Engulfing Candlestick Pattern

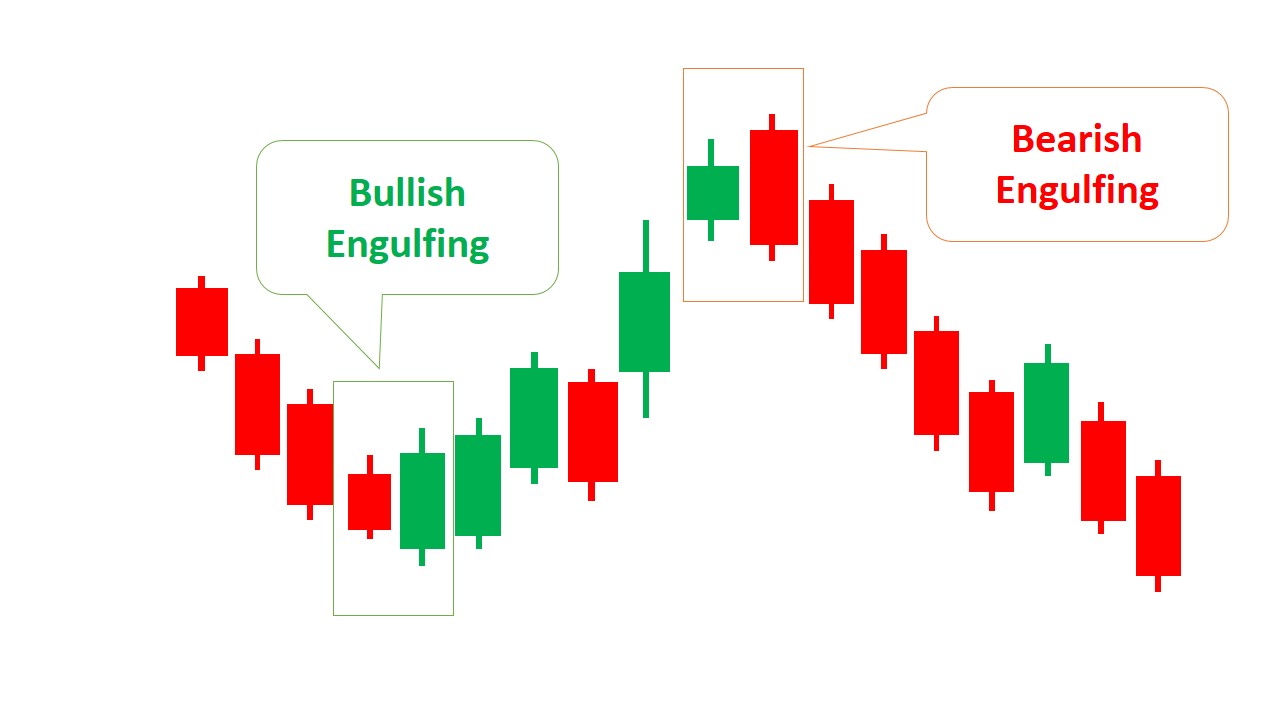

Engulfing Candlestick Pattern - Web the engulfing pattern is the first multiple candlestick patterns that we need to look into. The body of the second candle must engulf the body of the first candle. Here’s how to recognize them: They are popular candlestick patterns because they are easy to spot and trade. Bullish that forms at the bottom of a trend and bearish establishing at the top. Web this technical pattern, characterized by a red candlestick engulfing the preceding bullish candlestick, is widely regarded as one of the most bearish signals in the market, indicating a potential. Bullish engulfing occurs after a downtrend, signaling a potential reversal to the upside. This quick introduction will teach you how to identify the pattern, and how traders use this in technical analysis. It consists of a candle, which gets. The bearish engulfing reversal is recognized if: Both indicate potential market reversals. Web the bullish engulfing candlestick pattern is a bullish reversal pattern, usually occurring at the bottom of a downtrend. Web the engulfing candlestick pattern is formed by two candles (two periods). Comprising two consecutive candles, the pattern features a smaller. Web the engulfing candlestick pattern is a chart pattern consisting of green and red candles. Depending on their heights and collocation, a bullish or a bearish trend reversal can be predicted. The engulfing pattern needs 2 trading sessions to evolve. Engulfing is a trend reversal candlestick pattern consisting of two candles. They are popular candlestick patterns because they are easy to spot and trade. Web an engulfing pattern happens when a larger candle engulfs the. What is a bullish engulfing pattern? Web an engulfing pattern happens when a larger candle engulfs the entire body of the previous candle, signaling a potential reversal of the current trend. Web this technical pattern, characterized by a red candlestick engulfing the preceding bullish candlestick, is widely regarded as one of the most bearish signals in the market, indicating a. Both indicate potential market reversals. Bullish engulfing and bearish engulfing. This pattern is a standard bearish engulfing. Web the candle engulfing pattern is a technical analysis tool used by traders to identify potential reversals in the market. Comprising two consecutive candles, the pattern features a smaller. Web engulfing is a trend reversal candlestick pattern consisting of two candles. It consists of a pair of candles on a chart that signals a shift in momentum from buyers to sellers, or vice versa. What is the significance of the engulfing candle in this pattern? Web there are two engulfing candle patterns: In a typical engulfing pattern, you will. The first candle is bullish and continues the uptrend; The body of the second candle must engulf the body of the first candle. Web there are two engulfing candle patterns: Statistics to prove if the engulfing pattern really works In a bearish pattern, a red candle forms after the green one appears and absorbs it. In a bullish pattern, on the contrary, the green candle absorbs the red one. A bearish engulfing pattern has a green candle engulfed within a red candle; Both indicate potential market reversals. They are popular candlestick patterns because they are easy to spot and trade. Comprising two consecutive candles, the pattern features a smaller. Web the bullish engulfing candlestick pattern is a bullish reversal pattern, usually occurring at the bottom of a downtrend. Are there specific criteria for identifying a bullish engulfing pattern? The first candle is contained with the 2nd candle; Web the candle engulfing pattern is a technical analysis tool used by traders to identify potential reversals in the market. In addition. Bullish engulfing occurs after a downtrend, signaling a potential reversal to the upside. What does a bullish engulfing pattern indicate about the market? Web many traders will use this candlestick pattern to identify price reversals and continuations to support their trading strategies. Web the bullish engulfing candlestick pattern is a bullish reversal pattern, usually occurring at the bottom of a. The second candlestick will be much larger than the first, so that it completely covers or ‘engulfs’ the length of the previous bar. Web this technical pattern, characterized by a red candlestick engulfing the preceding bullish candlestick, is widely regarded as one of the most bearish signals in the market, indicating a potential. Bullish engulfing and bearish engulfing. Bullish engulfing. How does a bullish engulfing pattern form? The second candlestick will be much larger than the first, so that it completely covers or ‘engulfs’ the length of the previous bar. This pattern is the most extended version. The candles must be opposite colors (except if the first candle is a doji) for the engulfing pattern to indicate a reversal, the pattern must occur after a clear downtrend (for the bullish engulfing pattern to signal a potential bullish reversal) What is the bullish engulfing. Both indicate potential market reversals. Web there are two engulfing candle patterns: What does a bullish engulfing pattern indicate about the market? In a typical engulfing pattern, you will find a small candle on day 1 and a relatively long candle on day 2, which appears as if it engulfs the candle on day 1. Engulfing candles, which can be either bullish or bearish, are trusted by many traders for their reliability in predicting future. In a bearish pattern, a red candle forms after the green one appears and absorbs it. Bullish engulfing occurs after a downtrend, signaling a potential reversal to the upside. Web many traders will use this candlestick pattern to identify price reversals and continuations to support their trading strategies. Comprising two consecutive candles, the pattern features a smaller. This pattern is a standard bearish engulfing. Web a bullish engulfing pattern is a candlestick pattern that forms when a small black candlestick is followed the next day by a large white candlestick, the body of which completely.

Engulfing Candlestick Patterns (Types, Examples & How to Trade

Engulfing Candle Patterns & How to Trade Them

Engulfing Candle Patterns & How to Trade Them

Engulfing Candlestick Patterns (Types, Examples & How to Trade

Engulfing Candle Patterns & How to Trade Them

Bullish Engulfing Candlestick Pattern & How To Trade Forex With It

Engulfing Candle Patterns & How to Trade Them

Bullish and Bearish Engulfing Candlesticks ThinkMarkets EN

Candlestick Patterns The Definitive Guide (2021)

How to Use a Bullish Engulfing Candle to Trade Entries Bybit Learn

Web Engulfing Candlestick Patterns Are Comprised Of Two Bars On A Price Chart.

The Bearish Engulfing Reversal Is Recognized If:

The Engulfing Pattern Most Likely Signals A Trend Reversal.

This Occurs When A Candlestick, Irrespective Of Its Size, Is Followed By A Larger Candlestick That Fully ‘Engulfs’ The Prior One.

Related Post: