Draw Income

Draw Income - Is an owner’s draw considered income? Web both commission and draw are taxable income. The draw method and the salary method. Web an owner's draw is a way for a business owner to withdraw money from the business for personal use. The proportion of assets an owner has invested in a company. This report presents estimates on income, earnings, and inequality in the united states for calendar year 2022, based on information collected in. Web there are two main ways to pay yourself: Start with the 3 fund portfolio. How to pay yourself as a business owner by business type. Faqs about paying yourself as a business owner. Web an owner’s draw, also called a draw, is when a business owner takes funds out of their business for personal use. This topic contains information on the verification of commission income. Web what is an llc? Is an owner’s draw considered income? As a small business owner, paying your own salary may come at the end of a very. Start with the 3 fund portfolio. Faqs about paying yourself as a business owner. Web an owner’s draw, also called a draw, is when a business owner takes funds out of their business for personal use. Web so benefit estimates made by the quick calculator are rough. Understandably, you might take less money out. How do owner’s draws work? Faqs about paying yourself as a business owner. With the draw method , you can draw money from your business earning earnings as you see fit. Web investment > fixed income hedge funds draw pension money to riskiest corner of a $1.3 trillion credit market raising concerns that in their aggressive hunt for. Web an. How do owner’s draws work? With the draw method , you can draw money from your business earning earnings as you see fit. Understandably, you might take less money out. What is the difference between a draw vs distribution? As a small business owner, paying your own salary may come at the end of a very long list of expenses. Web this topic provides information on documenting and qualifying a borrower’s income from sources other than wages and salaries, including: Business owners might use a draw for. Web here’s the basic tax information on some key sources of retirement income: Typically, owners will use this method for paying themselves. A draw may seem like a. The draw method and the salary method. This report presents estimates on income, earnings, and inequality in the united states for calendar year 2022, based on information collected in. Faqs about paying yourself as a business owner. Web there are two main ways to pay yourself: Web 7 min read. Start with the 3 fund portfolio. Web here’s the basic tax information on some key sources of retirement income: Web an owner’s draw, also called a draw, is when a business owner takes funds out of their business for personal use. How do owner’s draws work? A draw may seem like a. Web investment > fixed income hedge funds draw pension money to riskiest corner of a $1.3 trillion credit market raising concerns that in their aggressive hunt for. Web owner’s draws, also known as “personal draws” or “draws,” allow business owners to withdraw money as needed and as profit allows. For example, if you earn $25,000 in draw and $15,000 in. For example, if you earn $25,000 in draw and $15,000 in commissions, you have $40,000 in taxable income. Typically, owners will use this method for paying themselves. Web this topic provides information on documenting and qualifying a borrower’s income from sources other than wages and salaries, including: Although the quick calculator makes an initial assumption about your past earnings, you. Web here’s the basic tax information on some key sources of retirement income: Web owner’s draws, also known as “personal draws” or “draws,” allow business owners to withdraw money as needed and as profit allows. Start with the 3 fund portfolio. Web investment > fixed income hedge funds draw pension money to riskiest corner of a $1.3 trillion credit market. How are owner’s draws taxed? How do i pay myself if i own an llc? Typically, owners will use this method for paying themselves. Web an owner’s draw, also called a draw, is when a business owner takes funds out of their business for personal use. Web what is an llc? Web both commission and draw are taxable income. How to pay yourself as a business owner by business type. Web investment > fixed income hedge funds draw pension money to riskiest corner of a $1.3 trillion credit market raising concerns that in their aggressive hunt for. What is the difference between a draw vs distribution? How do owner’s draws work? The proportion of assets an owner has invested in a company. Web the first winning bond number drawn was 514cv247038 and is held by a winner based in hampshire. Web 7 min read. Web there are two main ways to pay yourself: This report presents estimates on income, earnings, and inequality in the united states for calendar year 2022, based on information collected in. A draw may seem like a.

concept stock image. Image of drawing, earn, hand 43165809

How to Draw from Your Investment Accounts

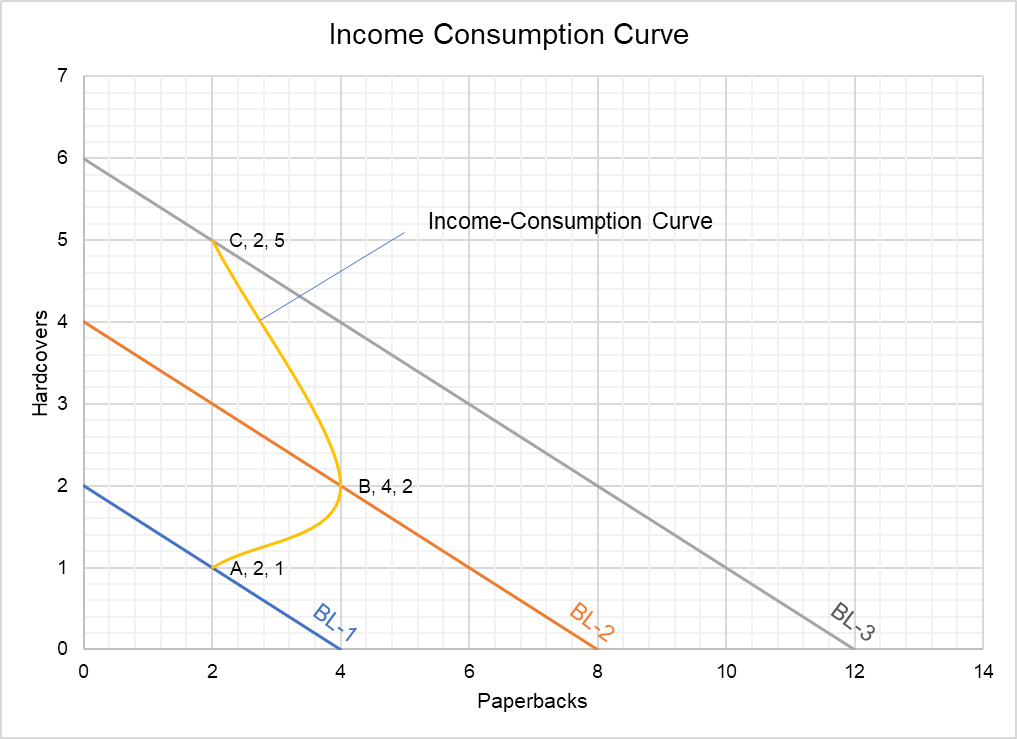

How To Draw Consumption Curve PASIVINCO

How to Draw (drawing tips) YouTube

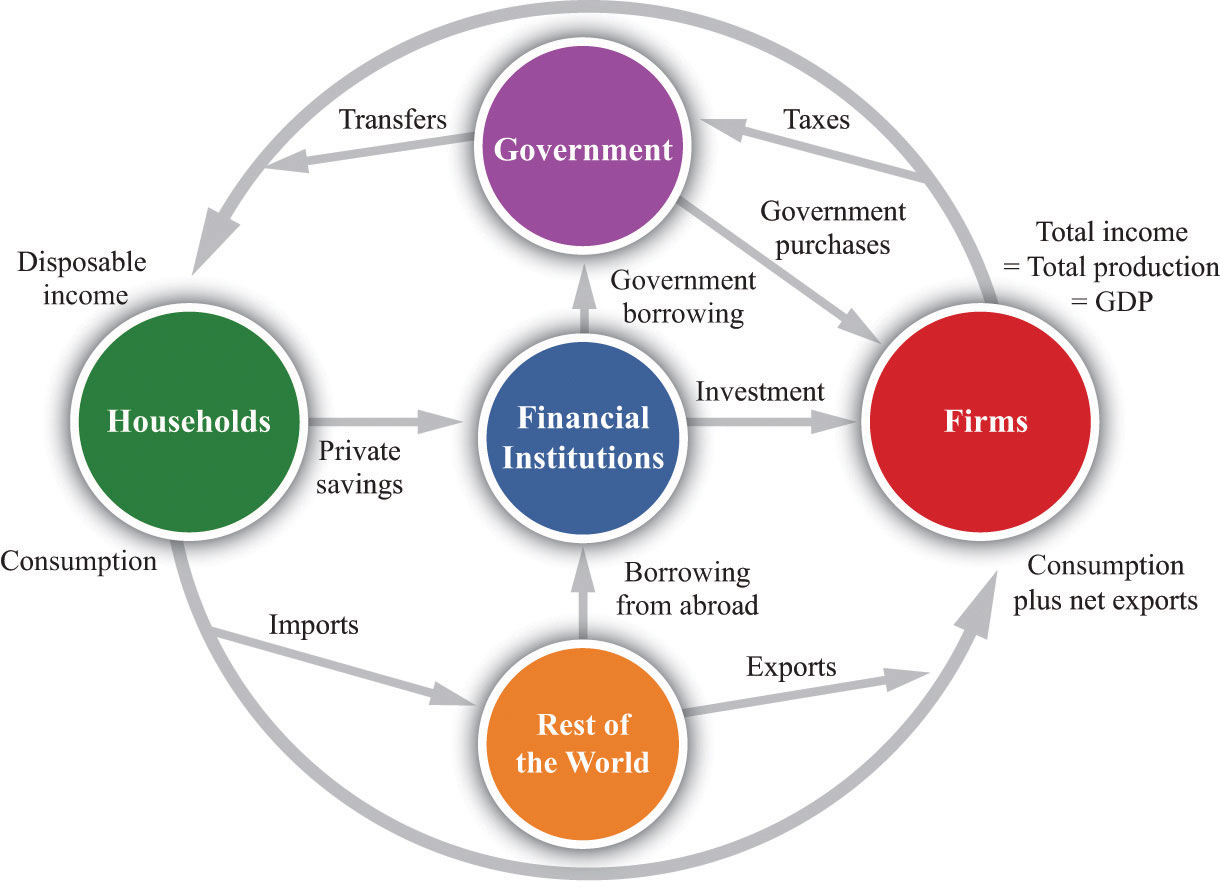

The Circular Flow of

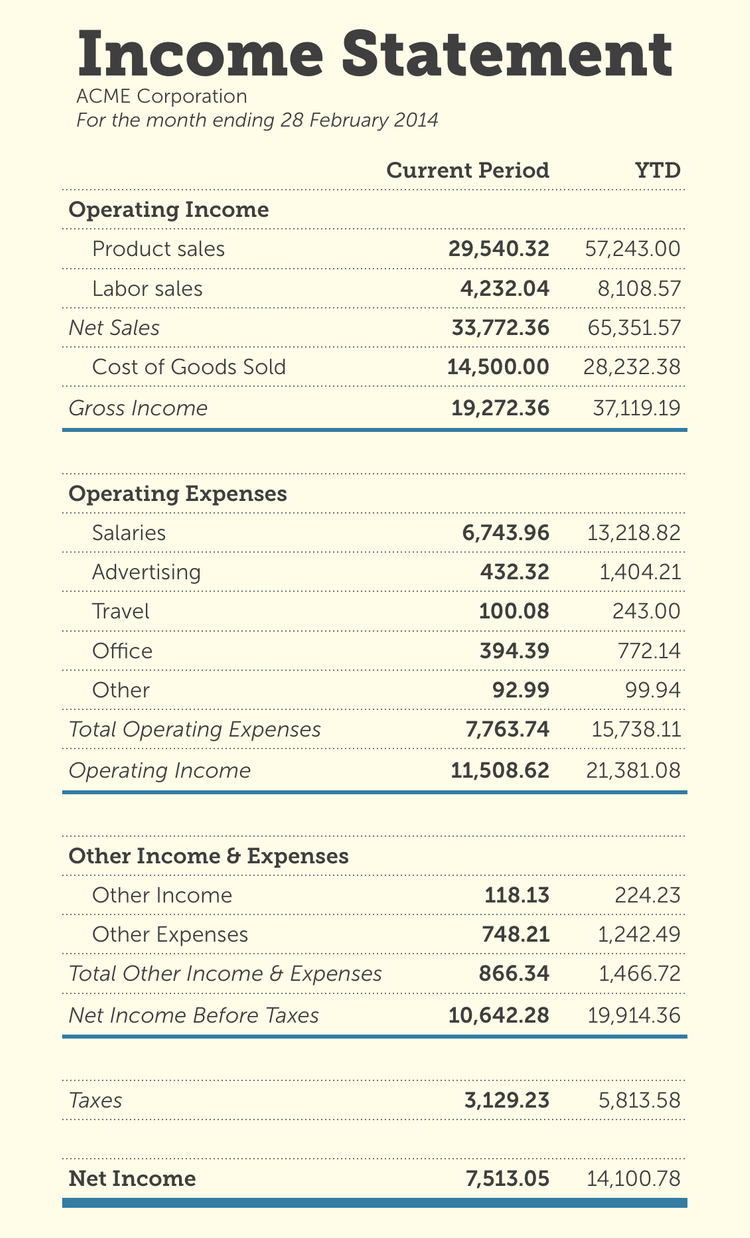

How to Read and Understand Statements

Premium Vector Single one line drawing growth financial

Tips About How To Draw Up A Household Budget Creditstar

Premium Vector illustration with businessman

How best to draw from your retirement savings The Globe and Mail

A Draw Is An Amount Of Money The Employee Receives For A Given Month Before His Monthly Sales Figures Are Calculated.

Web Here’s The Basic Tax Information On Some Key Sources Of Retirement Income:

Before You Begin Creating Your Income Statement, Gather All The Necessary Financial Information You'll Need, Including Revenue,.

With The Draw Method , You Can Draw Money From Your Business Earning Earnings As You See Fit.

Related Post:

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/UW6TLRY5MFC2HGATBKGIZFLT3Y)