Falling Wedge Stock Pattern

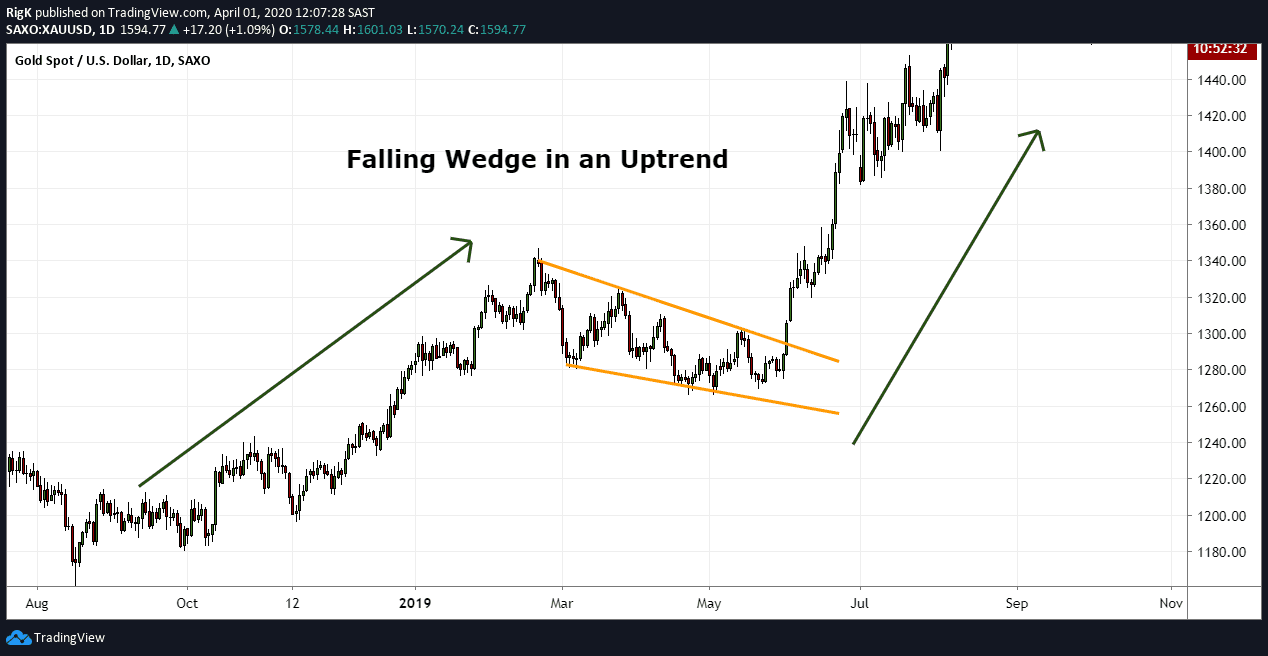

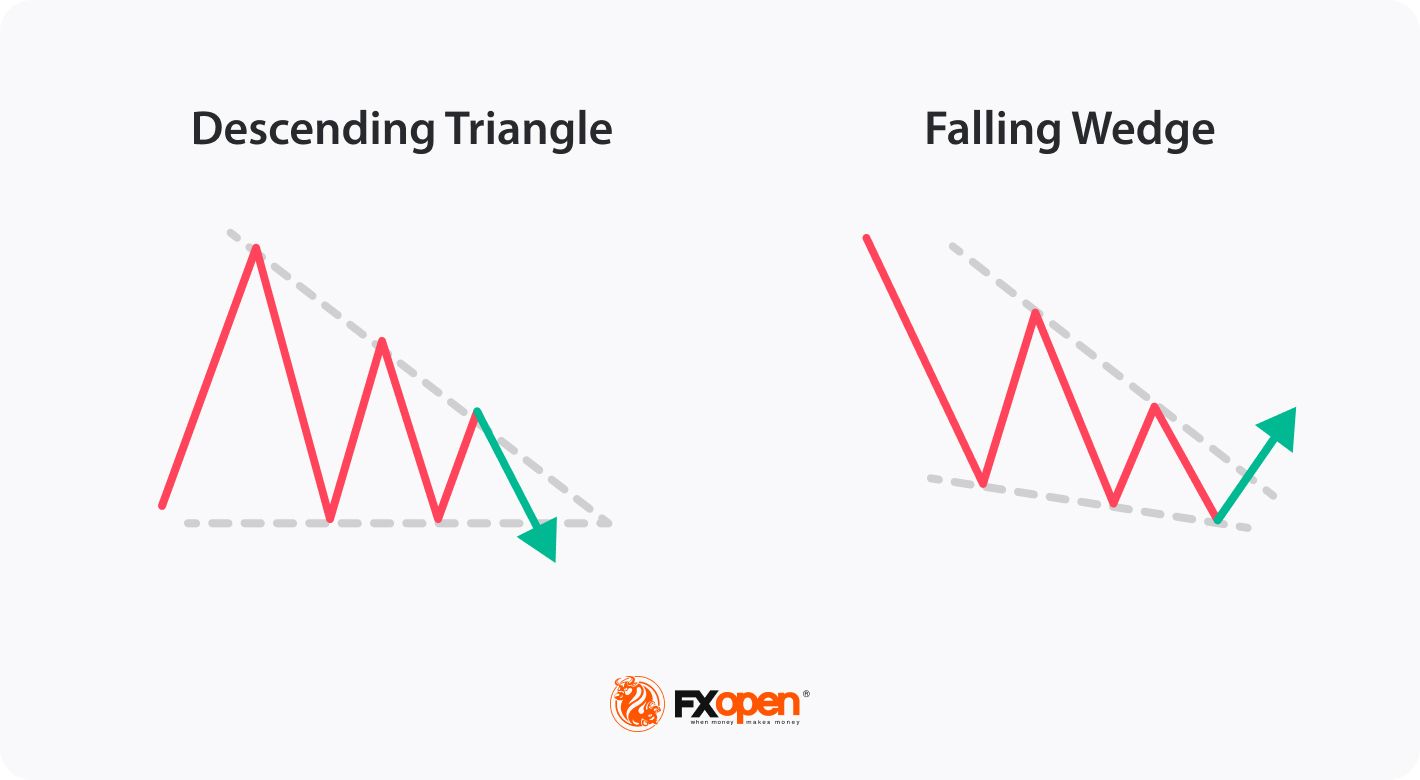

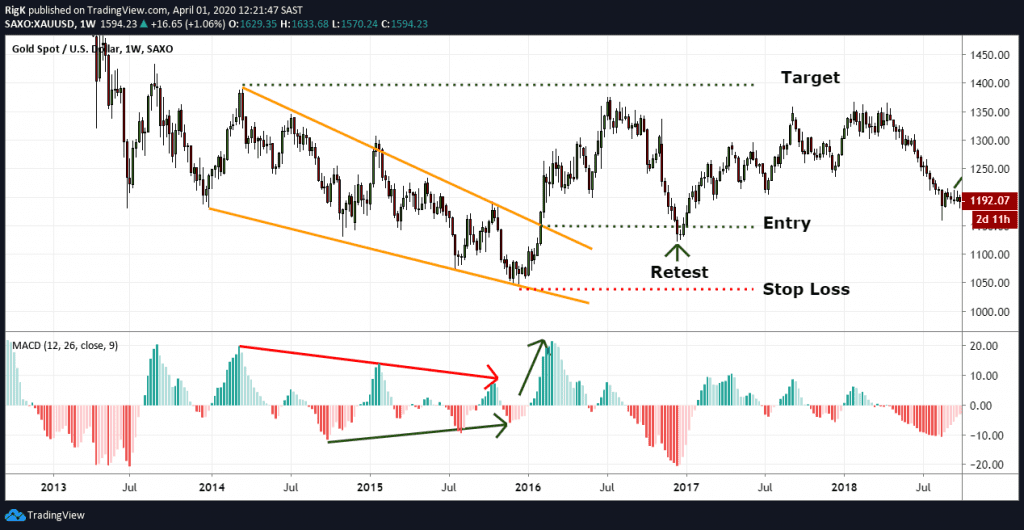

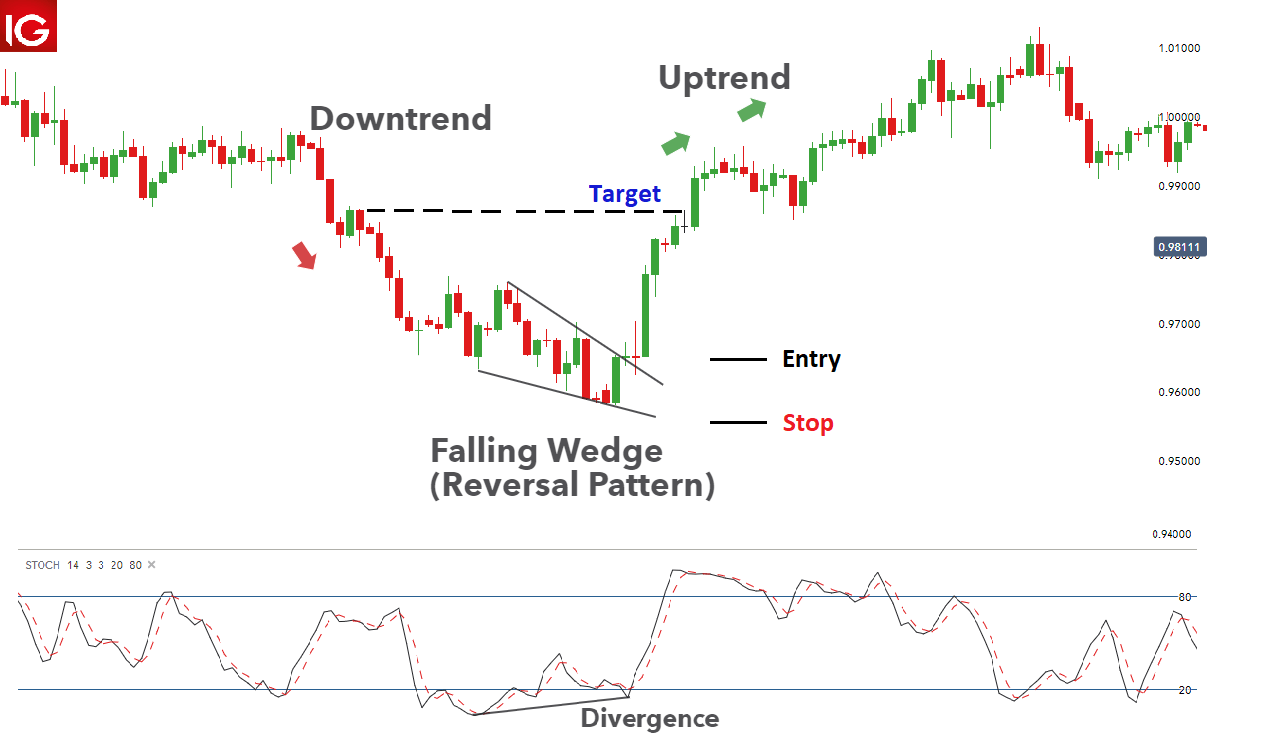

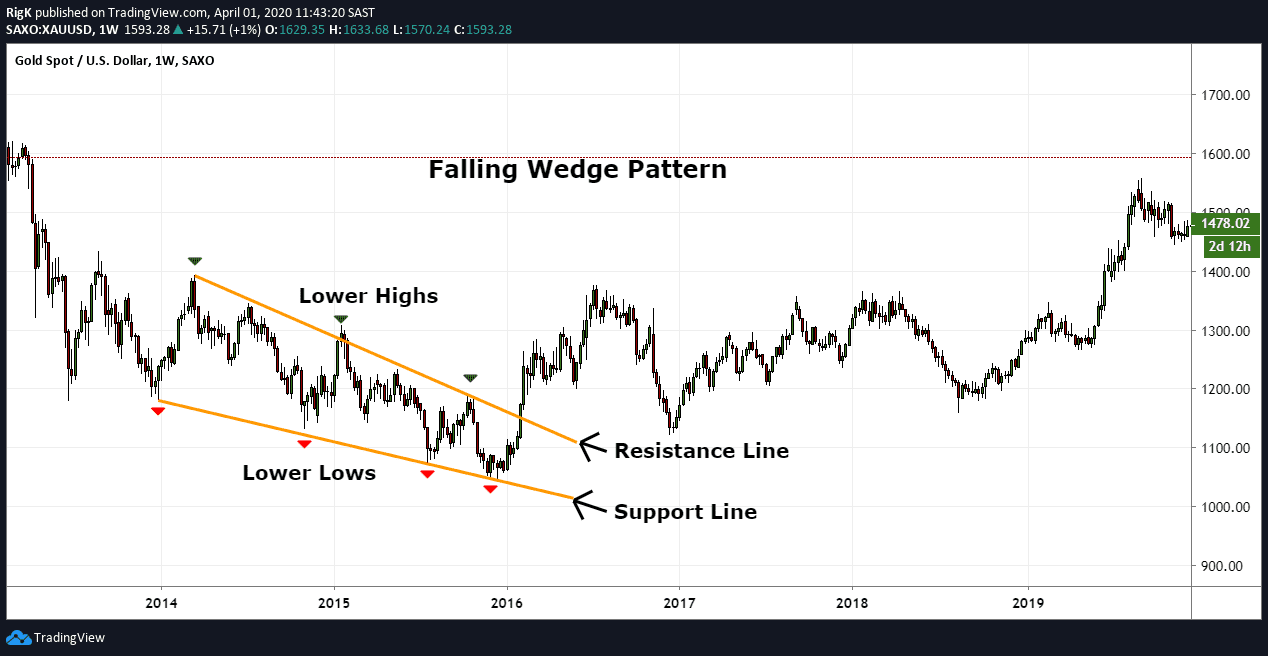

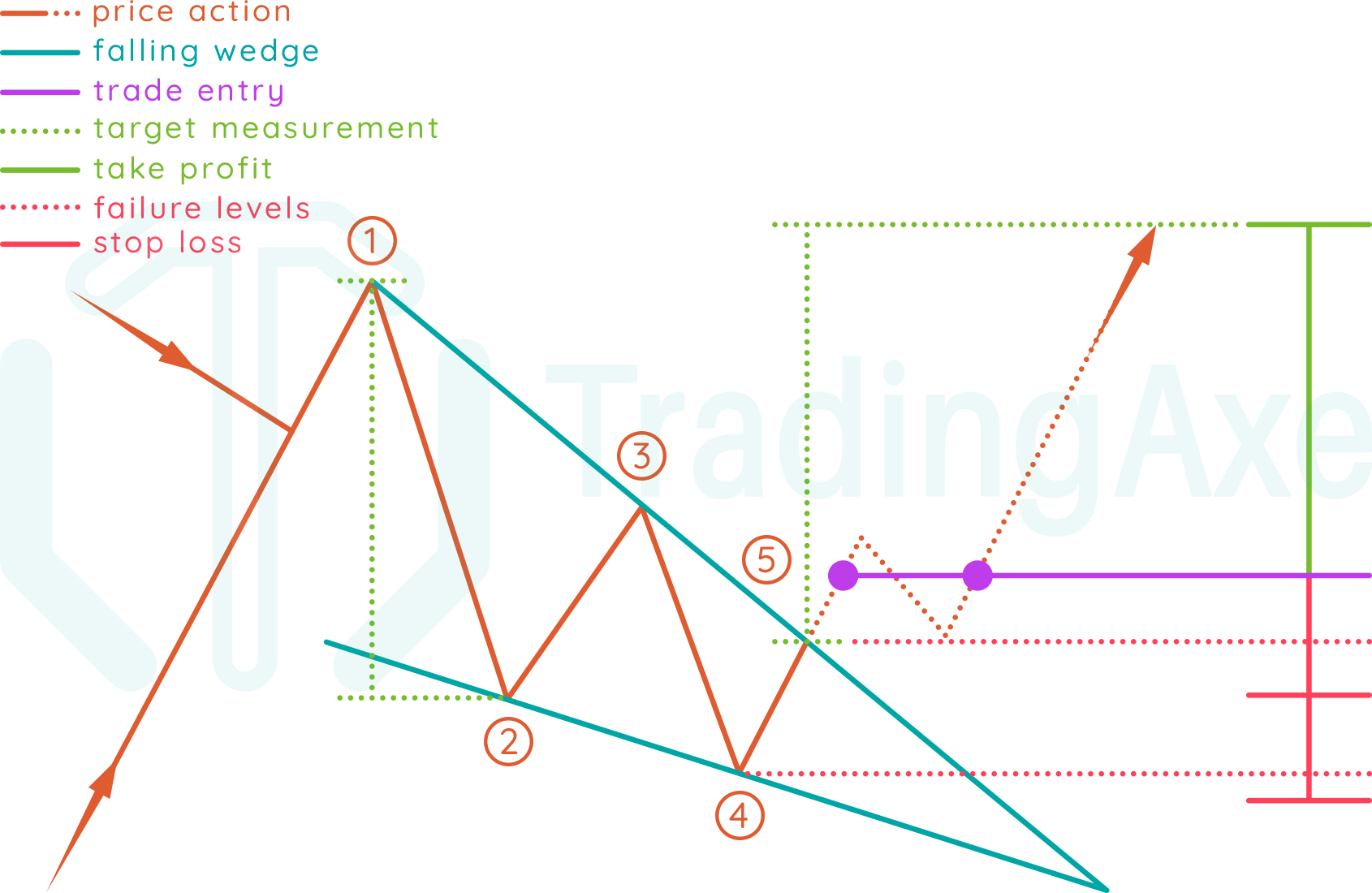

Falling Wedge Stock Pattern - Web but they share one thing in common: They develop when a narrowing trading range has a. Web the rising wedge is a technical chart pattern used to identify possible trend reversals. Web when a falling wedge is a reversal pattern, the widest portion of the wedge may be added to the breakout level to determine the upside move which follows. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines. In many cases, when the market. Rising and falling wedges are a technical chart pattern used to predict trend continuations and trend reversals. Web the falling (or descending) wedge can also be used as either a continuation or reversal pattern, depending on where it is found on a price chart. Stock wedge patterns constitute inflection points where trends reverse, breakouts bloom, or breakdowns begin. This lesson shows you how to. Web a falling wedge is a very powerful bullish pattern. Falling wedges are the inverse of rising wedges and are always considered bullish signals. Stock wedge patterns constitute inflection points where trends reverse, breakouts bloom, or breakdowns begin. Web february 28, 2024. Web the rising wedge is a technical chart pattern used to identify possible trend reversals. In many cases, when the market. They develop when a narrowing trading range has a. Stock wedge patterns constitute inflection points where trends reverse, breakouts bloom, or breakdowns begin. Web the falling (or descending) wedge can also be used as either a continuation or reversal pattern, depending on where it is found on a price chart. Below are some common. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines. This lesson shows you how to. It shows a grid with a list of. Web the rising wedge is a technical chart pattern used to identify possible trend reversals. Below are some common conditions that occur in the market that generate. Web february 28, 2024. They develop when a narrowing trading range has a. Rising and falling wedges are a technical chart pattern used to predict trend continuations and trend reversals. Web the falling wedge pattern is a bullish chart pattern that can indicate a potential continuation of an uptrend or a reversal of a downtrend. Web the falling (or descending). Web the falling (or descending) wedge can also be used as either a continuation or reversal pattern, depending on where it is found on a price chart. Web but they share one thing in common: Web the falling wedge pattern is a bullish chart pattern that can indicate a potential continuation of an uptrend or a reversal of a downtrend.. Web the falling (or descending) wedge can also be used as either a continuation or reversal pattern, depending on where it is found on a price chart. They develop when a narrowing trading range has a. It shows a grid with a list of. Web when a falling wedge is a reversal pattern, the widest portion of the wedge may. Rising and falling wedges are a technical chart pattern used to predict trend continuations and trend reversals. They develop when a narrowing trading range has a. Web the falling wedge pattern is a continuation pattern that forms when the price oscillates between two trendlines sloping downward and converging. It is considered a bullish chart formation. This lesson shows you how. Rising and falling wedges are a technical chart pattern used to predict trend continuations and trend reversals. Web the falling (or descending) wedge can also be used as either a continuation or reversal pattern, depending on where it is found on a price chart. It shows a grid with a list of. Web february 28, 2024. Falling wedges are the. Rising and falling wedges are a technical chart pattern used to predict trend continuations and trend reversals. Web when a falling wedge is a reversal pattern, the widest portion of the wedge may be added to the breakout level to determine the upside move which follows. This lesson shows you how to. In many cases, when the market. Web the. Web the falling (or descending) wedge can also be used as either a continuation or reversal pattern, depending on where it is found on a price chart. Stock wedge patterns constitute inflection points where trends reverse, breakouts bloom, or breakdowns begin. Web but they share one thing in common: Web the falling wedge pattern is a continuation pattern formed when. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines. Web the falling wedge pattern is a continuation pattern that forms when the price oscillates between two trendlines sloping downward and converging. Web the falling wedge pattern is a bullish chart pattern that can indicate a potential continuation of an uptrend or a reversal of a downtrend. Web but they share one thing in common: Below are some common conditions that occur in the market that generate a falling wedge pattern. Web a falling wedge is a very powerful bullish pattern. Rising and falling wedges are a technical chart pattern used to predict trend continuations and trend reversals. They develop when a narrowing trading range has a. Also called the downward or descending wedge, this pattern results in an overall downward price. Web the rising wedge is a technical chart pattern used to identify possible trend reversals. Falling wedges are the inverse of rising wedges and are always considered bullish signals. Stock wedge patterns constitute inflection points where trends reverse, breakouts bloom, or breakdowns begin. This lesson shows you how to. It is considered a bullish chart formation. In many cases, when the market. According to published research, the falling wedge pattern has a 74% success rate in bull markets with an average potential profit of +38%.

The Falling Wedge Pattern Explained With Examples

What Is the Falling Wedge Trading Pattern? Market Pulse

The Falling Wedge Pattern Explained With Examples

Trading the Falling Wedge Pattern

Falling Wedge Patterns How to Profit from Slowing Bearish Momentum

Falling Wedge Pattern Definition, Formation, Examples, Screener

The Falling Wedge Pattern Explained With Examples

How To Trade Falling Wedge Chart Pattern TradingAxe

Simple Wedge Trading Strategy For Big Profits

Falling Wedge Chart Pattern Trading charts, Trading quotes, Stock

Web February 28, 2024.

Web When A Falling Wedge Is A Reversal Pattern, The Widest Portion Of The Wedge May Be Added To The Breakout Level To Determine The Upside Move Which Follows.

It Shows A Grid With A List Of.

Web The Falling (Or Descending) Wedge Can Also Be Used As Either A Continuation Or Reversal Pattern, Depending On Where It Is Found On A Price Chart.

Related Post: