Expanding Wedge Pattern

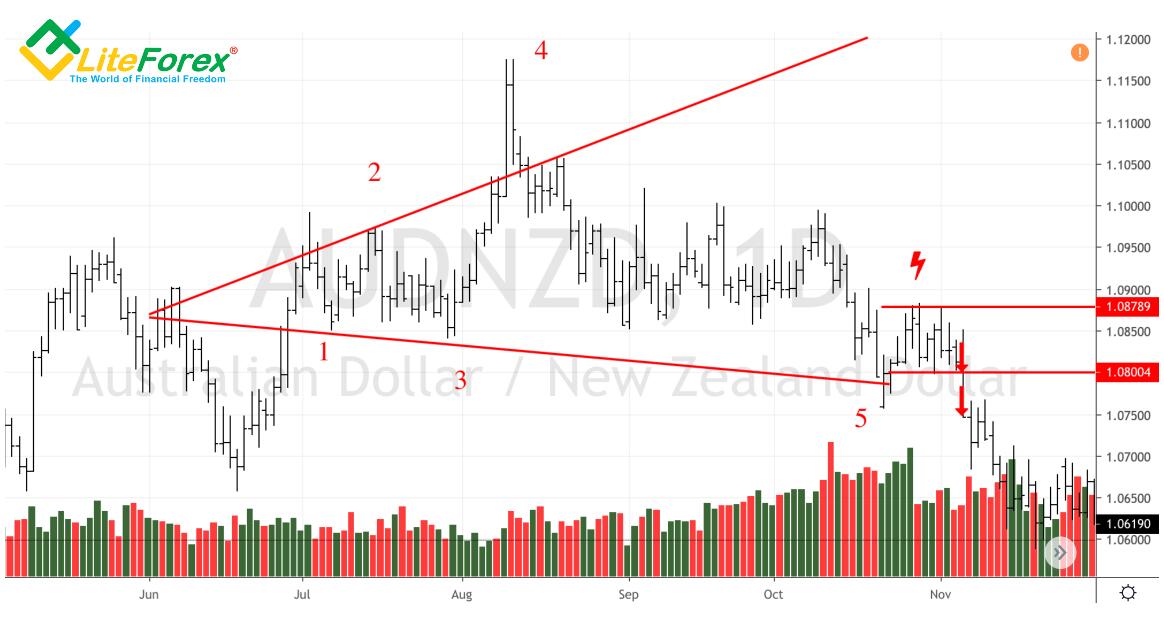

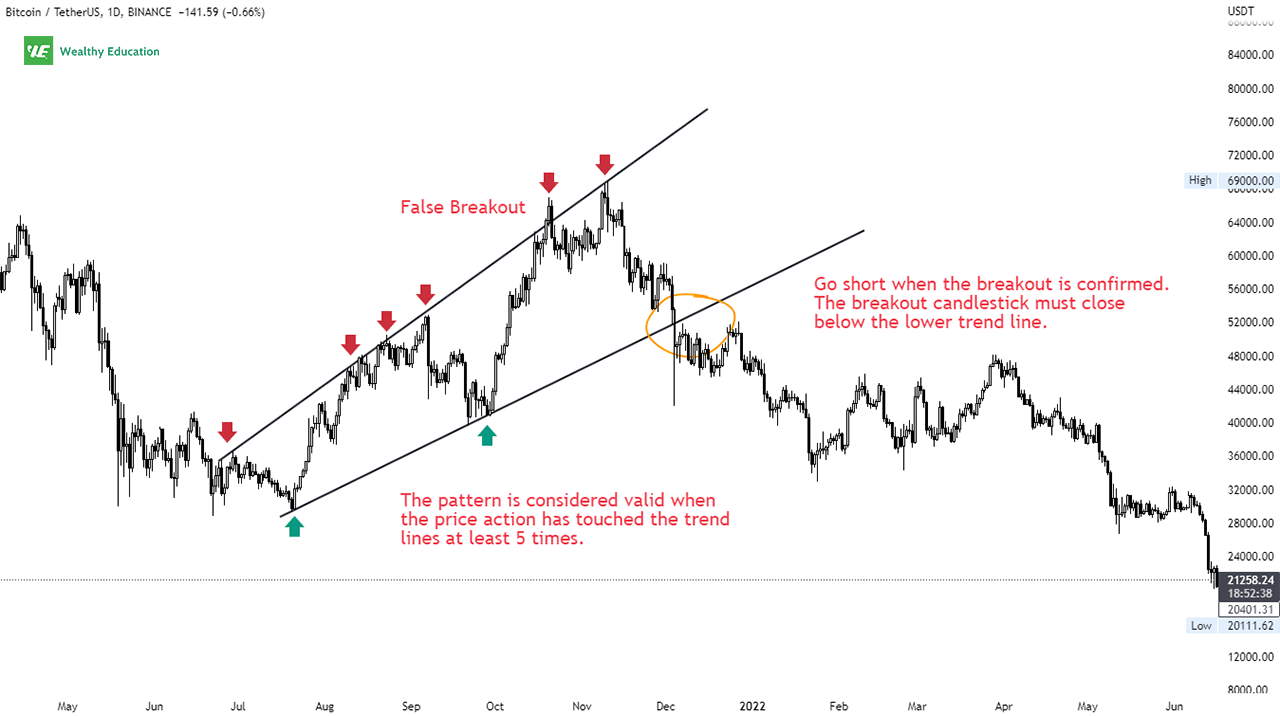

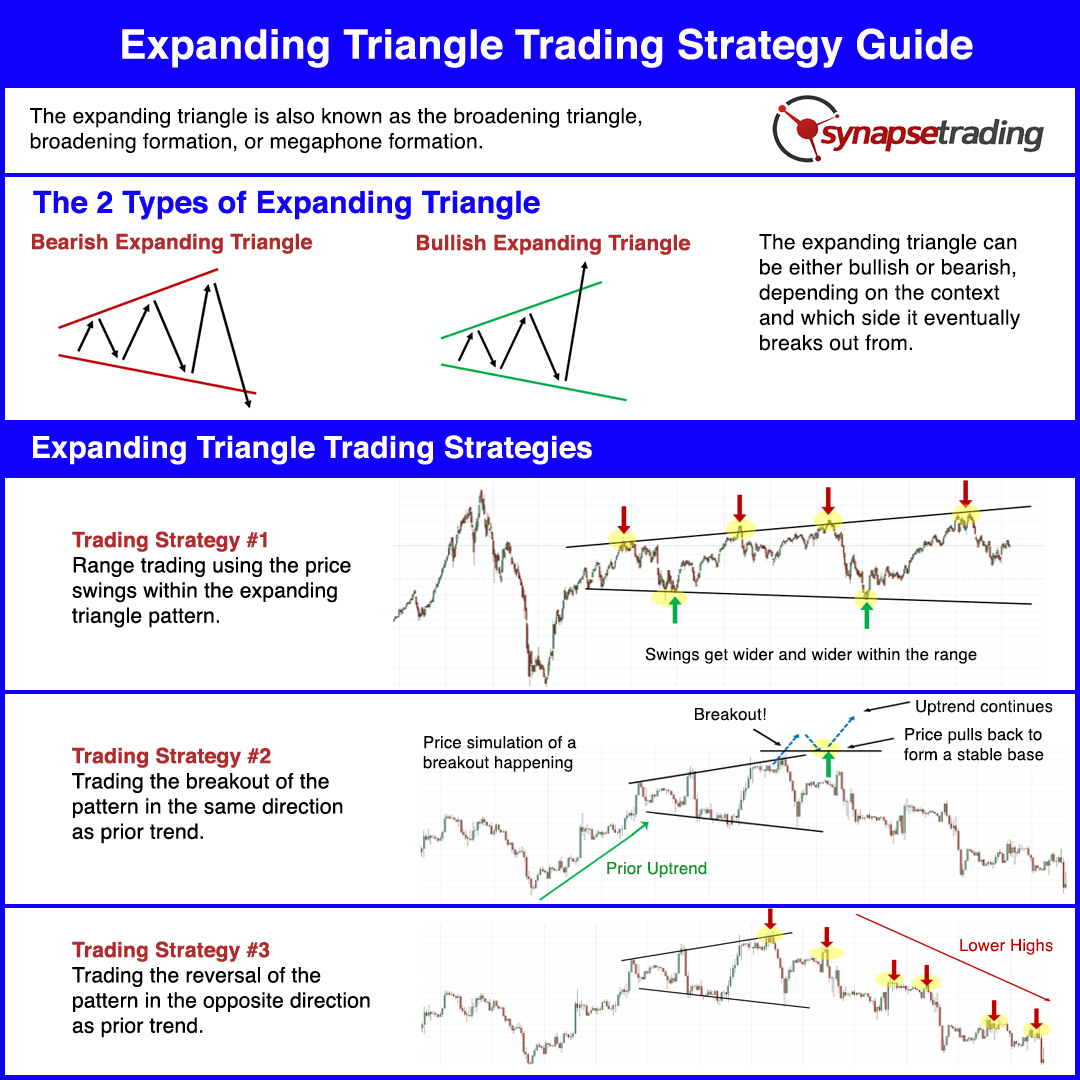

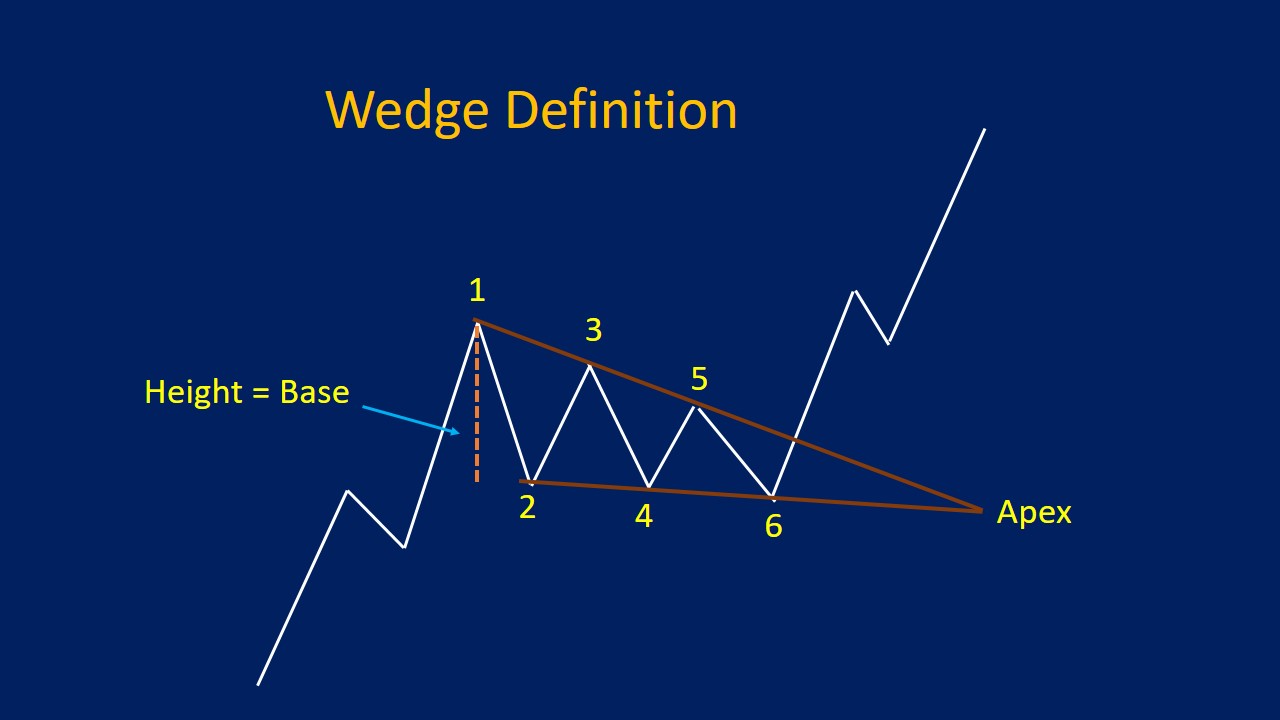

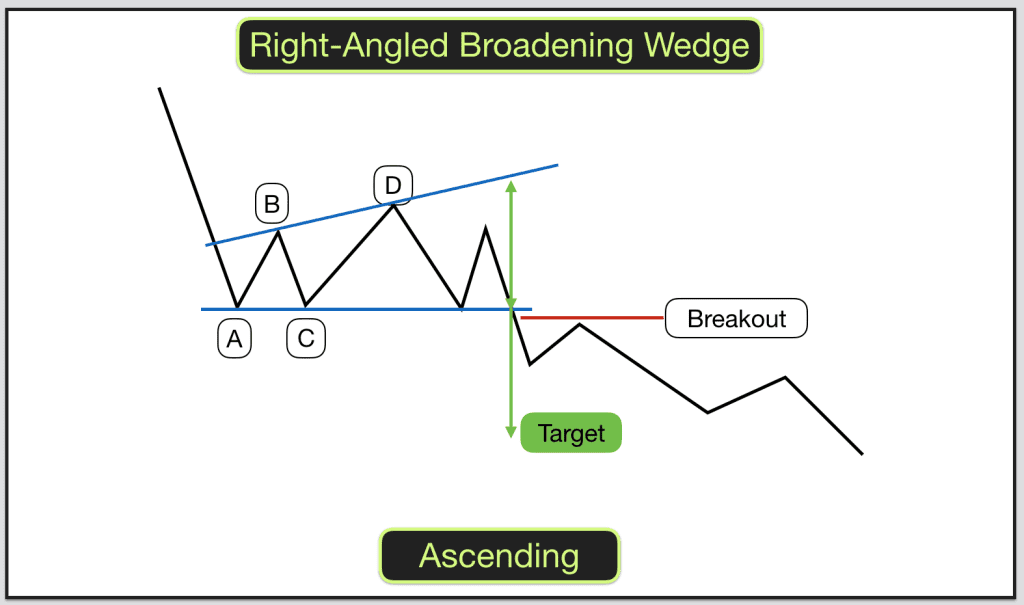

Expanding Wedge Pattern - The pattern is a reversal pattern, but if the correction passes the level of 88.6%, then it should be considered a trend continuation pattern. To form a descending wedge, the support and resistance lines have to both point in a downwards direction and the resistance line has to be steeper than the line of support. Recognizing this pattern involves identifying a. The critical value is 78.6%. Web the rising wedge pattern is one of the numerous tools in technical analysis, often signaling a potential move in the asset or broader market. In contrast to symmetrical triangles, which have no definitive slope and no bullish or bearish bias, rising wedges definitely slope up and have a bearish bias. Web a broadening formation is a technical chart pattern depicting a widening channel of high and low levels of support and resistance. The breakout direction from the wedge determines whether the price resumes the previous trend or moves in the same direction. This pattern can appear in both uptrends and downtrends and is used by traders to signal potential bullish or bearish price movements. Rising and falling wedges are a technical chart pattern used to predict trend continuations and trend reversals. Web also known as the expanding wedge pattern, it offers valuable clues about potential trend reversals and continuations. Broadening formations indicate increasing price volatility. Wave 3 is longer than wave 1. An ascending broadening wedge is a bearish chart pattern (said to be a reversal pattern). There are 2 types of wedges indicating price is in consolidation. Web updated 9/12/2023 10 min read. Web simple rules for expanding wedge formation are. An ascending broadening wedge is a specific type of this pattern, where the widening channel leans upward and is considered a bearish signal. The pattern is a reversal pattern, but if the correction passes the level of 88.6%, then it should be considered a trend continuation. To form a rising wedge, the support and resistance lines both have to point in an upwards direction and the support line has to be steeper than resistance. Web the falling wedge chart pattern is a recognisable price move that is formed when a market consolidates between two converging support and resistance lines. Web formation of the expanding wedge pattern. Web also known as the expanding wedge pattern, it offers valuable clues about potential trend reversals and continuations. Web the rising wedge is a bearish pattern that begins wide at the bottom and contracts as prices move higher and the trading range narrows. It is represented by two lines, one ascending and one descending, that diverge from each other. Web. Web the rising wedge pattern is one of the numerous tools in technical analysis, often signaling a potential move in the asset or broader market. When you encounter this formation, it signals that forex traders are still deciding where to take the pair next. Web there are 6 broadening wedge patterns that we can separately identify on our charts and. Whether you’re a seasoned trader or just starting out, this comprehensive guide will equip you with everything you need to know about this powerful chart pattern. Wave 4 is longer than wave 2. It is formed by two diverging bullish lines. An ascending broadening wedge is confirmed/valid if it has good oscillation between the two upward lines. An ascending broadening. An ascending broadening wedge is a specific type of this pattern, where the widening channel leans upward and is considered a bearish signal. It’s a powerful tool for traders looking to identify breakout opportunities in both bullish and bearish markets. Web quantvue jan 25, 2023. This wedge pattern forex traders recognize signals a potential bearish reversal pattern. Web also known. Web written by timothy sykes. Start investing with free expert advice! Web the key characteristic of the broadening wedge pattern is the expanding price fluctuation, which is indicative of increasing price volatility. This wedge could be either a rising wedge pattern or falling wedge pattern. Wedges signal a pause in the current trend. Web there are 6 broadening wedge patterns that we can separately identify on our charts and each provide a good risk and reward potential trade setup when carefully selected and used alongside other components to a successful trading strategy. The breakout direction from the wedge determines whether the price resumes the previous trend or moves in the same direction. Web. Web the rising wedge chart pattern is a recognisable price move that’s formed when a market consolidates between two converging support and resistance lines. Web what is an ascending broadening wedge? Web quantvue jan 25, 2023. The wedge pattern is a chart formation used in technical analysis to predict price movements. The first is rising wedges where price is contained. Web what is an ascending broadening wedge? Web updated 9/12/2023 10 min read. The critical value is 78.6%. This pattern can appear in both uptrends and downtrends and is used by traders to signal potential bullish or bearish price movements. The patterns may be considered rising or falling wedges depending on their direction. Web formation of the expanding wedge pattern is considered complete if after point 5 there is a rollback in the direction of 23.6%, 38.2%, etc. This wedge could be either a rising wedge pattern or falling wedge pattern. A technical chart pattern recognized by analysts, known as a broadening formation or megaphone pattern, is characterized by expanding price fluctuation. Broadening formations indicate increasing price volatility. The breakout direction from the wedge determines whether the price resumes the previous trend or moves in the same direction. Start investing with free expert advice! Web there are 6 broadening wedge patterns that we can separately identify on our charts and each provide a good risk and reward potential trade setup when carefully selected and used alongside other components to a successful trading strategy. Web in a wedge chart pattern, two trend lines converge. An ascending broadening wedge is a bearish chart pattern (said to be a reversal pattern). Web a wedge pattern is a popular trading chart pattern that indicates possible price direction changes or continuations. Wave 3 is longer than wave 1.

Expanding Wedge profitable Forex pattern Litefinance

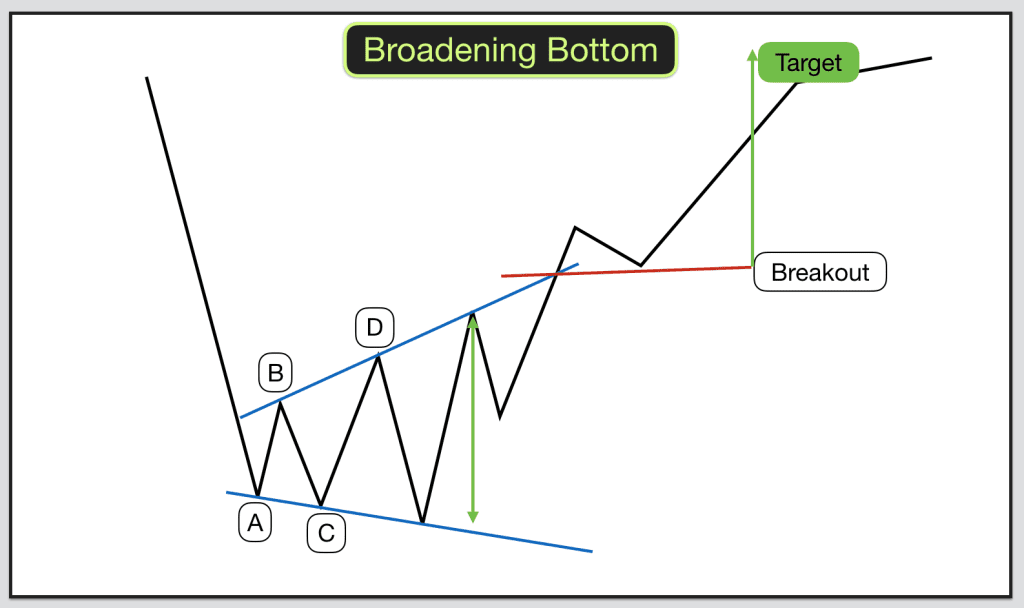

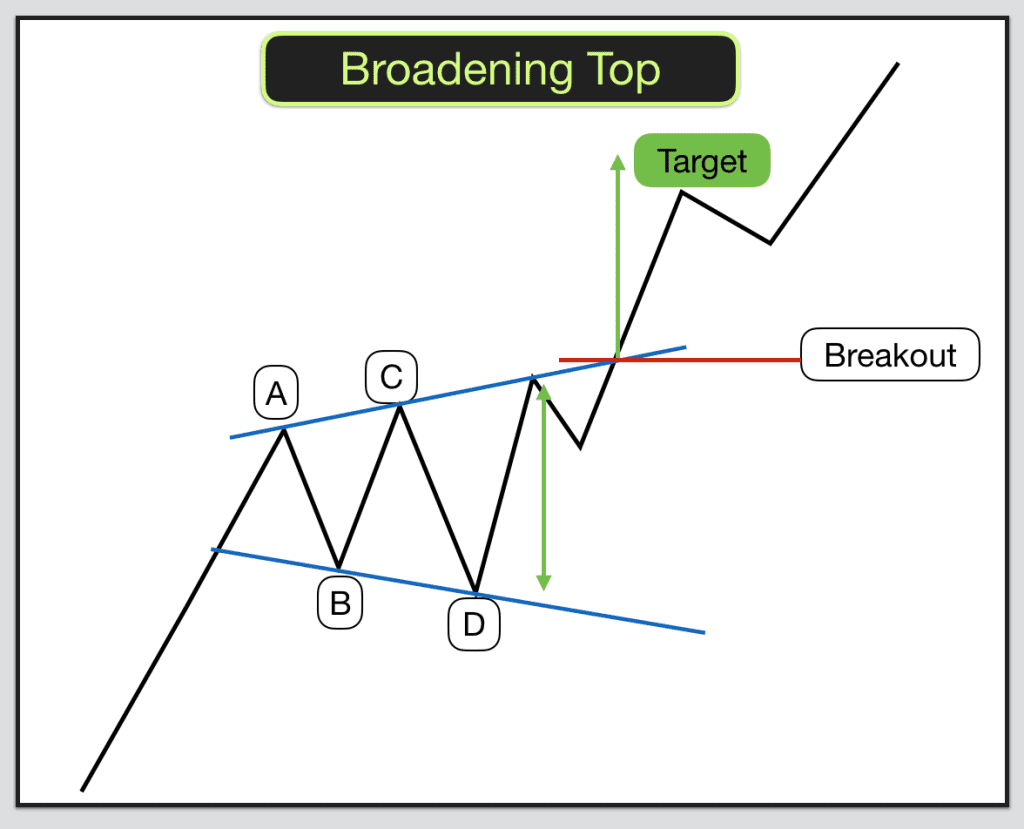

How to trade Wedges Broadening Wedges and Broadening Patterns

How to trade Wedges Broadening Wedges and Broadening Patterns

How to trade Wedges Broadening Wedges and Broadening Patterns

Broadening Wedge Pattern (Updated 2023)

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

Wedge Patterns How Stock Traders Can Find and Trade These Setups

Price Chart Patterns Archives Synapse Trading

Wedge Pattern Rising & Falling Wedges, Plus Examples

How to trade Wedges Broadening Wedges and Broadening Patterns

It Is Represented By Two Lines, One Ascending And One Descending, That Diverge From Each Other.

Today, We Will Uncover The Hidden Gem Of Trading Patterns:

In Contrast To Symmetrical Triangles, Which Have No Definitive Slope And No Bullish Or Bearish Bias, Rising Wedges Definitely Slope Up And Have A Bearish Bias.

The Broadening Wedge Pattern Is A Technical Chart Pattern Characterized By Diverging Trend Lines, Forming A Shape That Resembles A Widening Wedge.

Related Post: