterns are visual representations of the movement of currency prices over a given period of time, they can be. Web the technical analysis of markets involves studying price movements and patterns. A specific price action which has been formed before repeated times. If you got all six right, brownie points for you! Web forex chart patterns are patterns in past prices that are supposed to hint at future trends. In this guide, you’ll learn how to read these patterns. Web chart patterns are made up of price waves or swings on the candlestick chart, such as head and shoulder, double top, and triple top patterns. Web most commonly used forex chart patterns. These patterns belong to one. Web the technical analysis of markets involves studying price movements and patterns. Web forex chart patterns are an essential tool for traders. They can signal potential market movements and guide trading decisions. Web like we promised, here’s a neat little cheat sheet to help you remember all those chart patterns and what they are signaling. Web improve your forex trading by learning how to spot basic chart patterns and formations. Continuation chart pattern appears when the market is moving in an uptrend. To trade these chart patterns, simply place an order beyond the neckline and in the direction of the new trend. They can signal potential market movements and guide trading decisions. Patterns are being scanned in real time and presented in the table below (table refreshes automatically every 30 seconds). But they’re still important to know if you’re interested in identifying. In technical analysis, patterns are used to predict. Symmetrical triangles, flags, and wedges. It might exhibit a diamond pattern formed at the zenith of an uptrend. With so many ways to trade. Forex chart patterns are visual representations of the movement of currency prices over a given period of time, they can be based on various factors such as market. This group includes price extension figures like the flag pattern, the pennant or the wedges (rising or falling). To trade these chart patterns, simply place an order beyond the neckline and in the direction of the new trend. A specific price action which has been formed before repeated times. To hide/show event marks, right click anywhere on the chart, and. To hide/show event marks, right click anywhere on the chart, and select hide marks on bars. Web chart patterns are made up of price waves or swings on the candlestick chart, such as head and shoulder, double top, and triple top patterns. It refers to patterns where the price direction reverses like the double top or bottom, the head and shoulders or triangles. Web chart patterns forex trading. Let’s examine how technical traders use the patterns created by candlesticks on a chart to understand and predict market movements. To trade these chart patterns, simply place an order beyond the neckline and in the direction of the new trend. Web chart patterns cheat sheet is an essential tool for every trader who is keen to make trading decisions by identifying repetitive patterns in the market. A chart pattern is a graphical presentation of price movement by using a series of trend lines or curves. Web common types of chart patterns. Symmetrical triangles, flags, and wedges. Web chart patterns are visual representations of price movements on a forex chart. Ascending and descending staircases are probably the most basic chart patterns. They are formed by the interaction between supply and demand in the market and can be categorized into two main types: Charts serve as the cornerstone of technical analysis. There are many different patterns, with various suggestions depending on the situation. Patterns are being scanned in real time and presented in the table below (table refreshes automatically every 30 seconds).

Chart Patterns Cheat Sheet r/FuturesTrading

How Important are Chart Patterns in Forex? Forex Academy

The Forex Chart Patterns Guide (with Live Examples) ForexBoat

Forex Chart Patterns (part 1) YouTube

The Forex Chart Patterns Guide (with Live Examples) ForexBoat

:max_bytes(150000):strip_icc()/dotdash_Final_Most_Commonly_Used_Forex_Chart_Patterns_Jun_2020-02-f9a2aa69cf4f4546b2ed3857797e8be8.jpg)

Most Commonly Used Forex Chart Patterns

The Forex Chart Patterns Guide (with Live Examples) ForexBoat

:max_bytes(150000):strip_icc()/dotdash_Final_Most_Commonly_Used_Forex_Chart_Patterns_Jun_2020-01-a6be7f7fd3124918a519946fead796b8.jpg)

Most Commonly Used Forex Chart Patterns

How to Trade Chart Patterns with Target and SL FOREX GDP

The Forex Chart Patterns Guide (with Live Examples) ForexBoat

Forex Chart Patterns Are Visual Representations Of The Movement Of Currency Prices Over A Given Period Of Time, They Can Be Based On Various Factors Such As Market Trends, Price Levels, And Trading Volume.

Forex Chart Patterns Are Graphical Representations Of Price Movements In The Foreign Exchange Market.

Continuation Chart Pattern Appears When The Market Is Moving In An Uptrend Or Downtrend.

We’ve Listed The Basic Classic Chart Patterns, When They Are Formed, What Type Of Signal They Give, And.

Related Post: