Excel Template Credit Card Payoff

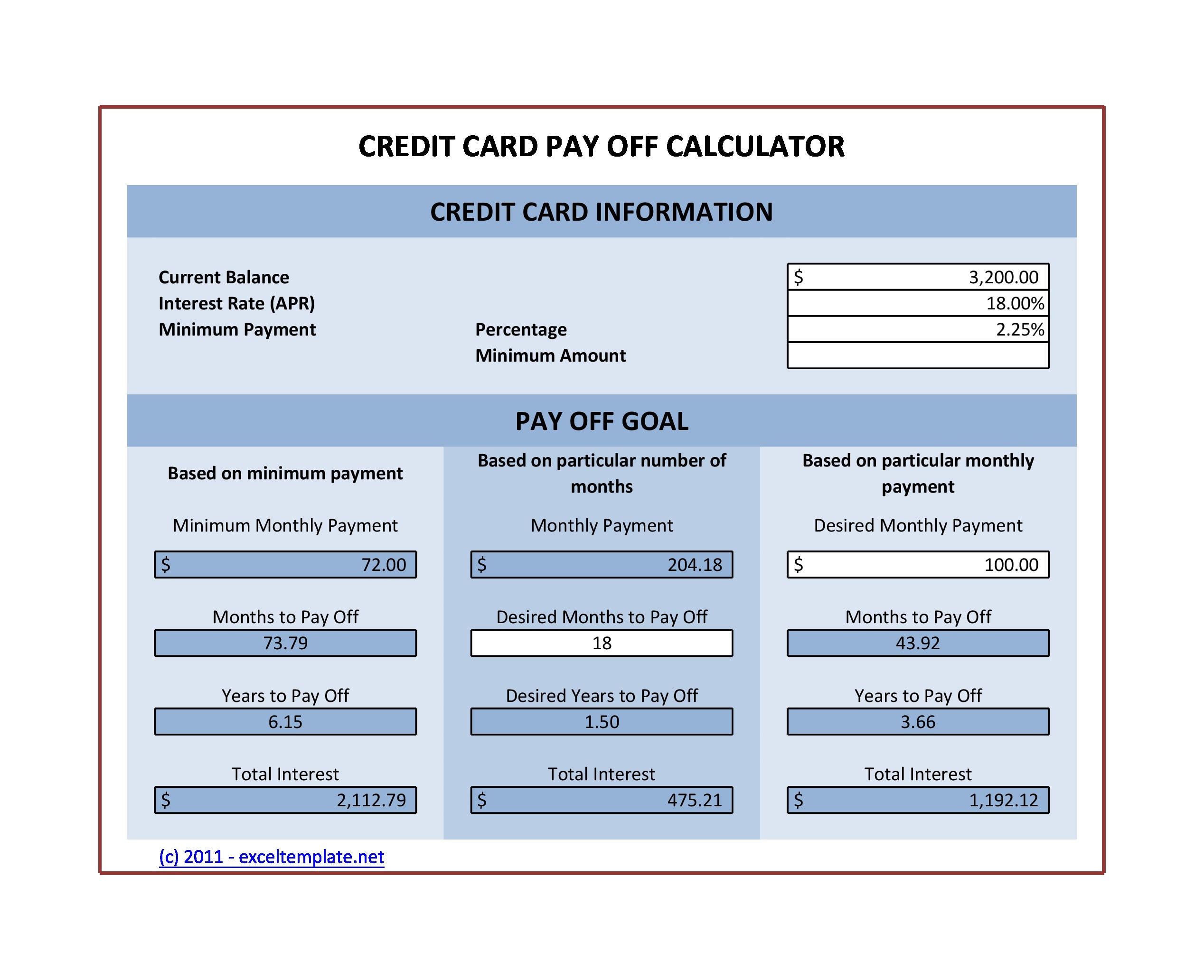

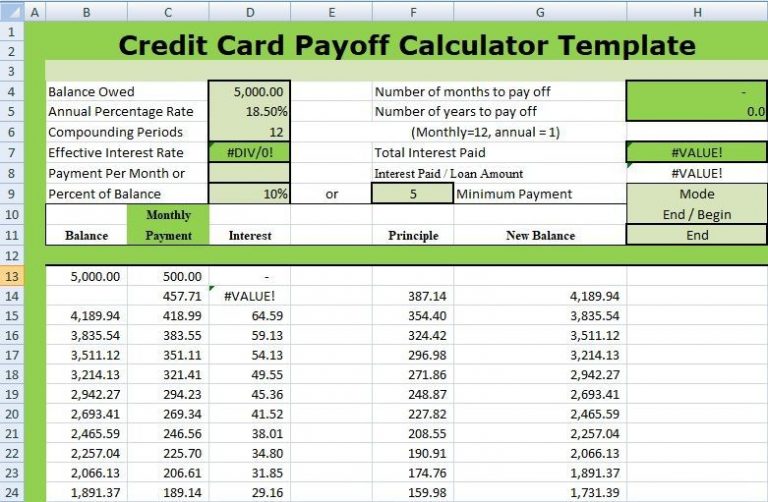

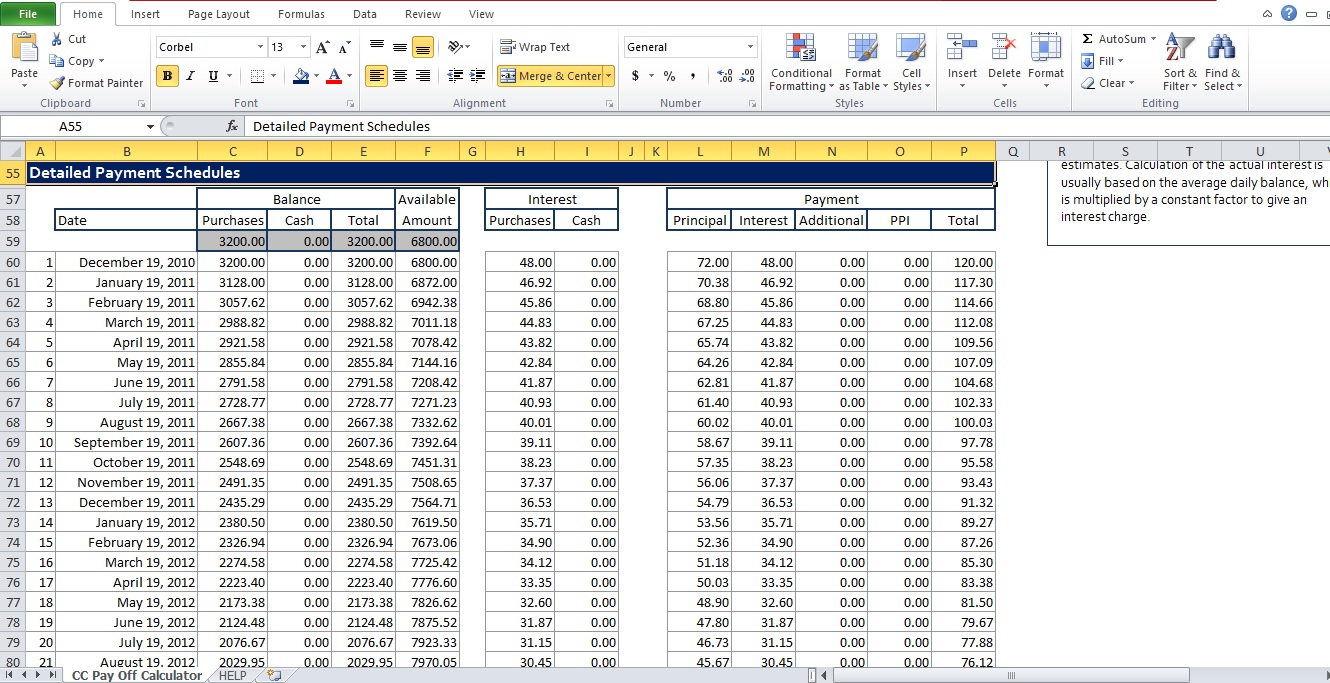

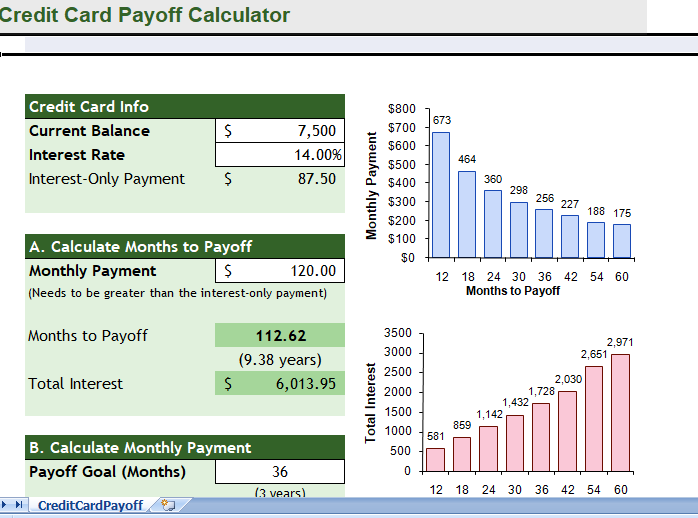

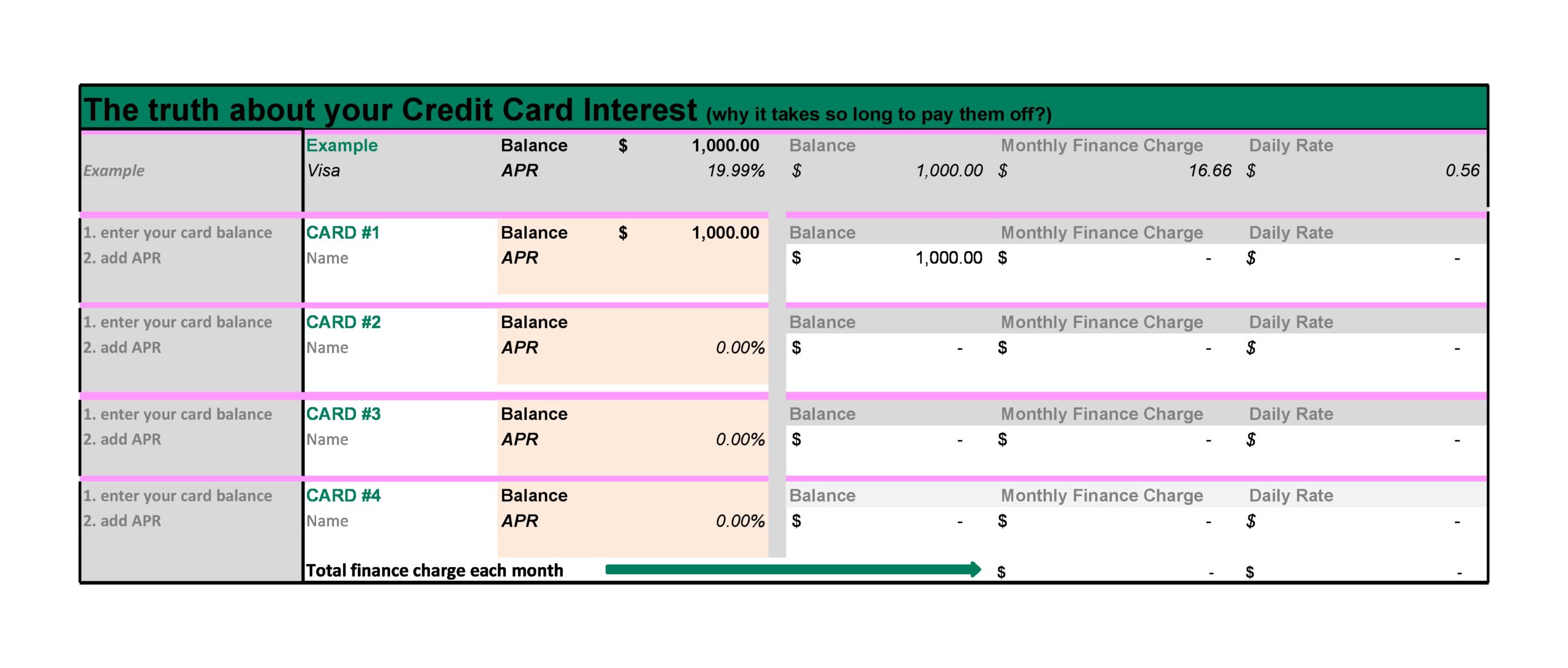

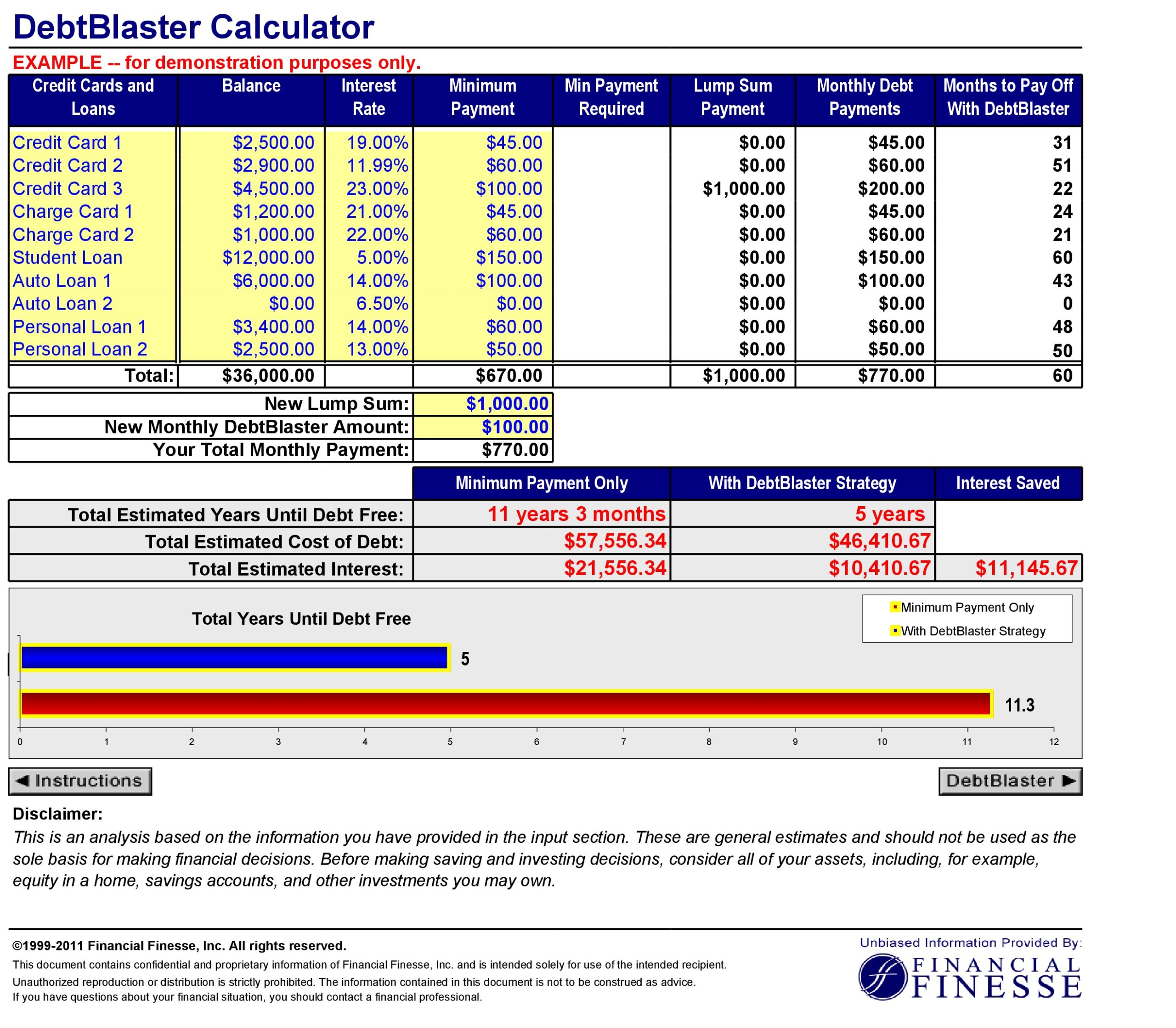

Excel Template Credit Card Payoff - Web feeling suffocated by a sizable debt load? We consider $10,000 as the current. You can use a debt calculator excel to make. Web in this video, i'll guide you through two methods to create a credit card payoff spreadsheet in excel. 3) add a column for months and extra. This template consists helps you calculate months to pay off your debt based on the mode you choose for payment. Web figure out the monthly payments to pay off a credit card debt. Using the function pmt (rate,nper,pv) =pmt (17%/12,2*12,5400) the result is a monthly payment of $266.99 to pay the debt off in two. Built with smart formulas, formatting, and dynamic tables, you can view credit payoff performance to stay on top of your personal finances. Web paying your credit card in full possibly saves you some money in interest and keeps your credit record healthy. Get rid of your credit card debt asap with our excel tools. Using the function pmt (rate,nper,pv) =pmt (17%/12,2*12,5400) the result is a monthly payment of $266.99 to pay the debt off in two. The debt payoff template from medium for google. Download the credit card payoff calculator for free and learn to escape crushing credit card debt. Web in. Web 1) open a blank page in google sheets or excel. Web figure out the monthly payments to pay off a credit card debt. Get rid of your credit card debt asap with our excel tools. Built with smart formulas, formatting, and dynamic tables, you can view credit payoff performance to stay on top of your personal finances. Firstly, type. This template consists helps you calculate months to pay off your debt based on the mode you choose for payment. Create a table named credit card information. Built with smart formulas, formatting, and dynamic tables, you can view credit payoff performance to stay on top of your personal finances. Web paying your credit card in full possibly saves you some. Firstly, type the following fields. Excel and google sheets template. Web track and map your credit card payments with our credit card payoff calculator excel template. Personal use (not for distribution or resale) description. This template consists helps you calculate months to pay off your debt based on the mode you choose for payment. This template consists helps you calculate months to pay off your debt based on the mode you choose for payment. Web figure out the monthly payments to pay off a credit card debt. Web in this video, i'll guide you through two methods to create a credit card payoff spreadsheet in excel. Credit card debt payoff spreadsheet for calculating your. Download the credit card payoff calculator for free and learn to escape crushing credit card debt. Let’s input some sample data in the range of cells c10:c11 to check the accuracy of our formula. This type of spreadsheet can help you. Web how to create a credit card payoff calculator in excel. Nobody wants to pay 25% interest. Get rid of your credit card debt asap with our excel tools. Built with smart formulas, formatting, and dynamic tables, you can view credit payoff performance to stay on top of your personal finances. 3) add a column for months and extra. Debt payoff template from medium for google sheets. 2) list your debts across the top with your balance,. Web feeling suffocated by a sizable debt load? 3) add a column for months and extra. 2) list your debts across the top with your balance, minimum payment, and interest rates. Using the function pmt (rate,nper,pv) =pmt (17%/12,2*12,5400) the result is a monthly payment of $266.99 to pay the debt off in two. Web free credit card payoff calculator: Personal use (not for distribution or resale) description. Web how to create a credit card payoff calculator in excel. Built with smart formulas, formatting, and dynamic tables, you can view credit payoff performance to stay on top of your personal finances. Creating a credit card payoff spreadsheet in excel can be a highly effective way to track and manage your. Web in this video, i'll guide you through two methods to create a credit card payoff spreadsheet in excel. Nobody wants to pay 25% interest. 3) add a column for months and extra. Web paying your credit card in full possibly saves you some money in interest and keeps your credit record healthy. Nothing else will be purchased on the. Web 1) open a blank page in google sheets or excel. Track multiple debts with a. Nobody wants to pay 25% interest. Web free credit card payoff calculator: Web with this free credit card payment calculator template, you can plug in your balance, interest rate, and your expected monthly payment (either fixed or as a. Nothing else will be purchased on the card while the debt is being paid off. Web in this video, i'll guide you through two methods to create a credit card payoff spreadsheet in excel. Web figure out the monthly payments to pay off a credit card debt. You'll learn about creating a credit card payoff sprea. Personal use (not for distribution or resale) description. Firstly, type the following fields. Web how to create a credit card payoff calculator in excel. Web feeling suffocated by a sizable debt load? This type of spreadsheet can help you. Let’s input some sample data in the range of cells c10:c11 to check the accuracy of our formula. Web paying your credit card in full possibly saves you some money in interest and keeps your credit record healthy.

30 Credit Card Payoff Spreadsheets (Excel) TemplateArchive

EXCEL of Credit Card Payoff Calculator.xlsx WPS Free Templates

credit card payoff ExcelTemplate

Printable Credit Card Payoff Spreadsheet

Credit Card Payoff Calculator Excel Template Excel TMP

Free Credit Card Payoff Calculator for Excel

Credit card payoff calculator excel template for free

30 Credit Card Payoff Spreadsheets (Excel) TemplateArchive

Pay Off Credit Card Excel Template

Excel Credit Card Payoff Calculator and Timeline Easy Etsy

Web How To Create Credit Card Payoff Calculator With Snowball In Excel.

The Debt Payoff Template From Medium For Google.

Creating A Credit Card Payoff Spreadsheet In Excel Can Be A Highly Effective Way To Track And Manage Your Debt Repayment.

3) Add A Column For Months And Extra.

Related Post: