Flag Pattern In Stocks

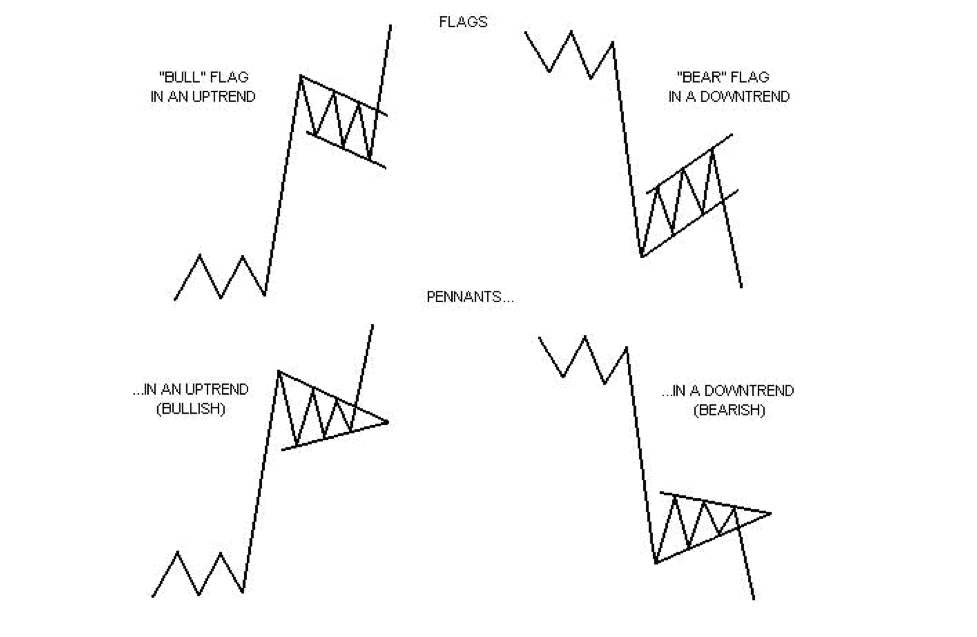

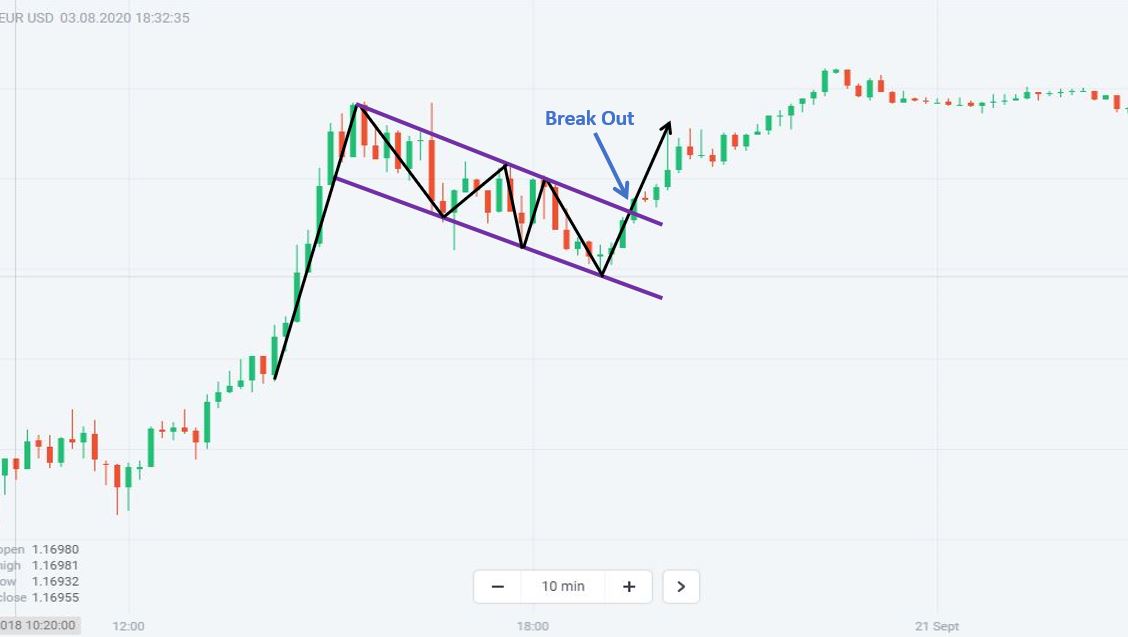

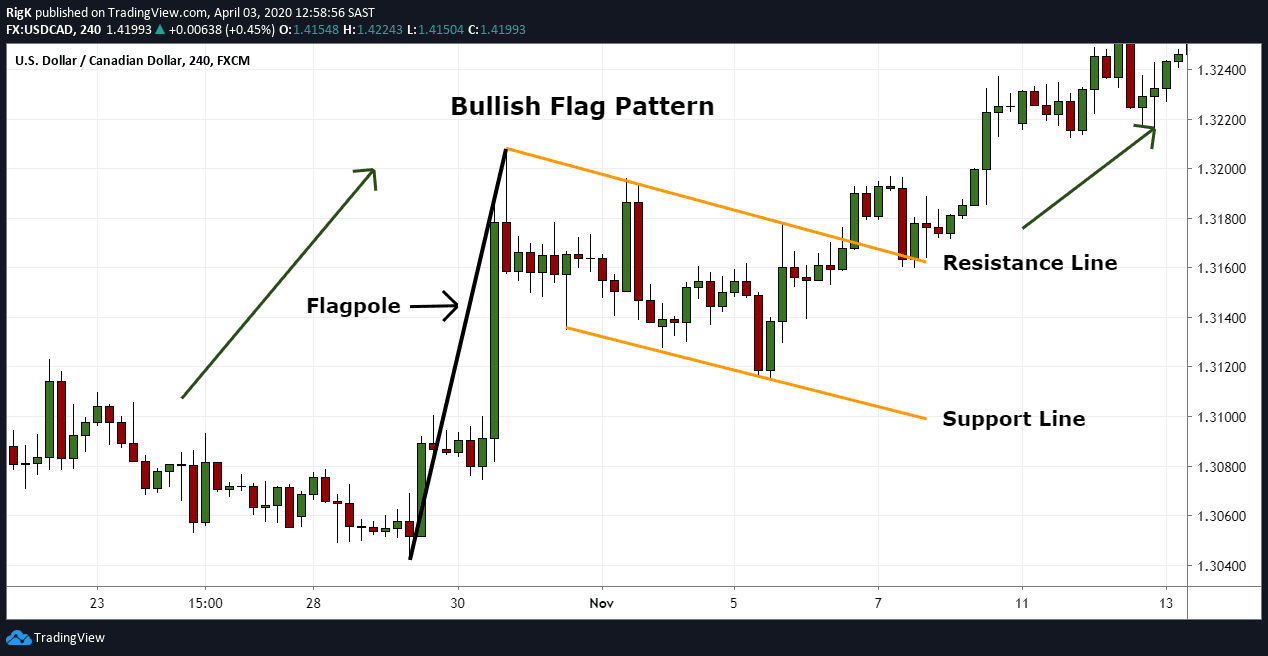

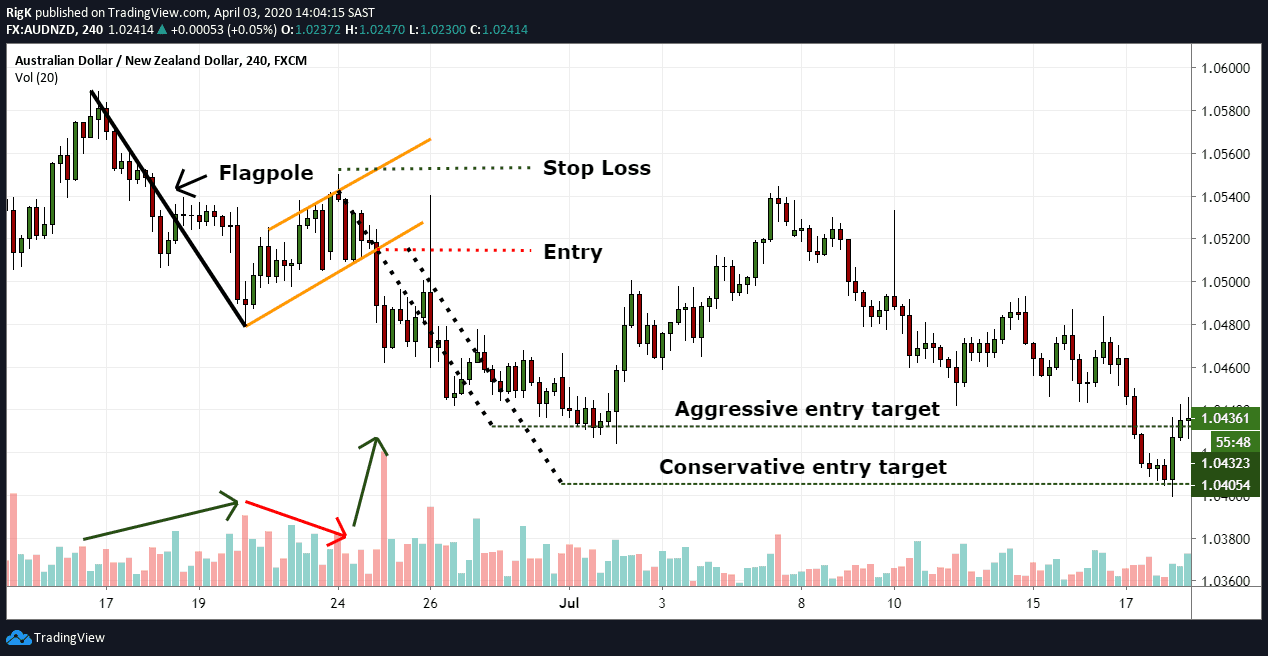

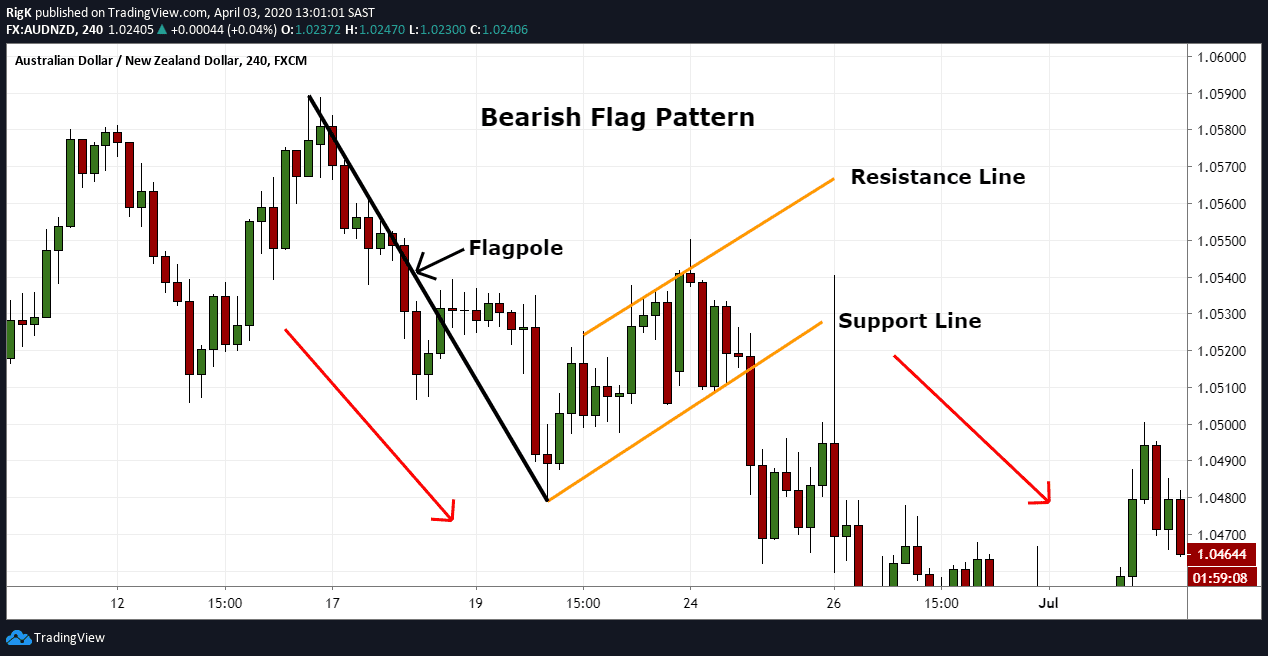

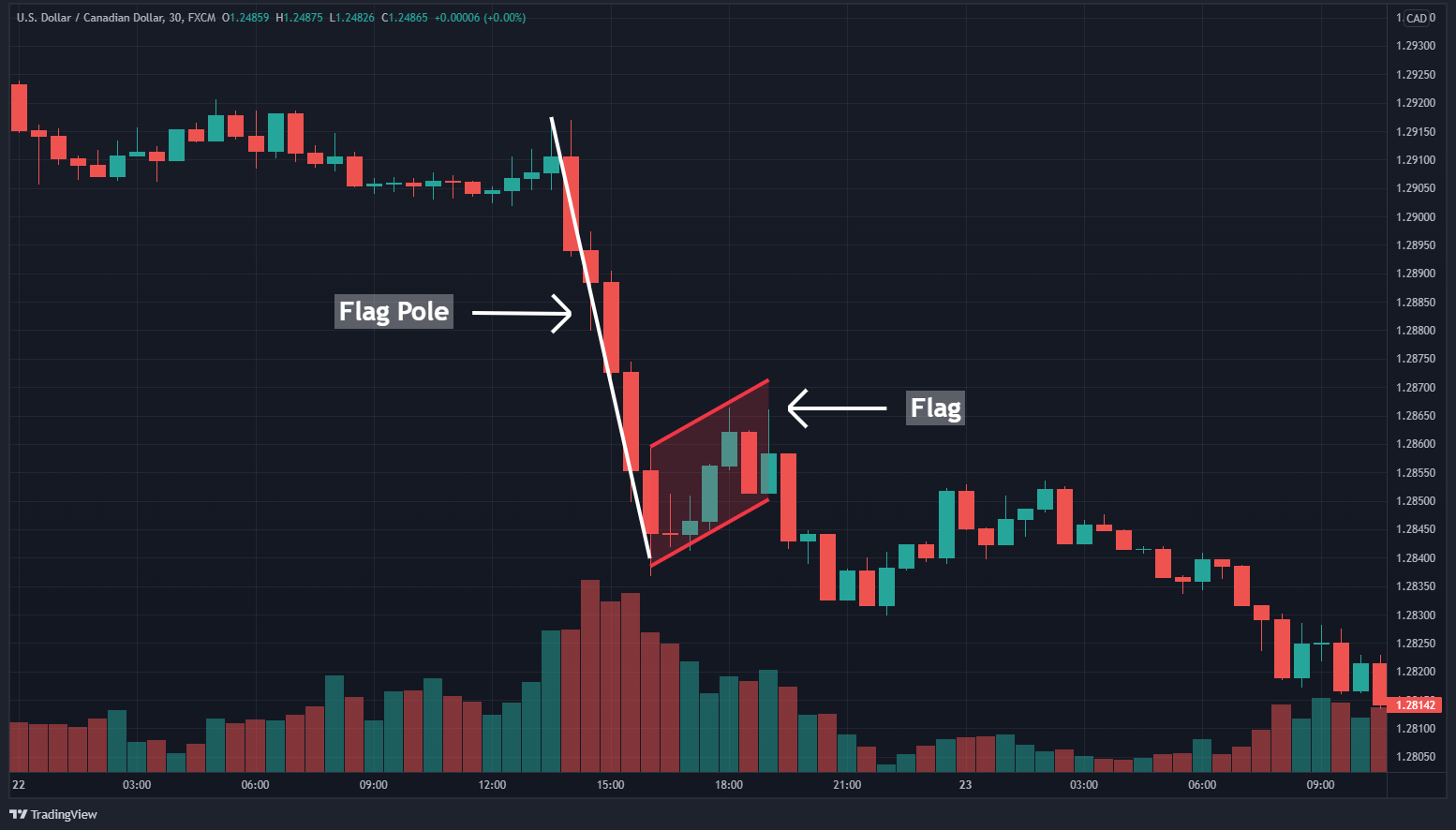

Flag Pattern In Stocks - Web what are flag and pennant chart patterns? Recognized by a distinct flagpole and consolidation phase, this pattern offers traders actionable insights and clear entry points. The flag can be a horizontal rectangle but mostly angles down from the pole. The vertical rise forms the pole and the following period of consolidation forms the flag. The pattern can be seen in any timeframe, and it consists of a small rectangular price formation that follows a fast price movement. What is a bullish flag? In technical analysis, a pennant is a type of continuation pattern. Web updated may 26, 2021. Web the flag pattern is a powerful trend continuation chart pattern that appears in all markets and timeframes. There are usually five parts to a bull flag pattern:. Web a flag, in technical analysis of the financial markets, is a continuation chart pattern that forms when the market consolidates in a narrow range after a sharp move. Flags can be seen in any time frame but normally consist of about five to 15 price bars, although that is not a set rule. Web a flag chart pattern is. A flag pattern is a type of chart continuation pattern that shows candlesticks contained in a small parallelogram. Web a flag, in technical analysis of the financial markets, is a continuation chart pattern that forms when the market consolidates in a narrow range after a sharp move. The bull flag andthe bear flag. The pattern consists of between five to. Bear flag suggests (but doesn’t guarantee) that the. Then, we explore the flag pattern indicators that show potential buy or sell signals. There are usually five parts to a bull flag pattern:. Web this technical analysis guide teaches you about flag chart patterns. Web updated may 26, 2021. Then, we explore the flag pattern indicators that show potential buy or sell signals. There are usually five parts to a bull flag pattern:. Flags can be seen in any time frame but normally consist of about five to 15 price bars, although that is not a set rule. Web a flag pattern is a chart continuation pattern displaying candlesticks. A line extending up from this break to the. Web updated december 10, 2023. Flag patterns can be bullish or bearish. Web there are mainly 2 types of flag pattern in trading: There are usually five parts to a bull flag pattern:. They are called bull flags because the pattern resembles a flag on a pole. The second element is the flag, which takes shape. The ‘flagpole’ is the trend preceding the ‘flag’. Web bull flags represent one of the most powerful and dynamic patterns in trading, signaling continuation in an uptrend. Web this technical analysis guide teaches you about flag chart. The ‘flag’ is a support level and highlights the consolidation after a trend. The pole is the result of a vertical rise in a stock and the flag results from a period of consolidation. The pattern consists of between five to twenty candlesticks. Web bull flags represent one of the most powerful and dynamic patterns in trading, signaling continuation in. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. Whenever you see this pattern form on a chart, it means that there are high chances of the price action breaking out in the direction of the prevailing trend. Web a flag pattern. Web this technical analysis guide teaches you about flag chart patterns. Web there are many different types of flags that technical traders should keep an eye out for when analyzing chart patterns. Web a flag chart pattern is formed when the market consolidates in a narrow range after a sharp move. The pattern consists of between five to twenty candlesticks.. Flags can be seen in any time frame but normally consist of about five to 15 price bars, although that is not a set rule. Web the flag pattern is a powerful trend continuation chart pattern that appears in all markets and timeframes. Web a flag pattern is a technical analysis chart pattern that can be observed in the price. The pole is the result of a vertical rise in a stock and the flag results from a period of consolidation. We start by discussing what flag patterns are and how they are presented on a chart. Flags can be seen in any time frame but normally consist of about five to 15 price bars, although that is not a set rule. A bull flag pattern occurs after a strong upward price movement and the bear flag pattern occurs after a strong downward price movement. Here are some of the most common types of flags: Web there are many different types of flags that technical traders should keep an eye out for when analyzing chart patterns. Web a flag, in technical analysis of the financial markets, is a continuation chart pattern that forms when the market consolidates in a narrow range after a sharp move. Once these patterns come to an end, the resulting move can often be strong and reach your target quickly, which is why it is so popular amongst technical traders. The bull flag andthe bear flag. Web technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. The pattern can be seen in any timeframe, and it consists of a small rectangular price formation that follows a fast price movement. They are called bull flags because. There are usually five parts to a bull flag pattern:. What is a bullish flag? Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. Web a bear flag is a continuation pattern in technical analysis.

Stock Trading Training Flag Patterns

What Is Flag Pattern? How To Verify And Trade It Efficiently

Flag Pattern Full Trading Guide with Examples

Flag Pattern Forex Trading

Flag Pattern Full Trading Guide with Examples

Flag Pattern Full Trading Guide with Examples

How To Trade The Bear Flag Pattern

What Is Flag Pattern? How To Verify And Trade It Efficiently

How to use the flag chart pattern for successful trading

Chart Patterns Flags TrendSpider Learning Center

Web First And Foremost, A Stock Must Rally 100% To 120% In Just Four To Eight Weeks.

Web There Are Mainly 2 Types Of Flag Pattern In Trading:

A Flag Pattern Is A Trend Continuation Pattern, Appropriately Named After It’s Visual Similarity To A Flag On A Flagpole.

Web Bullish Flags Are A Continuation Pattern Found In Stocks With A Strong Uptrend.

Related Post: