Expanding Chart Pattern

Expanding Chart Pattern - About 79% have beaten profit. Generally, the pattern is broken after 5 hits of the resistance trend lines. Web with friends like post malone and morgan wallen, look no further for some help having a good time. Web the megaphone pattern is characterized by a series of higher highs and lower lows on a trading chart. A pattern that occurs during high volatility, when a security shows great movement with little direction. On joining the highs and lows with lines, a diverging pattern is seen on the chart. Prices create higher highs and lower lows in a broadening pattern, then the trading range narrows after peaking highs and uptrending lows trend. The broadening tops is a significant reversal pattern that comprises three extending resistance trend lines. This is where the 50% has to be hit for the move to be complete. Technical analysis of price charts bar by bar for the serious trader [book] This pattern typically appears after a significant increase or decrease in security prices. The technical outlook is distinctly promising. The black horizontal arrow indicates the price level which serves as the minimum profit target for the expanding triangle pattern breakout. Web a global view —global relative abundance and range maps for 1,009 species; The expanding triangle is another broadening formation. Web a global view —global relative abundance and range maps for 1,009 species; Bearish expanding triangle pattern is a bearish reversal chart pattern, the price forms lower lows and higher highs, indicating that sellers are becoming more aggressive while buyers are losing momentum. This divergence leads to wider price swings, higher highs, and lower lows, ultimately. There are two types. It can occur in both. It is represented by two lines, one ascending and one descending, that diverge from each other. Web the various triangle chart patterns are popular technical analysis indicators used by traders of all types of assets and derivatives. The breakout direction signals the resolution to a new trend—upward (diamond bottom) or It represents a concurrent movement. The 7% rally in the csi 300 index. Web an expanding triangle is a unique triangle pattern that differs from other triangle patterns such as the symmetrical, ascending, and descending triangles. It represents a concurrent movement that is about the be broken. Web the timeframe of these patterns includes a few weeks to many months. Web ultimately, being able to. Web a technical chart pattern recognized by analysts, known as a broadening formation or megaphone pattern, is characterized by expanding price fluctuation. The expanding triangle is a very tricky pattern, because price is making new lows and new highs in each wave. Diverging upper and lower trendlines as volatility. This is where the 50% has to be hit for the. This divergence leads to wider price swings, higher highs, and lower lows, ultimately. Web a technical chart pattern recognized by analysts, known as a broadening formation or megaphone pattern, is characterized by expanding price fluctuation. The pattern resembles a megaphone, with price action expanding as the pattern develops. Web there are 6 broadening wedge patterns that we can separately identify. It is formed when the prices forge higher highs and lower lows consecutively. Web a global view —global relative abundance and range maps for 1,009 species; Web the expanding triangle pattern is formed by two converging trendlines, with one being a horizontal resistance level and the other being an upward sloping support level. This pattern exhibits a broadening formation, indicating. Web the expanding triangle pattern is formed by two converging trendlines, with one being a horizontal resistance level and the other being an upward sloping support level. Web bearish expanding triangle pattern. Diverging upper and lower trendlines as volatility. The expanding triangle is another broadening formation with diverging trend lines that may take longer to form than other triangles. This. Web this will depend on the respective one of the elliott wave charts. Ebirders filled in data gaps. The 7% rally in the csi 300 index. The expanding triangle is another broadening formation with diverging trend lines that may take longer to form than other triangles. Web a global view —global relative abundance and range maps for 1,009 species; Web there are 6 broadening wedge patterns that we can separately identify on our charts and each provide a good risk and reward potential trade setup when carefully selected and used alongside other components to a successful trading strategy. This volatile pattern is formed when at least two higher highs and two lower lows are created from five distinct swings.. The formation is identified by a series of higher pivot highs and. Prices create higher highs and lower lows in a broadening pattern, then the trading range narrows after peaking highs and uptrending lows trend. While the other triangle patterns have converging lines, the expanding triangle has diverging lines. 36.1 million ebird checklists —a 28% increase in number of checklists. Web this is the billboard hot 100 for the week dated may 18. A pattern that occurs during high volatility, when a security shows great movement with little direction. This is where the 50% has to be hit for the move to be complete. Web with friends like post malone and morgan wallen, look no further for some help having a good time. Web trade example number 2. The breakout direction signals the resolution to a new trend—upward (diamond bottom) or The black horizontal arrow indicates the price level which serves as the minimum profit target for the expanding triangle pattern breakout. Web chapter 6 expanding triangles an expanding triangle can be either a reversal or a continuation pattern and is made of at least five swings (sometimes seven, and rarely nine), each. Web the expanding triangle pattern is a unique chart formation commonly found in technical analysis. Generally, the price tries to continue in a bullish direction preceding the breakout. Technical analysis of price charts bar by bar for the serious trader [book] Web this will depend on the respective one of the elliott wave charts.

Expanding Triangle How to trade with this price pattern? Forex Dominion

Expanding Triangle Forex Trading Technical Analysis Stock

How to Trade the Expanding Triangle Pattern for Maximum Profits

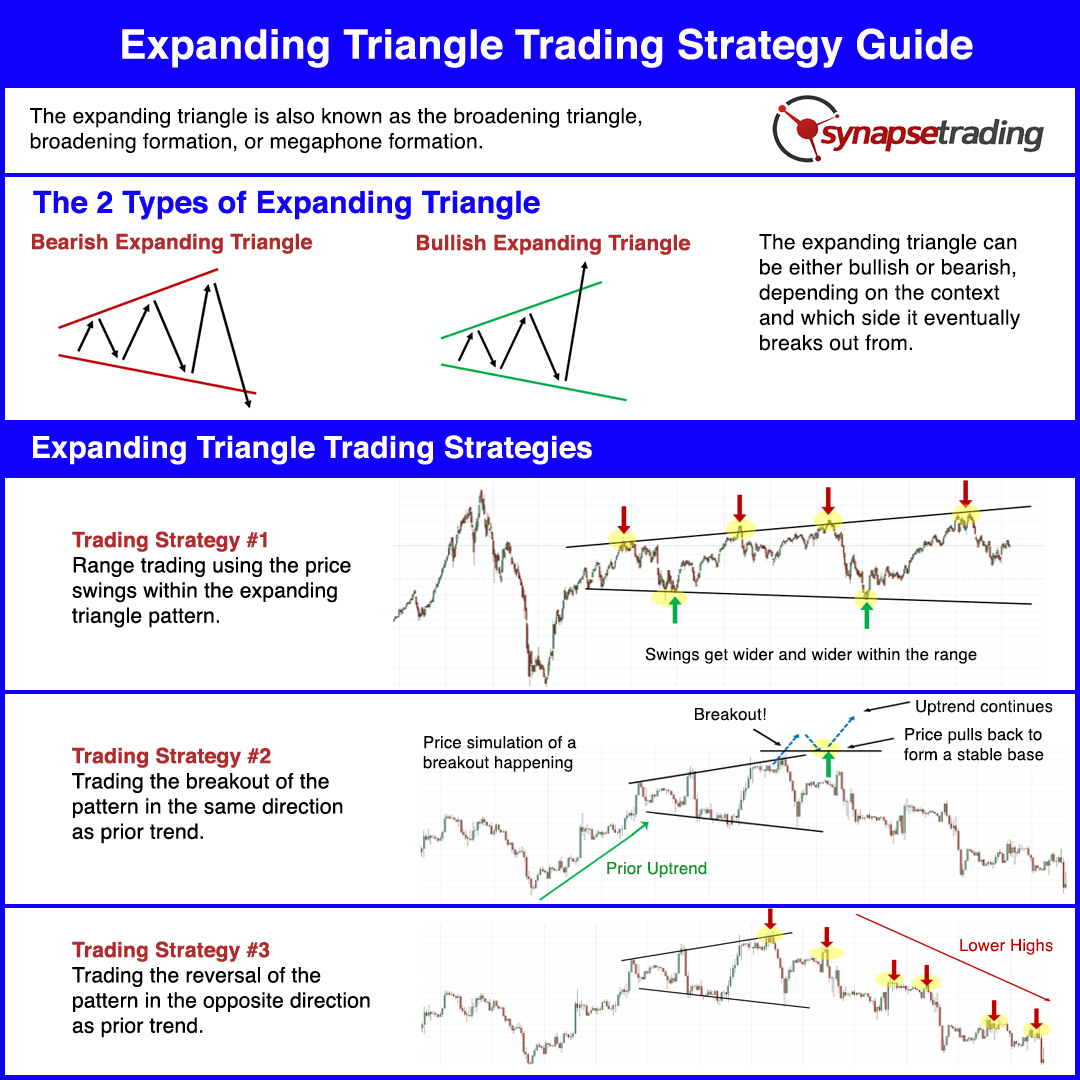

Expanding Triangle Pattern Trading Strategy Guide (Updated 2024

Expanding Triangle Pattern Trading Strategy Guide (Updated 2024

Expanding Triangle Pattern Trading Strategy Guide (Updated 2023

Expanding Triangle Pattern Trading Strategy Guide (Updated 2023

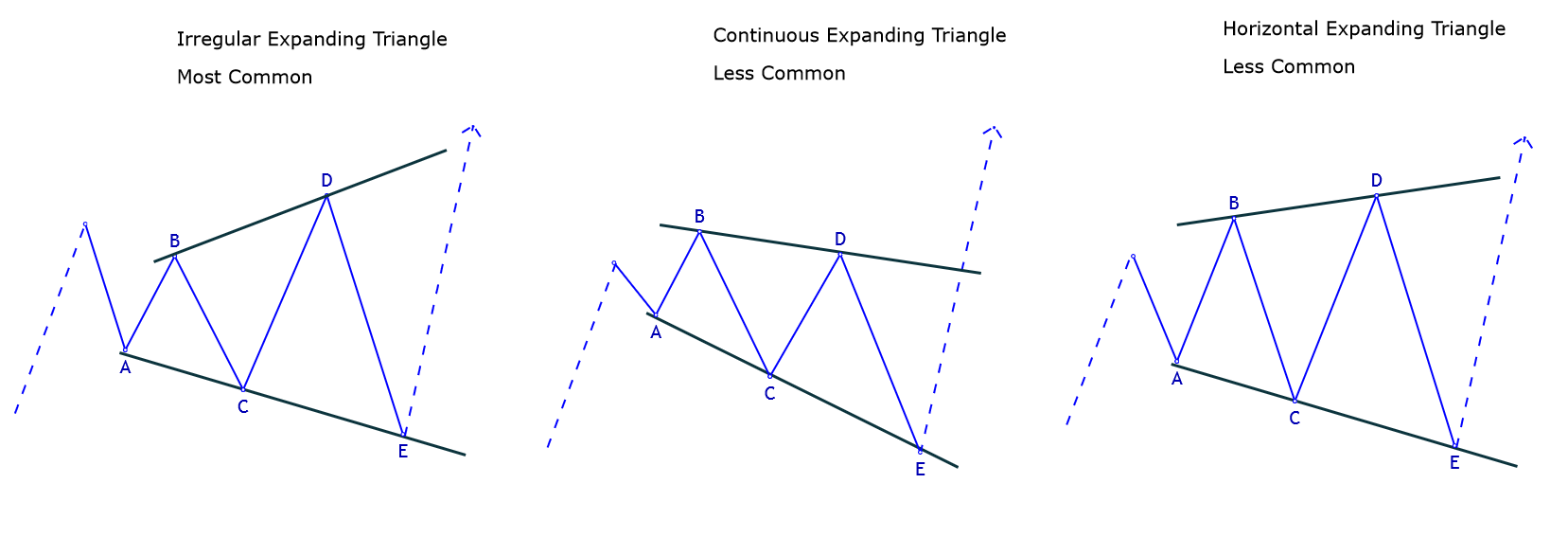

Your detailed guide to the Elliott Wave expanding triangle pattern

Expanding Triangle Pattern Trading Strategy Guide (Updated 2023

Expanding Wedge Forex System Forex Trading Strategies

Web Kendrick Lamar, “Meet The Grahams” (Pglang/Interscope/Iclg):

Web Bearish Expanding Triangle Pattern.

11 Million Unique Locations— An Additional 4 Million.

Web In The Chart Above, The Maximum Height Of The Expanding Triangle Is Indicated By The Blue Rectangular Box, Which Is Then Used As A Price Projection At The Breakout Point.

Related Post: