Failed Inverse Head And Shoulders Pattern

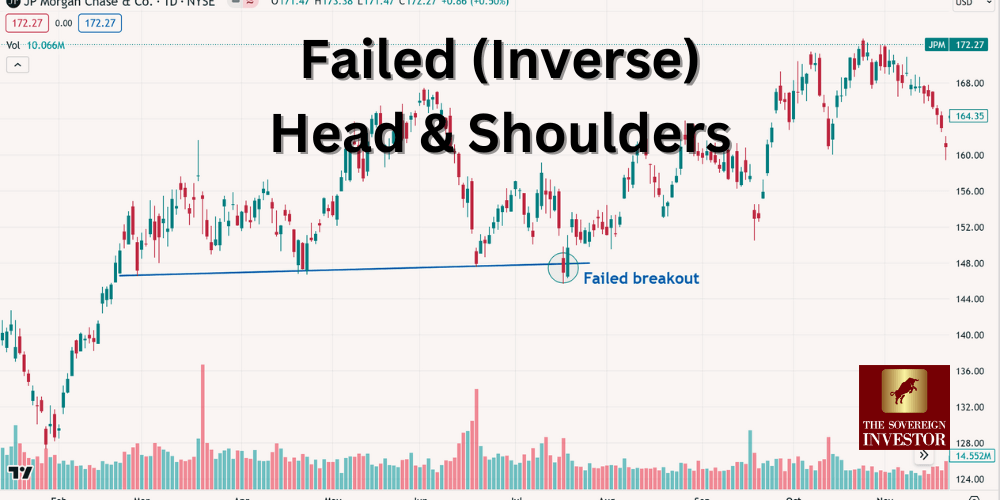

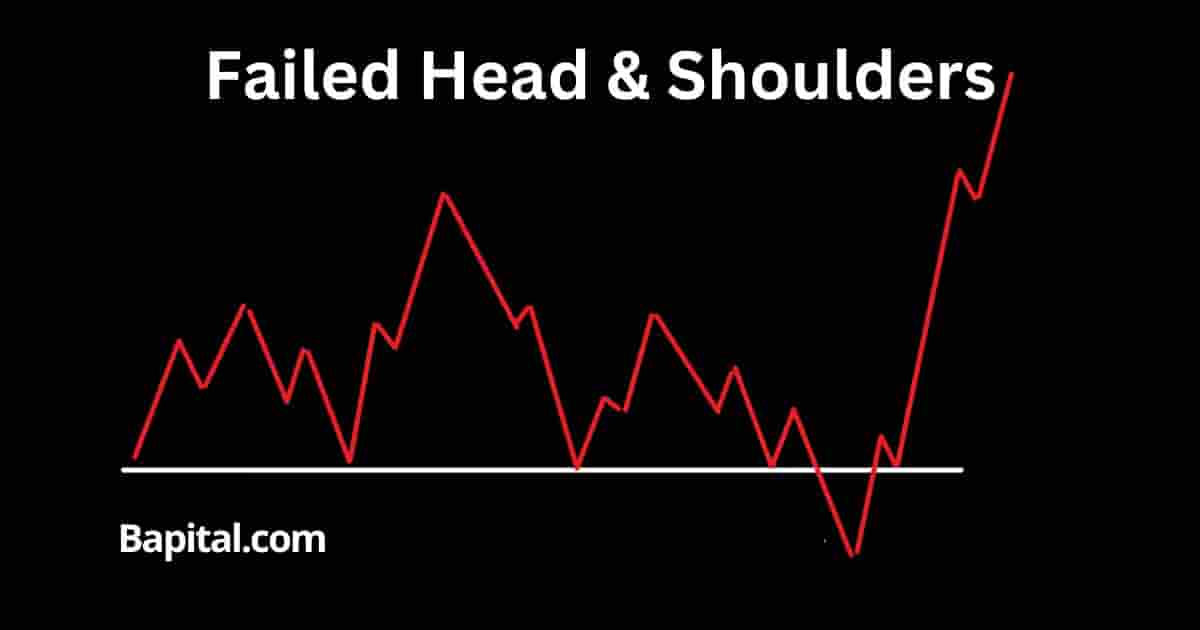

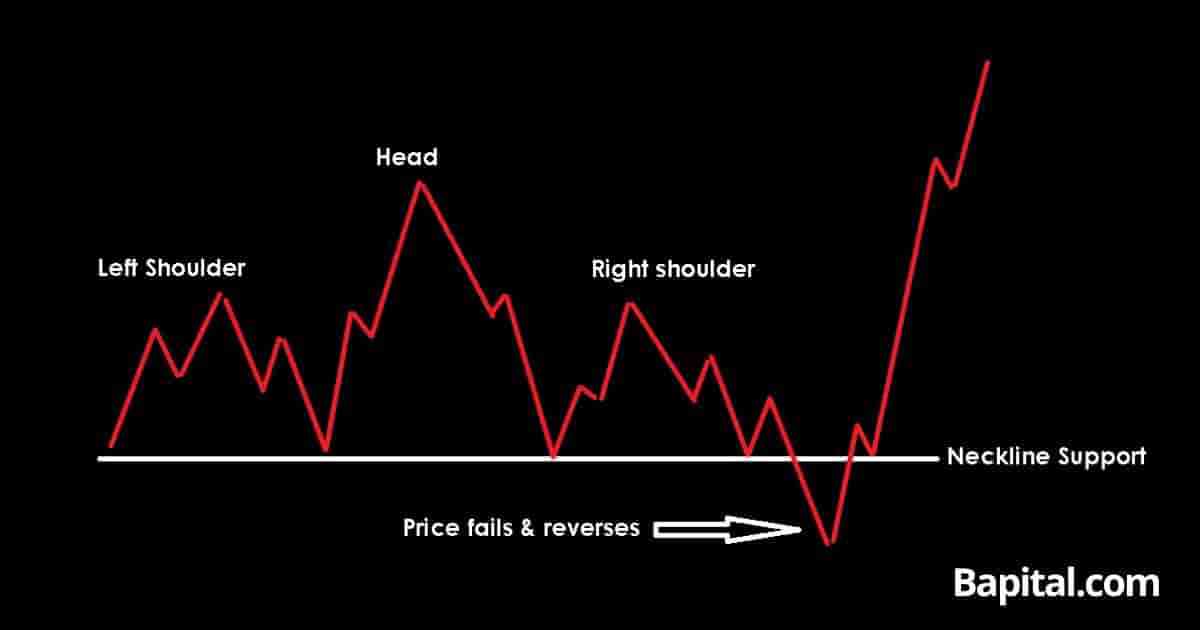

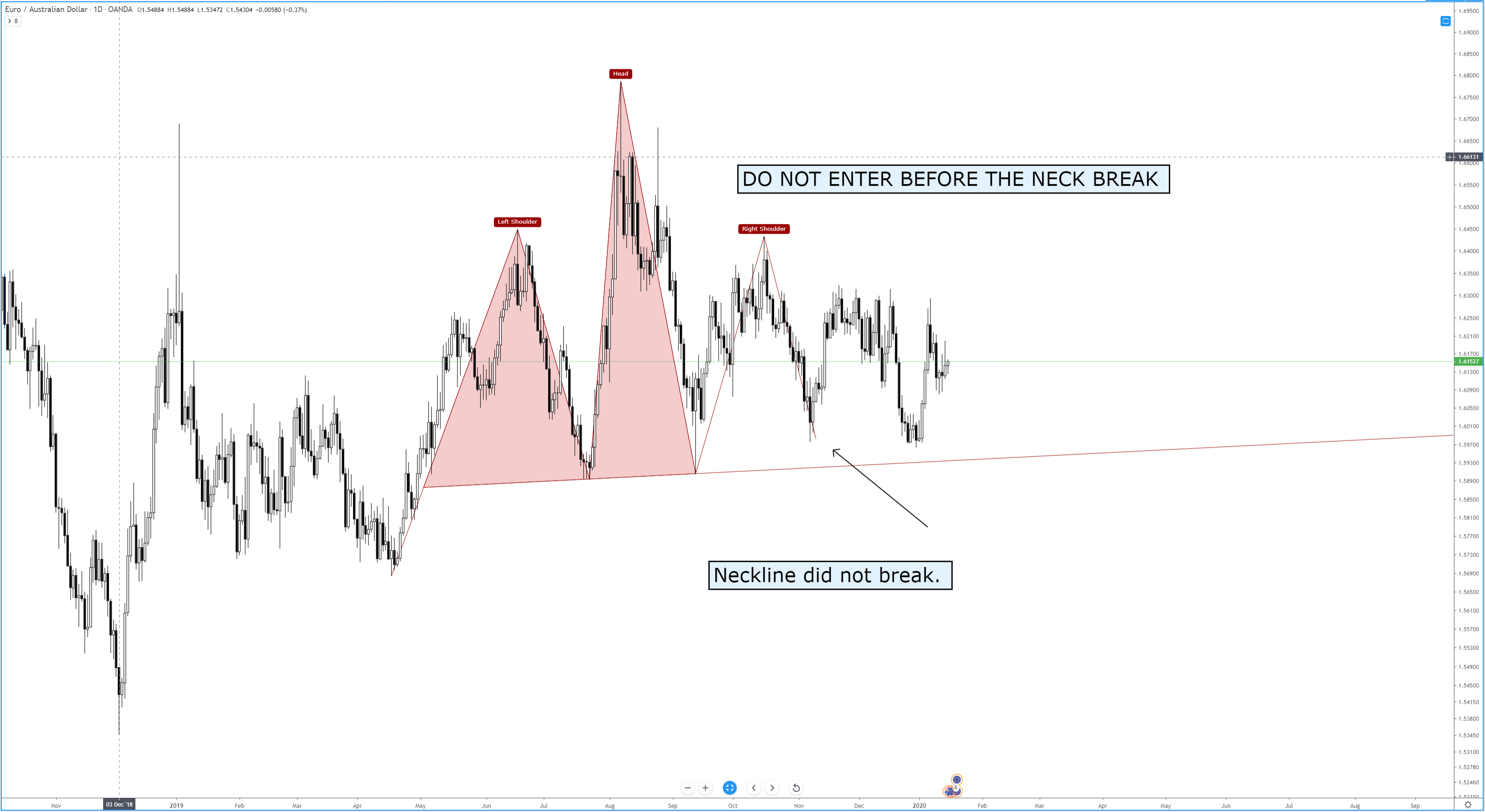

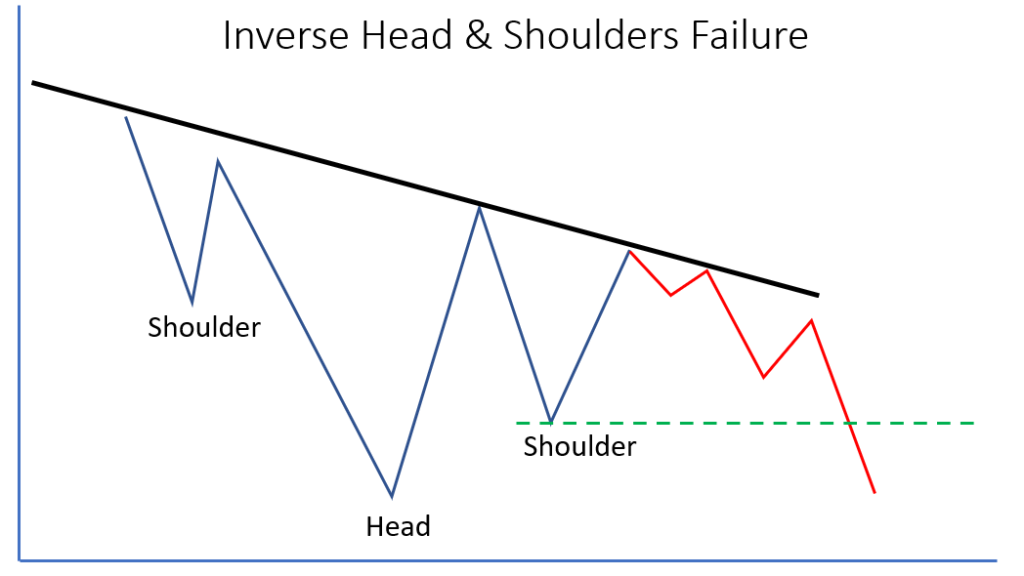

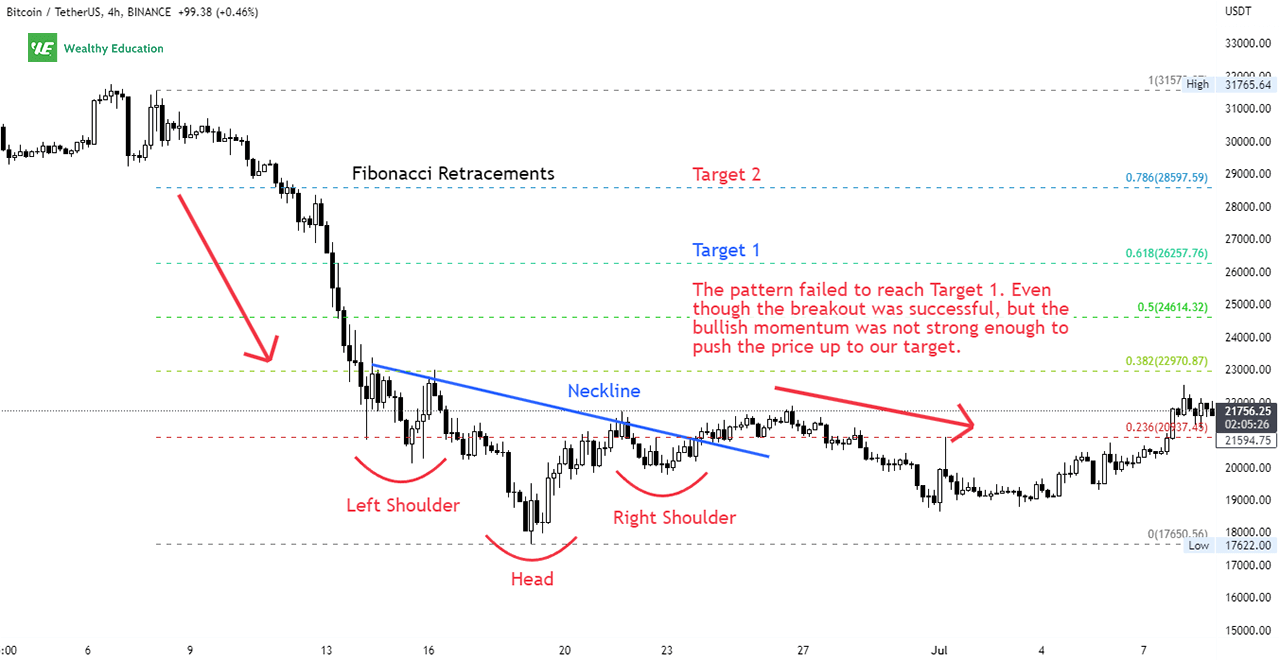

Failed Inverse Head And Shoulders Pattern - Web we'll discuss what a failed inverse head and shoulders pattern looks like in a moment. However, if traded correctly, it allows you to identify high probability breakout trades, catch the start of a new trend, and even “predict” market bottoms ahead of time. Web the inverse head and shoulders occurs when a downtrend reverses into an uptrend, and is basically the head and shoulders pattern we have just analyzed turned upside down. Web bitcoin market indicators and breakout signals. Is the inverse head and shoulders bullish or bearish? A head & shoulders has failed when the initial breakout reverses and prices break back through the neckline. The first and third lows are called shoulders. Suffice it to say that because this pattern is seen as a reversal pattern in a downtrend, traders are looking to trade it as a bullish pattern. This pattern is formed when an asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low (the “right shoulder”). The inverse head and shoulders pattern is a chart pattern that has fooled many traders (i’ll explain why shortly). Web 📌how to easily identify these patterns? Web discover what a failed inverse head and shoulders pattern signifies for traders and how it impacts your investment strategies. The head and shoulders pattern is exactly what the term indicates. Web by rayner teo. Web the inverse head and shoulders, or inverted h&s pattern, is formed at the end of a downtrend. Web the consolidation & head and shoulders scanner is designed to operate in a fully automated manner, detecting consolidation patterns, head and shoulders patterns and inverse head and shoulders patterns across the symbol and timeframe that you select. Web an inverse head and shoulder pattern is also called a “head and shoulders bottom” in a reversal chart pattern. Web the. The price might not follow through with the change in the trend, and sometimes the original trend could still resume. What is an inverse head and shoulders pattern? The first and third lows are called shoulders. Bitcoin’s price chart is showing an inverse head and shoulders pattern, a strong indicator that often predicts a reversal of a previous downward. Web. Find out how to detect and use this chart pattern to improve your trading. This article has answers to all your questions over here. Web head and shoulder is a reliable reversal chart pattern that forms after an advance or a decline and the completion of the formation suggests a reversal of the existing trend. The height of the pattern. However, if traded correctly, it allows you to identify high probability breakout trades, catch the start of a new trend, and even “predict” market bottoms ahead of time. Overview | how to trade | examples | benefits | limitations | psychology | faq. Global equity markets report focuses mainly on. It resembles a baseline with three peaks with the middle. It typically forms at the end of a bullish trend. Clicking any of the books (below) takes you to amazon.com if you buy anything while there, they pay for. Web the head and shoulders pattern is a market chart that crypto traders use to identify price reversals. An inverse head and shoulders patterns is a bullish pattern that signals a. A piece of exchanging productively is to work out the gamble and likely prize of each exchange that you make. The head and shoulders pattern has been. Web how do you know when an (inverse) head and shoulders pattern has failed? Web discover what a failed inverse head and shoulders pattern signifies for traders and how it impacts your investment. Based on the technical formation, bitcoin could rally to the upside if a break above the trendline occurs, according to a may 13 x post from crypto investor. Bitcoin’s price chart is showing an inverse head and shoulders pattern, a strong indicator that often predicts a reversal of a previous downward. The head and shoulders pattern is exactly what the. This pattern is formed when an asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low (the “right shoulder”). Web an inverse head and shoulder pattern is also called a “head and shoulders bottom” in a reversal chart pattern. It is also one of the most profitable chart patterns, with. Web the inverse head and shoulders chart pattern is a bullish chart formation that signals a potential reversal of a downtrend. The inverse head and shoulders pattern is a chart pattern that has fooled many traders (i’ll explain why shortly). Web despite the bearish outlook, kevin suggested that now would be an ideal time for dogecoin to form a right. The pattern is shaped with three peaks, a left shoulder peak, a higher head peak, and a right shoulder peak similar in height to the left shoulder. This article has answers to all your questions over here. The right shoulder on these patterns typically is higher than the left, but many times it’s equal. The price might not follow through with the change in the trend, and sometimes the original trend could still resume. An inverse head and shoulders patterns is a bullish pattern that signals a price reversal from a bearish downtrend to a bullish uptrend. Web how accurate is the inverse head and shoulders pattern? A failed inverse head and shoulders pattern, on the other hand, happens when price does not break through the neckline but trends downward again. The first and third lows are called shoulders. Web head and shoulder is a reliable reversal chart pattern that forms after an advance or a decline and the completion of the formation suggests a reversal of the existing trend. Find out how to detect and use this chart pattern to improve your trading. Is the inverse head and shoulders bullish or bearish? Web the consolidation & head and shoulders scanner is designed to operate in a fully automated manner, detecting consolidation patterns, head and shoulders patterns and inverse head and shoulders patterns across the symbol and timeframe that you select. What is an inverse head and shoulders pattern? It grants you the ability to simultaneously scan for patterns across as many as 20 distinct. It is possible that even if the head and shoulders chart pattern follows through, it might still fail, and the trend reversal isn’t guaranteed. Web the inverse head and shoulders occurs when a downtrend reverses into an uptrend, and is basically the head and shoulders pattern we have just analyzed turned upside down.

Failed (Inverse) Head and Shoulders Pattern How to Spot it

Failed Head And Shoulders Pattern Explained With Examples

Failed Head And Shoulders Pattern Explained With Examples

What is Inverse Head and Shoulders Pattern & How To Trade It

Failed Head And Shoulders Pattern Explained With Examples

Chart Patterns The Head And Shoulders Pattern Forex Academy

Inverse Head and Shoulders Pattern How To Spot It

TRUE AND FALSE Head & Shoulder PATTERN YouTube

Inverse Head & Shoulders Definition & How to Trade Stock Trading Teacher

Reverse Head And Shoulders Pattern (Updated 2023)

This Pattern Is Formed When An Asset’s Price Creates A Low (The “Left Shoulder”), Followed By A Lower Low (The “Head”), And Then A Higher Low (The “Right Shoulder”).

Have You Considered The Complex Head And Shoulders Top Variety?

It Is Also One Of The Most Profitable Chart Patterns, With An Average 45% Price Increase Per Trade.

Web By Rayner Teo.

Related Post: