Falling Wedge Chart Pattern

Falling Wedge Chart Pattern - Web the falling (or descending) wedge can also be used as either a continuation or reversal pattern, depending on where it is found on a price chart. Technically, the ongoing amc share price surge happened after the company formed a falling wedge pattern. The upper line is typically the resistance level, while the lower trend line. Wedge with downside slant is called falling wedge 2. Web crypto analyst ali martinez predicts bitcoin could rally to $76,610 if it breaks crucial $64,290 level. It is expected that after the price breaks the upper line of the wedge, it will move further up to approximately the height of the base of the wedge. The falling wedge pattern explained. Web the falling wedge pattern is a bullish chart pattern that can indicate a potential continuation of an uptrend or a reversal of a downtrend. To form a descending wedge, the support and resistance lines have to both point in a downwards direction and the resistance line has to be steeper than the line of support. It is formed by two converging bearish lines. Less than equal to 1 day ago. Web hence there are three key characteristics of a falling wedge pattern: Bitcoin nears critical $60,000 support, indicating potential for further price decline. Wedge patterns have converging trend lines that come to an apex with a distinguishable upside or downside slant. It is considered a bullish chart formation but can indicate both reversal. Price throws back to the breakout and continues down. Web amc chart by tradingview. It is considered a bullish chart formation but can indicate. Wedge patterns have converging trend lines that come to an apex with a distinguishable upside or downside slant. Without volume expansion, the breakout will lack conviction and be vulnerable to failure. To create a falling wedge, the support and resistance lines have to both point in a downwards direction. When the pattern occurs, it can be interpreted as a trend reversal or continuation pattern and can help traders find trading opportunities. The trend lines include an upper line that connects the high points and a lower line that connects the low. Web a falling wedge is a reversal pattern that is an inclined, converging channel that limits the price movement. Web the falling wedge chart pattern is a recognizable price move. Scanner guide scan examples feedback. It is expected that after the price breaks the upper line of the wedge, it will move further up to approximately the height of the. The upper line is the resistance line; Wedge with downside slant is called falling wedge 2. Web the falling wedge is a bullish chart pattern that signals a buying opportunity after a downward trend or mark correction. Stock passes all of the below filters in futures segment: Web a falling wedge pattern is a pattern in technical analysis that indicates. Wedge with downside slant is called falling wedge 2. Web the falling wedge is a bullish pattern that suggests potential upward price movement. The resistance line has to be steeper than the support line. Web a falling wedge is a bullish chart pattern (said to be of reversal). Analysts identify a bullish falling wedge pattern on bitcoin's daily chart, indicating. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines. To form a descending wedge, the support and resistance lines have to both point in a downwards direction and the resistance line has to be steeper than the line of support. After a strong upward trend, the wedge forms, dropping price. It is created when a market consolidates between two converging support and resistance lines. The trend lines include an upper line that connects the high points and a lower line that connects the low price points. It is expected that after the price breaks the upper line of the wedge, it will move further up to approximately the height of. To create a falling wedge, the support and resistance lines have to both point in a downwards direction. It is considered a bullish chart formation but can indicate both reversal and continuation patterns. To form a descending wedge, the support and resistance lines have to both point in a downwards direction and the resistance line has to be steeper than. Price throws back to the breakout and continues down. The upper line is typically the resistance level, while the lower trend line. It is formed by two converging bearish lines. Web a falling wedge pattern is a pattern in technical analysis that indicates bullish price trend movement after a price breakout. After a strong upward trend, the wedge forms, dropping. It is considered a bullish chart formation but can indicate. There are two trend lines (the upper and lower) that are converging; This pattern, while sloping downward, signals a likely trend reversal or continuation, marking a potential inflection point in trading strategies. These patterns form by connecting at least two to three lower highs and two to three lower lows, becoming trend lines. Web amc chart by tradingview. Wedge with an upside slant is called a rising wedge b. The upper line is typically the resistance level, while the lower trend line. It is considered a bullish chart formation but can indicate both reversal and continuation patterns. Web the falling wedge is a bullish pattern that suggests potential upward price movement. The falling wedge chart pattern is considered a bullish continuation pattern when it forms. After a strong upward trend, the wedge forms, dropping price to 50. Web falling wedge pattern, technical analysis scanner. Web a falling wedge is a reversal pattern that is an inclined, converging channel that limits the price movement. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines. Web the falling wedge chart pattern is a recognisable price move that is formed when a market consolidates between two converging support and resistance lines. The lower line is the support line.

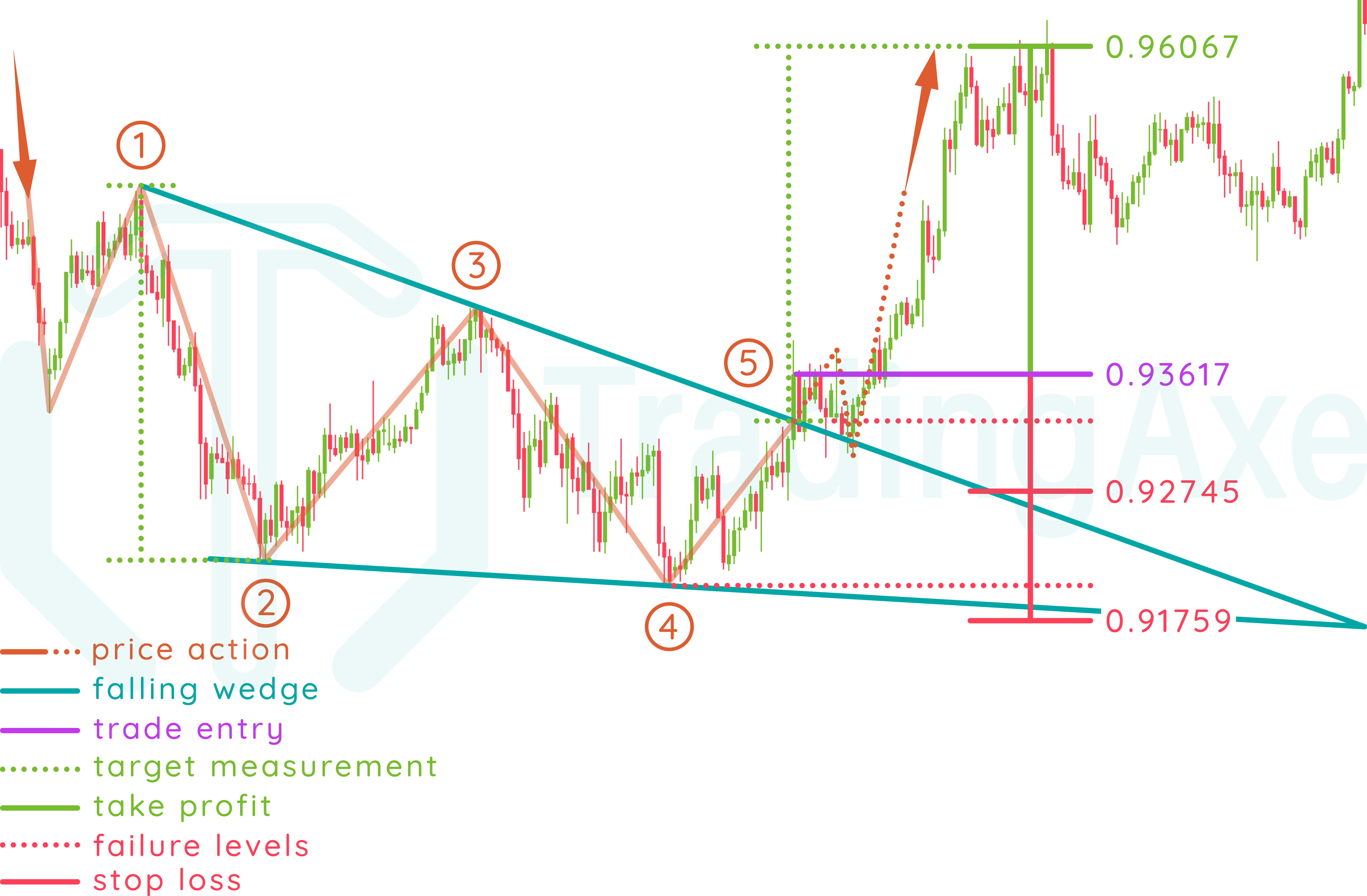

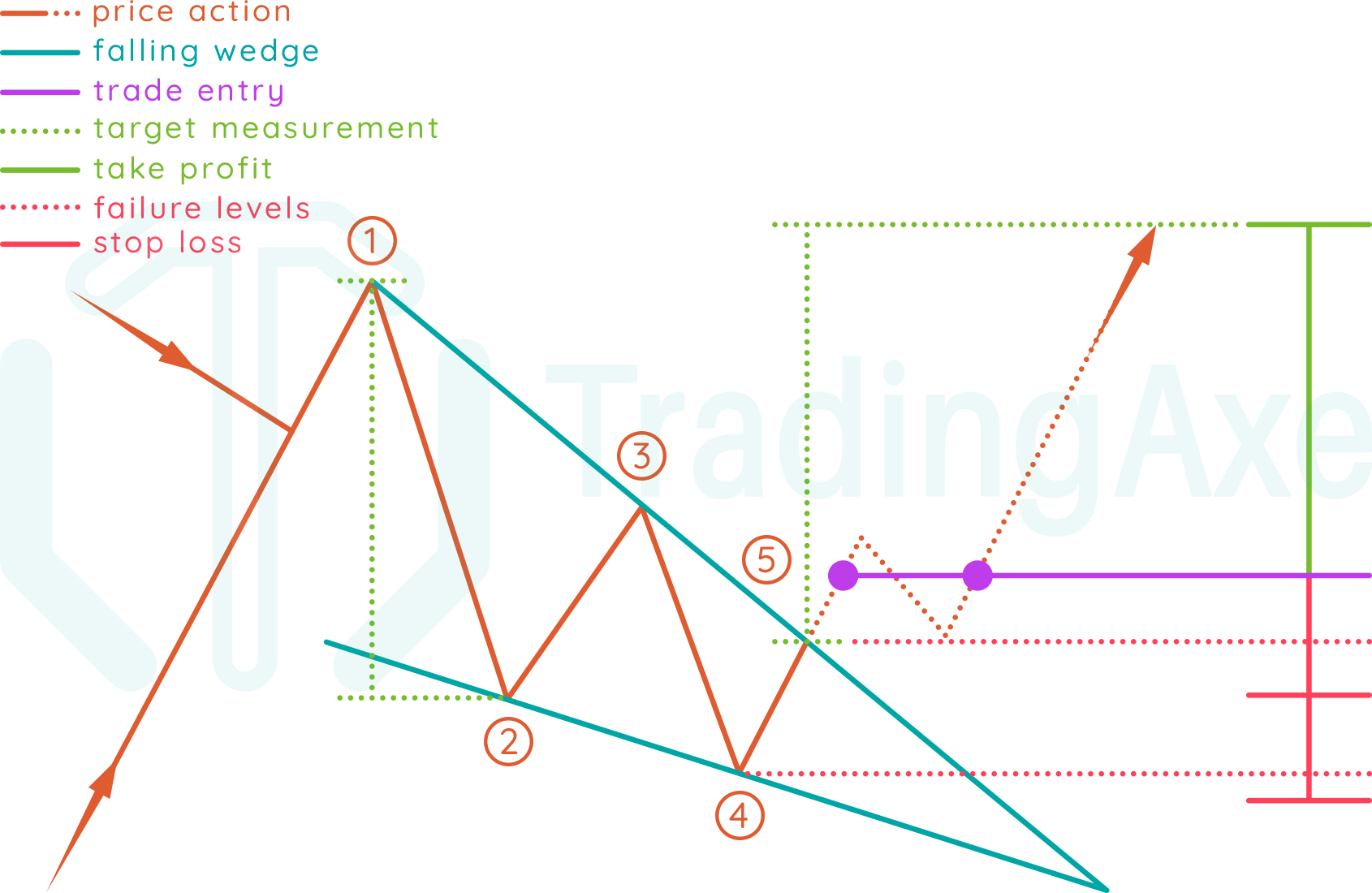

Trading the Falling Wedge Pattern

How To Trade Falling Wedge Chart Pattern TradingAxe

![Falling Wedge [ChartSchool]](https://school.stockcharts.com/lib/exe/fetch.php?media=chart_analysis:chart_patterns:falling_wedge_reversal:fallingwedge-rdc.png)

Falling Wedge [ChartSchool]

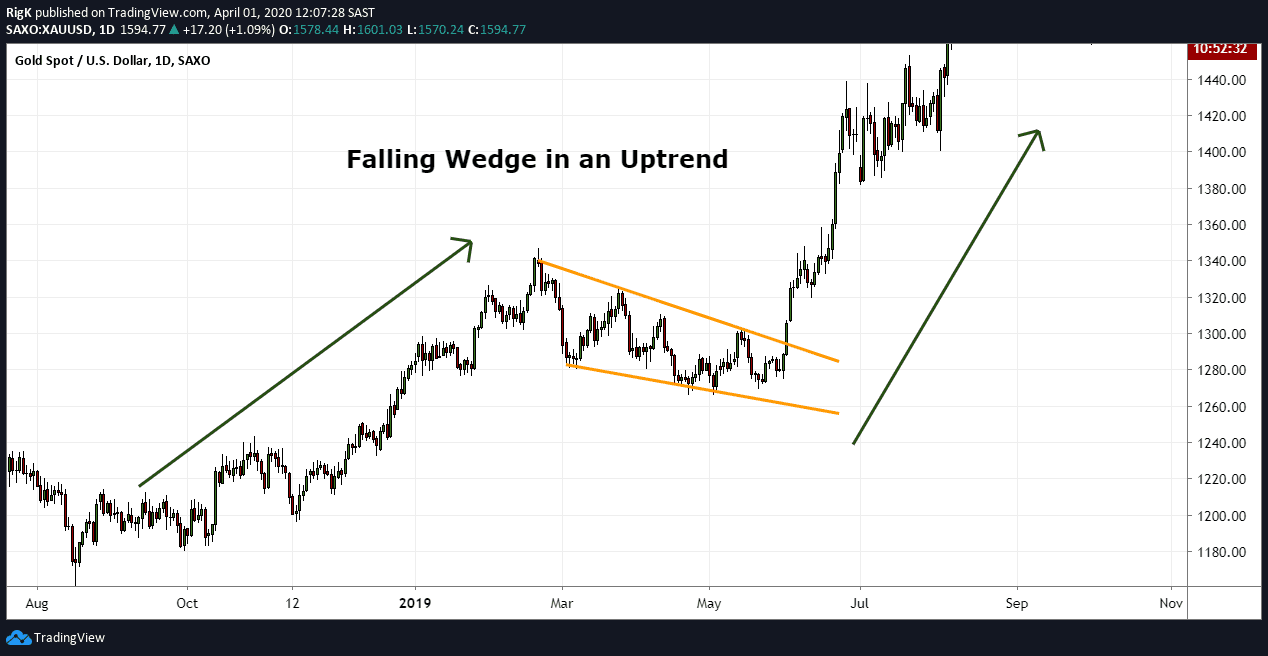

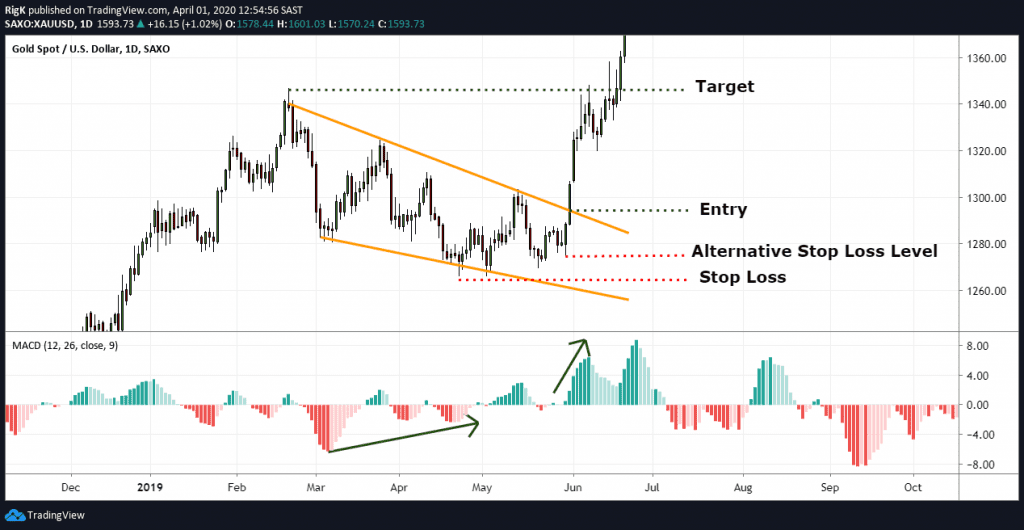

Simple Wedge Trading Strategy For Big Profits

The Falling Wedge Pattern Explained With Examples

Falling Wedge — Chart Patterns — Education — TradingView

How To Trade Falling Wedge Chart Pattern TradingAxe

Falling & Rising Wedge Chart Patterns with OctaFX The Complete Guide

The Falling Wedge Pattern Explained With Examples

Falling Wedge Pattern Definition, Formation, Examples, Screener

It Has Declining Volumes As The Pattern Progresses 3.

To Form A Descending Wedge, The Support And Resistance Lines Have To Both Point In A Downwards Direction And The Resistance Line Has To Be Steeper Than The Line Of Support.

There Is A Decrease In Volume As The Channel Progresses.

The Upper Line Is The Resistance Line;

Related Post: