Failed Double Top Pattern

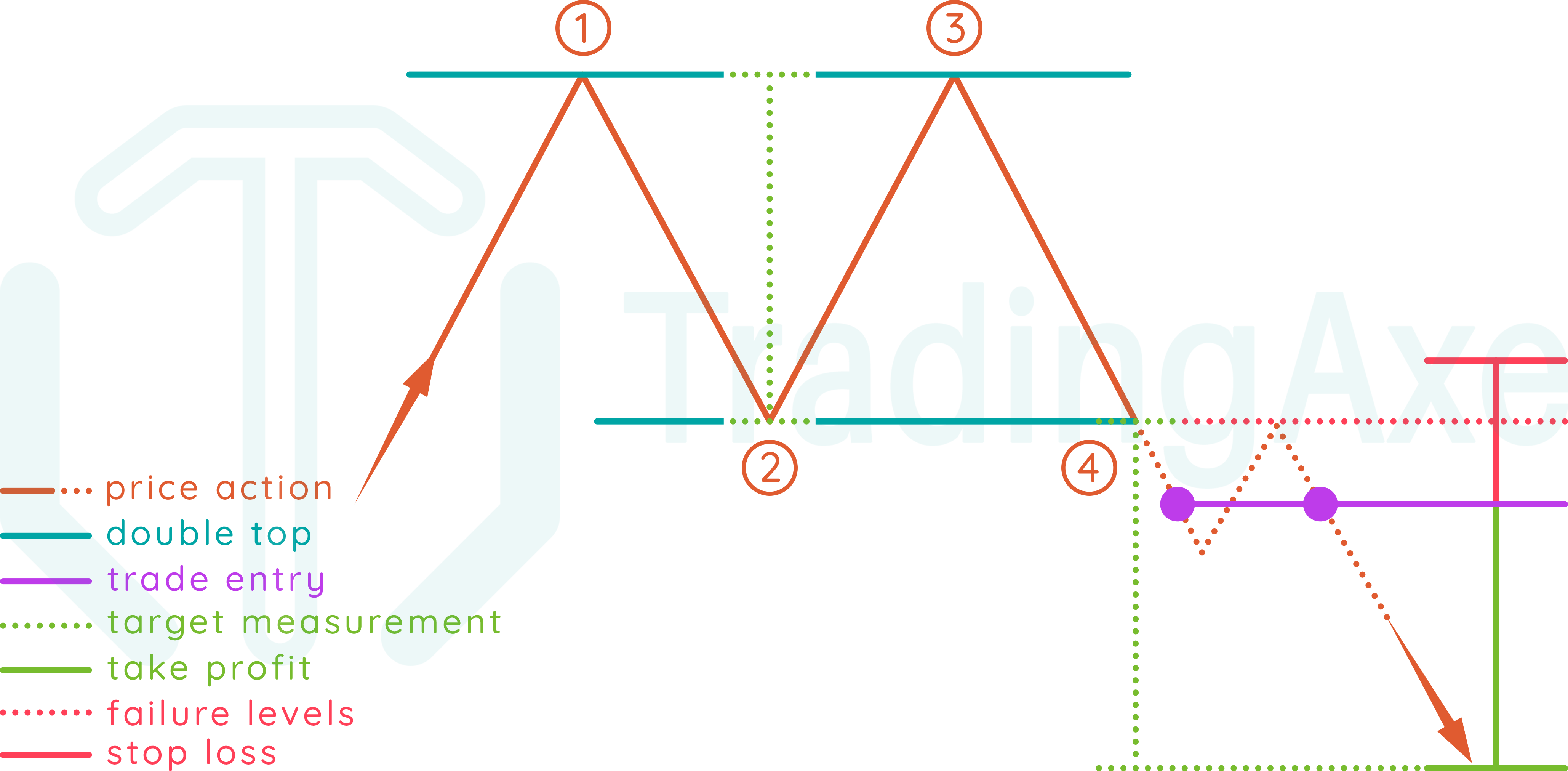

Failed Double Top Pattern - It occurs when the price retests the same. Web a failed double top isn’t followed by a reversal to downtrend, so relying on it can lead to an early exit from a position. Unlike the double bottom formation that. When the pattern occurs, traders should refrain from taking long positions; To get a clear confirmation of the pattern, wait until the. Web a double top is a chart pattern characterized by two price highs that are rejected by a resistance level, signaling a potential bearish reversal trend. Web a double bottom pattern forms when the price of an asset, for example, of a stock or a cryptocurrency, suddenly decreases further after a long consistent downtrend,. Locate the two distinct peaks that have the same height and width. What happens after a double top pattern? How to trade double top patterns. Web m formation deep dive. Web simply follow the steps below to identify a double top on a chart: Web > double top and bottom trading with bollinger bands. It occurs when the price retests the same. Bollinger bands is an effective tool for finding reversal patterns like the double top and. An m formation is a bearish reversal pattern and its more popular name is the “double top”. Web a double top is a bearish technical reversal pattern that forms when an asset reaches a high price two consecutive times with a moderate decline between the. Locate the two distinct peaks that have the same height and width. 544 views 2. Web updated june 28, 2021. Web simply follow the steps below to identify a double top on a chart: Web m formation deep dive. Make sure the distance between the two peaks is not very short (of course, we should also consider the timeframe). Instead the focus should then be put on finding a bearish entry point. Web > double top and bottom trading with bollinger bands. It signals that the market is unable to break through the upper resistance level. A double top is an extremely bearish technical reversal pattern that forms after an asset reaches a high price two consecutive times. Web therefore, it is better to choose the most traded currency pairs on forex. Web a double bottom pattern forms when the price of an asset, for example, of a stock or a cryptocurrency, suddenly decreases further after a long consistent downtrend,. It signals that the market is unable to break through the upper resistance level. Web a double top pattern is a technical chart pattern that is commonly used to analyse price movements. Web failed double top pattern. Web a double top is a bearish technical reversal pattern that forms when an asset reaches a high price two consecutive times with a moderate decline between the. It occurs when the price retests the same. Web a failed double top isn’t followed by a reversal to downtrend, so relying on it can lead to. Web updated june 28, 2021. What is double top and bottom? Web > double top and bottom trading with bollinger bands. Web failed double top pattern. How to trade double top patterns. Make sure the distance between the two peaks is not very short (of course, we should also consider the timeframe). In an uptrend, if a higher high is made but fails to carry through, and then prices drop below the previous high, then the trend is apt to reverse. Now you need to support the price level or confirm the. That is point f in the figure. What happens after a double top pattern? To get a clear confirmation of the pattern, wait until the. An m formation is a bearish reversal pattern and its more popular name is the “double top”. Web a failed double top isn’t followed by a reversal to downtrend, so relying on it can lead. Web failed double top pattern. In this video, our analyst fawad razaqzada discusses how to spot. In an uptrend, if a higher high is made but fails to carry through, and then prices drop below the previous high, then the trend is apt to reverse. It is considered one of the most reliable and widely. Web therefore, it is better. What is double top and bottom? In an uptrend, if a higher high is made but fails to carry through, and then prices drop below the previous high, then the trend is apt to reverse. Now you need to support the price level or confirm the neckline. That is point f in the figure. It signals that the market is unable to break through the upper resistance level. How to trade double top patterns. Web a double top reversal pattern typically occurs after a failed move to the upside. Web m formation deep dive. Web a double bottom pattern forms when the price of an asset, for example, of a stock or a cryptocurrency, suddenly decreases further after a long consistent downtrend,. Instead the focus should then be put on finding a bearish entry point. In this video, our analyst fawad razaqzada discusses how to spot. A double top is an extremely bearish technical reversal pattern that forms after an asset reaches a high price two consecutive times. A real double top, on the other hand, will indicate. Make sure the distance between the two peaks is not very short (of course, we should also consider the timeframe). Web a double top is a chart pattern characterized by two price highs that are rejected by a resistance level, signaling a potential bearish reversal trend. Web a failed double top isn’t followed by a reversal to downtrend, so relying on it can lead to an early exit from a position.

Double Top Stock Pattern (Updated 2022)

:max_bytes(150000):strip_icc()/download3-5c58eb62c9e77c0001a41b4b.png)

Double Top Definition

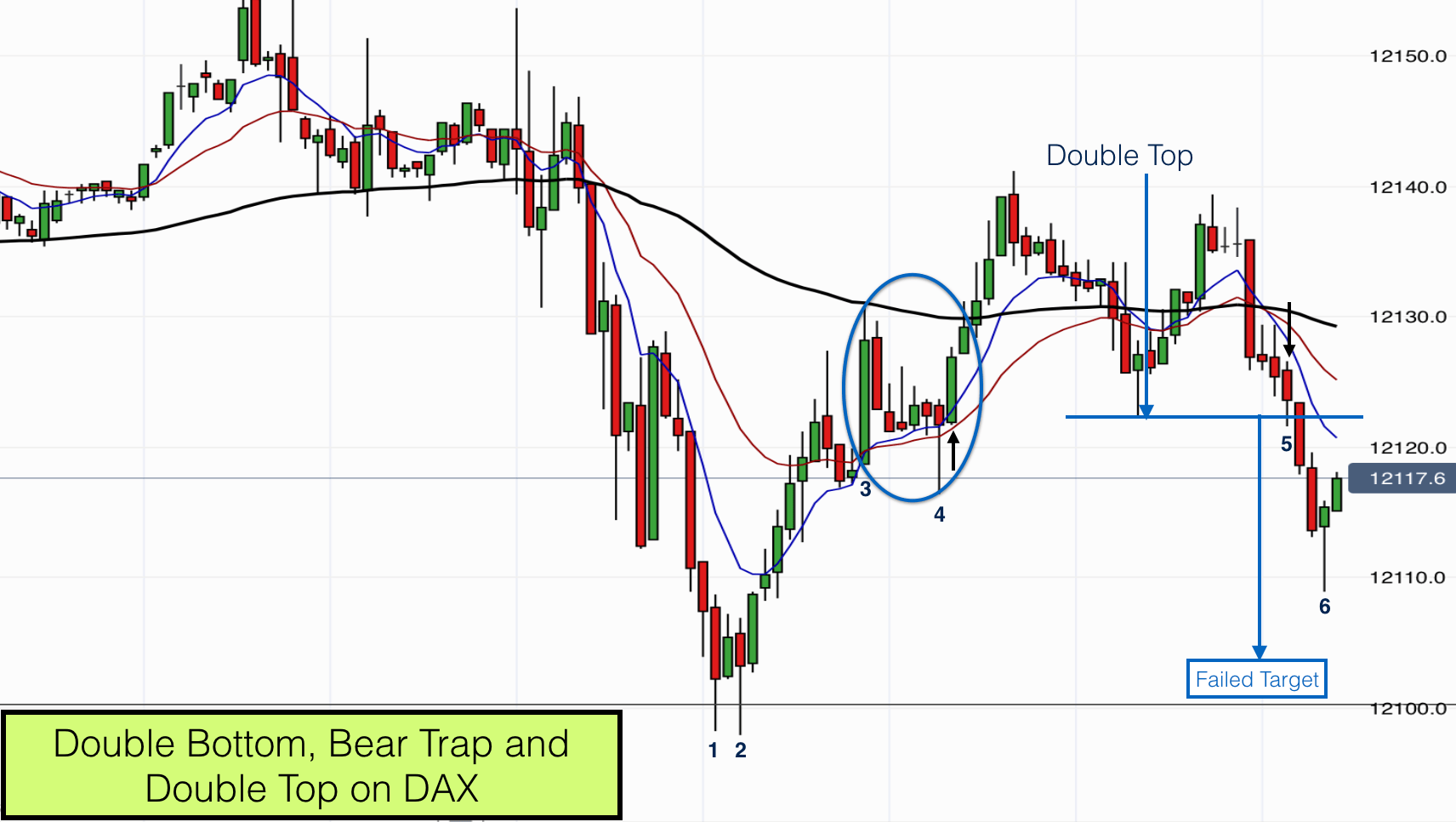

Failure of Patterns Price Action Trading

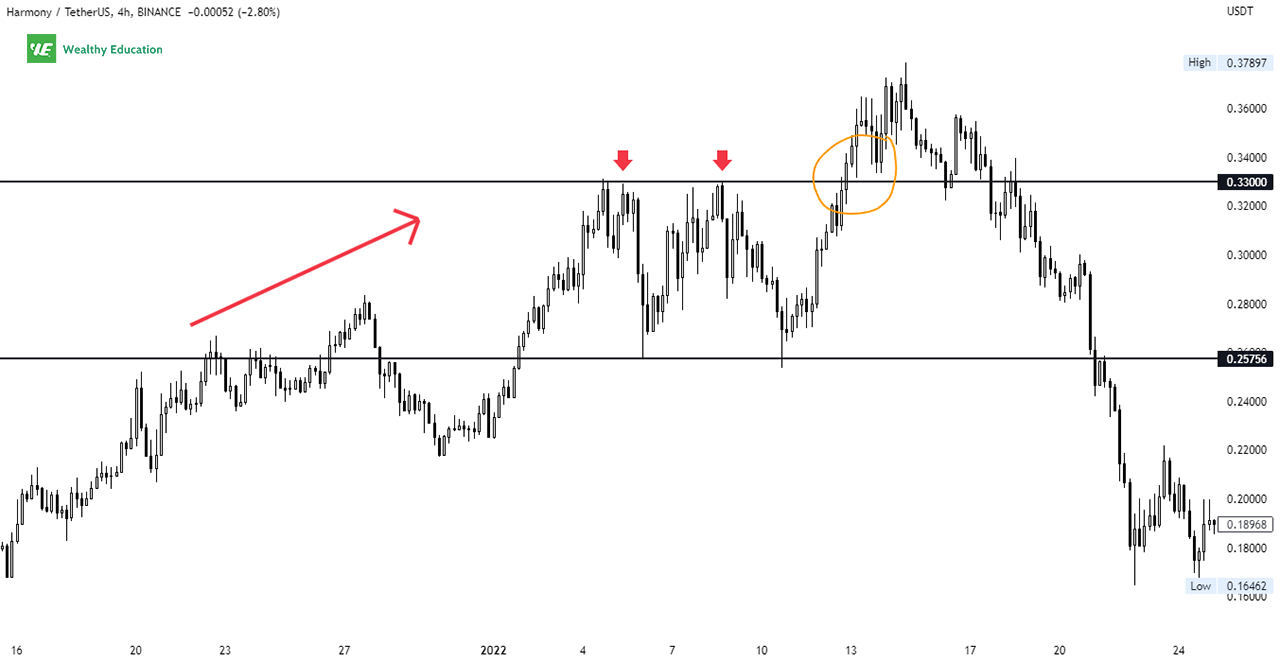

Double bottom, bear trap and failed double top on DAX

How To Trade Double Top Chart Pattern TradingAxe

Learn How to Trade and Profit from Chart Pattern Failures Forex

How to Trade Double and Triple Tops and Bottoms and Their Performance

The Double Top Trading Strategy Guide

Double Tops Trading the Failure of Technical Patterns Double Top

Double top patterns are some of the most common price patterns that

Web Simply Follow The Steps Below To Identify A Double Top On A Chart:

Unlike The Double Bottom Formation That.

Web Therefore, It Is Better To Choose The Most Traded Currency Pairs On Forex To Apply The Double Top Pattern.

Bollinger Bands Is An Effective Tool For Finding Reversal Patterns Like The Double Top And.

Related Post: