Flag Pattern Stocks

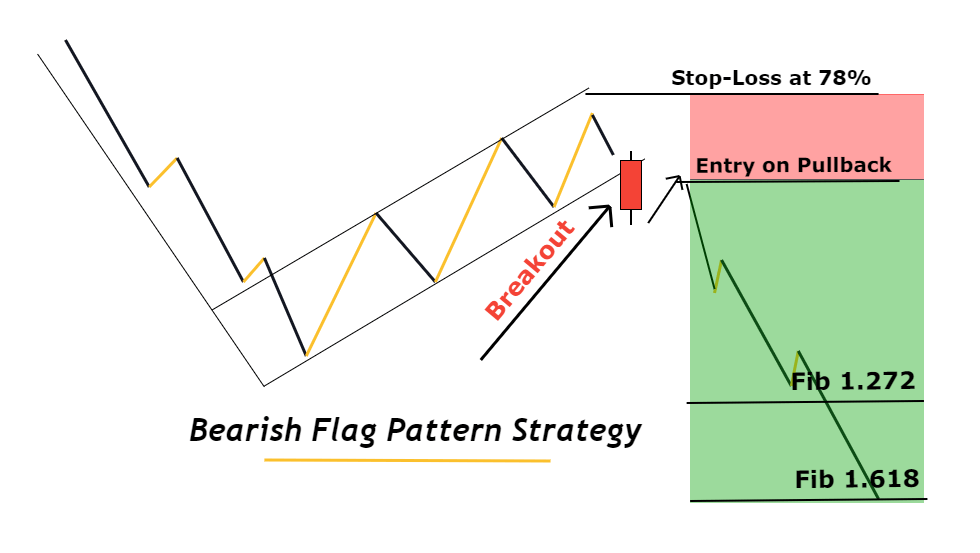

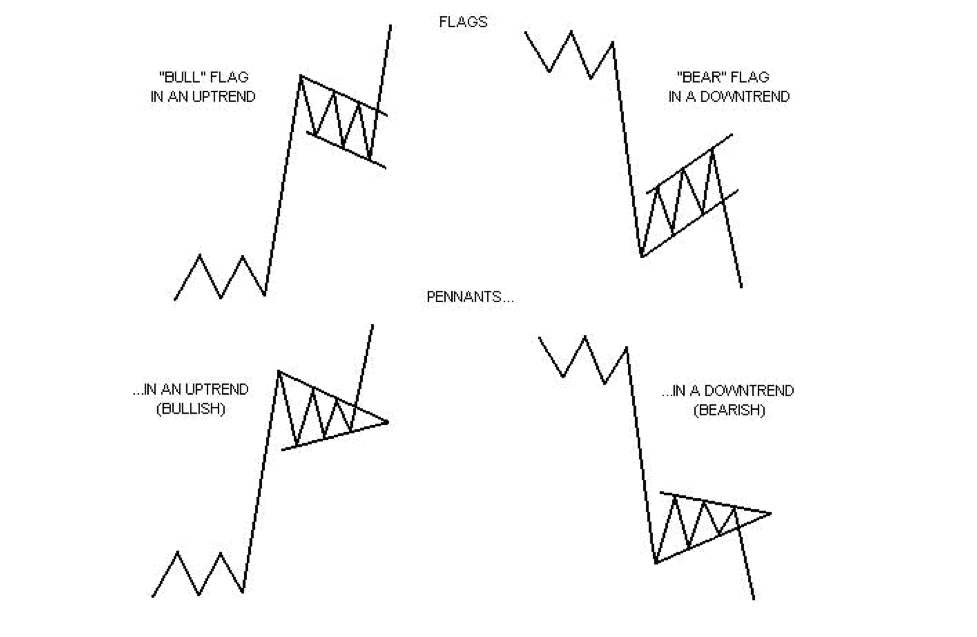

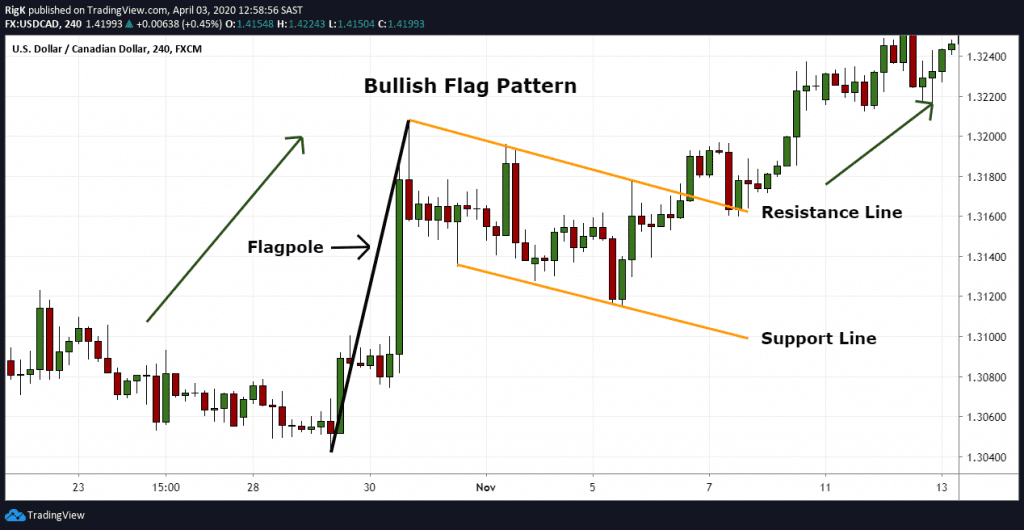

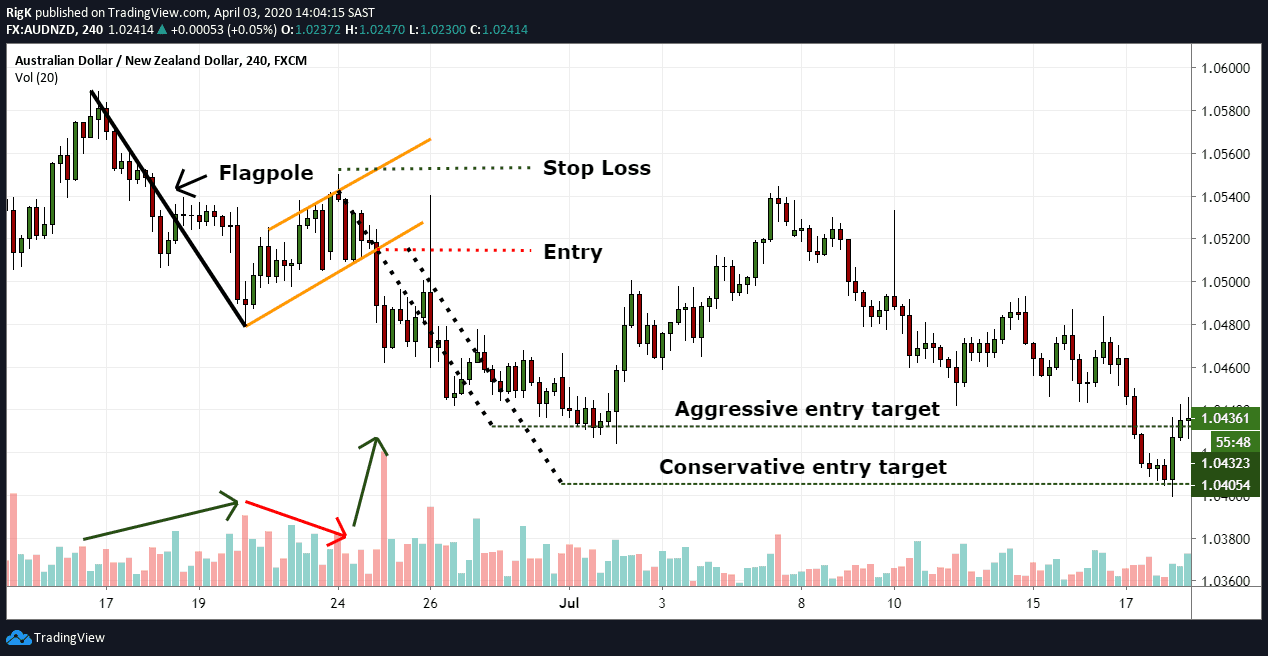

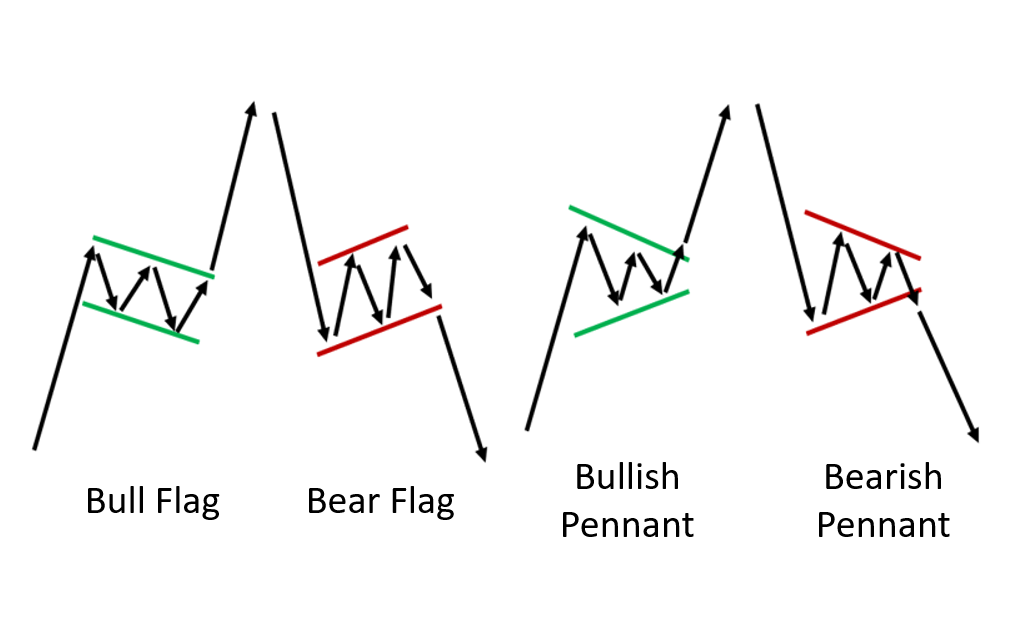

Flag Pattern Stocks - Web the flag pattern is a powerful trend continuation chart pattern that appears in all markets and timeframes. Web what is a flag pattern? A flag pattern is a type of chart continuation pattern that shows candlesticks contained in a small parallelogram. A flag pattern is a trend continuation pattern, appropriately named after it’s visual similarity to a flag on a flagpole. Crossed above 1 day ago. A line extending up from this break to the high of. Web a flag chart pattern is formed when the market consolidates in a narrow range after a sharp move. Web technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. It is thought of as a technique used to identify continuing downward trends in stock and commodity trading charts. Web there are three potential price target levels indicated by 1.27, 1.414 and 1.618 fib extensions, which each double as a potential price reversal zone (prz). Crossed above 1 day ago. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. Web bullish flag formations are found in stocks with strong uptrends and are considered good continuation patterns. These patterns are usually preceded by a sharp advance or decline with heavy volume, and mark a. It is thought of as a technique used to identify continuing downward trends in stock and commodity trading charts. Web there are many different types of flags that technical traders should keep an eye out for when analyzing chart patterns. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial. They are called bull flags because the pattern resembles a flag on a pole. Web a flag chart pattern is formed when the market consolidates in a narrow range after a sharp move. The pattern consists of between five to twenty candlesticks. Crossed above 1 day ago. Once these patterns come to an end, the resulting move can often be. Stock passes all of the below filters in cash segment: Flag patterns can be bullish or bearish. Web technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Bullish flag formations are found in stocks with strong uptrends and are considered good continuation patterns. Web bull flags represent. A flag pattern is a trend continuation pattern, appropriately named after it’s visual similarity to a flag on a flagpole. Hi, nse:hikal has given a bullish flag breakout on daily charts with very good volume. In technical analysis, a pennant is a type of continuation pattern. Here are some of the most common types of flags: A flag can be. The second element is the flag, which takes shape. Web bull flags represent one of the most powerful and dynamic patterns in trading, signaling continuation in an uptrend. Learn how to trade bull flag and bear flag chart patterns the right way. Whenever you see this pattern form on a chart, it means that there are high chances of the. Web there are many different types of flags that technical traders should keep an eye out for when analyzing chart patterns. Web a flag pattern is formed when the price of a stock or asset rises rapidly in a short period of time called the flagpole. The pattern consists of between five to twenty candlesticks. A flag can be used. Recognized by a distinct flagpole and consolidation phase, this pattern offers traders actionable insights and clear entry points. Bullish flag formations are found in stocks with strong uptrends and are considered good continuation patterns. It is thought of as a technique used to identify continuing downward trends in stock and commodity trading charts. Macd is also on the bullish side. The formation usually occurs after a strong trending move that can contain gaps (this move is known as the mast or pole of the flag) where the flag represents a relatively short period of indecision. Flags are categorized as continuation processes and represent only brief pauses in a dynamic market. Web a flag pattern is a chart continuation pattern displaying. In technical analysis, a pennant is a type of continuation pattern. Once these patterns come to an end, the resulting move can often be strong and reach your target quickly, which is why it is so popular amongst technical traders. Web what is a flag pattern? Enter a trade when the prices break above or below the upper or lower. Web a flag pattern is a chart continuation pattern displaying candlesticks within a small parallelogram. Stock passes all of the below filters in cash segment: A flag pattern is a trend continuation pattern, appropriately named after it’s visual similarity to a flag on a flagpole. These patterns are usually preceded by a sharp advance or decline with heavy volume, and mark a midpoint of the move. The formation usually occurs after a strong trending move that can contain gaps (this move is known as the mast or pole of the flag) where the flag represents a relatively short period of indecision. Web a flag pattern is formed when the price of a stock or asset rises rapidly in a short period of time called the flagpole. Web unlike a bull flag pattern, a bear pattern shows traders a sharp downward price drop in a chart, followed by a gradual positive consolidation after the ‘flag pole’. A flag can be used as an entry pattern for the continuation of an established trend. Macd is also on the bullish side on daily and weekly time frames. They are called bull flags because. Bullish flag formations are found in stocks with strong uptrends and are considered good continuation patterns. The stock history shows a sharp rise which is the flag pole followed. Web technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. What is a bullish flag? It is thought of as a technique used to identify continuing downward trends in stock and commodity trading charts. Web updated may 26, 2021.

Bearish Flag Pattern Explained with Powerful Trading Plan ForexBee

Stock Trading Training Flag Patterns

What Is Flag Pattern? How To Verify And Trade It Efficiently

How to use the flag chart pattern for successful trading

Flag Pattern Full Trading Guide with Examples

Flag Pattern Full Trading Guide with Examples

Bull Flag Chart Pattern & Trading Strategies Warrior Trading

Flag Pattern Forex Trading

Bull Flag Chart Patterns The Complete Guide for Traders

Bull Flag & Bear Flag Pattern Trading Strategy Guide (Updated 2023)

Recognized By A Distinct Flagpole And Consolidation Phase, This Pattern Offers Traders Actionable Insights And Clear Entry Points.

Web The Flag Pattern Is A Powerful Trend Continuation Chart Pattern That Appears In All Markets And Timeframes.

The Second Element Is The Flag, Which Takes Shape.

A Rectangular Shaped Consolidation Pattern Will Form Before Continuing Its Prior Trend.

Related Post: