Elliott Wave Correction Patterns

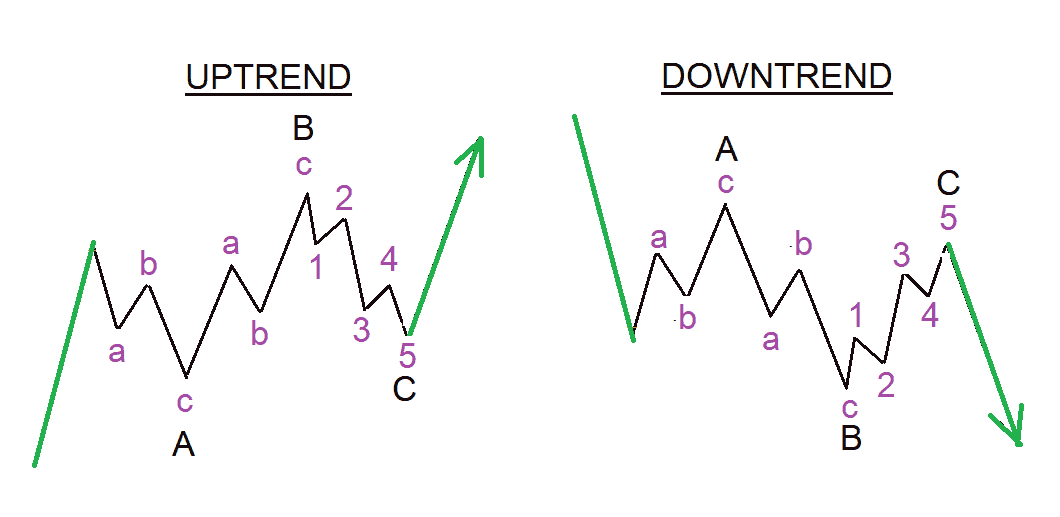

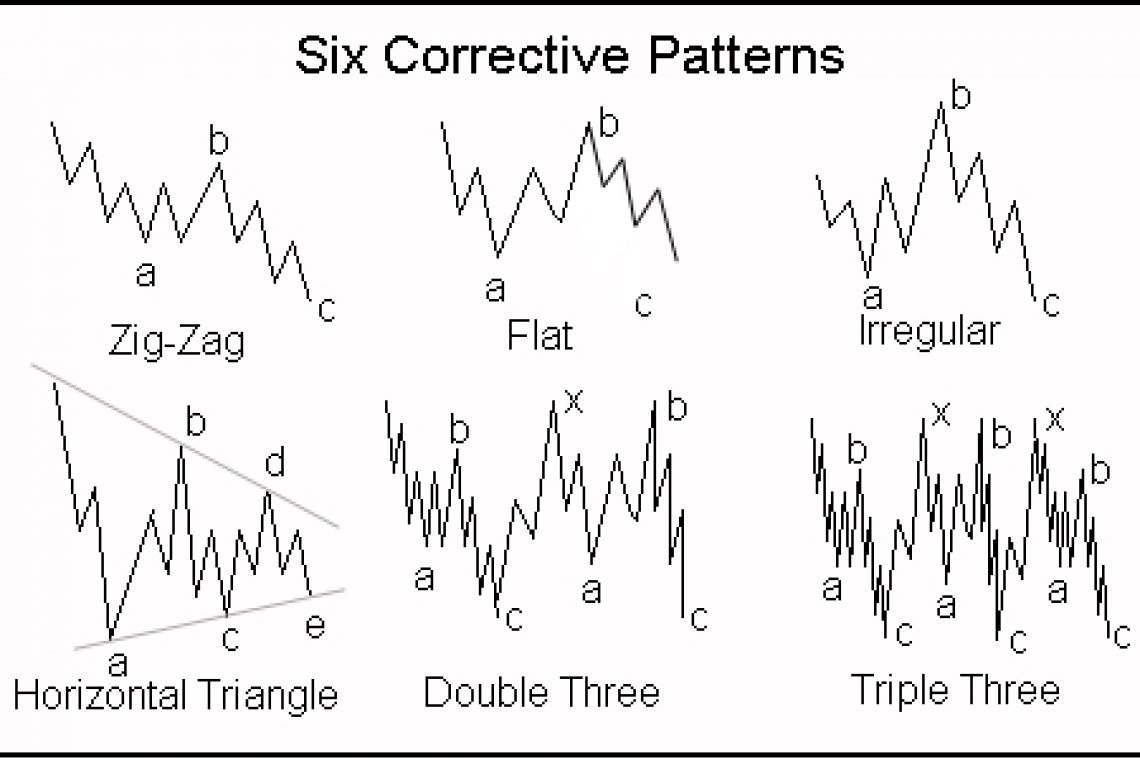

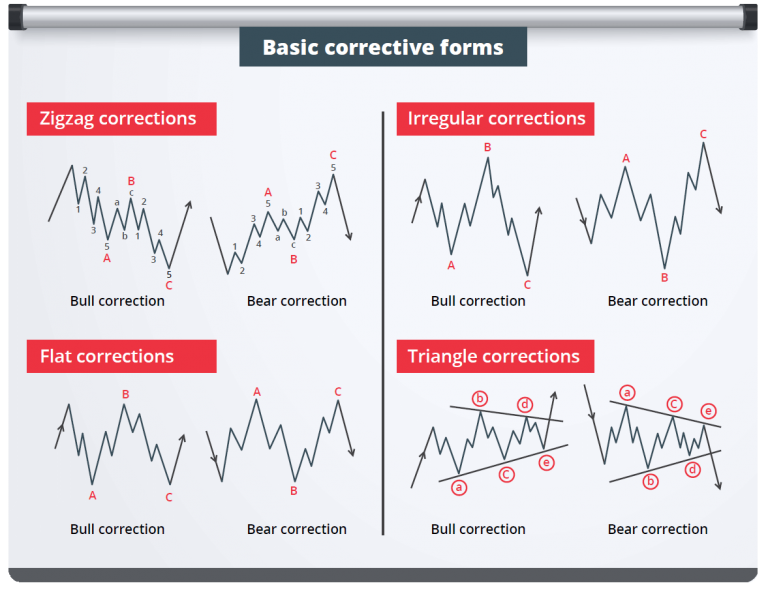

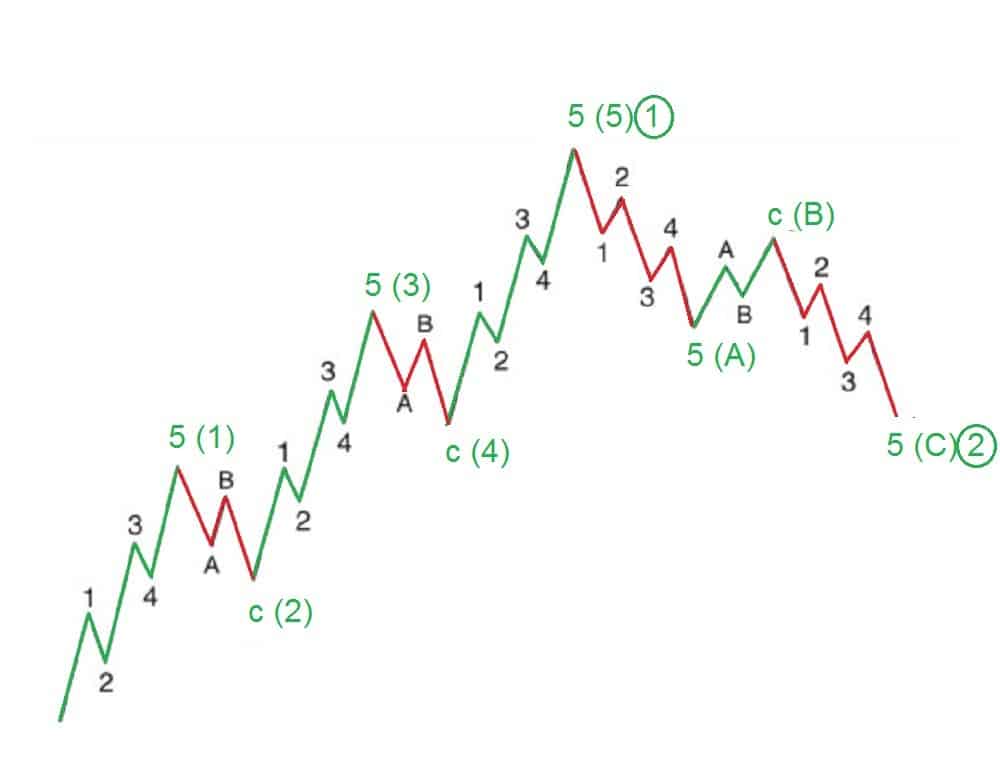

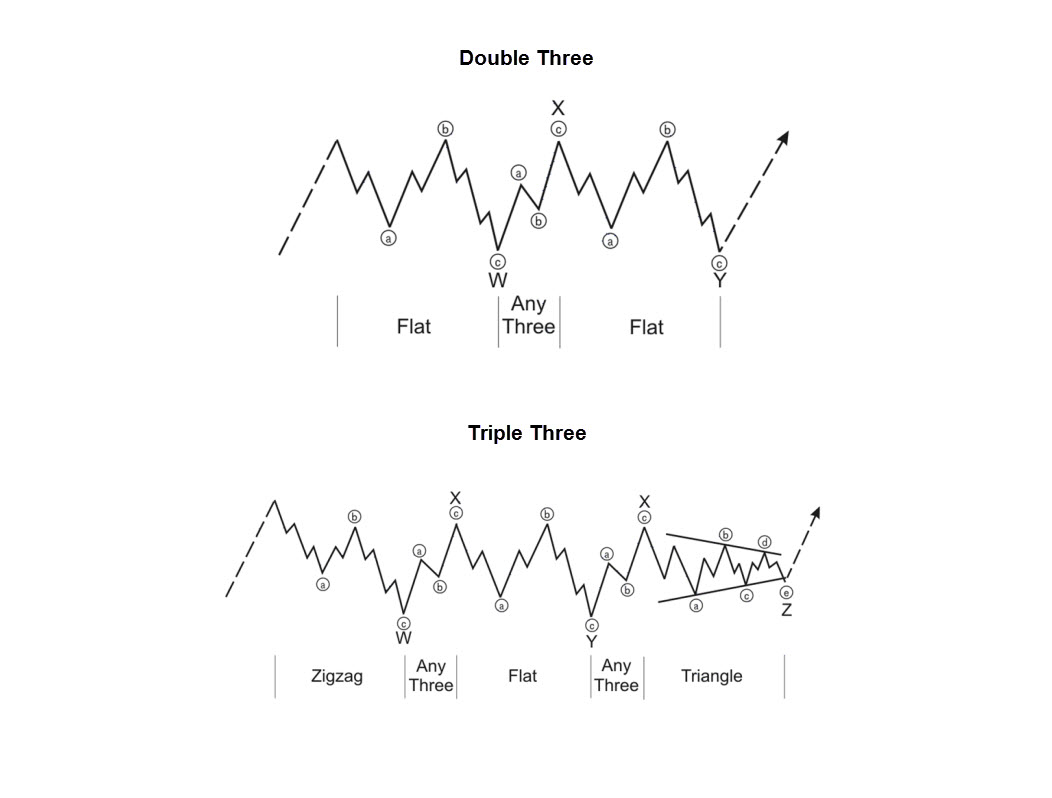

Elliott Wave Correction Patterns - Web the basic pattern elliott described consists of impulsive waves (denoted by numbers) and corrective waves (denoted by letters). It is a corrective pattern that runs against the trend. Web the elliott wave principle, or elliott wave theory, is a form of technical analysis that financial traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology and price levels, such as highs and lows, by looking for patterns in prices. Ideally, smaller patterns can be identified within bigger patterns. Fast, easy & securepaperless solutionsfree mobile appedit on any device Although channeling can be used for corrective waves, it really boils down to the application of trend lines and doesn't have any hard tendencies for corrective applications. Web a nuanced understanding of elliott wave correction patterns not only lays the groundwork for analytical precision but also arms financial specialists with the clarity needed to pinpoint the ebb and flow of market cycles. These two types of waves can be used to discern price. Web the movement in the direction of the trend is labelled as 1, 2, 3, 4, and 5. Wave 4 must not cross into the price territory of wave 1 in an impulse wave, but wave 4 can overlap wave 1 in a leading or ending diagonal wave. Impulse waves and corrective waves. Web the movement in the direction of the trend is labelled as 1, 2, 3, 4, and 5. It comprises impulse waves, representing the main trend, and corrective waves, aiming to counteract the primary trend and restore equilibrium. A corrective wave is divided into three subwaves. Although channeling can be used for corrective waves, it. What are the elliott wave abc correction rules. Elliott then put together what he considered his definitive work, nature’s law — the secret of the universe. Web the basic pattern elliott described consists of “motive waves” and “corrective waves.” a motive wave is composed of five subwaves. Web elliott called a sideways combination of two corrective patterns a “double three,”. Web elliott called a sideways combination of two corrective patterns a “double three,” and three patterns a “triple three.” while a single three is any zigzag or flat, a triangle is an allowable final component of such combinations and in this context is called a “three.” An impulsive wave is composed of five subwaves and Although channeling can be used. Web the basic pattern elliott described consists of “motive waves” and “corrective waves.” a motive wave is composed of five subwaves. Waves 1, 2,3, 4 and 5 form an impulse wave, alternating between motive and corrective waves. It moves in the same direction as the trend of the next larger size. Web download my entry strategy: These two types of. 1.2 significance of corrective waves. Since 1996, bloomberg press has published books for financial professionals on investing, economics, and policy affecting investors. The more powerful the underlying trend, the briefer the flat tends to be. Web download my entry strategy: What are the elliott wave abc correction rules. Web elliott found three types of simple corrections. Web a nuanced understanding of elliott wave correction patterns not only lays the groundwork for analytical precision but also arms financial specialists with the clarity needed to pinpoint the ebb and flow of market cycles. Web in markets, the elliott wave theory is interpreted as follows: These patterns can be seen in. Web elliott called a sideways combination of two corrective patterns a “double three,” and three patterns a “triple three.” while a single three is any zigzag or flat, a triangle is an allowable final component of such combinations and in this context is called a “three.” An impulsive wave is composed of five subwaves and Impulse waves and corrective waves.. The guideline of channeling is a technique to project the potential end of waves within impulses. These two types of waves can be used to discern price. Web download my entry strategy: It comprises impulse waves, representing the main trend, and corrective waves, aiming to counteract the primary trend and restore equilibrium. What are the elliott wave abc correction rules. Web in markets, the elliott wave theory is interpreted as follows: The zigzag is known to form a sharp style of correction and, in an impulse wave, usually shows up in the second wave position. Web elliott called a sideways combination of two corrective patterns a “double three,” and three patterns a “triple three.” while a single three is any. Web how to use elliott wave patterns in trading: An impulsive wave is composed of five subwaves and The theory identifies impulse waves that establish a pattern and. The more powerful the underlying trend, the briefer the flat tends to be. Web in markets, the elliott wave theory is interpreted as follows: Web elliot wave theory posits that security price movements are broken up into two types of waves: A corrective wave is divided into three subwaves. Web a flat correction usually retraces less of the preceding impulse wave than does a zigzag. What are the elliott wave abc correction rules. Web specific corrective patterns fall into three main categories: Free animation videos.master the fundamentals.learn finance easily.find out today. Web the movement in the direction of the trend is labelled as 1, 2, 3, 4, and 5. Web elliott found three types of simple corrections. Web the basic pattern elliott described consists of impulsive waves (denoted by numbers) and corrective waves (denoted by letters). An impulsive wave is composed of five subwaves and Web elliott tied the patterns of collective human behavior to the fibonacci, or “golden” ratio, a mathematical phenomenon known for millennia as one of nature’s ubiquitous laws of form and progress. Web in markets, the elliott wave theory is interpreted as follows: Web abc patterns are one of several corrections that we see in elliott wave, and it can be one of the most difficult patterns to trade. The guideline of channeling is a technique to project the potential end of waves within impulses. Elliott then put together what he considered his definitive work, nature’s law — the secret of the universe. Web the elliott wave principle, or elliott wave theory, is a form of technical analysis that financial traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology and price levels, such as highs and lows, by looking for patterns in prices.

Elliott Wave Corrective Patterns Candle Stick Trading Pattern

8 Scenarios After an Elliott Wave Impulse Pattern Completes

SIMPLE Elliott Wave Correction Patterns rules and guidelines

Corrective Elliott waves explanation investingchef

Elliott Wave Intermediate Course Module Lionheart EWA

Traders Guide to Elliott Wave, ( Step by Step )

AWESOME GUIDE to Elliott Wave Correction Patterns and Rules

Elliott Wave Theory and the Sideways ABC Correction Wave theory, Wave

ELLIOT WAVE BASICS PART 4 Corrective Waves DreamGains

AWESOME GUIDE to Elliott Wave Correction PatternsBest Forex Trading

The More Powerful The Underlying Trend, The Briefer The Flat Tends To Be.

It Comprises Impulse Waves, Representing The Main Trend, And Corrective Waves, Aiming To Counteract The Primary Trend And Restore Equilibrium.

Web The Elliott Wave Theory Is A Technical Analysis Of Price Patterns Related To Changes In Investor Sentiment And Psychology.

Waves 1, 2,3, 4 And 5 Form An Impulse Wave, Alternating Between Motive And Corrective Waves.

Related Post: