Foreign Grantor Trust Template

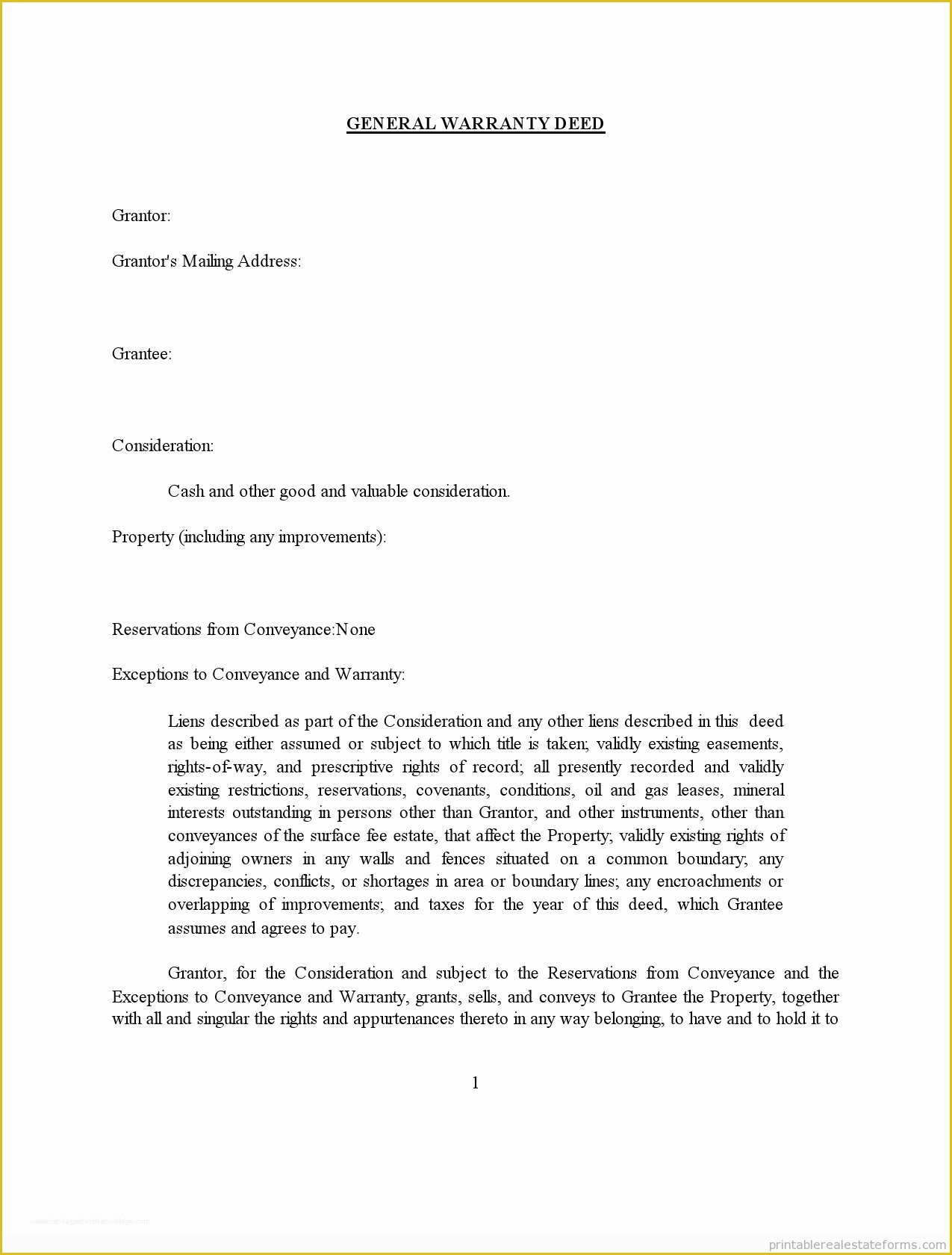

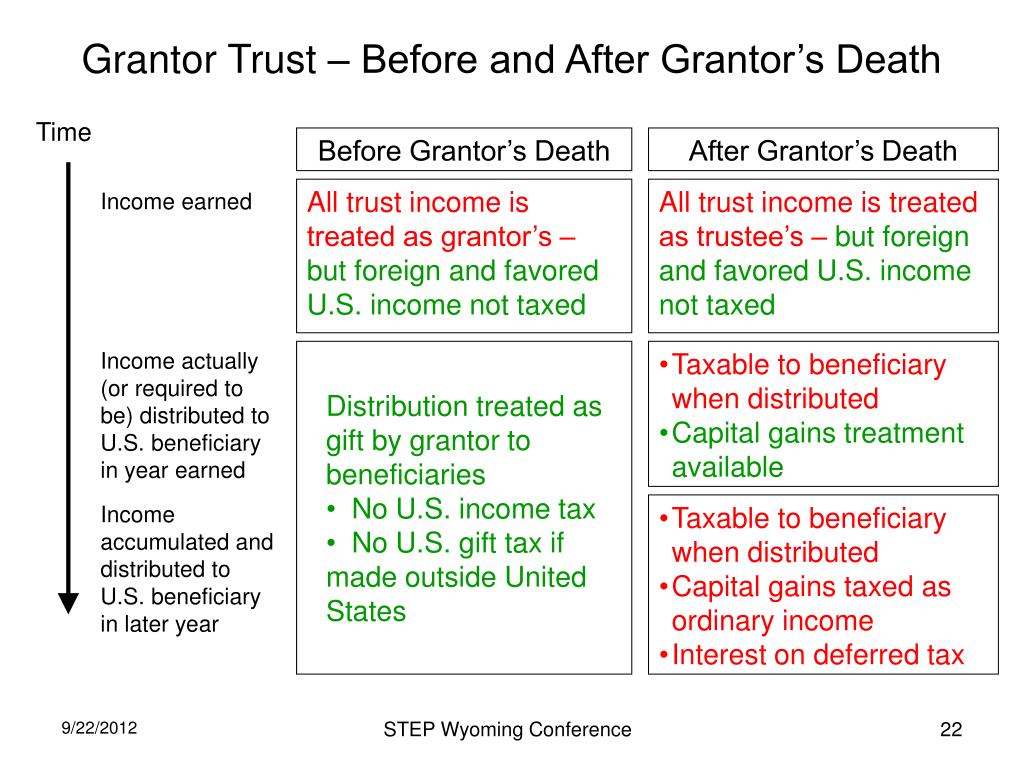

Foreign Grantor Trust Template - A grantor trust describes a trust for which the grantor retains some ownership over the assets. Persons who create a foreign trust, or have transactions with a foreign trust, can have both u.s. Web trust with a us owner. Sample irs letter to taxpayer on form 3520. Aicpa letter to irs on rev. Web the first 3 goals can be achieved by grantor trust status. Persons and their tax return preparers should be aware that u.s. 3 foreign trust without us assets. The trust’s us beneficiaries do not need to receive distributions from this trust for an extended period of time because they have access to other income or assets. Web foreign grantor trust (fgt) for u.s. For calendar year 20 , or tax year beginning, 20 , ending.check appropriate boxes. Web trust with a us owner. Web they cover various statutory provisions, ranging from foreign trust and gift reporting (secs. Web know that moving your assets into a foreign trust will not exempt you from certain taxes. A grantor trust describes a trust for which the. 3 foreign trust without us assets. Income tax return for foreign estates and trusts, and relevant schedules, for consideration by the irs. Web annual information return of foreign trust with a u.s. A trust is considered a foreign trust unless it meets the court and control tests. For instructions and the latest information. Persons and their tax return preparers should be aware that u.s. Web the first 3 goals can be achieved by grantor trust status. In order to avoid penalties, the us Web foreign grantor trust beneficiary statement: A trust is considered a foreign trust unless it meets the court and control tests. Web “foreign grantor trust owner statement” to each us owner of a portion of the trust and a “foreign grantor trust beneficiary statement” to each us beneficiary who received a distribution during the taxable year. A grantor trust is a trust that is treated as owned by its grantor under code §671. A foreign nongrantor trust is funded with $100. Persons and their tax return preparers should be aware that u.s. In order to avoid penalties, the us Web they cover various statutory provisions, ranging from foreign trust and gift reporting (secs. Web aicpa draft form 1041nr, u.s. In this blog, we’ll talk about the creation of u.s. Web they cover various statutory provisions, ranging from foreign trust and gift reporting (secs. The trust generates and realizes 10% investment returns every year for 15 years. Persons and their tax return preparers should be aware that u.s. We’ll provide an overview of revocable foreign grantor trustsand irrevocable u.s. It includes instructions, checkboxes, and lines for identifying information, trust details,. For instructions and the latest information. All information must be in english. Tax consequences and tax reporting requirements for a trust are determined by the residence and classification of the trust and its fiduciary. We’ll provide an overview of revocable foreign grantor trustsand irrevocable u.s. Web know that moving your assets into a foreign trust will not exempt you from. There are a number of options to consider for the design of a trust by a foreign person who intends to benefit u.s. The first scenario arises when distributions from the trust during the settlor’s lifetime, whether comprising income or capital, are limited only to the settlor or the settlor’s. 6039f, 6048, and 6677) to transactions with foreign grantor trusts. Persons who create a foreign trust, or have transactions with a foreign trust, can have both u.s. Persons and their tax return preparers should be aware that u.s. Tax consequences and tax reporting requirements for a trust are determined by the residence and classification of the trust and its fiduciary. Web the first 3 goals can be achieved by grantor. For calendar year 20 , or tax year beginning, 20 , ending.check appropriate boxes. The trustee must also provide the grantor with a foreign grantor trust owner statement, Web fatca compliance & fbar reporting. A trust is considered a foreign trust unless it meets the court and control tests. Sample irs letter to taxpayer on form 3520. Web this is the official pdf form for reporting transactions with foreign trusts and receipt of certain foreign gifts. Web foreign grantor trust beneficiary statement: The first scenario arises when distributions from the trust during the settlor’s lifetime, whether comprising income or capital, are limited only to the settlor or the settlor’s. Web a grantor trust is where the foreign settlor is considered the owner of the trust’s income, subject to taxation, which may occur under two specific circumstances. Aicpa letter to irs on rev. A foreign nongrantor trust is funded with $100 million. Sample irs letter to taxpayer on form 3520. For calendar year 20 , or tax year beginning, 20 , ending.check appropriate boxes. It includes instructions, checkboxes, and lines for identifying information, trust details, and obligations. In this blog, we’ll talk about the creation of u.s. 6039f, 6048, and 6677) to transactions with foreign grantor trusts (secs. Web annual information return of foreign trust with a u.s. We’ll provide an overview of revocable foreign grantor trustsand irrevocable u.s. Persons and their tax return preparers should be aware that u.s. Beneficiaries, depending on the priorities of the settlor. Owner (under section 6048(b)) go to.

Form 3520A Annual Information Return of Foreign Trust with a U.S

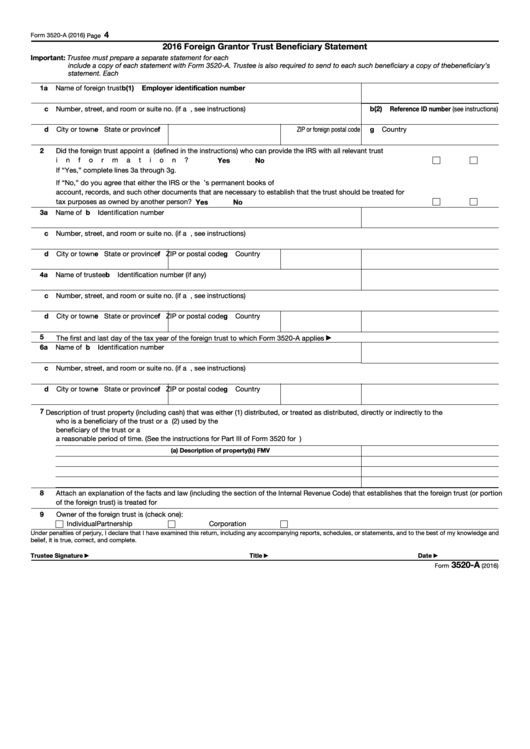

Fillable Form 3520A Foreign Grantor Trust Beneficiary Statement

Foreign Grantor Trust Template

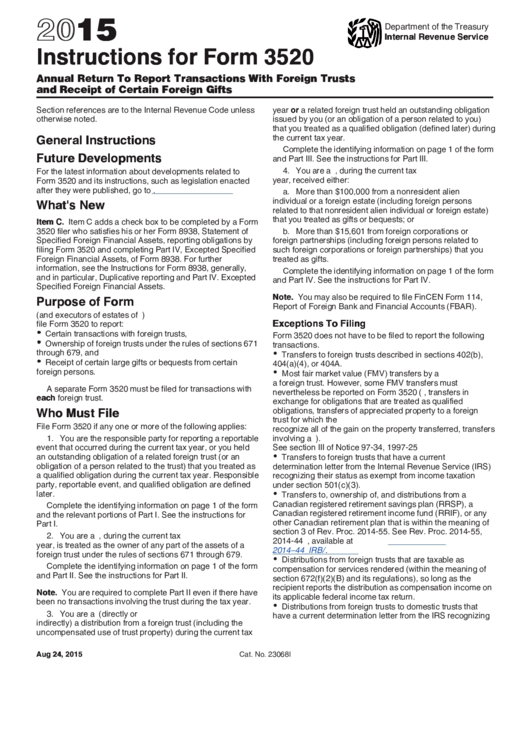

Instructions For Form 3520 Annual Return To Report Transactions With

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Foreign Grantor Trust Template

How to set up a foreign trust for ultimate asset protection Nomad

Form 3520 Examples and Guide to Filing fro Expats

Types of Grantor Trusts What Are They, and When to Use Them

Grantor Trust Agreemetn Form Fill Out and Sign Printable PDF Template

There Are A Number Of Options To Consider For The Design Of A Trust By A Foreign Person Who Intends To Benefit U.s.

The Parties Hereto Intend That This Trust Be Classified As A Grantor Trust For United States Federal Income Tax Purposes Under Subpart E Of Subchapter J Of The Code Pursuant To Which The Trustor Shall Be The Owner Of The Trust For United States Federal Income Tax Purposes, And The Trustor Will Include Directly.

Web Foreign Grantor Trust (Fgt) For U.s.

A Trust Is Considered A Foreign Trust Unless It Meets The Court And Control Tests.

Related Post: