Flag Candlestick Pattern

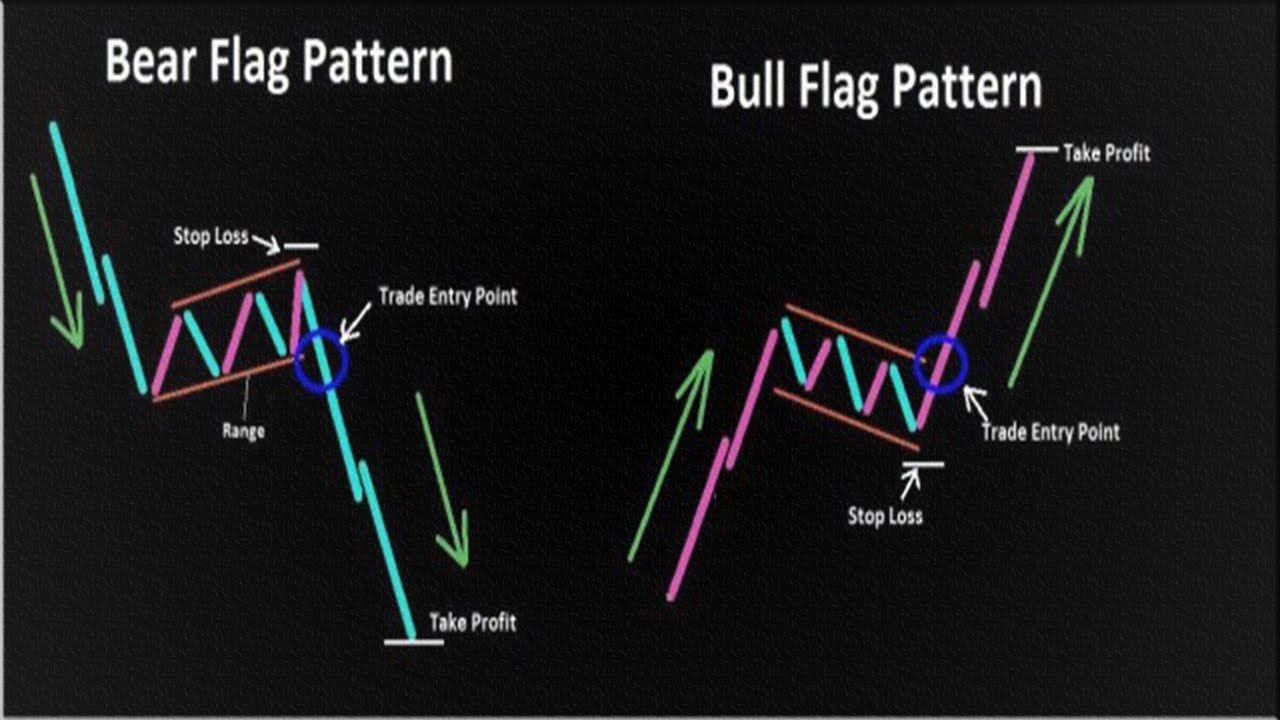

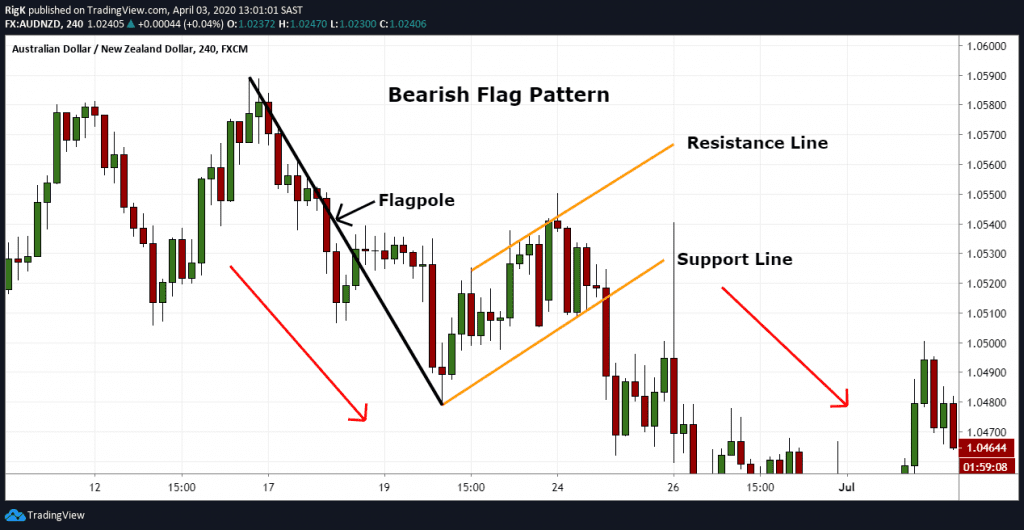

Flag Candlestick Pattern - Web it is characterized by strong price action in the upward direction (price increase), with high volume, followed by the aforementioned price consolidation, where for a period of time the price of the asset will move mostly sideways or decline, on relatively lower volume, resembling a flag. Web there are certain bullish patterns, such as the bull flag pattern, double bottom pattern, and the ascending triangle pattern, that are largely considered the best. The price action consolidates within the two parallel trend lines in the opposite direction of the uptrend, before breaking out and continuing the uptrend. As a continuation pattern, the bear flag helps sellers to push the price action further lower. Bearish flag pattern candlestick chart pattern#chartpatternsandtechnicalanalysis#nseindia#bse#bseindia#. Bull flags can occur on any time frame. Web updated december 10, 2023. Web the flag limit is the area where the price penetrates the sr flip, forms a narrow sideways price action with 1 or 2 candlesticks, and breaks the support or resistance undoubtedly. With candles, you'll notice that a bull flag is usually generated with very large green candles, then a series of red candles that pull back, and then another large green candle that creates the breakout pattern. The flag pattern is encompassed by two parallel lines. Web this technical analysis guide teaches you about flag chart patterns. As a continuation pattern, the bear flag helps sellers to push the price action further lower. Whilst using one and two candlestick patterns such as the pin bar reversal are extremely popular for finding trade setups, they are only as good as the area that the trade is being. The pole is formed by a line which represents the primary trend in the market. The flag pattern is encompassed by two parallel lines. The stop is placed just below the lower flag or pennant line, in line (vertically) with the point of breakout. There are dozens of different candlestick patterns with intuitive, descriptive. If a pin bar is being. There are dozens of different candlestick patterns with intuitive, descriptive. With candles, you'll notice that a bull flag is usually generated with very large green candles, then a series of red candles that pull back, and then another large green candle that creates the breakout pattern. Web bull flag patterns are one of the most popular bullish patterns. Web the. Web a flag pattern is a type of chart continuation pattern that shows candlesticks contained in a small parallelogram. What is a bullish flag? In technical analysis, a pennant is a type of continuation pattern. The pattern consists of between five to twenty candlesticks. The flag pattern is encompassed by two parallel lines. When identified, this pattern can signal a potential for massive price movement. Web bull flag patterns are one of the most popular bullish patterns. Whilst using one and two candlestick patterns such as the pin bar reversal are extremely popular for finding trade setups, they are only as good as the area that the trade is being taken from. Flag. What is a bullish flag? Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. Web a bear flag pattern consists of a larger bearish candlestick (going down in price), which forms the flag pole. It’s basically a continuation pattern aligned with support or resistance. Flag patterns are a useful visual tool to. There are dozens of different candlestick patterns with intuitive, descriptive. Web it is characterized by strong price action in the upward direction (price increase), with high volume, followed by the aforementioned price consolidation, where for a period of time the price of the asset will move mostly sideways or decline, on relatively lower volume, resembling a flag. What are flag. Web there are certain bullish patterns, such as the bull flag pattern, double bottom pattern, and the ascending triangle pattern, that are largely considered the best. It’s basically a continuation pattern aligned with support or resistance. They are called bull flags. Web the bearish flag is a candlestick chart pattern that signals the extension of the downtrend once the temporary. Followed by at least three or more smaller consolidation candles, forming the flag. In technical analysis, a pennant is a type of continuation pattern. Web there are certain bullish patterns, such as the bull flag pattern, double bottom pattern, and the ascending triangle pattern, that are largely considered the best. Web how to trade the pennant, triangle, wedge, and flag. Bullish flag formations are found in stocks with strong uptrends and are considered good continuation patterns. The best way to view them is using a candlestick chart. Web a bear flag pattern consists of a larger bearish candlestick (going down in price), which forms the flag pole. They are called bull flags. Recognizing the high tight flag pattern can act. Usually, these candles are moving up or down, just a little bit in a tight range after the “flag pole.” It’s basically a continuation pattern aligned with support or resistance. The flag pattern is encompassed by two parallel lines. In technical analysis, a pennant is a type of continuation pattern. Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. They are called bull flags. When identified, this pattern can signal a potential for massive price movement. Web there are certain bullish patterns, such as the bull flag pattern, double bottom pattern, and the ascending triangle pattern, that are largely considered the best. Web a bear flag pattern consists of a larger bearish candlestick (going down in price), which forms the flag pole. Web bull flag candle pattern. Web the bullish flag is a continuation chart pattern that facilitates an extension of the uptrend. They consist of either a large bullish candlestick or several smaller bullish candlesticks up, forming the flag pole, followed by several smaller bearish candlesticks pulling back down for consolidation, which forms the flag. Flag patterns are a useful visual tool to identify and evaluate changes in price over time. Web how to trade the pennant, triangle, wedge, and flag chart patterns. What are flag patterns and how to identify them. Web the high tight flag pattern is a rare but potent candlestick formation appearing on price charts.

Flag Pattern Forex Trading

Top Continuation Patterns Every Trader Should Know

10 Powerful Candlesticks Patterns And Strategies You Need To Know

How To Trade Flag Pattern Basics Candlestick Chart The Waverly

How to use the flag chart pattern for successful trading

Learn about Bull Flag Candlestick Pattern ThinkMarkets EN

Flag Pattern Full Trading Guide with Examples

The Common Forex Candlestick Patterns

Flag Forex Indicator How To Trade Es Futures Options

Flag Candlestick Pattern Candlestick Pattern Tekno

Web A Flag Pattern Is A Type Of Chart Continuation Pattern That Shows Candlesticks Contained In A Small Parallelogram.

The Best Way To View Them Is Using A Candlestick Chart.

Web Bull Flag Patterns Are One Of The Most Popular Bullish Patterns.

The Price Action Consolidates Within The Two Parallel Trend Lines In The Opposite Direction Of The Uptrend, Before Breaking Out And Continuing The Uptrend.

Related Post: