Failed Double Bottom Pattern

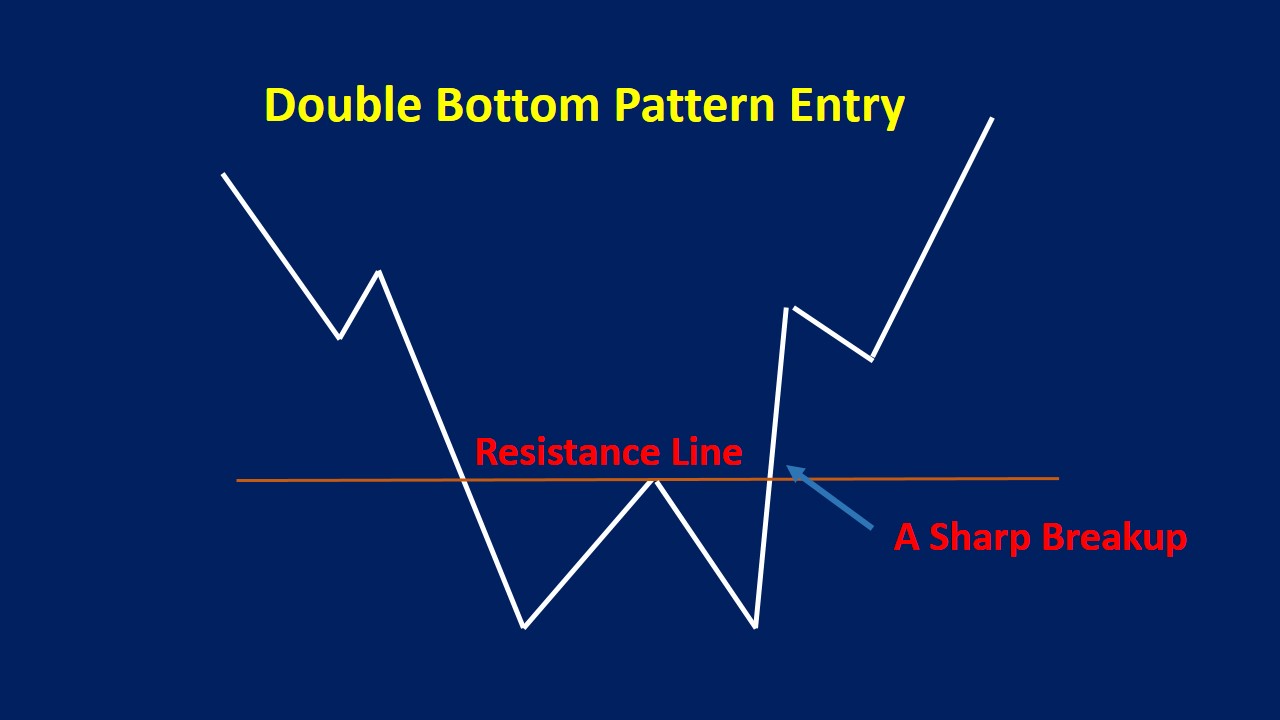

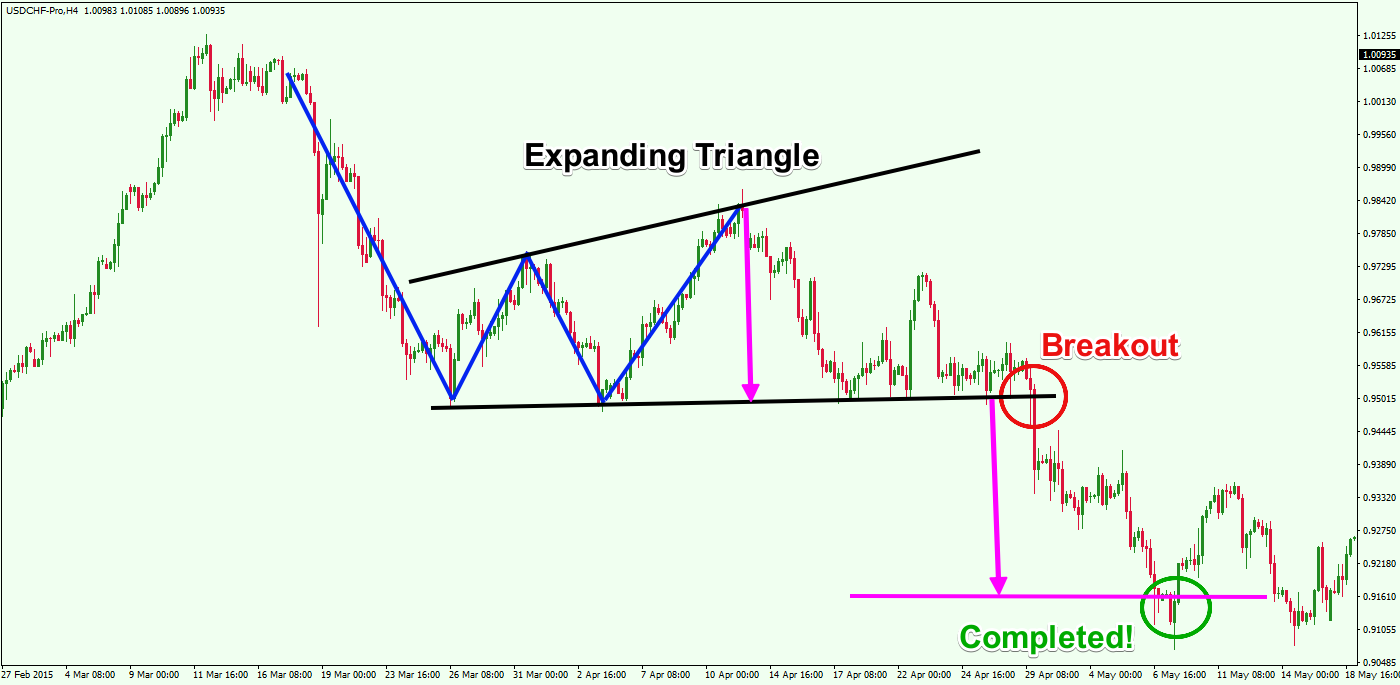

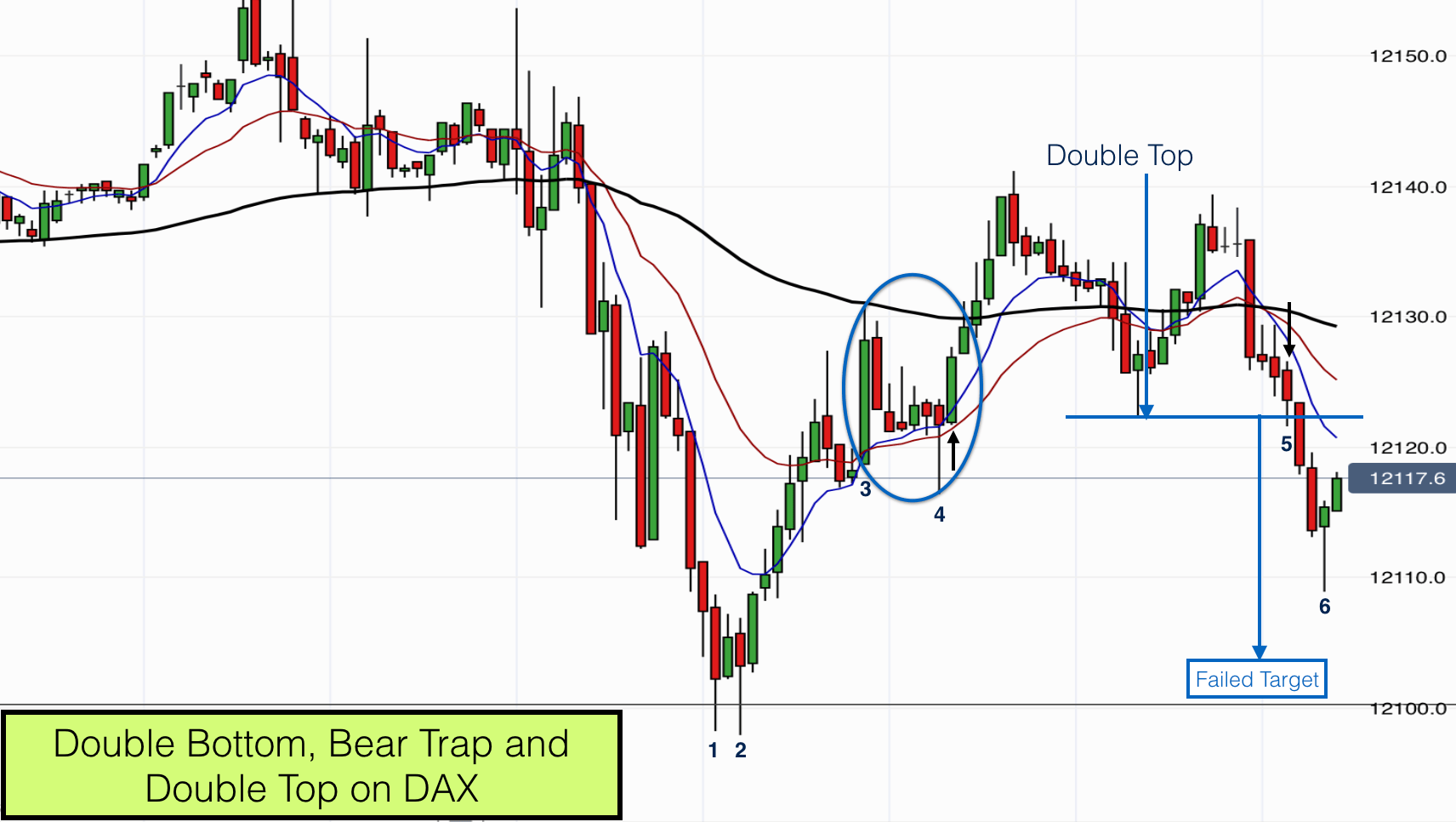

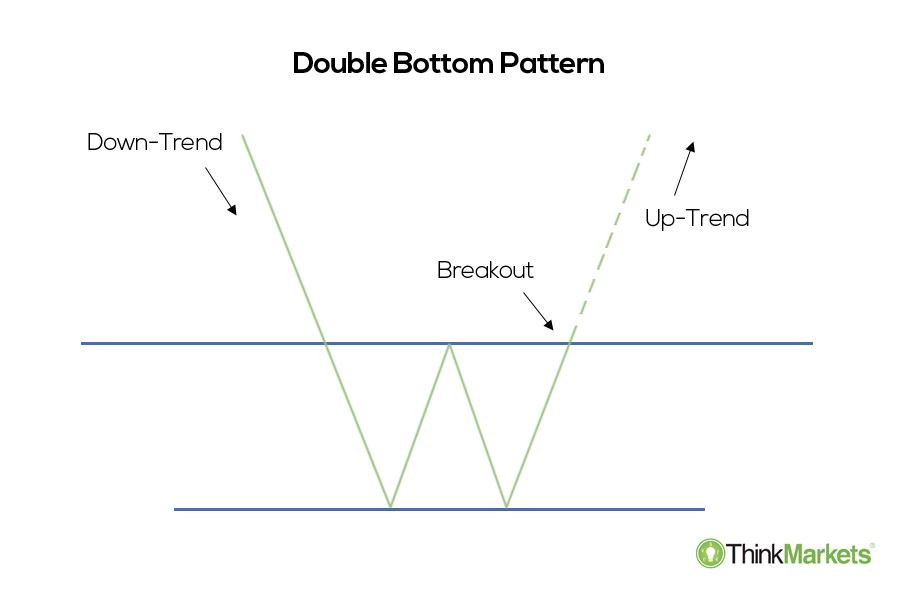

Failed Double Bottom Pattern - In the below chart, we can see that the prices move in the opposite direction of what. What is double top and bottom? A failed double bottom chart pattern is when the expected direction doesn’t materialize as expected. Web what happens with a failed double bottom pattern? Web the double bottom itself can offer a clue. Web a double bottom pattern means the market stalled twice in the same demand zone. Even though various chart patterns help execute profitable trades, it is only the case when these trends are identified correctly. In many cases, you will see that your failure pattern is evolving into another pattern, either on your trading. Web a stock forms a double bottom which confirms as a valid pattern when price closes above the top of the double bottom. Web a double bottom is a bullish reversal trading pattern that consists of two market bottoms that form around the same level, which are followed by a breakout to the. Web the double bottom reversal is a bullish reversal pattern typically found on bar charts, line charts, and candlestick charts. A failed double bottom chart pattern is when the expected direction doesn’t materialize as expected. Then the upside is the path of least resistance; This pattern is called a. Web what happens with a failed double bottom pattern? Then the upside is the path of least resistance; This pattern is called a. Web the double bottom pattern is a bullish reversal pattern that occurs at the bottom of a downtrend and signals that the sellers, who were in control of the price action so far, are. What is double top and bottom? Web what happens with a failed. Web a double bottom pattern is a bullish reversal pattern that occurs at the bottom of a downtrend and signals that the sellers, who were in control of the price. Web what happens with a failed double bottom pattern? Web by stelian olar, updated on: In many cases, you will see that your failure pattern is evolving into another pattern,. Web a double bottom pattern consists of several candlesticks that form two valleys or support levels that are either equal or near equal height. Web what happens with a failed double bottom pattern? This pattern is called a. Web by stelian olar, updated on: A double bottom in a bull market fails 12% of the time. Web the double bottom pattern is a bullish reversal pattern that occurs at the bottom of a downtrend and signals that the sellers, who were in control of the price action so far, are. Price rises no more than 10% before. Web a double bottom pattern is a bullish reversal pattern that occurs at the bottom of a downtrend and. Web updated june 28, 2021. Some traders even view the latter as the continuation of the double bottom. Imagine taking the distance between the trough and the peak, then stretching it upwards from the breakout point. Web the double bottom itself can offer a clue. As its name implies, the pattern is made up of two. This pattern is called a. Web a double bottom pattern is a bullish reversal pattern that occurs at the bottom of a downtrend and signals that the sellers, who were in control of the price. Web 03:04 pm et 02/13/2017. Web the double bottom itself can offer a clue. Web the double bottom pattern is a bullish reversal pattern that. Even though various chart patterns help execute profitable trades, it is only the case when these trends are identified correctly. In many cases, you will see that your failure pattern is evolving into another pattern, either on your trading. This pattern is called a. Then the upside is the path of least resistance; Web a stock forms a double bottom. Web a double bottom pattern is a bullish reversal pattern that occurs at the bottom of a downtrend and signals that the sellers, who were in control of the price. This pattern is called a. Web a double bottom pattern consists of several candlesticks that form two valleys or support levels that are either equal or near equal height. Web. Web a double bottom pattern is a bullish reversal pattern that occurs at the bottom of a downtrend and signals that the sellers, who were in control of the price. Web the double bottom reversal is a bullish reversal pattern typically found on bar charts, line charts, and candlestick charts. Even though various chart patterns help execute profitable trades, it. What is double top and bottom? Some traders even view the latter as the continuation of the double bottom. Web a stock forms a double bottom which confirms as a valid pattern when price closes above the top of the double bottom. This pattern is called a. Web the double bottom reversal is a bullish reversal pattern typically found on bar charts, line charts, and candlestick charts. Then the upside is the path of least resistance; Web updated june 28, 2021. Even though various chart patterns help execute profitable trades, it is only the case when these trends are identified correctly. Web the double bottom itself can offer a clue. Web the truth is that failed patterns are usually part of something bigger. Web by stelian olar, updated on: In many cases, you will see that your failure pattern is evolving into another pattern, either on your trading. Web a double bottom pattern means the market stalled twice in the same demand zone. This approach is based on the premise that the lowest point of the pattern is. Price rises no more than 10% before. Imagine taking the distance between the trough and the peak, then stretching it upwards from the breakout point.

Double Bottom chart pattern failure Forex Training Group

Double Bottom Pattern How to Trade and Examples

Failure of Patterns Price Action Trading

DOUBLE BOTTOM BREAKOUT (LESSON) GoldPredict

Learn How to Trade and Profit from Chart Pattern Failures Forex

Trading double bottoms for failure

Double Bottom Pattern failed? for NSEFEDERALBNK by avinash786

Double Bottom Chart Pattern Strategy (How To Trade It Backtest

Double bottom, bear trap and failed double top on DAX

Learn About The Double Bottom Pattern ThinkMarkets EN

Web 03:04 Pm Et 02/13/2017.

Web A Double Bottom Pattern Is A Bullish Reversal Pattern That Occurs At The Bottom Of A Downtrend And Signals That The Sellers, Who Were In Control Of The Price.

Web A Double Bottom Is A Bullish Reversal Trading Pattern That Consists Of Two Market Bottoms That Form Around The Same Level, Which Are Followed By A Breakout To The.

A Failed Double Bottom Chart Pattern Is When The Expected Direction Doesn’t Materialize As Expected.

Related Post: