Flag And Pole Pattern

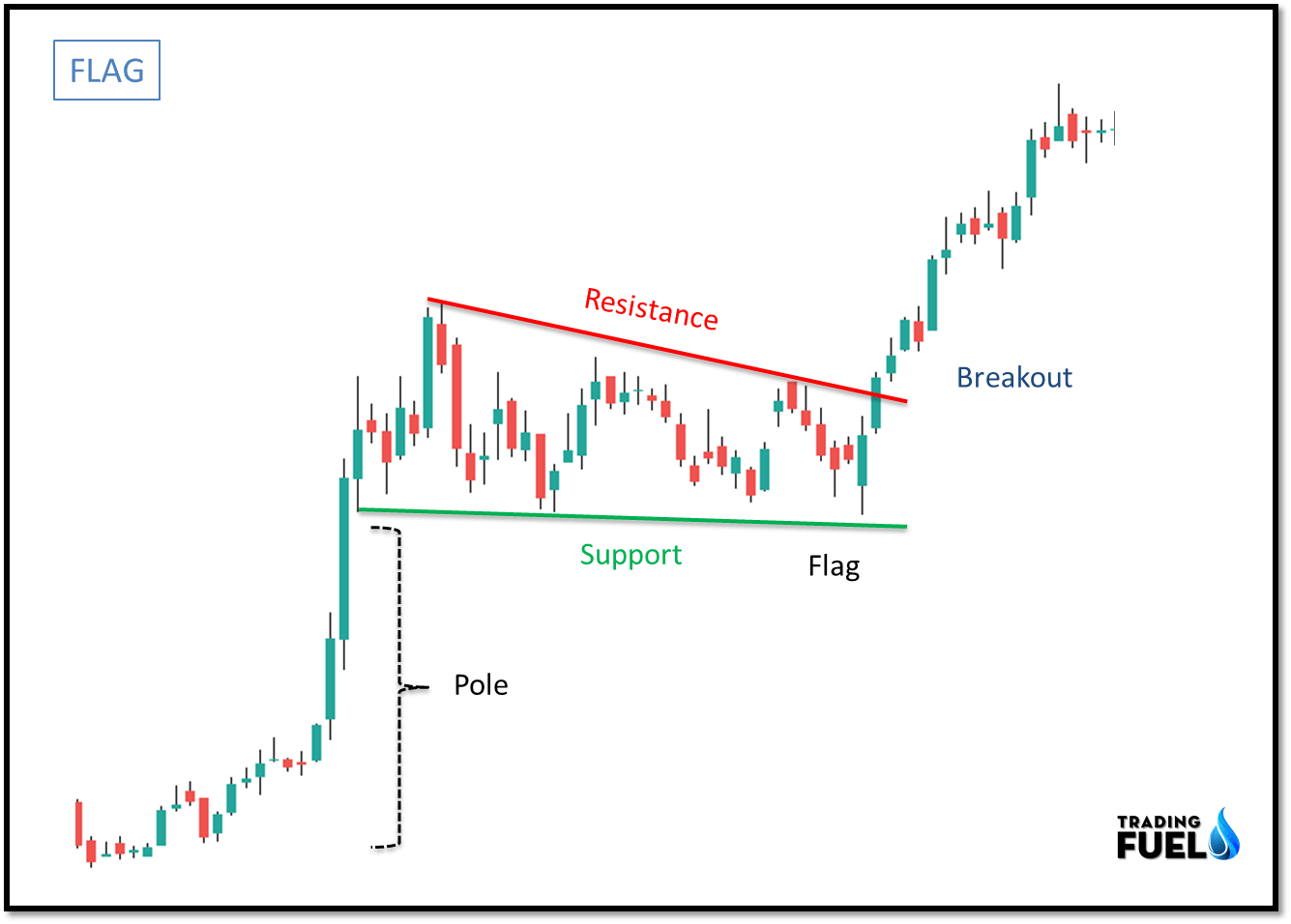

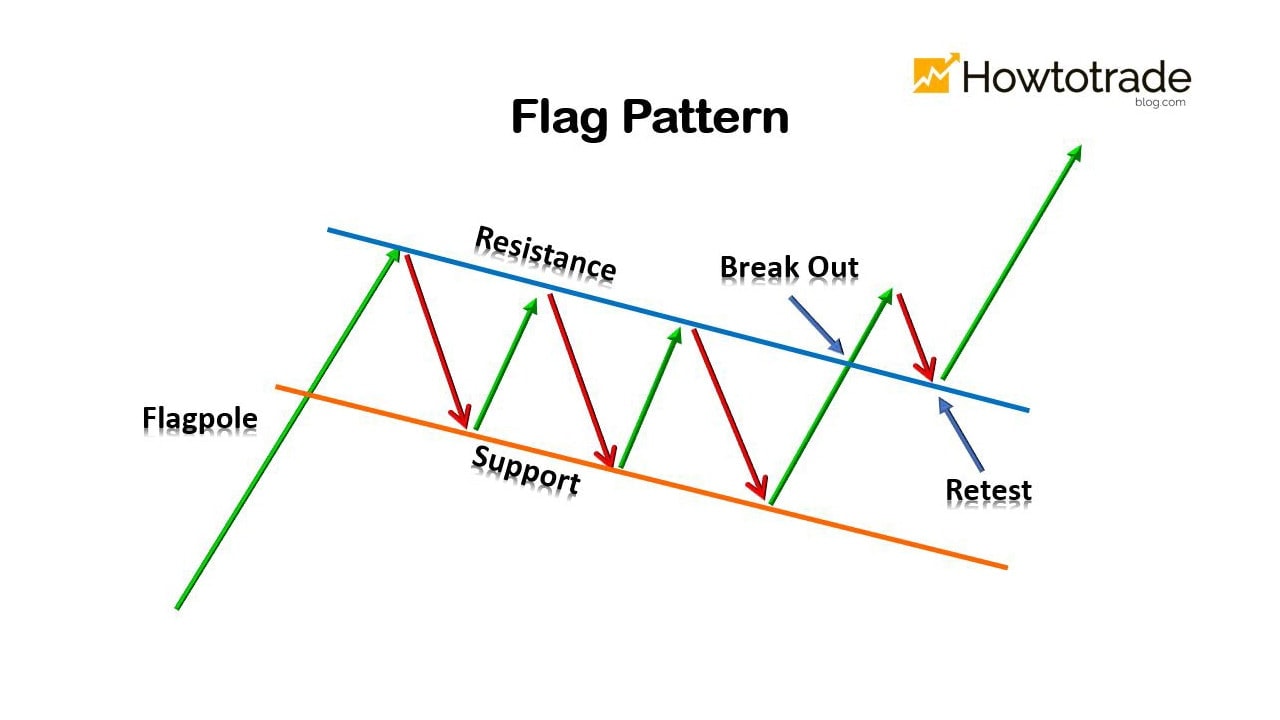

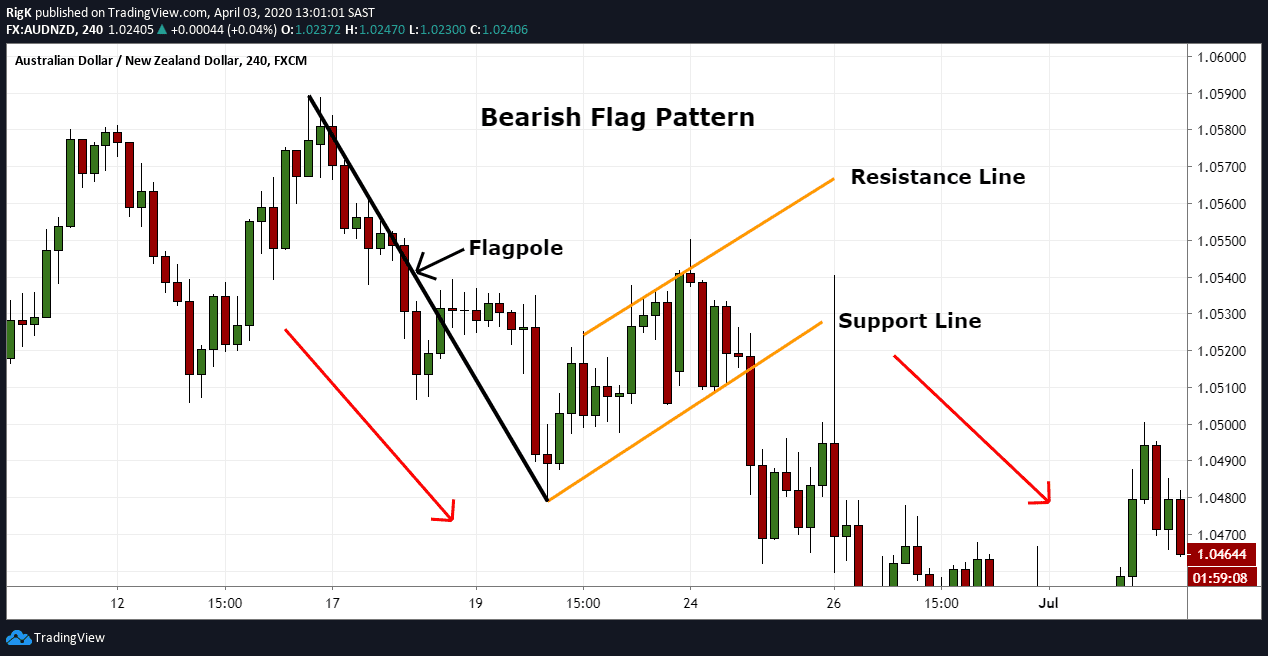

Flag And Pole Pattern - Bull flag this pattern occurs in an uptrend to confirm further movement up. The pole refers to the initial strong price movement that forms the vertical line, while the flag means the consolidation period that forms the horizontal line. They are called bull flags because. As the flag pattern emerges, you will see a large impulse move, commonly known as the flag pole. Web a flag and pole pattern describes a specific chart formation used to identify the continuation of a previous trend from a point at which the price moved against the same trend. It is thought of as a technique used to identify continuing downward trends in stock and commodity trading charts. The continuation of the movement down can be measured by the size of the pole. The continuation of the movement up can be measured by the size of the of pole. A “flag” is composed of an explosive strong price move that forms the flagpole, followed by an orderly and diagonally symmetrical pullback, which forms the flag. This pattern occurs when there is a sharp and significant upward or downward price movement, known as the pole, followed by a period of consolidation, known as the flag pattern. They are called bull flags because. Web the flag and pole pattern is a commonly used technical analysis tool that helps traders identify market trends. The continuation of the movement up can be measured by the size of the of pole. Web a flag and pole pattern in technical analysis is a chart pattern that occurs when the price of. These patterns are usually preceded by a sharp advance or decline with heavy volume, and mark a midpoint of the move. A flag chart pattern is formed when the market consolidates in a narrow range after a sharp move. Scanner guide scan examples feedback. The continuation of the movement down can be measured by the size of the pole. Web. Web the flag pole is the first component of the flag chart pattern. Bullish flag formations are found in stocks with strong uptrends and are considered good continuation patterns. Web a flag pattern is a trend continuation pattern, appropriately named after it’s visual similarity to a flag on a flagpole. Web the flag chart pattern is also known as a. Web goldviewfx dec 9, 2021. What is a bullish flag? Scanner guide scan examples feedback. Web flag and pole pattern, technical analysis scanner. Web a flag pattern is a trend continuation pattern, appropriately named after it’s visual similarity to a flag on a flagpole. These patterns are usually preceded by a sharp advance or decline with heavy volume, and mark a midpoint of the move. Web updated may 26, 2021. As with all trades, a risk/reward ratio should be quantified at entry and the trade managed to optimize wins and minimize profits. A line extending up from this break to the high of the. Web flag and pole pattern, technical analysis scanner. Bear flag this pattern occurs in a downtrend to confirm further movement down. Web regardless of the type of flag pattern, the most important part of the pattern is the flag pole, which represents the sharp move in price that precedes the consolidation phase. In this pattern, the price makes a sharp. Traders can use these patterns to identify potential trading opportunities, and should also consider setting take profit and stop loss orders to manage their risk. Web goldviewfx dec 9, 2021. The formation usually occurs after a strong trending move that can contain gaps (this move is known as the mast or pole of the flag) where the flag represents a.. The formation usually occurs after a strong trending move that can contain gaps (this move is known as the mast or pole of the flag) where the flag represents a. The flag and pole pattern is a very bullish pattern on a chart that can be signaling a chart is about to go much higher in price. The formation usually. The formation usually occurs after a strong trending move that can contain gaps (this move is known as the mast or pole of the flag) where the flag represents a. It shows a trend impulse on the chart. Web the flag pole is the first component of the flag chart pattern. Web the pattern has a “flag” appearance because the. Web pole flag technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Web the pattern has a “flag” appearance because the small rectangle—the consolidation—is connected to the pole—the large and swift move. This pattern occurs when there is a sharp and significant upward or downward price movement,. The flag and pole pattern is a very bullish pattern on a chart that can be signaling a chart is about to go much higher in price. Web a flag can be used as an entry pattern for the continuation of an established trend. Web the pattern has a “flag” appearance because the small rectangle—the consolidation—is connected to the pole—the large and swift move. Web flag pattern is one of the most popular chart patterns, formed by price action, which is contained within a small rectangle or a channel in the shape of a flag. Web the flag pattern is a continuation formation that can appear during a brief pause in either a bullish or bearish trend. The formation usually occurs after a strong trending move that can contain gaps (this move is known as the mast or pole of the flag) where the flag represents a. The patterns are characterized by a clear direction of the price trend, followed by a consolidation and rangebound movement, which is then followed by a resumption of the trend. Web a flag pattern is a trend continuation pattern, appropriately named after it’s visual similarity to a flag on a flagpole. As the flag pattern emerges, you will see a large impulse move, commonly known as the flag pole. The chart example above shows a bullish flag pattern that formed in the usd/cad currency pair. A line extending up from this break to the high of the flag/pennant forms the flagpole. Web a flag and pole pattern in technical analysis is a chart pattern that occurs when the price of an asset experiences a rapid and significant movement (the pole) followed by a period of consolidation or sideways movement (the flag). Web unlike a bull flag pattern, a bear pattern shows traders a sharp downward price drop in a chart, followed by a gradual positive consolidation after the ‘flag pole’. Stock passes all of the below filters in futures segment: Any trending move can transition into a flag, meaning that every trend impulse can appear to be a flag pole. Web pole flag technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc.

What Is Flag Pattern? How To Verify And Trade It Efficiently

SbinFlag pole pattern for NSESBIN by N50ANALYST — TradingView India

What Is Flag Pattern? How To Verify And Trade It Efficiently

How to use the flag chart pattern for successful trading

What Is Flag Pattern? How To Verify And Trade It Efficiently

Flag And Pole Chart Pattern

What Is Flag Pattern? How To Verify And Trade It Efficiently

What Is Flag Pattern? How To Verify And Trade It Efficiently

Flag Pattern Full Trading Guide with Examples

Chart pattern Flag & Pole YouTube

Bullish Flag Formations Are Found In Stocks With Strong Uptrends And Are Considered Good Continuation Patterns.

These Patterns Are Usually Preceded By A Sharp Advance Or Decline With Heavy Volume, And Mark A Midpoint Of The Move.

It Shows A Trend Impulse On The Chart.

They Are Called Bull Flags Because.

Related Post: