Evening Star Candlestick Pattern

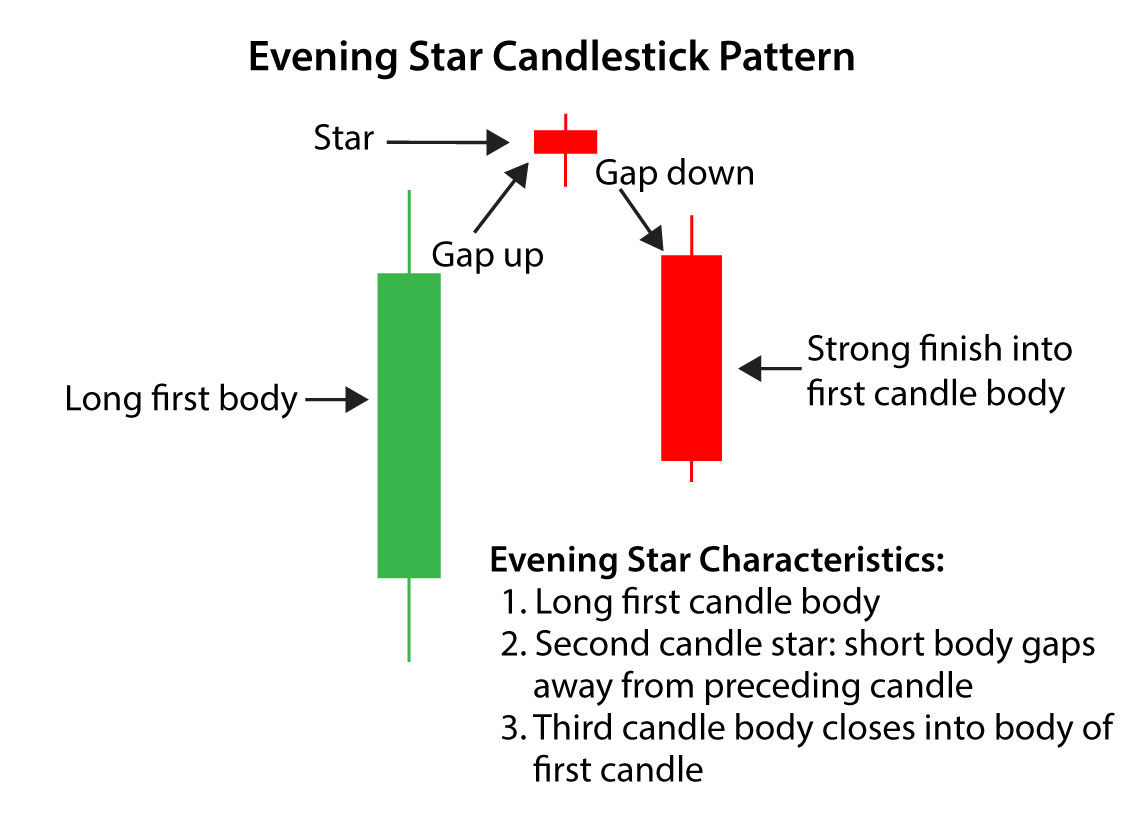

Evening Star Candlestick Pattern - Web the evening star candlestick is a bearish reversal pattern that often forms at the end of an uptrend. An evening star is a bearish candlestick pattern consisting of three candles that have demonstrated the following characteristics: This pattern consists of three distinct candles, each with specific characteristics. Web the evening star is a bearish reversal pattern in technical analysis that is identified by a tall bullish candle followed by a small candle that gaps above the first candle, and then a third candle that is bearish and closes below the midpoint of the first candle. Web the evening star pattern consists of three candlesticks, unlike a singular candlestick pattern like the doji or hammer, for example. As such, it usually appears at the end of an uptrend and beginning of a downtrend. Aptly named because it appears just before darkness sets in, the evening star is a bearish signal. In fact, it was so strong that the close was the same as the high (very bullish sign). Therefore, traders use it to either sell an existing long position or enter a new short position. Basically, the evening star is similar to a dark cloud cover with a star in the middle. Web evening star is a reliable bearish reversal candlestick pattern with a success rate of about 70.2%. A long bullish candle, followed by a short candle or a doji that gaps above the first candle, and finally a long bearish candle that falls into the body of the first candle. Trading the evening star with moving averages. This pattern is. The low of the preceding candle is higher than the low of the current session, and this gap is filled on the opening of. First of all it is formed at an. Web the evening star candle pattern is a bearish reversal signal in technical analysis, providing traders with potential insight into market momentum shifts. 4.1 three white soldiers and. For instance, when the pattern appears near a strong resistance level, there is always a strong likelihood that the price will correct from the. Day 2 continued day 1’s bullish sentiment by gapping up. A long bullish candle, followed by a short candle or a doji that gaps above the first candle, and finally a long bearish candle that falls. Web we see the evening star candlestick pattern on the tesla (tsla) november 23rd, 2021, daily chart. The pattern begins with a large bullish candle. A long bullish candle, followed by a short candle or a doji that gaps above the first candle, and finally a long bearish candle that falls into the body of the first candle. Evening star. This pattern can help you make informed decisions and capture profitable trades correctly. Web the evening star candlestick formation is the reverse of the morning star. Web the evening star candlestick pattern holds significant importance in technical analysis for several reasons: An evening star is a bearish candlestick pattern consisting of three candles that have demonstrated the following characteristics: It. Basically, the evening star is similar to a dark cloud cover with a star in the middle. Web the evening star candlestick pattern is a reliable bearish reversal pattern with a success rate of roughly about 70.2%. Web the evening star candlestick pattern holds significant importance in technical analysis for several reasons: 6.1 #1 set the right chart time frame;. This pattern typically indicates a potential reversal from an uptrend to a downtrend. Web evening star is a reliable bearish reversal candlestick pattern with a success rate of about 70.2%. However, day 2 was a doji, which is a candlestick signifying indecision. Millions of americans were able to see the magical glow of the northern lights on friday night when. In fact, it was so strong that the close was the same as the high (very bullish sign). 6.1 #1 set the right chart time frame; A rising window pattern formed at a high trading volume is followed by an evening star pattern and the bears are in control pushing price downward. The three candlesticks are typically found at important. For instance, when the pattern appears near a strong resistance level, there is always a strong likelihood that the price will correct from the. The three candlesticks are typically found at important market highs, and the pattern forms when you see a green candlestick moving higher, followed by a second candlestick with a much smaller body (which could be. Web. Consisting of three candles, the pattern usually forms at the end of an uptrend, suggesting a possible downturn in the market. The three candlesticks are typically found at important market highs, and the pattern forms when you see a green candlestick moving higher, followed by a second candlestick with a much smaller body (which could be. A large bullish candle,. Web the evening star is a bearish reversal pattern in technical analysis that is identified by a tall bullish candle followed by a small candle that gaps above the first candle, and then a third candle that is bearish and closes below the midpoint of the first candle. Correctly spotting reversals is crucial when trading financial. Evening star patterns appear at the top of a price uptrend, signifying that the uptrend is nearing its end. However, day 2 was a doji, which is a candlestick signifying indecision. Using additional technical indicators improves its ability to forecast bearish reversals. May 11, 2024 / 8:24 pm edt / cbs news. A rising window pattern formed at a high trading volume is followed by an evening star pattern and the bears are in control pushing price downward. For instance, when the pattern appears near a strong resistance level, there is always a strong likelihood that the price will correct from the. It consists of three candles: Millions of americans were able to see the magical glow of the northern lights on friday night when a powerful geomagnetic storm reached earth. Aptly named because it appears just before darkness sets in, the evening star is a bearish signal. 4.1 three white soldiers and black crows; As such, it usually appears at the end of an uptrend and beginning of a downtrend. The low of the preceding candle is higher than the low of the current session, and this gap is filled on the opening of. Its success rate in predicting bearish reversal is enhanced by using other technical indicators. Basically, the evening star is similar to a dark cloud cover with a star in the middle.

What Is Evening Star Candlestick Pattern? Meaning And How To Trade

What Is Evening Star Candlestick Pattern? Meaning And How To Trade

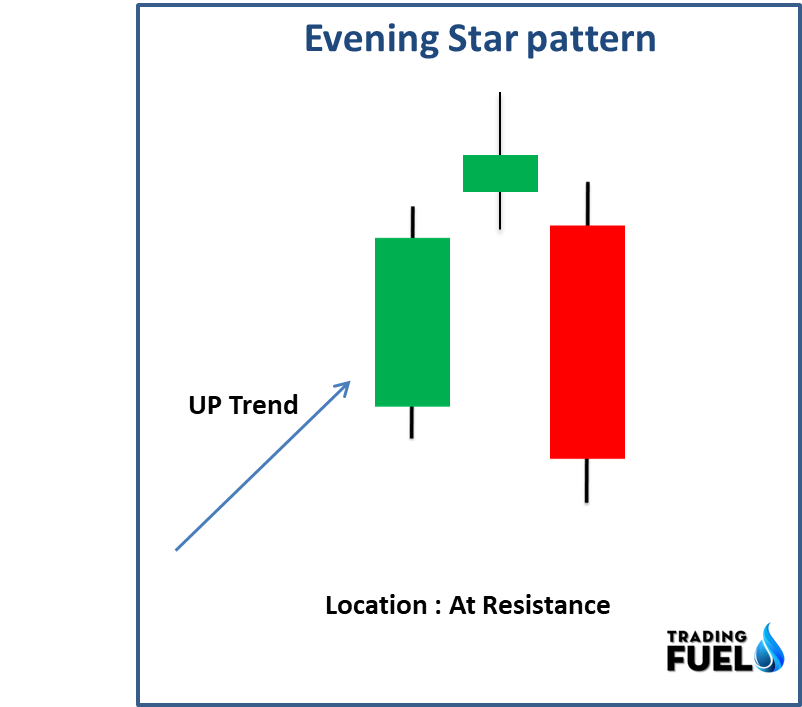

Evening Star Candlestick pattern How to Identify Perfect Evening Star

Evening Star Candlestick Pattern Trading Fuel

What Is Evening Star Candlestick Pattern? Meaning And How To Trade

Evening Star Candlestick Pattern And How To Trade Forex Most

Evening Star Definition and Use Candlestick Pattern

Evening Star Definition and Use Candlestick Pattern

What Is Evening Star Candlestick Pattern? Meaning And How To Trade

Evening Star Candlestick Pattern How to Trade It in 7 Steps Timothy

This Pattern Can Help You Make Informed Decisions And Capture Profitable Trades Correctly.

This Is Particularly Valuable For Traders And Investors Looking To Anticipate And Respond To Market Trend.

Web The Evening Star Candlestick Pattern Is A Significant Technical Analysis Pattern Used By Traders And Analysts To Identify Potential Trend Reversals In Financial Markets.

Web The Evening Star Pattern Consists Of Three Candlesticks, Unlike A Singular Candlestick Pattern Like The Doji Or Hammer, For Example.

Related Post: