Flag Pennant Pattern

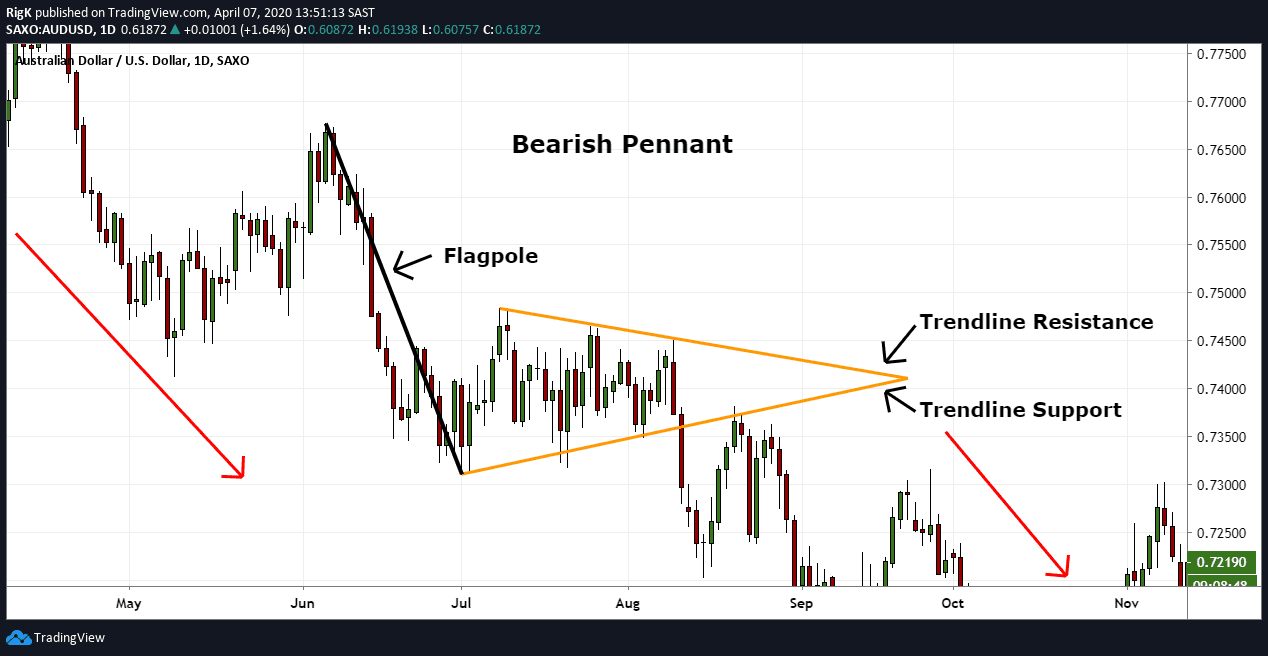

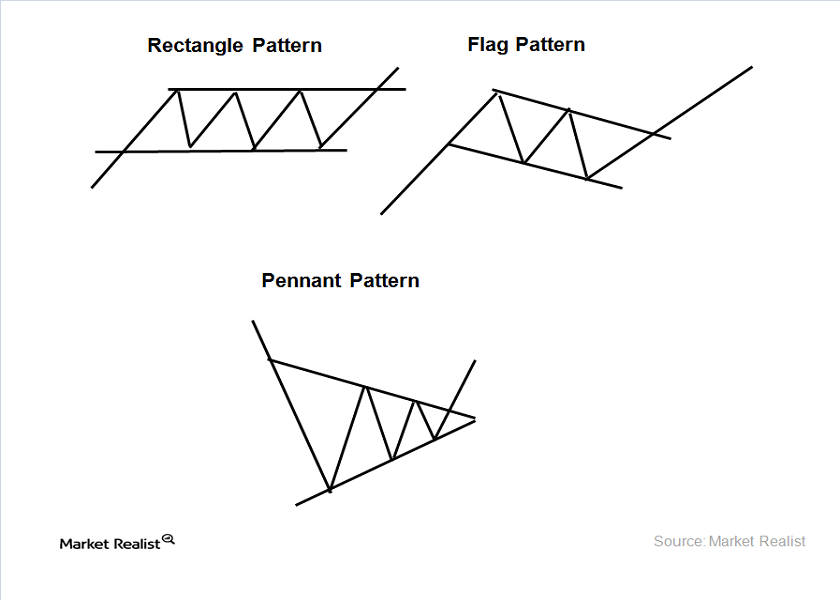

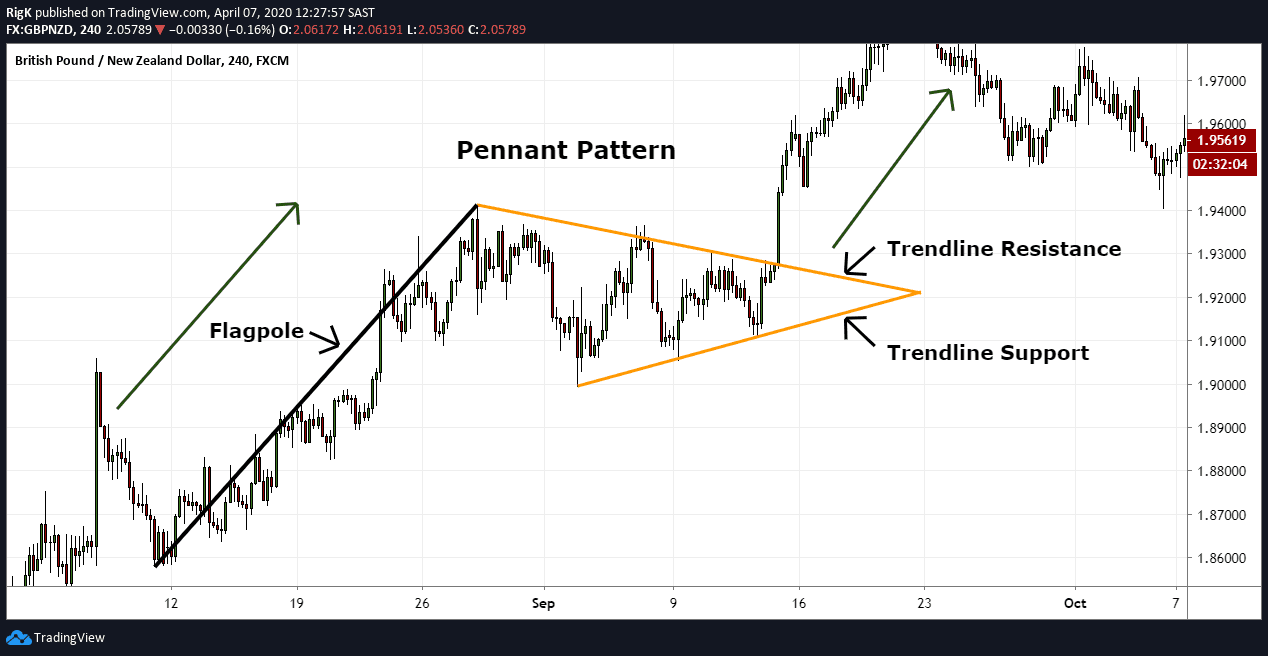

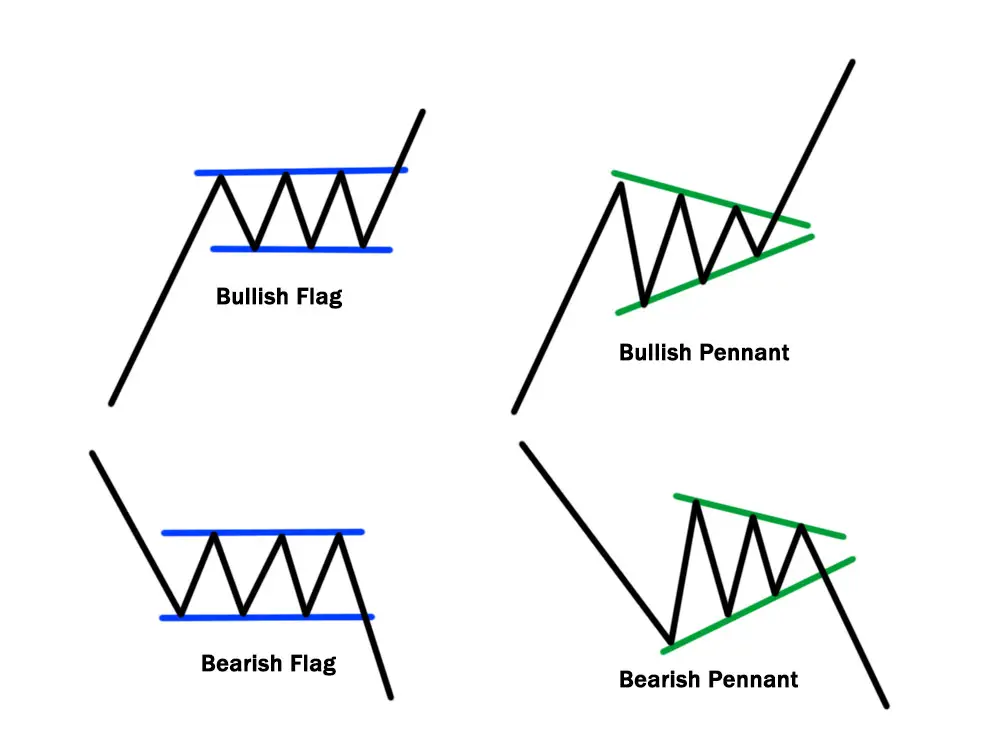

Flag Pennant Pattern - Web learn how to identify and trade pennant patterns, which are continuation patterns formed by a large movement followed by a consolidation and a breakout. Web a pennant pattern is a continuation chart pattern, seen when a security experiences a large upward or downward movement, followed by a brief consolidation, before. Web flag and pennant patterns. Web the flag or pennant chart pattern is formed right after a bullish or bearish price movement followed by a period of consolidation. They represent pauses while a trend consolidates and. This is where price tends to take a pause before. Web the flag and pennant patterns are commonly found patterns in the price charts of financially traded assets (stocks, bonds, futures, etc.). Web flag and pennant patterns are technical analysis patterns used in trading financial markets. They usually represent only brief pauses in a dynamic market. Web a flag or pennant pattern forms when the price rallies sharply, then moves sideways or slightly to the downside. Whilst using one and two candlestick patterns such as the pin bar reversal are extremely popular for. Web the flag and pennant patterns are commonly found patterns in the price charts of financially traded assets (stocks, bonds, futures, etc.). Flags and pennants can be categorized as continuation patterns. By stelian olar, updated on: Web it is named the pennant pattern. The only difference is that the flagpole is not as straight and the pattern forms a. They usually represent only brief pauses in a dynamic stock. Whilst using one and two candlestick patterns such as the pin bar reversal are extremely popular for. Web the pennant pattern is a classic pattern for technical analysts and is identifiable by a large. Web a pennant pattern is a kind of continuation pattern that appears when there’s a significant upward or downward movement in a financial instrument’s price and a subsequent. The pennant pattern is one of my favorite chart formations to trade. Web what are flag and pennant chart patterns? Web a flag pattern is a technical analysis chart pattern that can. Web learn how to identify and trade pennant patterns, which are continuation patterns formed by a large movement followed by a consolidation and a breakout. Web a pennant pattern is a continuation chart pattern, seen when a security experiences a large upward or downward movement, followed by a brief consolidation, before. The chart pattern is characterized by a countertrend price. Web a flag or pennant pattern forms when the price rallies sharply, then moves sideways or slightly to the downside. Web a pennant pattern is a continuation chart pattern, seen when a security experiences a large upward or downward movement, followed by a brief consolidation, before. The flag and pennant patterns appear rather frequently on price charts. Web a flag. This sideways movement typically takes the form or a rectangle. Web the pennant pattern is a classic pattern for technical analysts and is identifiable by a large price move followed by a unification period and a breakout. Web what are flag and pennant chart patterns? Flags and pennants can be categorized as continuation patterns. Web a pennant pattern is a. By stelian olar, updated on: Flags and pennants can be categorized as continuation patterns. Web the flag and pennant patterns are commonly found patterns in the price charts of financially traded assets (stocks, bonds, futures, etc.). Web a pennant pattern is a continuation chart pattern, seen when a security experiences a large upward or downward movement, followed by a brief. Web flag and pennant patterns are technical analysis patterns used in trading financial markets. This is where price tends to take a pause before. Web the flag or pennant chart pattern is formed right after a bullish or bearish price movement followed by a period of consolidation. Web a pennant pattern is a kind of continuation pattern that appears when. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. Web a pennant pattern is a continuation chart pattern, seen when a security experiences a large upward or downward movement, followed by a brief consolidation, before. Web the flag and pennant patterns are. Whilst using one and two candlestick patterns such as the pin bar reversal are extremely popular for. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. Web a pennant pattern is a continuation chart pattern, seen when a security experiences a large. They are typically seen right after a big, quick. The only difference is that the flagpole is not as straight and the pattern forms a. Web flag and pennant patterns. Web a flag or pennant pattern forms when the price rallies sharply, then moves sideways or slightly to the downside. Description of the pennant and flag: The chart pattern is characterized by a countertrend price consolidation (the pennant) that follows. They usually represent only brief pauses in a dynamic stock. Web it is named the pennant pattern because it resembles a pennant on a flagpole. The flag and pennant patterns appear rather frequently on price charts. Whilst using one and two candlestick patterns such as the pin bar reversal are extremely popular for. By stelian olar, updated on: Web a pennant pattern is a kind of continuation pattern that appears when there’s a significant upward or downward movement in a financial instrument’s price and a subsequent. Flags and pennants can be categorized as continuation patterns. Web the flag and pennant patterns are commonly found patterns in the price charts of financially traded assets (stocks, bonds, futures, etc.). Web flags and pennants can be categorized as continuation patterns. Web the flag & pennant pattern.

Pennant guide How to Trade Bearish and Bullish Pennants?

How to Trade the Pennant, Triangle, Wedge, and Flag Chart Patterns

Pennant Chart Patterns Definition & Examples

Technical analysis—the rectangle, flag, and pennant patterns

Pennant Patterns Trading Bearish & Bullish Pennants

Bullish Pennant Patterns A Complete Guide

.png)

Mastering Trading Our Ultimate Chart Patterns Cheat Sheet

Pennant Chart Patterns Definition & Examples

Flag and Pennant Pattern Indicator (MT4) Free Download Best Forex

Flag and Pennant Price Action Patterns Explained Video

Web Learn How To Identify And Trade Pennant Patterns, Which Are Continuation Patterns Formed By A Large Movement Followed By A Consolidation And A Breakout.

Web What Are Flag And Pennant Chart Patterns?

Web How To Trade The Pennant, Triangle, Wedge, And Flag Chart Patterns.

Web The Flag Or Pennant Chart Pattern Is Formed Right After A Bullish Or Bearish Price Movement Followed By A Period Of Consolidation.

Related Post: