Dragonfly Candlestick Pattern

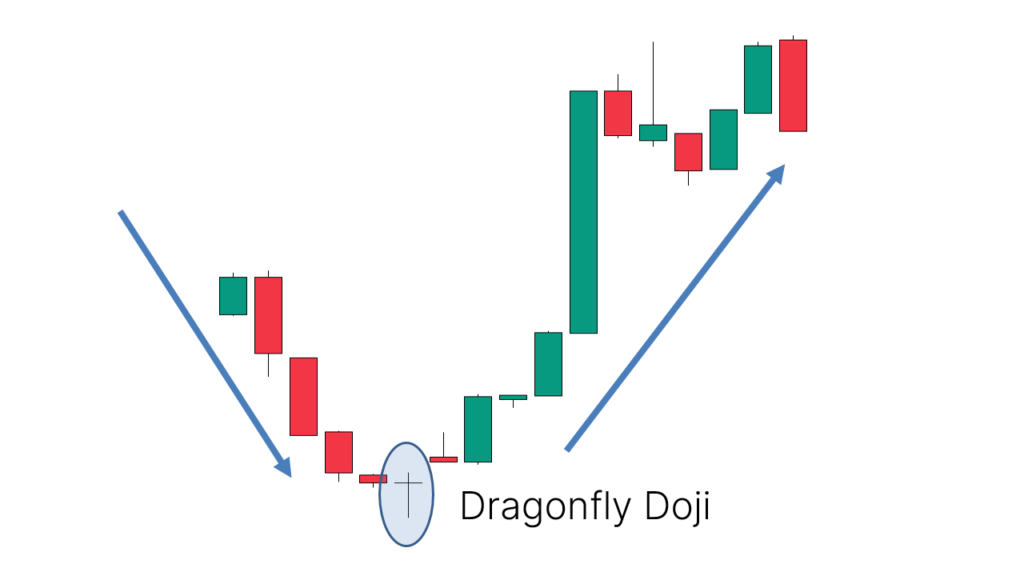

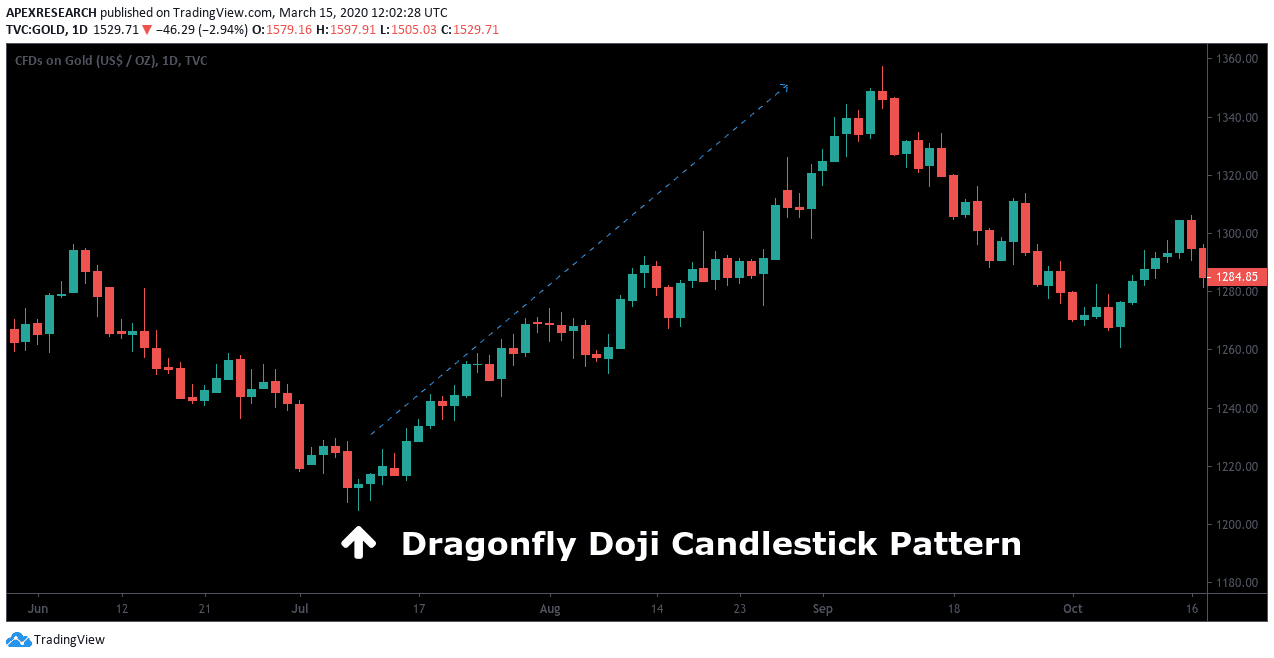

Dragonfly Candlestick Pattern - Web the dragonfly doji is a candlestick pattern that can signal a potential trend reversal. In this article, we’re going to have a closer look at the dragonfly doji, its meaning, definition, and how to improve the accuracy of the pattern. An ideal dragonfly doji possesses a nearly invisible body and an. It is usually seen at the bottom of a downtrend. Steve nison is credited with bringing japanese candlestick charting to the west. Web a dragonfly doji is a candlestick pattern that appears in technical analysis when the open, high, and close prices are equal or nearly equal, creating a distinct “t” shape. Dragonfly dojis initially cast long wicks toward the downside, suggesting aggressive selling within the market. Web doji candlesticks look like a cross, inverted cross or plus sign. When appearing after a downtrend, it suggests a potential bullish reversal, indicating that selling pressure is. Web the dragonfly doji candlestick pattern is a valuable tool for technical analysis in financial markets. Web a dragonfly doji candlestick pattern used with technical analysis can be powerful. Dragonfly doji are a candlestick patterns that signal rising possibilities for a bullish reversal in the market price of an asset. The dragonfly doji is typically interpreted as a bullish reversal candlestick chart pattern that mainly occurs at the bottom of downtrends.the dragonfly doji is a candlestick. Web a dragonfly doji candlestick is a candlestick pattern with the open, close, and high prices of an asset at the same level. These are indecision candles that help confirm reversals. Web the dragonfly doji candlestick pattern is usually employed in the technical analysis of financial markets, like stocks, forex, and commodities. Web the red or green dragonfly doji is. Dragonfly dojis initially cast long wicks toward the downside, suggesting aggressive selling within the market. After an extended decline, dragonfly doji candlesticks develop when the opening price, the closing price, and the price high for an asset are nearly equal in value during a. A dragonfly doji is a type of single japanese candlestick pattern formed when the high, open,. In this article, we’re going to have a closer look at the dragonfly doji, its meaning, definition, and how to improve the accuracy of the pattern. Understanding and utilizing this pattern enhances traders’ ability to identify better opportunities and. The open and close prices are at or near. Web what is a dragonfly doji candlestick pattern? Steve nison is credited. A dragonfly doji is formed when the opening and closing prices are the. When appearing after a downtrend, it suggests a potential bullish reversal, indicating that selling pressure is. The dragonfly doji is typically interpreted as a bullish reversal candlestick chart pattern that mainly occurs at the bottom of downtrends.the dragonfly doji is a candlestick pattern that can help traders. That’s why you need to know. It can be used with other indicators to. A dragonfly doji is formed when the opening and closing prices are the. Web the dragonfly doji is a one candle reversal pattern that forms after a bullish or bearish trend. In his book japanese candlestick charting techniques he describes dragonfly doji patterns with the following. After an extended decline, dragonfly doji candlesticks develop when the opening price, the closing price, and the price high for an asset are nearly equal in value during a. The dragonfly doji is used to spot possible reversals and appears when the open and closing price of a. It is usually seen at the bottom of a downtrend. A dragonfly. This pattern resembles the shape of a dragonfly with an extended lower shadow. It is usually seen at the bottom of a downtrend. A doji candlestick forms when a. It creates a long lower shadow, indicating that buyers have been in control during the session, pushing the price down. It is used as a technical indicator that signals a potential. Web a dragonfly doji candlestick pattern used with technical analysis can be powerful. When appearing after a downtrend, it suggests a potential bullish reversal, indicating that selling pressure is. It is usually seen at the bottom of a downtrend. It creates a long lower shadow, indicating that buyers have been in control during the session, pushing the price down. An. Web a dragonfly doji candlestick pattern used with technical analysis can be powerful. Web the dragonfly doji is a one candle reversal pattern that forms after a bullish or bearish trend. In this article, we’re going to have a closer look at the dragonfly doji, its meaning, definition, and how to improve the accuracy of the pattern. The candle ends. It is usually seen at the bottom of a downtrend. It signals a potential reversal. When appearing after a downtrend, it suggests a potential bullish reversal, indicating that selling pressure is. It is used as a technical indicator that signals a potential reversal of the asset’s price. If confirmed, it reached the 2:1 r/r target 35.1% of the time and it retested it's entry price level 95.6% of the time. After an extended decline, dragonfly doji candlesticks develop when the opening price, the closing price, and the price high for an asset are nearly equal in value during a. Web doji candlesticks look like a cross, inverted cross or plus sign. The dragonfly doji is used to spot possible reversals and appears when the open and closing price of a. Web a dragonfly doji candlestick is a candlestick pattern with the open, close, and high prices of an asset at the same level. Web the dragonfly doji candlestick pattern is identified by the following key criteria: It is recognized by its small body, long lower shadow, and absence of an upper shadow. It signals indecision between buyers and sellers and is considered a bullish reversal pattern. Web the dragonfly doji candlestick pattern is a valuable tool for technical analysis in financial markets. Reversals usually happen when a stock hits support or resistance and does not break. Web among the most widely recognized candlestick patterns is the dragonfly doji, which stands out conspicuously on the candlestick chart. That’s why you need to know.

Dragonfly Doji How to Spot and Trade Candlestick Patterns Freedom

Dragonfly Doji Candlestick Pattern What Is And How To Trade Living

How to Spot and Use the Dragonfly Doji Candle in Day Trading

:max_bytes(150000):strip_icc()/dragonfly-doji.asp-final-c5af384063774dfc96bc4bfdd10089f8.png)

Doji Dragonfly Candlestick What It Is, What It Means, Examples

Dragonfly Doji Candlestick Pattern I How to Use Dragonfly Doji Candle I

HOW TO TRADE DRAGONFLY DOJI CANDLESTICK PATTERN YouTube

Dragonfly Doji Candlestick Pattern, Technical Analysis, Episode 3

A Dragonfly Doji Candlestick Pattern Definition, Interpretation, and

Dragonfly Doji Candlestick Pattern (Explained With Examples)

Dragonfly Doji Candlestick Pattern All You Need to Know About

Web From Our Research The Dragonfly Doji Pattern Confirms 77.8% Of The Time On Average Overall All The 4120 Markets We Analysed.

Web The Dragonfly Doji Candlestick Pattern Can Provide Traders With Potential Bullish Reversal Signals, Offering Valuable Insights Into Market Sentiment And Entry Points.

In His Book Japanese Candlestick Charting Techniques He Describes Dragonfly Doji Patterns With The Following Characteristics:

These Are Indecision Candles That Help Confirm Reversals.

Related Post: