Flag Pattern Trading

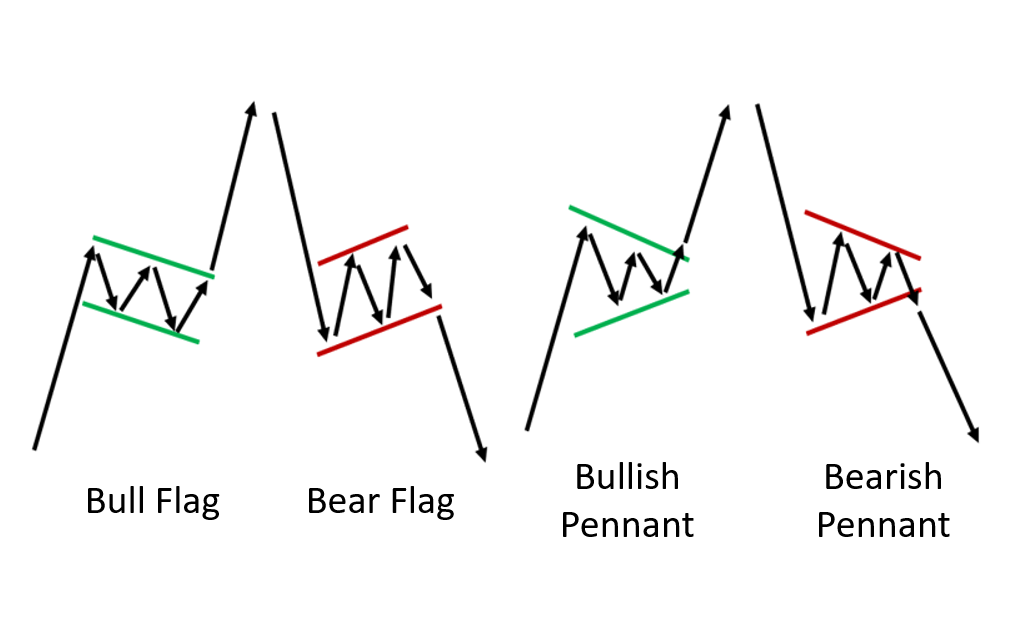

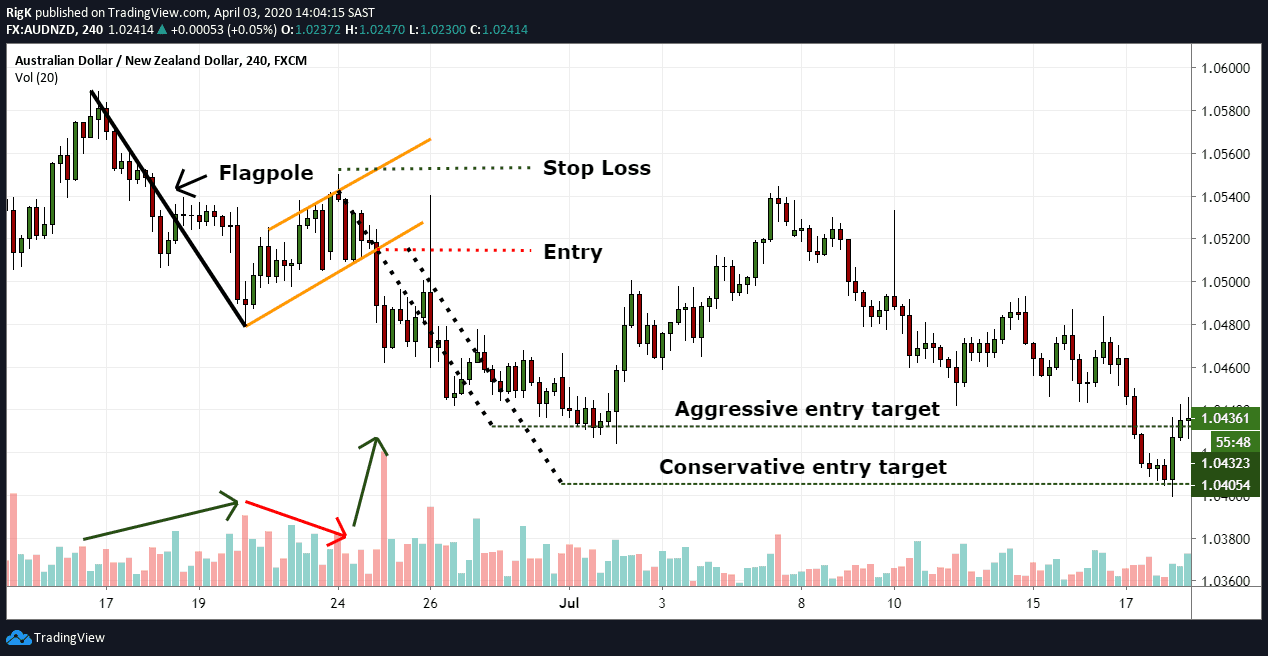

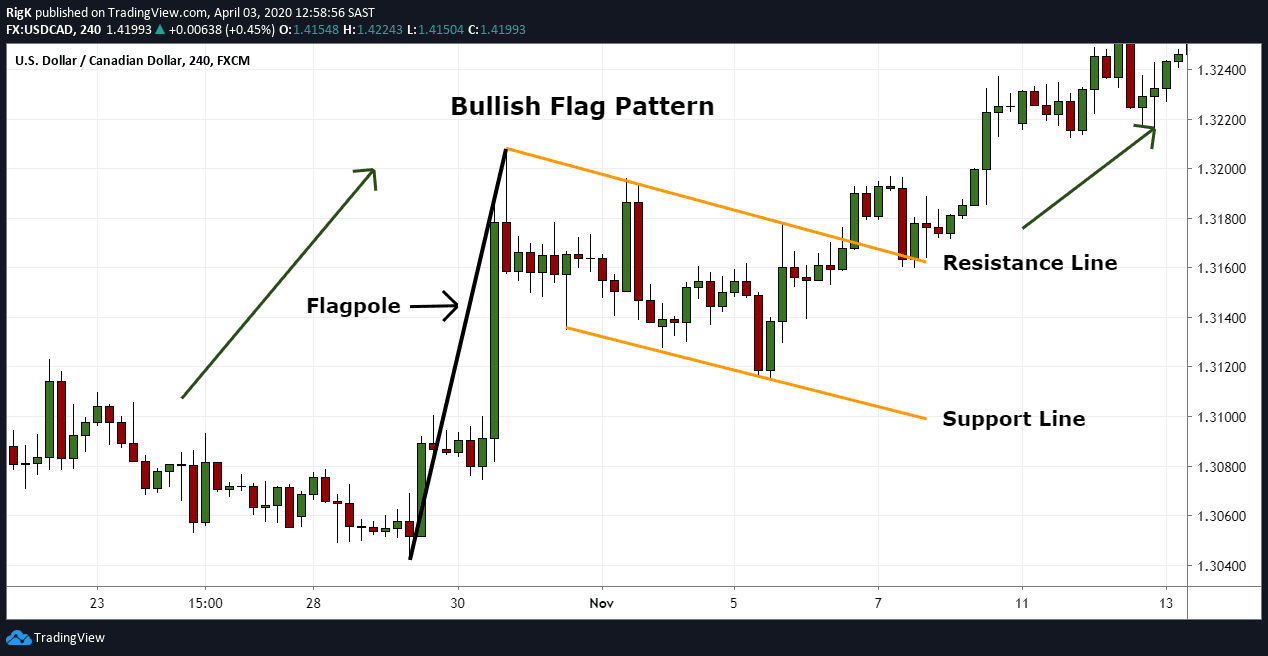

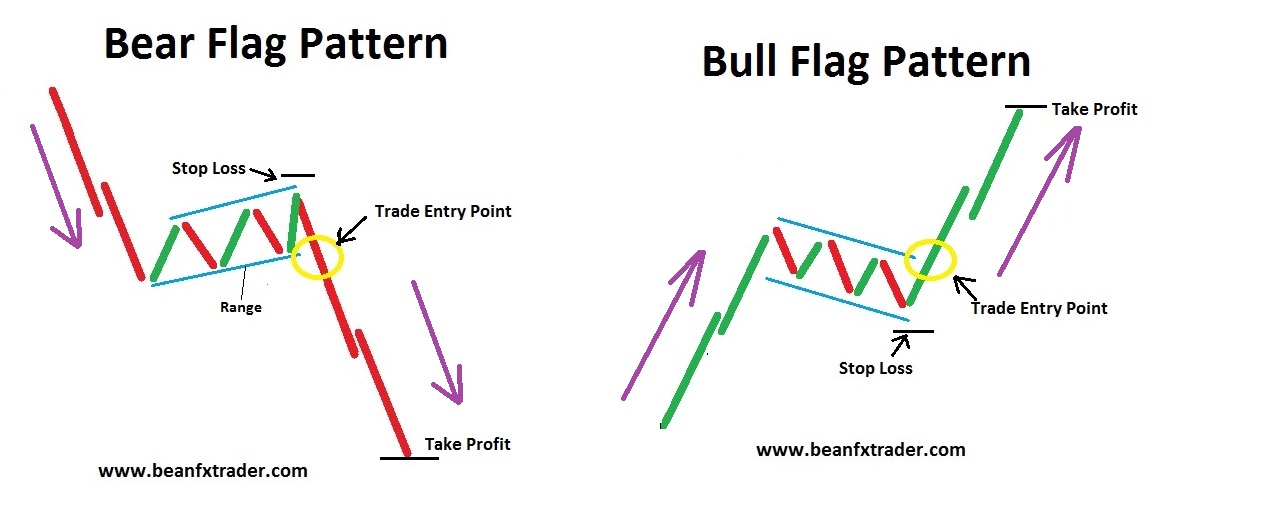

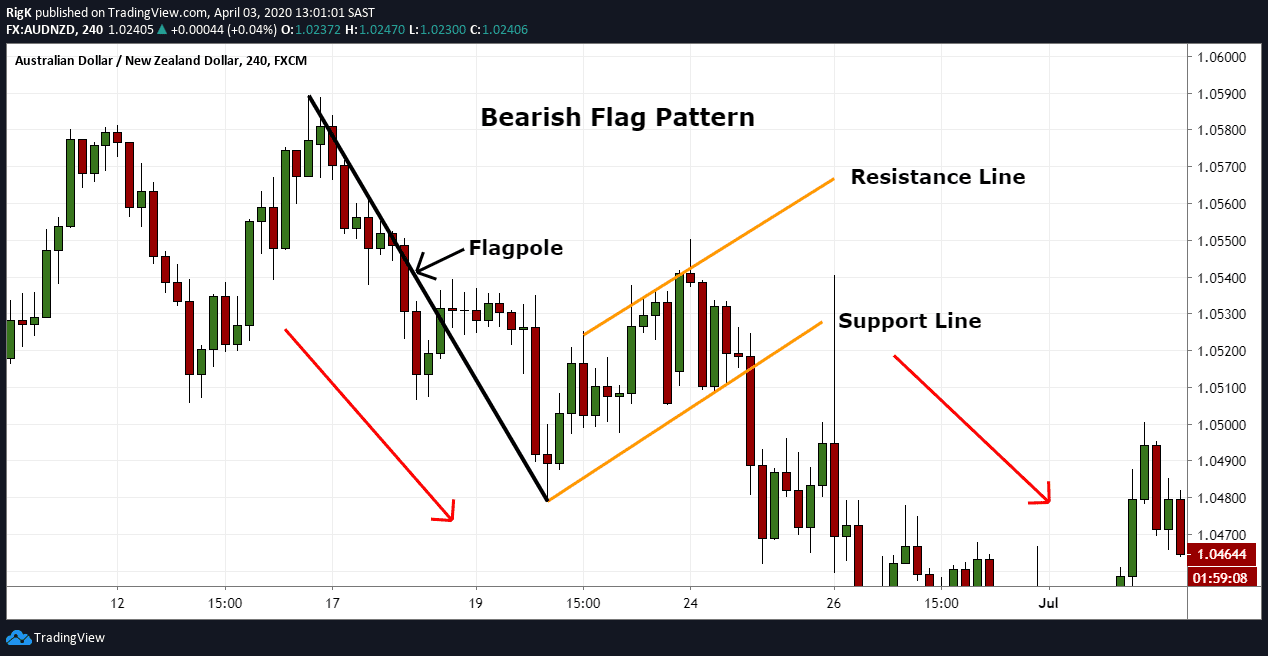

Flag Pattern Trading - Then, we explore the flag pattern indicators that show potential buy or sell signals. Web how to trade bull and bear flag patterns | ig us. Recognized by a distinct flagpole and consolidation phase, this pattern offers traders actionable insights and clear entry points. With that said, the bull flag pattern consists of two parts. Read on to learn more about the bull flag and its use in your financial markets trading. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. The pattern can be seen in any timeframe, and it consists of a small rectangular price formation that follows a fast price movement. You can practise trading flags with zero risk with a forex.com demo account, which comes with virtual funds to try out technical analysis on our full range of live markets. Web traders use flag patterns to identify potential trading opportunities as they show a strong trend that is to continue. The bull flag andthe bear flag. You can practise trading flags with zero risk with a forex.com demo account, which comes with virtual funds to try out technical analysis on our full range of live markets. A “flag” is composed of an explosive strong price move that forms the flagpole, followed by an orderly and diagonally symmetrical pullback, which forms the flag. The bull flag andthe. It often occurs after a big impulsive move. Web bull flags represent one of the most powerful and dynamic patterns in trading, signaling continuation in an uptrend. The impulse move is followed by short bodied candles countertrend to the impulse move, which is called the flag. Bull flag pattern on kirk daily timeframe: What is a bullish flag? Enter a trade when the prices break above or below the upper or lower trendline of the flag. Web this technical analysis guide teaches you about flag chart patterns. The bull flag andthe bear flag. In this article we look at how to trade these opportunities. A flag pattern is a trend continuation pattern, appropriately named after it’s visual similarity. Once these patterns come to an end, the resulting move can often be strong and reach your target quickly, which is why it is so popular amongst technical traders. Web the “bull flag” or “bullish flag pattern” is a powerful indicator for trading uptrends or topside market breakouts. In this article we look at how to trade these opportunities. Web. 201k views 5 years ago useful chart patterns. Web flag pattern trading strategy: Web traders use flag patterns to identify potential trading opportunities as they show a strong trend that is to continue. Bull flag pattern on kirk daily timeframe: Whenever you see this pattern form on a chart, it means that there are high chances of the price action. The best way to master flag patterns is to start looking for them on live markets. Web what are flag and pennant chart patterns? Recognized by a distinct flagpole and consolidation phase, this pattern offers traders actionable insights and clear entry points. We start by discussing what flag patterns are and how they are presented on a chart. The flag. Web updated may 26, 2021. The bull flag andthe bear flag. Web flag pattern trading strategy: Web a flag, in technical analysis of the financial markets, is a continuation chart pattern that forms when the market consolidates in a narrow range after a sharp move. Read on to learn more about the bull flag and its use in your financial. Enter a trade when the prices break above or below the upper or lower trendline of the flag. Web the flag pattern is the most common continuation patterns in technical analysis. Bull flag and bear flag chart patterns explained. You can roughly connect the peaks and valleys of the stock with parallel lines, with break points exceeding the. Web the. Whenever you see this pattern form on a chart, it means that there are high chances of the price action breaking out in the direction of the prevailing trend. There are mainly 2 types of flag pattern in trading: They represent a pattern of two parallel trendlines that meet at both the upper and lower points of an asset’s price,. 201k views 5 years ago useful chart patterns. How to identify and use the bull flag pattern in trading? The flag pattern holds immense importance for traders as it provides a valuable insight into potential trading opportunities. 11 chart patterns for trading symmetrical triangle. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after. How to identify and use the bull flag pattern in trading? It often occurs after a big impulsive move. 11 chart patterns for trading symmetrical triangle. What is the bull flag pattern? Web mastering the bearish flag pattern in forex and gold trading. Web the flag pattern is a powerful trend continuation chart pattern that appears in all markets and timeframes. They are called bull flags. How to trade the bull flag pattern? Web how to trade flag patterns. A “flag” is composed of an explosive strong price move that forms the flagpole, followed by an orderly and diagonally symmetrical pullback, which forms the flag. What is a flag pattern? The pattern can be seen in any timeframe, and it consists of a small rectangular price formation that follows a fast price movement. Web the “bull flag” or “bullish flag pattern” is a powerful indicator for trading uptrends or topside market breakouts. A bull flag pattern occurs after a strong upward price movement and the bear flag pattern occurs after a strong downward price movement. These patterns are usually preceded by a sharp advance or decline with heavy volume , and mark a midpoint of the move. How to become a professional trader :

Bull Flag & Bear Flag Pattern Trading Strategy Guide (Updated 2023)

Bull Flag Chart Patterns Trading Guide CenterPoint Securities

What Is Flag Pattern? How To Verify And Trade It Efficiently

Flag Pattern Full Trading Guide with Examples

How to use the flag chart pattern for successful trading

Flag Pattern Full Trading Guide with Examples

How to use the flag chart pattern for successful trading

Flag Pattern Forex Trading

FLAG PATTERNS FX & VIX Traders Blog

Flag Pattern Full Trading Guide with Examples

The Formation Usually Occurs After A Strong Trending Move That Can Contain Gaps (This Move Is Known As The Mast Or Pole Of The Flag) Where The.

Enter A Trade When The Prices Break Above Or Below The Upper Or Lower Trendline Of The Flag.

With That Said, The Bull Flag Pattern Consists Of Two Parts.

You Can Roughly Connect The Peaks And Valleys Of The Stock With Parallel Lines, With Break Points Exceeding The.

Related Post: