Expanding Triangle Pattern

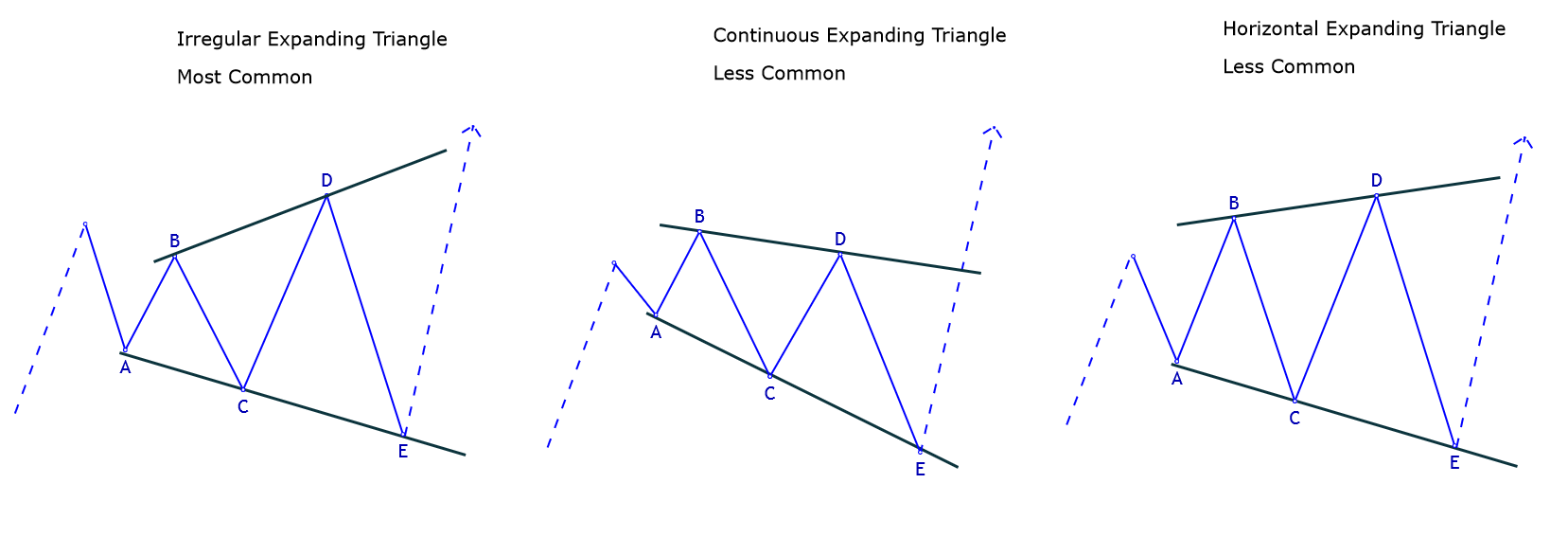

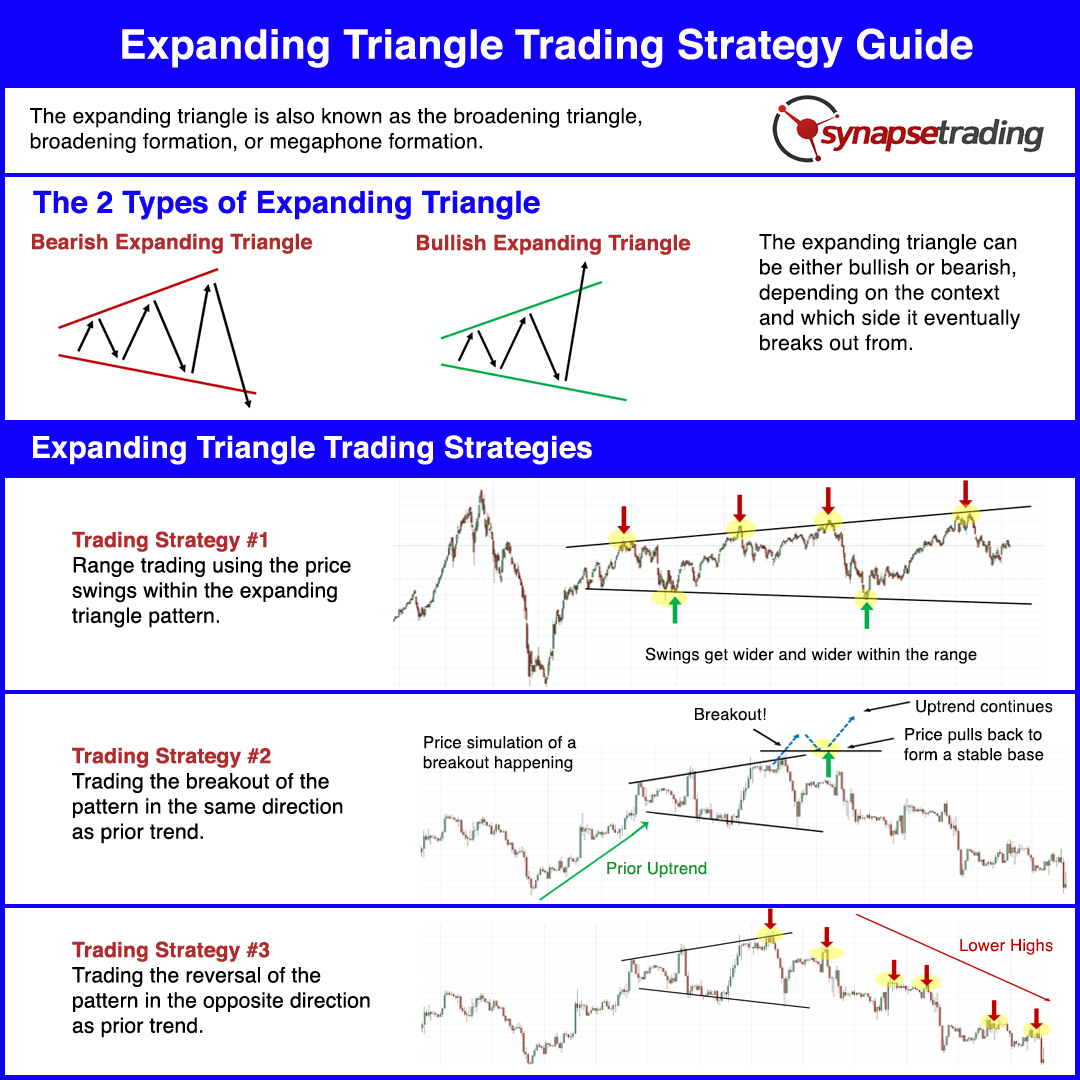

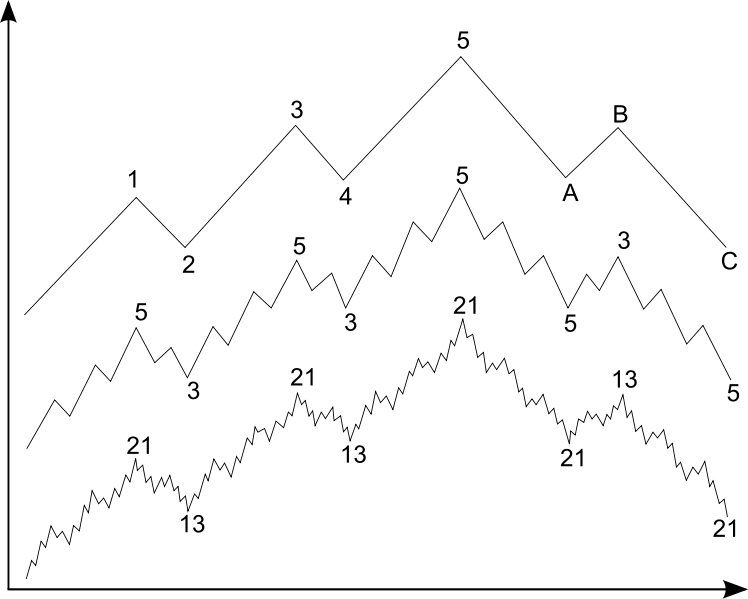

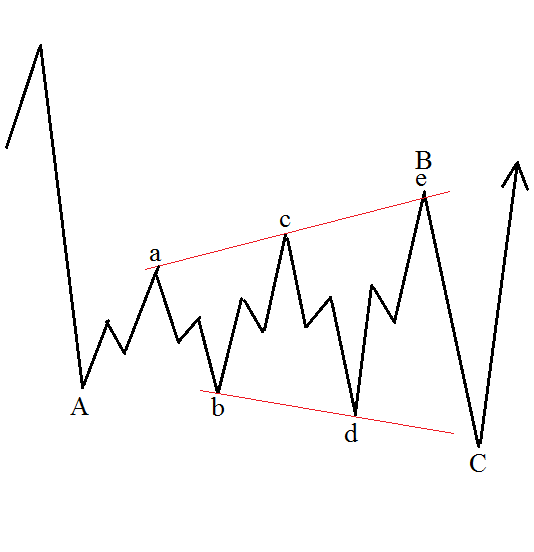

Expanding Triangle Pattern - Look for a trend of higher highs and lower lows or lower highs and higher lows. It is used to trade. Web a broadening formation is a technical chart pattern of two diverging trend lines, one rising and one falling, that indicate increasing price volatility. Web expanding triangles are the exception because they can show the opposite characteristics of increasing volatility and more active trading conditions. Web revealing the underlying rule. Web to identify an expanding triangle pattern, follow these steps: Web learning how to trade the expanding trianglefull free course: An expanding triangle can be either a reversal or a continuation pattern and is made of at least five swings (sometimes seven, and rarely. Web an expanding triangle is a unique triangle pattern that differs from other triangle patterns, such as symmetrical, ascending, and descending. This provides clues on the likely breakout direction. Web an ascending triangle is a chart pattern used in technical analysis. He explains, take type 1 as an example; Web have you faced a market where there are large price swings and high volatility? Web here are some key tips: Web learn how to identify and use the expanding triangle pattern, a technical analysis tool that signals increased price. Find out the characteristics, rules, and examples of this pattern. Make summertime all about relaxation and adventure! Look for a trend of higher highs and lower lows or lower highs and higher lows. Web learning how to trade the expanding trianglefull free course: Web a broadening formation is a technical chart pattern of two diverging trend lines, one rising and. Web an expanding triangle is a unique triangle pattern that differs from other triangle patterns, such as symmetrical, ascending, and descending. He explains, take type 1 as an example; Web an ascending triangle is a chart pattern used in technical analysis. Web a broadening formation is a technical chart pattern of two diverging trend lines, one rising and one falling,. Web a broadening formation is a technical chart pattern of two diverging trend lines, one rising and one falling, that indicate increasing price volatility. Web expanding triangles are the exception because they can show the opposite characteristics of increasing volatility and more active trading conditions. Most rules are the same as for contracting triangles, with these differences: Web an expanding. Web an expanding triangle is a unique triangle pattern that differs from other triangle patterns, such as symmetrical, ascending, and descending. An expanding triangle can be either a reversal or a continuation pattern and is made of at least five swings (sometimes seven, and rarely. A square is first divided. It is created by price moves that allow for a. Web learn how to identify and use the expanding triangle pattern, a technical analysis tool that signals increased price volatility and potential breakouts. Make summertime all about relaxation and adventure! Web revealing the underlying rule. A square is first divided. Web to identify an expanding triangle pattern, follow these steps: Web an ascending triangle is a chart pattern used in technical analysis. Web wave e is a simple, double, or triple zigzag pattern, or a triangle. Look for a trend of higher highs and lower lows or lower highs and higher lows. Discover 3 strategies to exploit the wide swings, breakouts, and reversals of this uncertain and volatile pattern. Make. Web learn how to identify and use the expanding triangle pattern, a technical analysis tool that signals increased price volatility and potential breakouts. Discover 3 strategies to exploit the wide swings, breakouts, and reversals of this uncertain and volatile pattern. Look for a trend of higher highs and lower lows or lower highs and higher lows. It is used to. Learn how to trade the expanding triangle pattern, a price chart pattern that sees prices moving further and further away from each line in the pattern. It is created by price moves that allow for a horizontal line to be drawn along the swing highs. Web to identify an expanding triangle pattern, follow these steps: Web the expanding triangle is. Most rules are the same as for contracting triangles, with these differences: Learn how to trade the expanding triangle pattern, a price chart pattern that sees prices moving further and further away from each line in the pattern. Web an expanding triangle is a unique triangle pattern that differs from other triangle patterns, such as symmetrical, ascending, and descending. Make. Here are my favorite free sewing. It is used to trade. Discover 3 strategies to exploit the wide swings, breakouts, and reversals of this uncertain and volatile pattern. Web an expanding triangle can be either a reversal or a continuation pattern and is made of at least five swings (sometimes seven, and rarely nine), each one greater. Web learn how to identify and trade the expanding triangle pattern, a corrective formation in the elliott wave theory. It is created by price moves that allow for a horizontal line to be drawn along the swing highs. Web the expanding triangle is a technical pattern formed by two points of resistance and support, with two opposite trend lines widening as price moves. Web revealing the underlying rule. Web a broadening formation is a technical chart pattern of two diverging trend lines, one rising and one falling, that indicate increasing price volatility. An expanding triangle can be either a reversal or a continuation pattern and is made of at least five swings (sometimes seven, and rarely. Web an ascending triangle is a chart pattern used in technical analysis. How do you profit from such markets?the expanding triangle pattern is one suc. Web have you faced a market where there are large price swings and high volatility? Most rules are the same as for contracting triangles, with these differences: Wave c, d, and e each move beyond the. Web while a contracting triangle, like the name suggests, is contracting (meaning the waves are smaller than the previous wave) there is another type of triangles, called expanding.

Your detailed guide to the Elliott Wave expanding triangle pattern

How to Trade the Expanding Triangle Pattern for Maximum Profits

Expanding Triangle Pattern Trading Strategy Guide (Updated 2024

Expanding Triangle How to trade with this price pattern? Forex Dominion

Expanding Triangle Pattern Trading Strategy Guide (Updated 2023

Expanding Triangle Pattern Trading Strategy Guide (Updated 2024

Expanding Triangle Pattern Trading Strategy Guide (Updated 2024

A Thorough Guide to the Elliott Wave Expanding Triangle Pattern

Your detailed guide to the Elliott Wave expanding triangle pattern

Expanding Triangle Pattern Trading Strategy Guide (Updated 2023

Learn How To Trade The Expanding Triangle Pattern, A Price Chart Pattern That Sees Prices Moving Further And Further Away From Each Line In The Pattern.

This Pattern Is Formed In A Position Prior To The.

Look For A Trend Of Higher Highs And Lower Lows Or Lower Highs And Higher Lows.

He Explains, Take Type 1 As An Example;

Related Post: