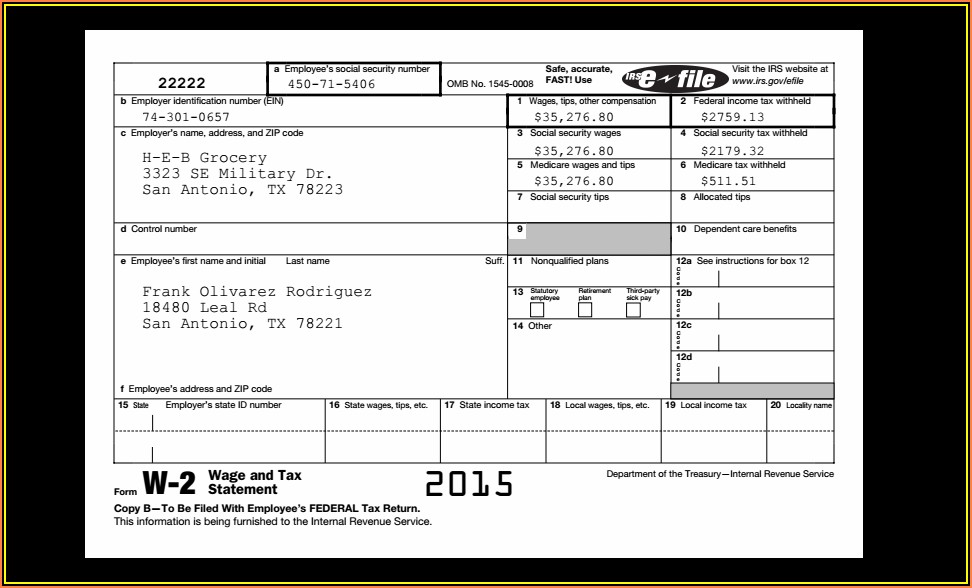

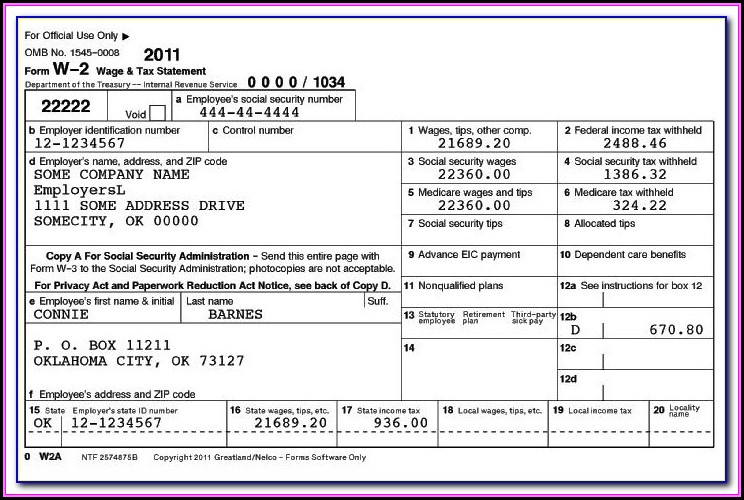

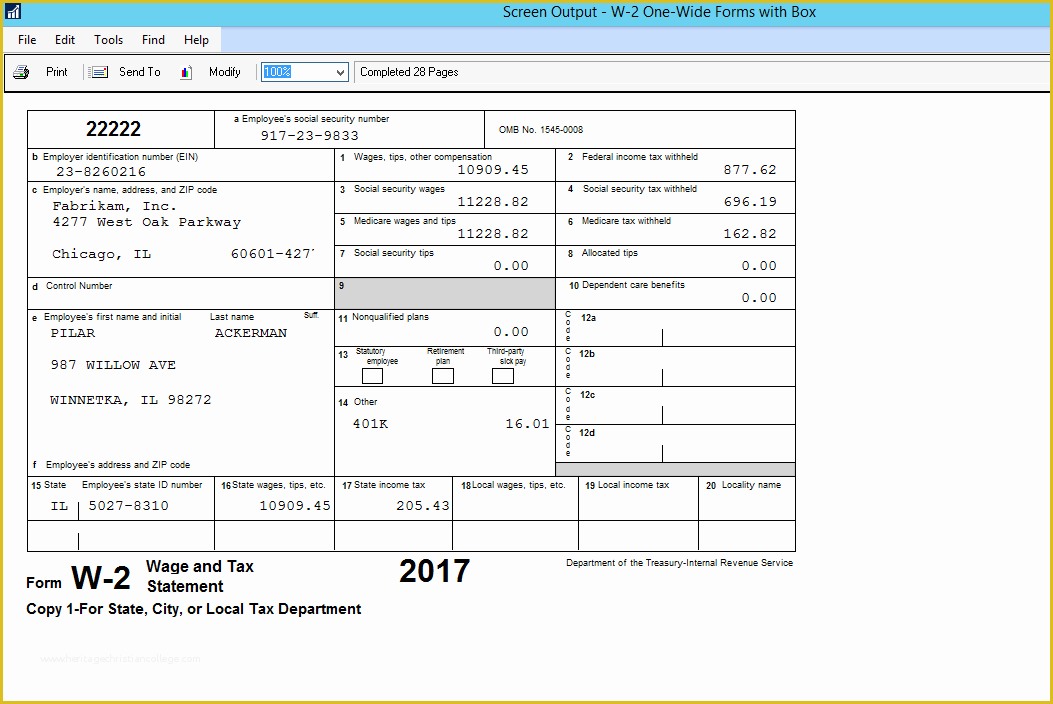

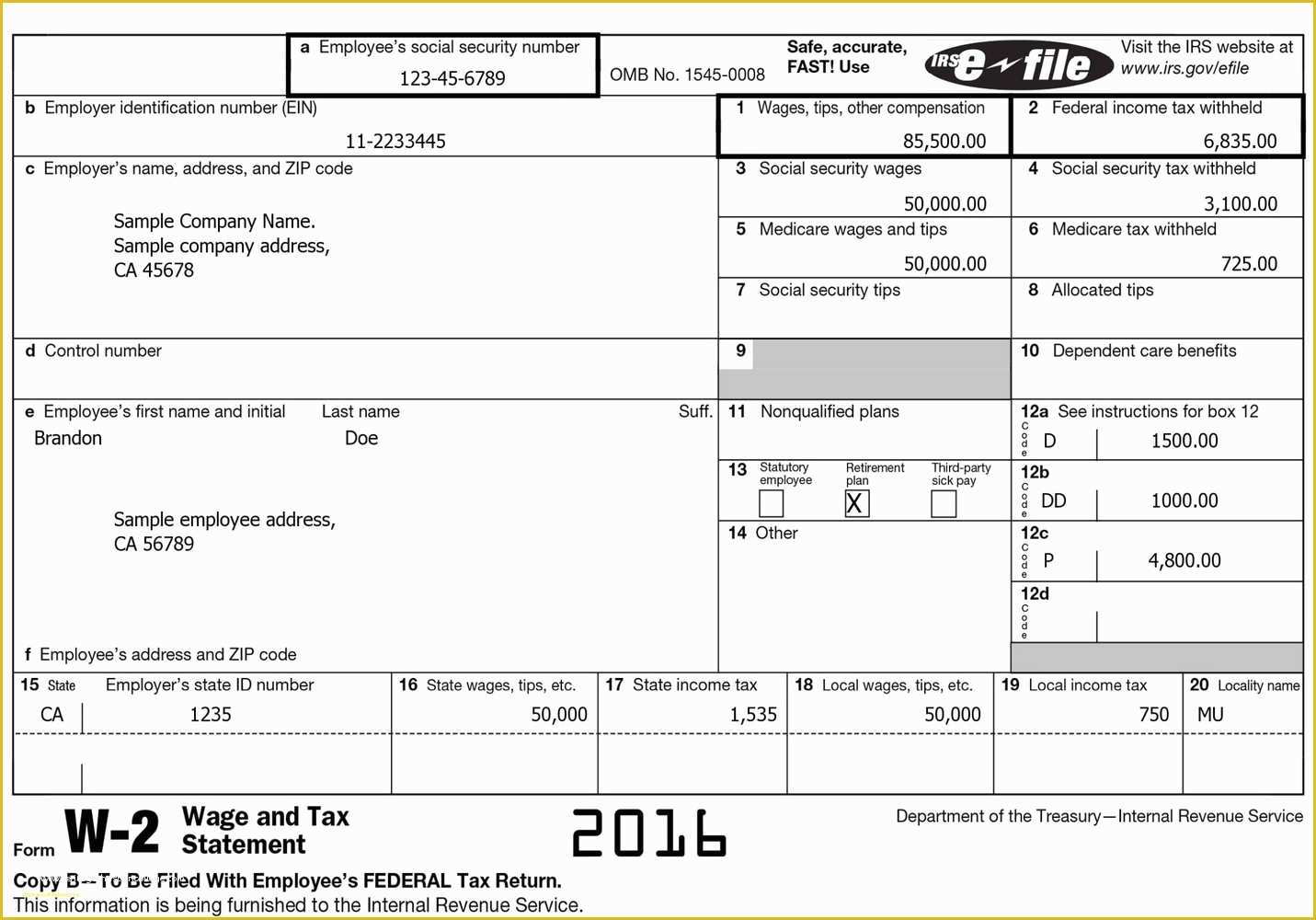

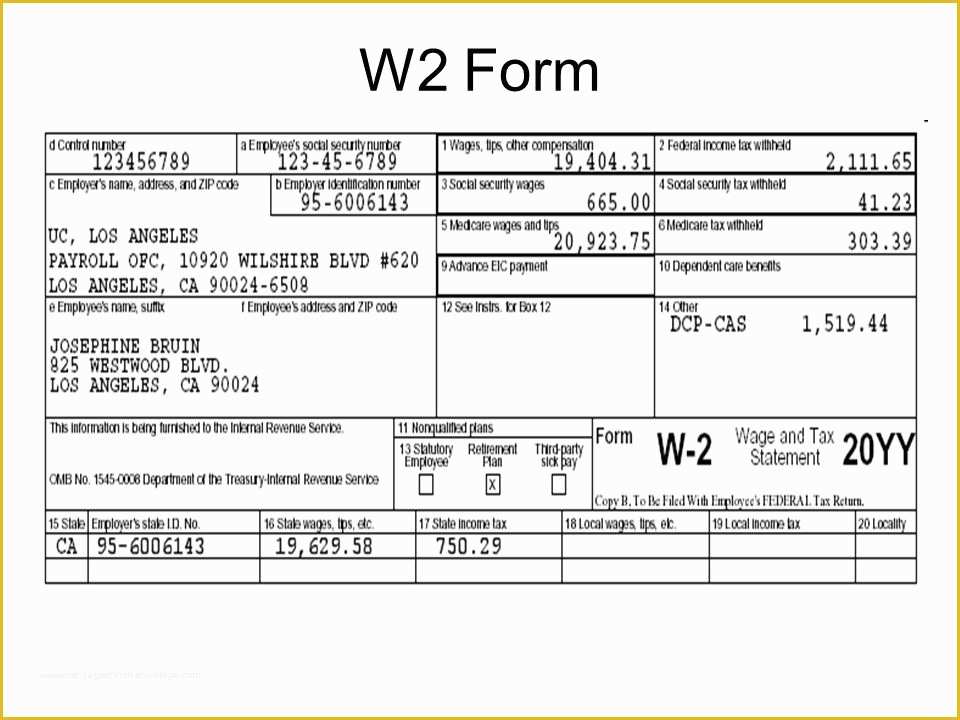

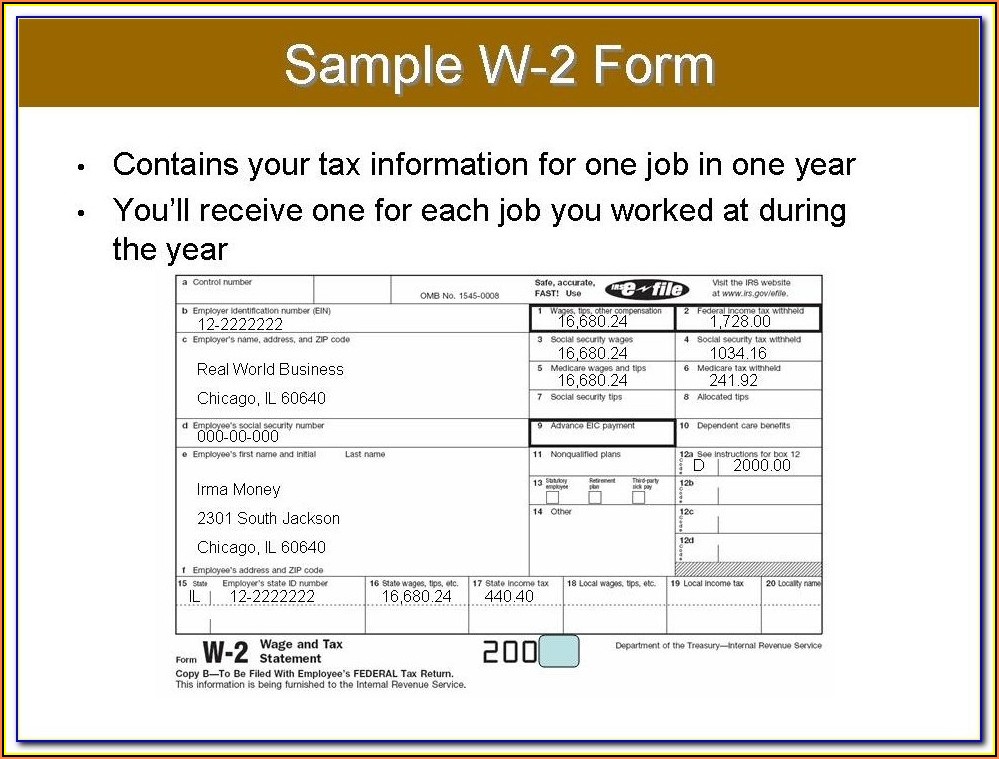

Fake W2 Template

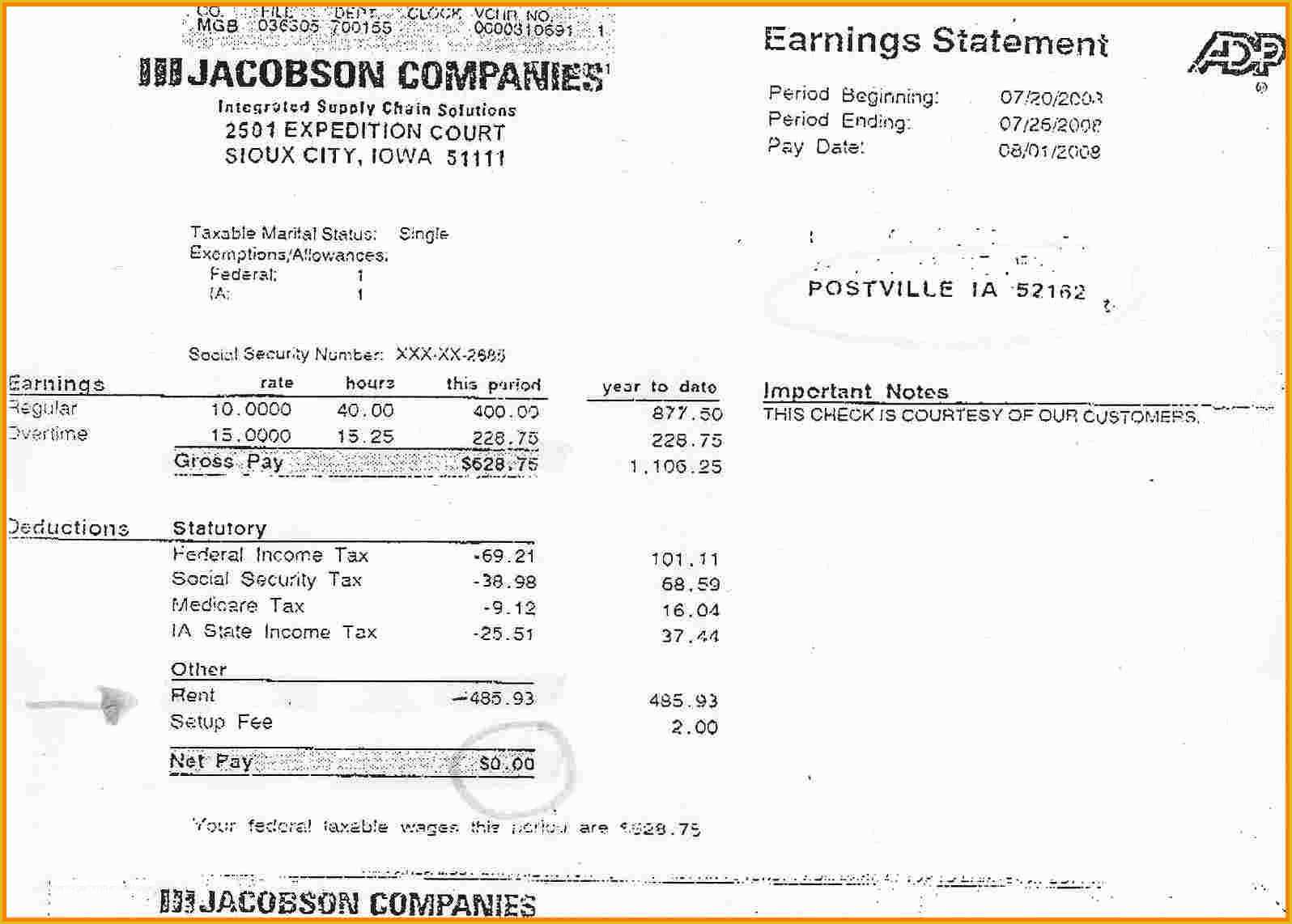

Fake W2 Template - Web how to spot a fake w2 in three easy steps. It also includes other deductions. Dot your i's and cross your t's. Simply download the template, fill in the gaps, and share it with your workers. Web form w2 is an important document given by an employer detailing deducted federal and state taxes from an employee’s income. 01 fill w2 form online: Web the w2 and paystub generator is a pivotal online tool designed for both employers and independent contractors, aimed at simplifying the creation of essential financial documents with precision and ease. Identity thieves and organized crime rings use the information on these forms to claim unemployment benefits in others’ names. Great for accountants or personal use. Note that you need to submit a copy of each employee’s w2 to the social security administration. If it is perfect, you can proceed towards checkout and if it is with any defects, you need to edit it. Note that you need to submit a copy of each employee’s w2 to the social security administration. A w2 form is also known as a wage and tax statement. An employer is required by law to provide a copy. Web people who try this scam face a wide range of penalties, including a frivolous return penalty of $5,000. A w2 form, a critical document required by. Every employee will need to have 3 copies of their form. Web completing the w2 form is a straightforward process. Web form w2 is an important document given by an employer detailing deducted. With a customizable template, just input specific details of the employer and the employee’s wages details like total gross income, adjusted gross income, and local and state taxes such as the federal income tax, local state tax, social security tax, etc. Web how to spot a fake w2 in three easy steps. If it is perfect, you can proceed towards. You can get this done at as cheap as $6.99 by checking out at the end using paypal or other leading card. For anyone who has taken part in one of these schemes, there are several options that the irs recommends. Enter employer and employee details. A w2 form, a critical document required by. Web people who try this scam. With a customizable template, just input specific details of the employer and the employee’s wages details like total gross income, adjusted gross income, and local and state taxes such as the federal income tax, local state tax, social security tax, etc. Simply download the template, fill in the gaps, and share it with your workers. Here are our tips for. Web get your printable w2 form in 3 easy steps. As a business owner, you must withhold federal and state taxes from the wages of your staff members during the entire tax year. Great for accountants or personal use. One copy remains with them, and the other 2 copies can be. This document shows the total earnings of an employee. Identity thieves and organized crime rings use the information on these forms to claim unemployment benefits in others’ names. Enter employer and employee details. Reach out to the employer using the contact information provided. No pdf editing software required, just answer a few simple questions about employer and employee. Web people who try this scam face a wide range of. You can get this done at as cheap as $6.99 by checking out at the end using paypal or other leading card. For anyone who has taken part in one of these schemes, there are several options that the irs recommends. Web stubcreator makes it easy to generate w2 form. This document shows the total earnings of an employee for. Every employee will need to have 3 copies of their form. Here are our tips for how to spot a fake w2 form. Web people who try this scam face a wide range of penalties, including a frivolous return penalty of $5,000. A w2 form is also known as a wage and tax statement. Great for accountants or personal use. Web get your printable w2 form in 3 easy steps. 02 get a free consultation to save tax (optional). No pdf editing software required, just answer a few simple questions about employer and employee. Web completing the w2 form is a straightforward process. They also run the risk of criminal prosecution for filing a false tax return. You can get this done at as cheap as $6.99 by checking out at the end using paypal or other leading card. For anyone who has taken part in one of these schemes, there are several options that the irs recommends. Enter employer and employee details. Great for accountants or personal use. People can amend a previous tax return or consult with a. Web completing the w2 form is a straightforward process. This includes stealing the victim's name, address, social security number (ssn), annual wage details, withholdings. A w2 form is also known as a wage and tax statement. Note that you need to submit a copy of each employee’s w2 to the social security administration. In addition to pay stubs, applicants will also sometimes submit other false documents as proof of income if they don’t meet certain rental application requirements. Web how to spot a fake w2 in three easy steps. Web form w2 is an important document given by an employer detailing deducted federal and state taxes from an employee’s income. A w2 form, a critical document required by. Dot your i's and cross your t's. Fill up the details on w2 form online. With a customizable template, just input specific details of the employer and the employee’s wages details like total gross income, adjusted gross income, and local and state taxes such as the federal income tax, local state tax, social security tax, etc.

Fake W2 Forms Form Resume Examples Or85RqO1Wz

How To Get Fake W2 Forms Form Resume Examples djVawzw9Jk

Fake W2 Forms Form Resume Examples o7Y3w1oYBN

Real Paycheck Stubs How to Spot a Fake W2

Free W2 Template Of 7 Fake Pay Stubs Online Heritagechristiancollege

Free Printable Fake Std Test Results Printable Word Searches

Fake W2 PDF Irs Tax Forms Social Security (United States)

Fake Std Test Results Template

Fake W2 Forms Pay Stubs Form Resume Examples A19XE5eY4k

Free W2 Template Of 7 Fake Pay Stubs Online Heritagechristiancollege

No Pdf Editing Software Required, Just Answer A Few Simple Questions About Employer And Employee.

Web People Who Try This Scam Face A Wide Range Of Penalties, Including A Frivolous Return Penalty Of $5,000.

It Also Includes Other Deductions.

02 Get A Free Consultation To Save Tax (Optional).

Related Post: