Flag And Pennant Pattern

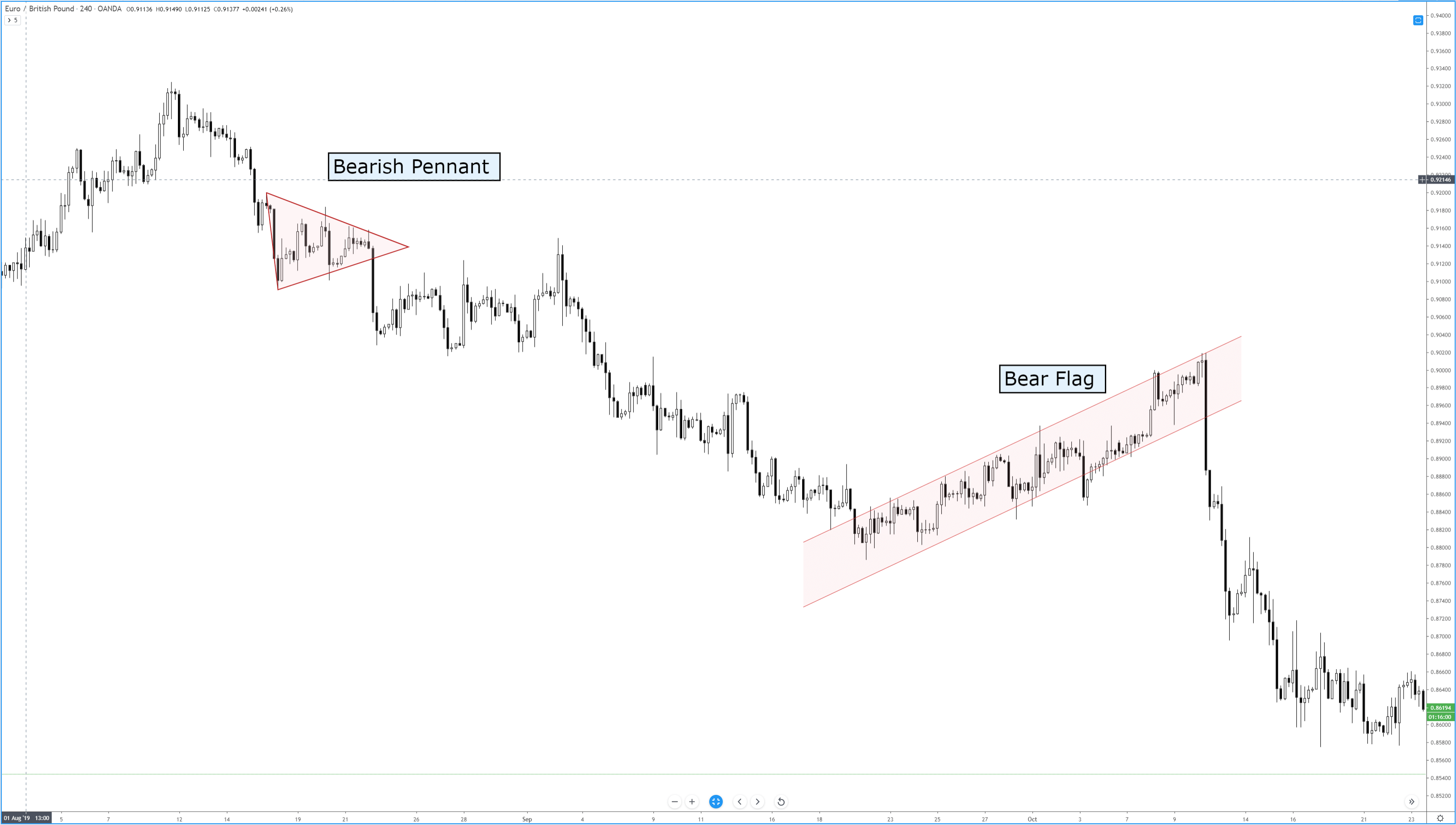

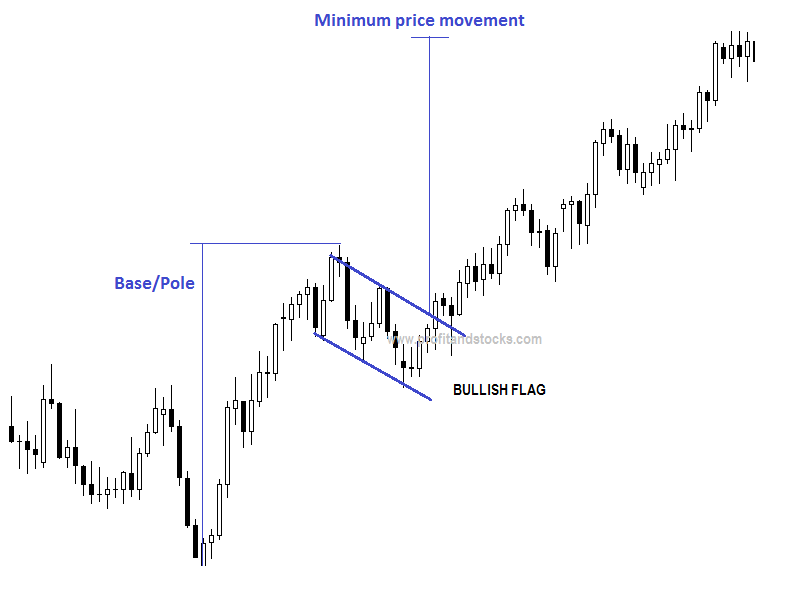

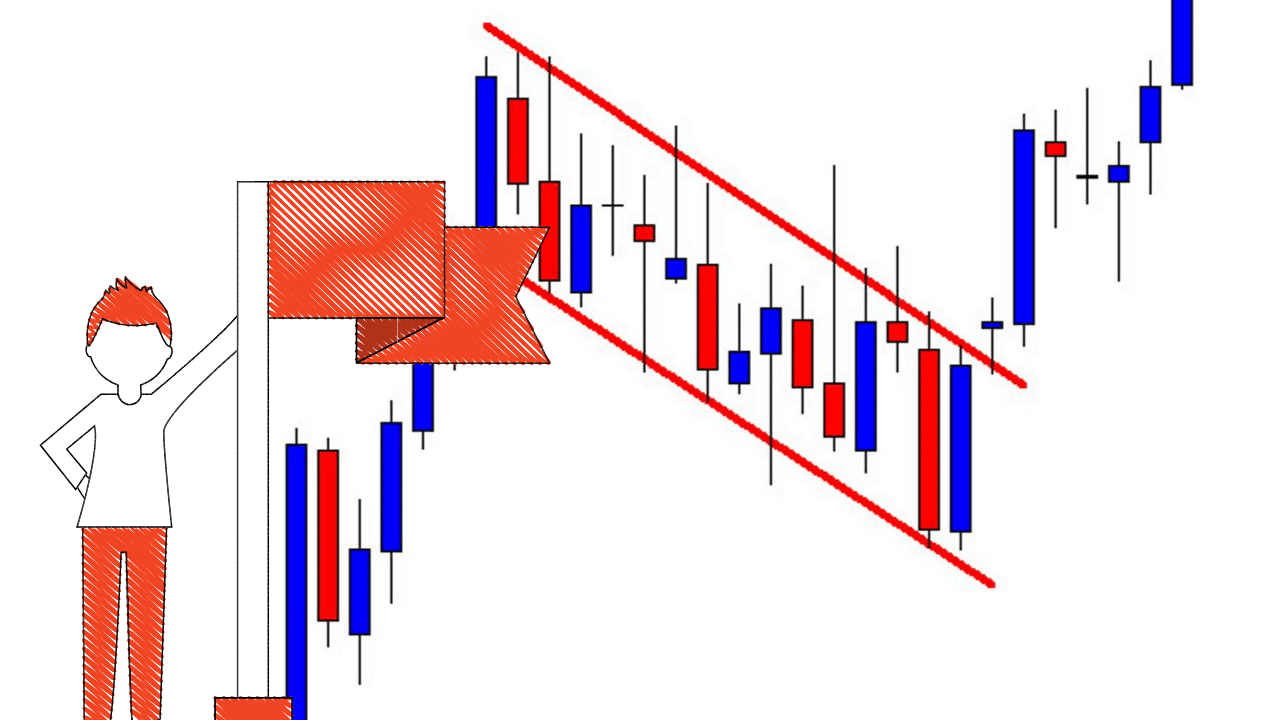

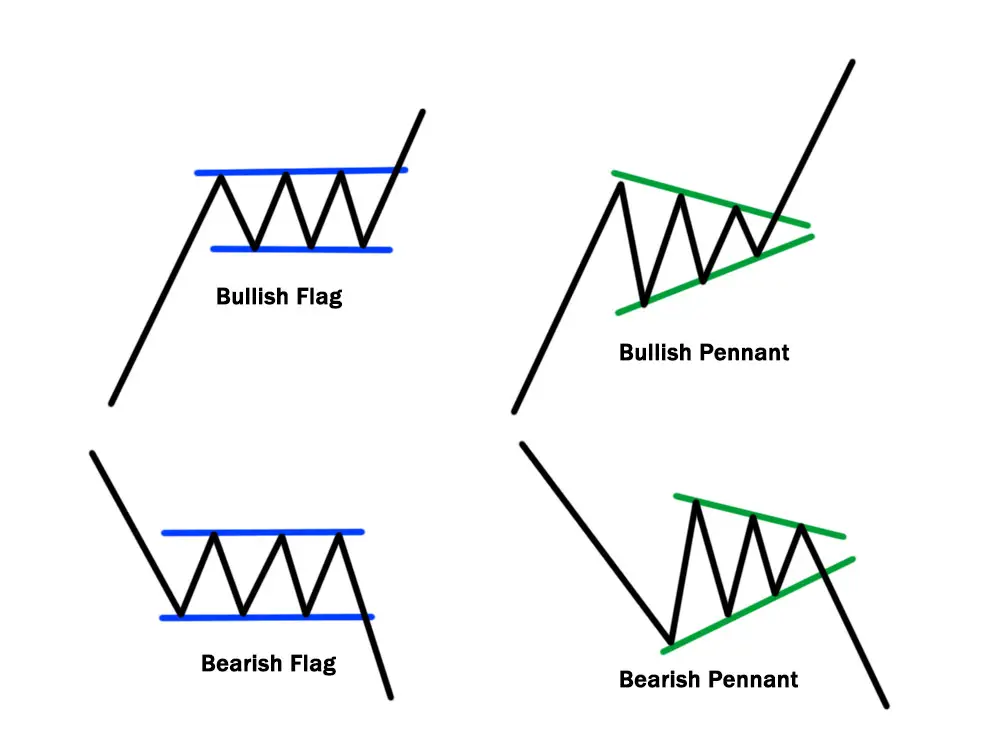

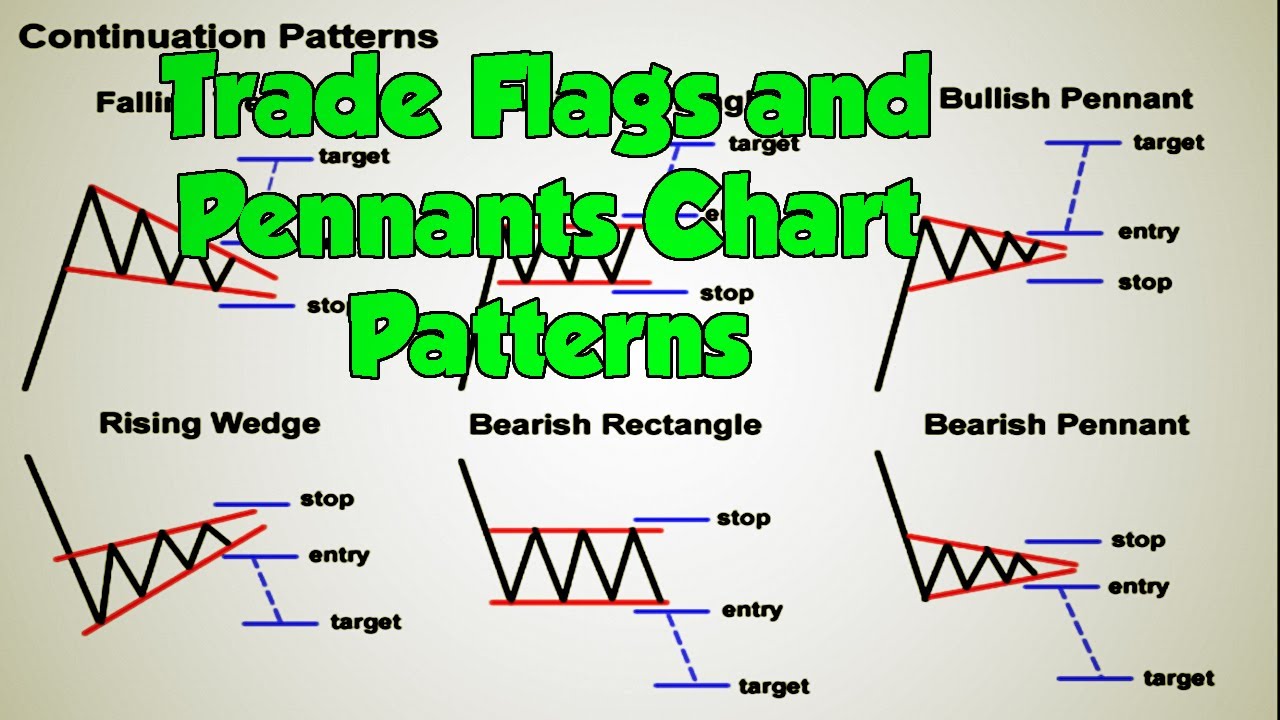

Flag And Pennant Pattern - Web flag and pennant chart patterns. It's formed when there is a large movement in a security, known as the flagpole. Web the difference between the two patterns is that trend lines of pennants eventually converge, which forms a mini triangle. It is named the pennant pattern because it resembles a pennant on a flagpole. Price consistently reaches higher lows and lower highs,. How to trade a bearish pennant pattern? Is it possible to trade a pennant pattern with fibonacci retracement ? Web what are flag and pennant chart patterns? Flags and pennants can be categorized as continuation patterns. You’ll learn how to identify both bullish pennant and bearish pennant formations. What i mean by this is most technical traders have heard of the patterns, as these are easy to recognize. What is the best way to trade a pennant pattern? Web in technical analysis, a pennant is a type of continuation pattern. These patterns are usually preceded by a sharp advance or decline with heavy volume , and mark a. Pennants are similar to flag chart patterns in the terms that they have converging lines during their consolidation period. It is named the pennant pattern because it resembles a pennant on a flagpole. They are typically seen right after a big, quick move. It's formed when there is a large movement in a security, known as the flagpole. Web pennant. Research has shown that these patterns are some of the most reliable continuation. Flag and pennant chart pattern indicator. The slope of pennants usually is in the opposite direction compared to that of the prior trend. Web the difference between the two patterns is that trend lines of pennants eventually converge, which forms a mini triangle. Web what are flag. You’ll learn how to identify both bullish pennant and bearish pennant formations. What is the best way to trade a pennant pattern? Pennants are similar to flag chart patterns in the terms that they have converging lines during their consolidation period. Flag patterns are accompanied by. Most of the trading strategies documented for flags and pennants are straightforward and somewhat. Web the pennant is a relatively short chart formation and appears as a small triangle pattern that forms after a steep trend. The patterns are characterized by a clear direction of the price trend , followed by a consolidation and rangebound movement, which is then followed by a resumption of the trend. Flag and pennant chart pattern indicator. The chart. This lesson unpacks what those differences are. Whilst using one and two candlestick patterns such as the pin bar reversal are extremely popular for finding trade setups, they are only as good as the area that the trade is. It's formed when there is a large movement in a security, known as the flagpole. We've included a few exercises for. The only difference is that the flagpole is not as straight and the pattern forms a small rectangle. We’ll also discuss chart pattern entries, stop losses, and profit targets so you can start trading pennants effectively within your own trading strategy. Web a flag or pennant pattern forms when the price rallies sharply, then moves sideways or slightly to the. Web a flag or pennant pattern forms when the price rallies sharply, then moves sideways or slightly to the downside. They usually represent only brief pauses in a dynamic market. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. Pennants pattern are. Sometimes these formations may be horizontal or in the same direction as the major trend. Web flag and pennant patterns. How to trade a bearish pennant pattern? Whilst using one and two candlestick patterns such as the pin bar reversal are extremely popular for finding trade setups, they are only as good as the area that the trade is. Price. Flag and pennant chart pattern indicator. What indicator is best to trade with a pennant pattern? Two very common price action patterns but with some key differences. Flag patterns are accompanied by. These patterns are usually preceded by a sharp advance or decline with heavy volume and mark a midpoint of the move. The only difference is that the flagpole is not as straight and the pattern forms a small rectangle. You’ll learn how to identify both bullish pennant and bearish pennant formations. Web a flag or pennant pattern forms when the price rallies sharply, then moves sideways or slightly to the downside. Both the symmetrical triangle and the pennant have conical bodies formed during a period of consolidation. The patterns are characterized by a clear direction of the price trend , followed by a consolidation and rangebound movement, which is then followed by a resumption of the trend. They usually represent only brief pauses in a dynamic market. Web what are flag and pennant chart patterns? Web the pennant is a relatively short chart formation and appears as a small triangle pattern that forms after a steep trend. Trend lines of flags are usually parallel. Is it possible to trade a pennant pattern with fibonacci retracement ? Pennants are similar to flag chart patterns in the terms that they have converging lines during their consolidation period. Web what are flag and pennant chart patterns? Research has shown that these patterns are some of the most reliable continuation. Web flags and pennants are foundational chart patterns of technical analysis. Web how to trade the pennant, triangle, wedge, and flag chart patterns. Web in technical analysis, a pennant is a type of continuation pattern.

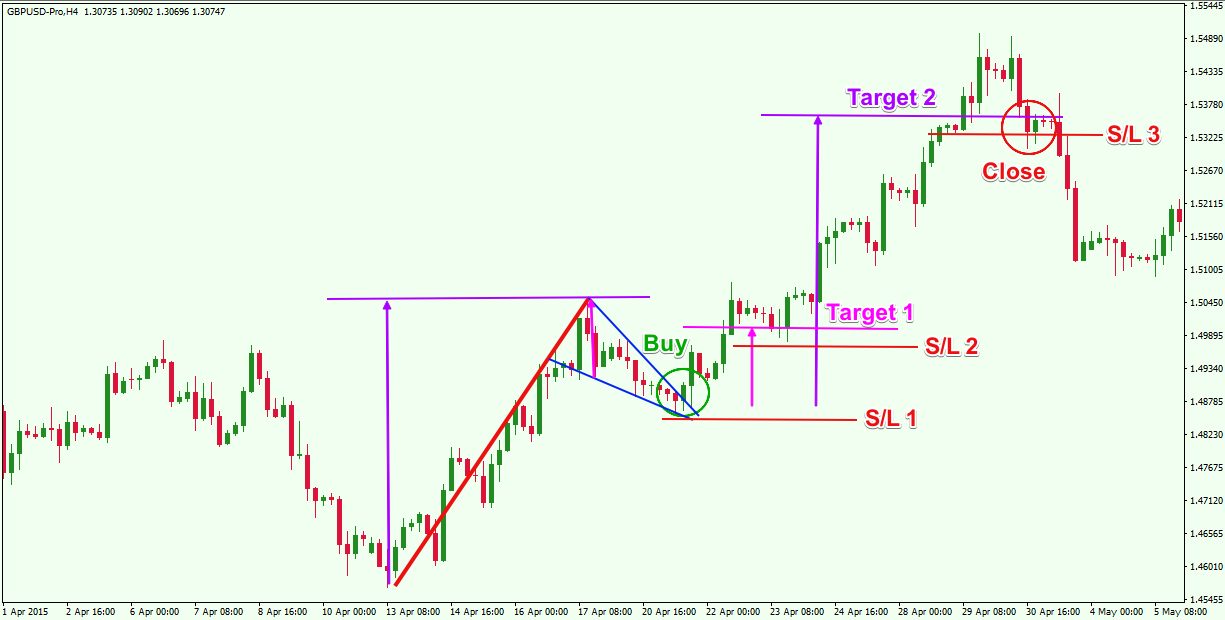

Flag Pennant Pattern Forex Forex E75 System

Flag Forex Indicator How To Trade Es Futures Options

Chart Patterns Flags and Pennants Forex Academy

Flag and Pennants Chart Pattern Profit and Stocks

How to Trade the Pennant, Triangle, Wedge, and Flag Chart Patterns

Flag and Pennant Pattern Indicator (MT4) Free Download Best Forex

How to Trade Bearish and the Bullish Flag Patterns Like a Pro Forex

.png)

Mastering Trading Our Ultimate Chart Patterns Cheat Sheet

Flag and Pennant Price Action Patterns Explained Video

How to trade Flags and Pennants Chart Patterns Forex Trading Strategy

These Patterns Are Usually Preceded By A Sharp Advance Or Decline With Heavy Volume And Mark A Midpoint Of The Move.

It Is Named The Pennant Pattern Because It Resembles A Pennant On A Flagpole.

Two Very Common Price Action Patterns But With Some Key Differences.

Sometimes These Formations May Be Horizontal Or In The Same Direction As The Major Trend.

Related Post: