Falling Triangle Pattern

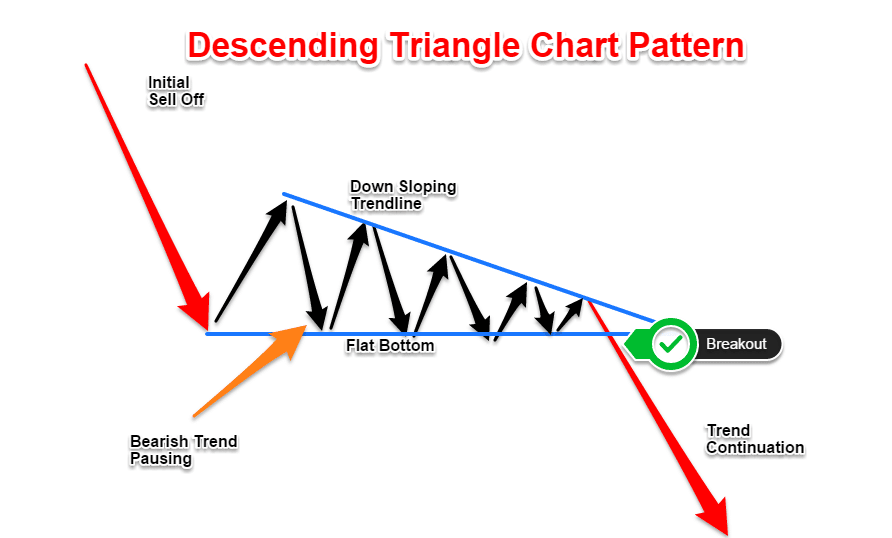

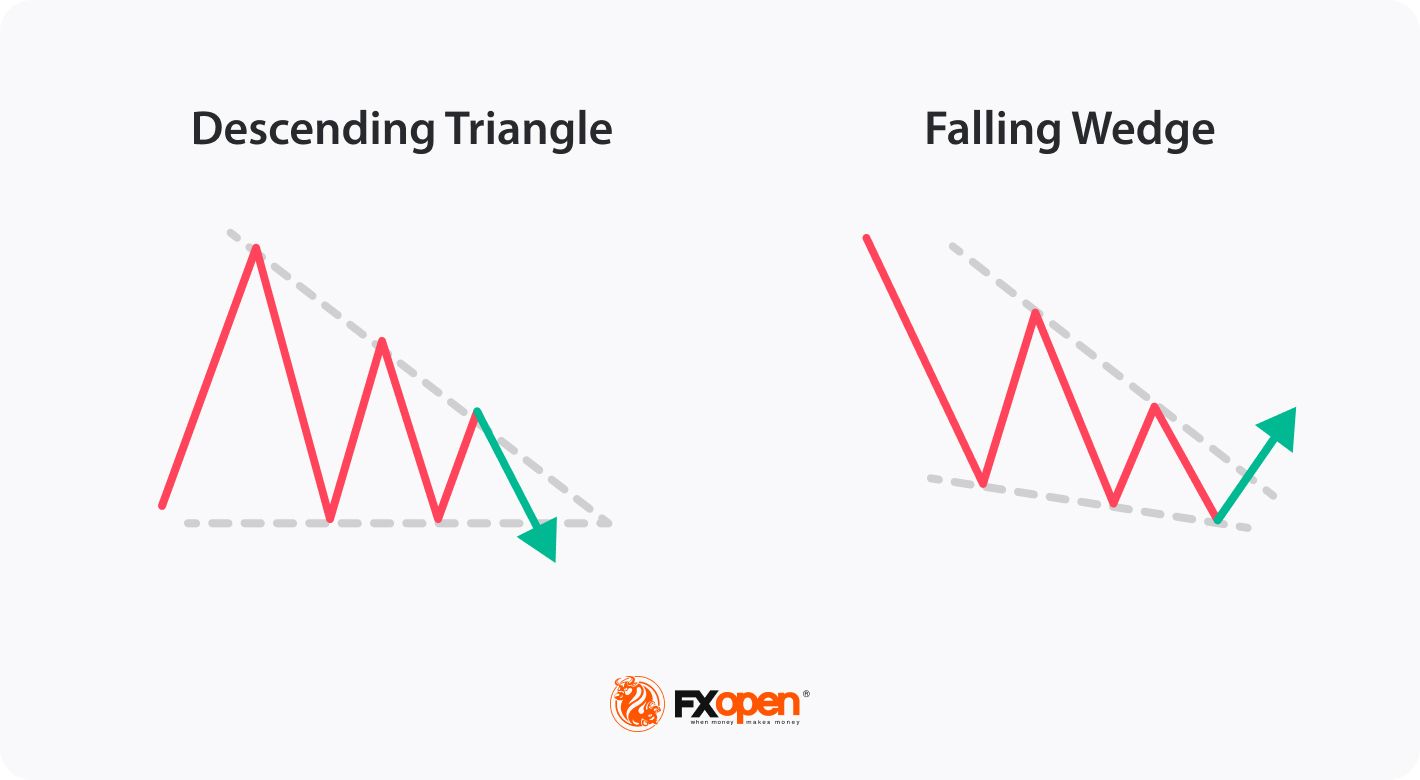

Falling Triangle Pattern - Traders look for descending triangles because the pattern indicates a breakdown. Traders anticipate the market to continue in the direction of. However, it can also occur as a consolidation in an uptrend as well. It typically occurs during a downtrend when sellers are in control, and the pattern signifies a period of consolidation before the. It is one of the chart patterns that are easy to recognise and consists of only two trendlines. Web a descending triangle pattern is typically considered a bearish continuation pattern. Price turns at apex 60% of the. When the price drop happens buyers come in the push the price up even higher. From the first trough or peak to the opposite border of the triangle. The move is then projected vertically from the point of breakout to the actual target. The ira makes additional and significant reductions in the cost of implementing ccs by extending and increasing the tax credit for co 2 sequestration under irc section 45q. Web get creative with your colors. There are three different types of triangles, and each should be closely studied. Art donaldson (mike faist), patrick zweig (josh o’connor), and tashi duncan (zendaya). Web. Web the descending triangle often referred to as falling triangle has an inherent measuring technique that can be applied to the pattern to gauge likely take profit targets. Web the descending triangle pattern suggests a potential bearish continuation or reversal in price trends. Could you be looking at a falling wedge? A flat lower trendline serves as support and a. Elliott wave has a version of the descending triangle. A descending triangle consists of: In contrast, a falling wedge pattern is a bullish reversal pattern, so traders expect the price to break up above the resistance level. To identify this pattern, traders should look for the following key components: It is characterized by a series of lower highs and a. Web the descending triangle often referred to as falling triangle has an inherent measuring technique that can be applied to the pattern to gauge likely take profit targets. Find out how to use a triangle apex to predict a trend change. Web falling wedge with lower highs and lower lows. I list her last because she’s the. Web a descending. Price turns at apex 60% of the. Triangles are similar to wedges and pennants and can be either a continuation. As the stock makes a series of lower highs, it will bounce between these two converging trend lines, forming the shape of a triangle tilted down. It is one of the chart patterns that are easy to recognise and consists. The descending triangle is a bearish formation that usually forms during a downtrend as a continuation pattern. Web descending triangles have a falling upper trendline as a result of distribution and are always considered bearish signals. Web a descending triangle pattern is also known as a falling triangle pattern. In contrast, a falling wedge pattern is a bullish reversal pattern,. However, it can also occur as a consolidation in an uptrend as well. The descending triangle is a bearish formation that usually forms during a downtrend as a continuation pattern. There are three different types of triangles, and each should be closely studied. It is characterized by a series of lower highs and a consistent support level that acts as. From the first trough or peak to the opposite border of the triangle. Web what is a descending triangle? Back to main menu patterns & books shop all. Traders look for descending triangles because the pattern indicates a breakdown. I list her last because she’s the. From the first trough or peak to the opposite border of the triangle. The finished quilt is 90 x109 inches. The descending triangle is a bearish formation that usually forms during a downtrend as a continuation pattern. It is characterized by a series of lower highs and a consistent support level that acts as the base of the triangle. It. A flat lower trendline serves as support and a falling upper trendline makes up the descending triangle, a bearish pattern. This pattern suggests that sellers are being more aggressive than buyers, as the price keeps hitting lower highs. There are three different types of triangles, and each should be closely studied. Elliott wave has a version of the descending triangle.. A descending triangle consists of: Find out how to use a triangle apex to predict a trend change. Web the descending triangle pattern suggests a potential bearish continuation or reversal in price trends. Web much like its opposite version, the ascending triangle pattern (which is a bullish continuation pattern), the descending triangle pattern works as a continuation bearish pattern and helps traders find entry and exit points during a downward trend. Web the descending triangle pattern is a bearish chart formation frequently observed in financial markets. In contrast, a falling wedge pattern is a bullish reversal pattern, so traders expect the price to break up above the resistance level. Symmetrical triangles have descending highs and ascending lows such that both the upper and lower trendlines are angled towards the triangle’s apex. Web the bierovic setup for descending triangles. Web descending triangles have a falling upper trendline as a result of distribution and are always considered bearish signals. There are instances when descending triangles form as reversal patterns at the end of an uptrend, but they are typically continuation patterns. Triangles are similar to wedges and pennants and can be either a continuation. It is one of the chart patterns that are easy to recognise and consists of only two trendlines. Web a descending triangle is a bearish technical chart pattern formed by a series of lower highs and a flat, lower trendline that acts as support. Triangle apex and turning points. To identify this pattern, traders should look for the following key components: From the first trough or peak to the opposite border of the triangle.

Triangle Chart Patterns Complete Guide for Day Traders

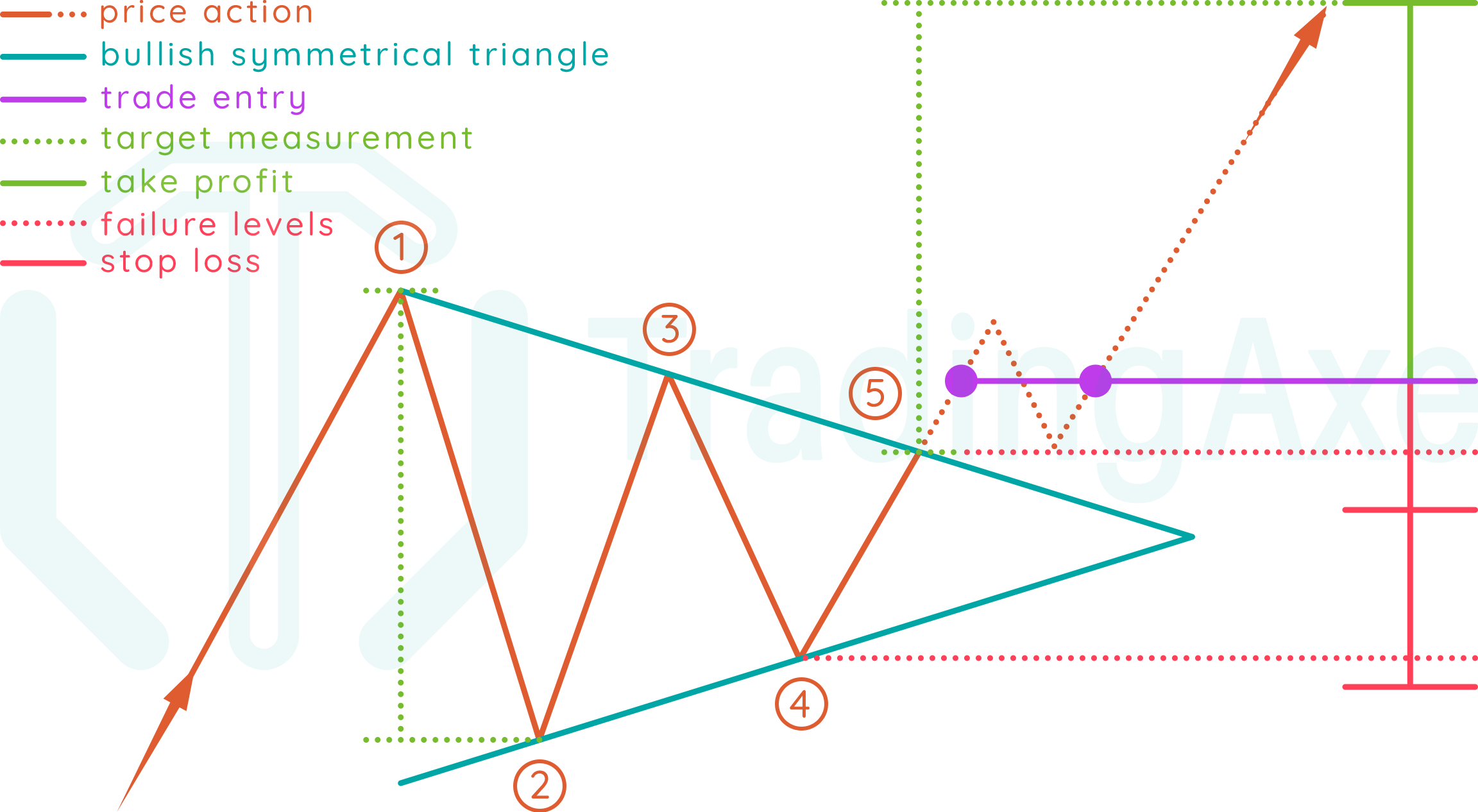

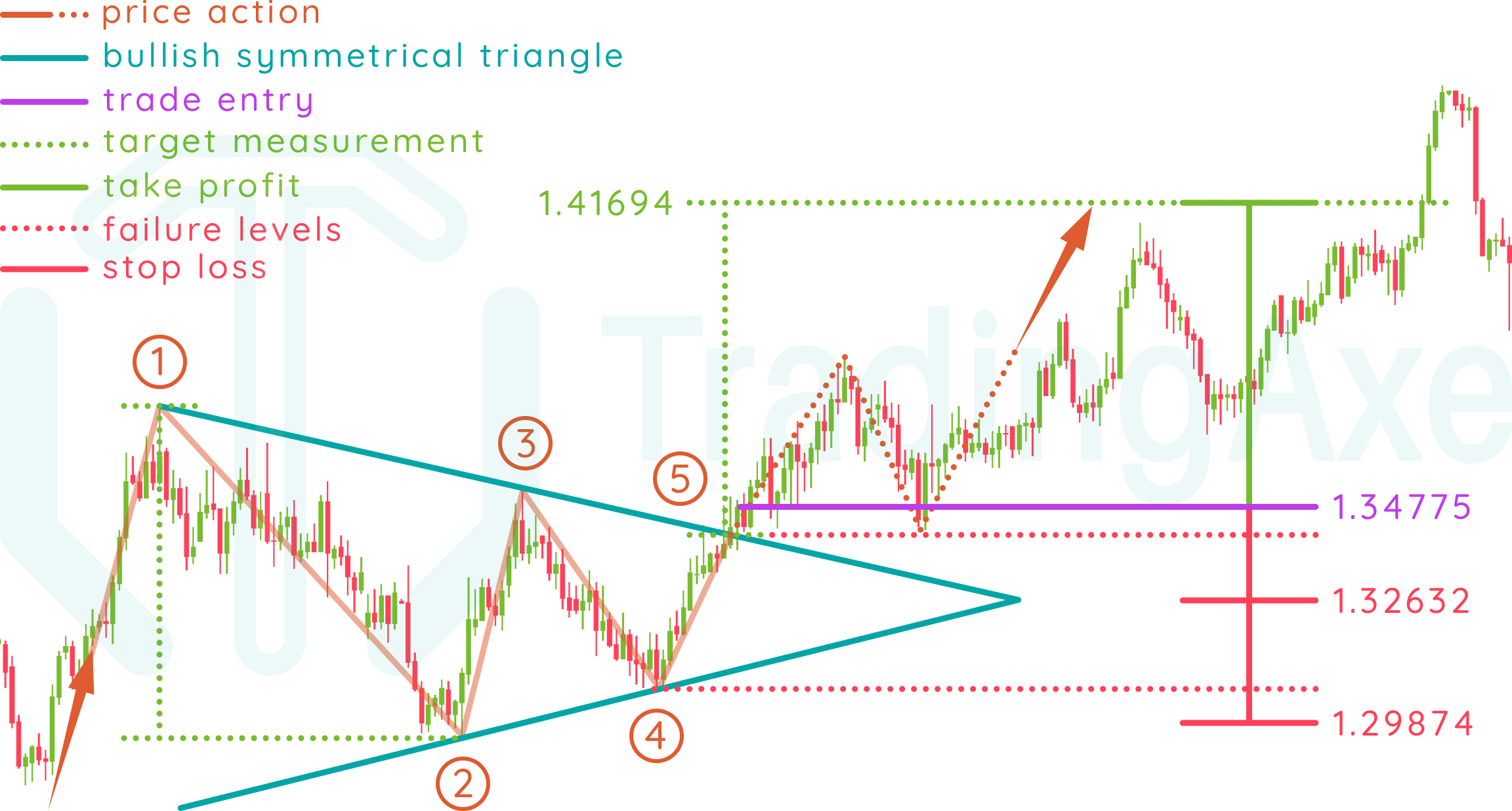

How To Trade Bullish Symmetrical Triangle Chart Pattern TradingAxe

Descending Triangle Pattern Best Reversal Triangle (2023)

How to Trade Triangle Chart Patterns FX Access

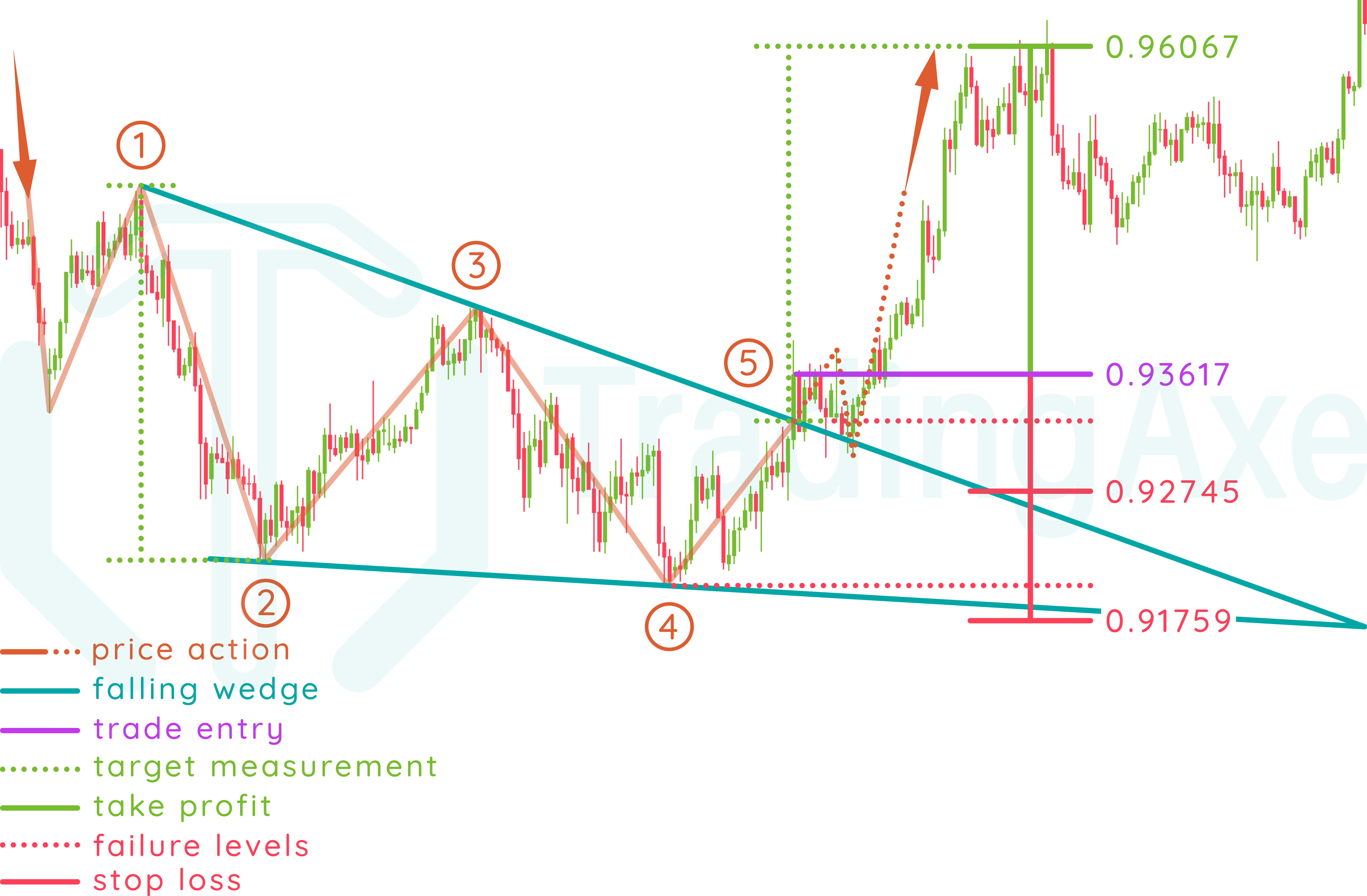

How To Trade Falling Wedge Chart Pattern TradingAxe

Descending Triangle Pattern 5 Simple Trading Strategies TradingSim

What Is the Falling Wedge Trading Pattern? Market Pulse

How To Trade Bullish Symmetrical Triangle Chart Pattern TradingAxe

The Descending Triangle What is it & How to Trade it?

Triangle Pattern Characteristics And How To Trade Effectively How To

The Finished Quilt Is 90 X109 Inches.

It Typically Occurs During A Downtrend When Sellers Are In Control, And The Pattern Signifies A Period Of Consolidation Before The.

Web Get Creative With Your Colors.

It Is Characterized By A Series Of Lower Highs And A Consistent Support Level That Acts As The Base Of The Triangle.

Related Post: