Dragonfly Candle Pattern

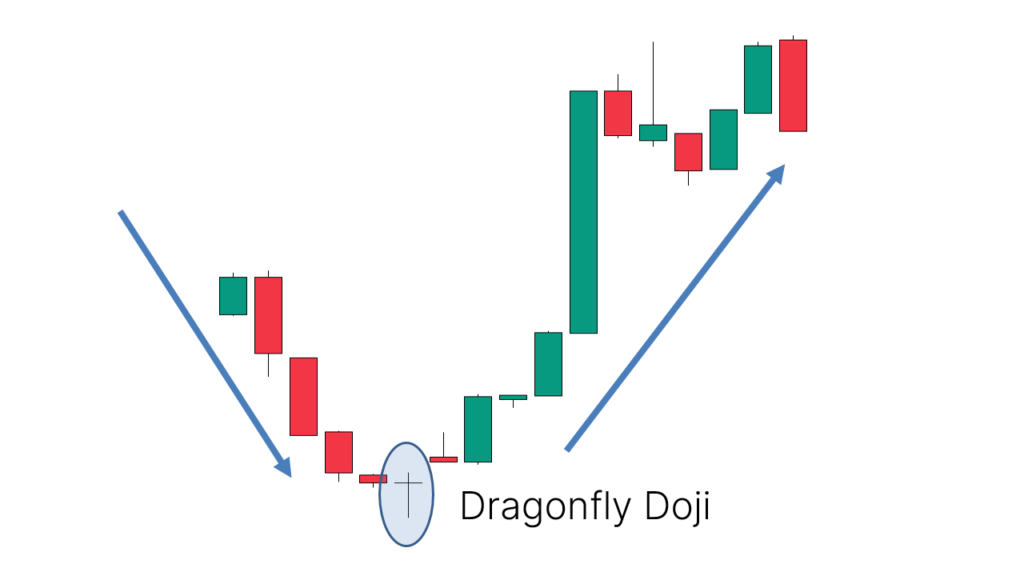

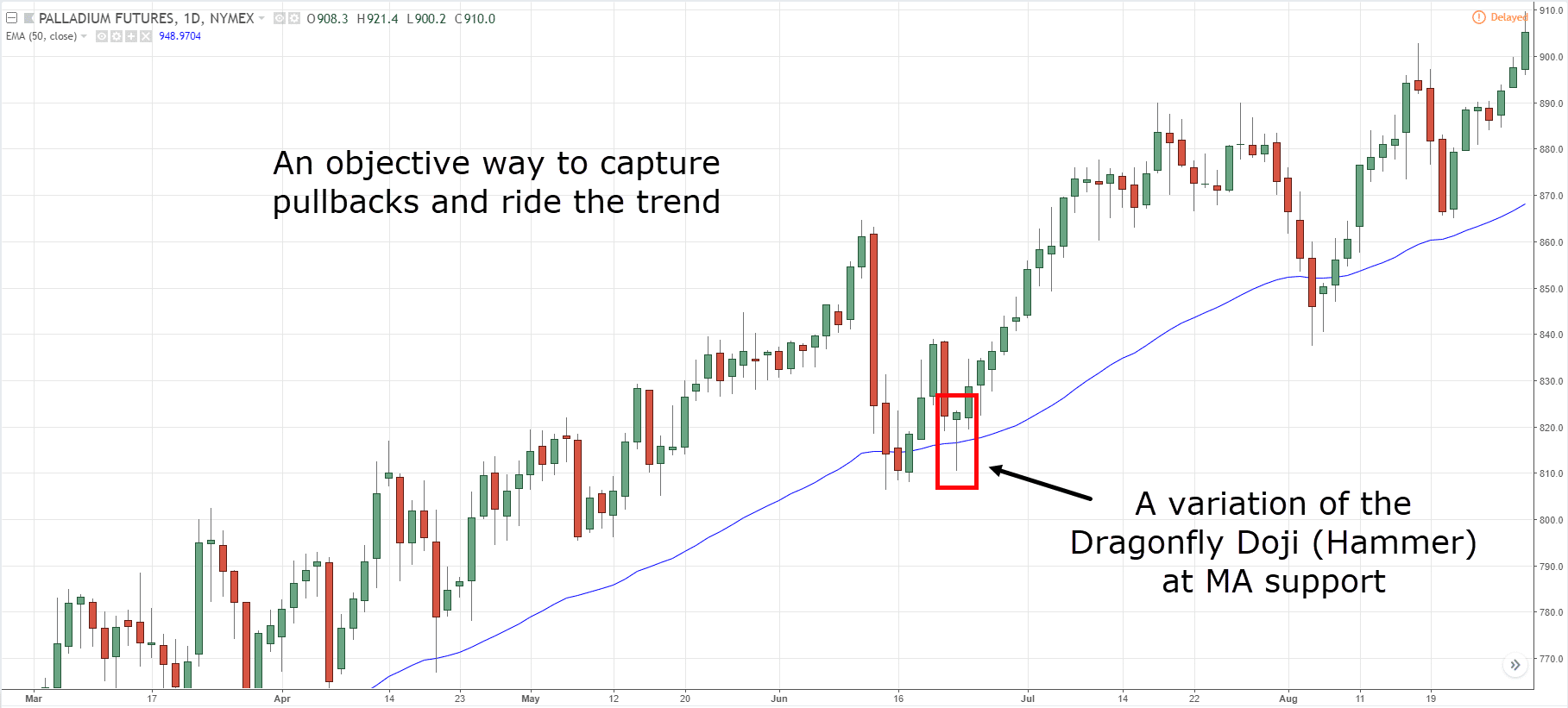

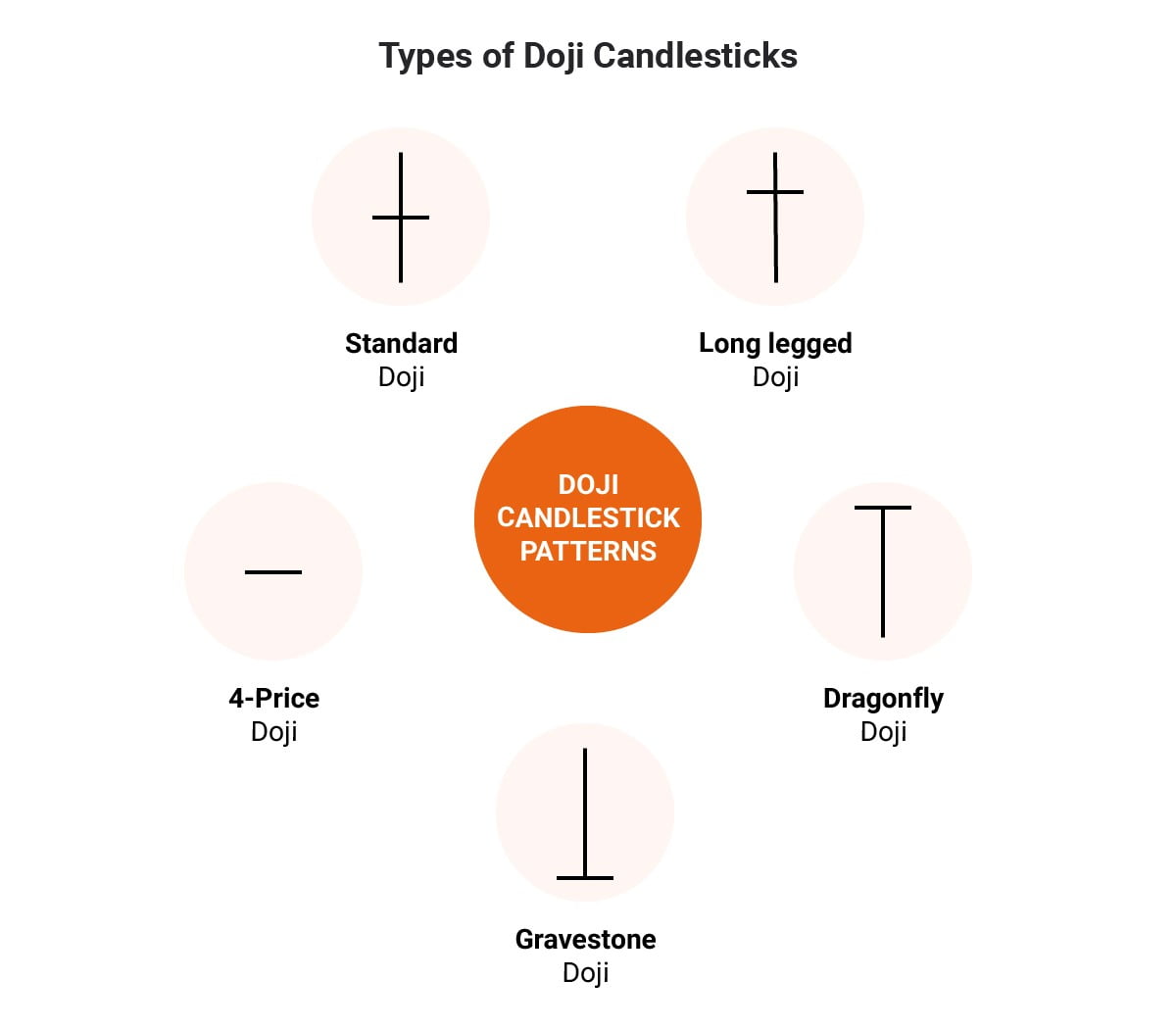

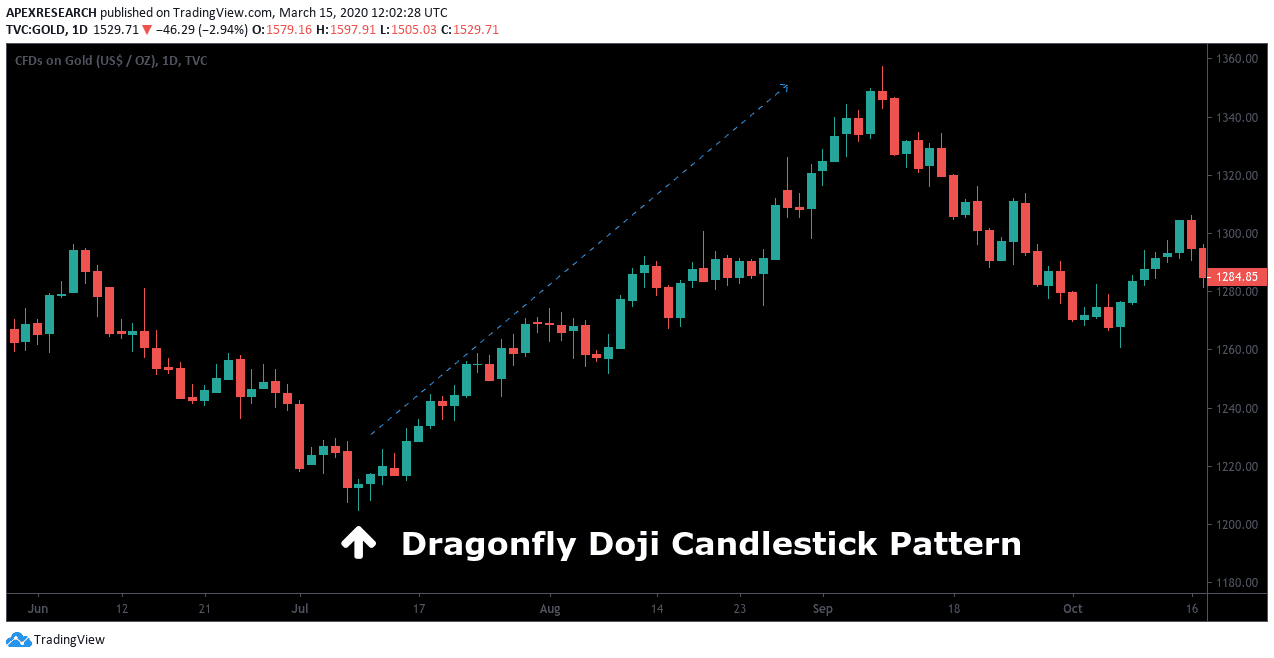

Dragonfly Candle Pattern - Web the dragonfly doji pattern occurs when a stock's opening and closing prices are the same as the high for the day: Web a dragonfly doji candlestick is a candlestick pattern with the open, close, and high prices of an asset at the same level. This pattern is the most uncommon candlestick. In this article, we’re going to have a closer look at the dragonfly doji, its meaning, definition, and how to improve the accuracy of the pattern. Learn what they are, how to identify them and how to apply them in your trading. It is used to identify reversal patterns after a bearish price trend. The dragonfly doji often takes center stage as a potent indicator of potential trend reversals on candlestick charts. It has a long lower wick, a short or absent upper wick, and closes and opens at roughly the same price. Steve nison is credited with bringing japanese candlestick charting to the west. Web a dragonfly doji candlestick pattern is one of the four different types of doji candlesticks. The red or green dragonfly doji is a candlestick pattern that forms when the opening, closing, and high prices of an asset are equal or almost equal. Web what does a dragonfly doji mean? Web a dragonfly doji is a candlestick pattern that signals a possible price reversal. Web a dragonfly doji is a candlestick pattern that appears in technical. Web a dragonfly doji candlestick is typically a bullish candlestick reversal pattern found at the bottom of downtrends. Female has same pattern but golden colors. Shop online or in store unique handmade products made in poland include six polish pottery factories, hand blown glass ornaments, woodcarvings, polish. This pattern is the most uncommon candlestick. Web the dragonfly doji is a. Web what are dragonfly doji candlestick patterns? Web the dragonfly doji is a one candle reversal pattern that forms after a bullish or bearish trend. A dragonfly doji pattern does not appear constantly. Understanding and utilizing this pattern enhances traders’ ability to identify better. Web more polish pottery is your source for famous boleslawiec polish pottery in the usa. Web the dragonfly doji is a specific type of doji candlestick pattern that occurs when the opening and closing prices are almost identical and at the high of the trading session. Web a dragonfly doji is a candlestick pattern that signals a possible price reversal. Web a dragonfly doji is a candlestick pattern that appears in technical analysis when the. Web a dragonfly doji candlestick pattern is one of the four different types of doji candlesticks. Learn what they are, how to identify them and how to apply them in your trading. Web the dragonfly doji candlestick pattern can provide traders with potential bullish reversal signals, offering valuable insights into market sentiment and entry points. It is used to identify. Dragonfly dojis initially cast long wicks toward the downside, suggesting aggressive selling within the market. Web the dragonfly doji is a candlestick pattern that can signal a potential trend reversal. Web the dragonfly doji is a specific type of doji candlestick pattern that occurs when the opening and closing prices are almost identical and at the high of the trading. It means it signals an important reversal. Web in this guide to understanding the dragonfly doji candlestick pattern, we’ll show you what this technical indicator looks like, explain its components, teach you how to interpret it, and discuss its limitations. Dragonfly dojis initially cast long wicks toward the downside, suggesting aggressive selling within the market. It works with the main. Data on these organisms will help us track their populations in order to better protect them and may provide additional support for the protection of wetland areas. It has a long lower wick, a short or absent upper wick, and closes and opens at roughly the same price. Web what does a dragonfly doji mean? The red or green dragonfly. Learn what they are, how to identify them and how to apply them in your trading. Web a dragonfly doji is a candlestick pattern characterized by a long lower shadow, little to no upper shadow, and a small body at the top of the candlestick with the opening and closing prices near the high of the period. Web the dragonfly. Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. Web the dragonfly doji is a specific type of doji candlestick pattern that occurs when the opening and closing prices are almost identical and at the high of the trading session. A dragonfly doji indicates a potential price reversal to the downside or. Web a dragonfly doji is a candlestick pattern that signals a possible price reversal. Learn what they are, how to identify them and how to apply them in your trading. Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. The candle is composed of a long lower shadow and an open, high, and close price that equal each other. It is used to identify reversal patterns after a bearish price trend. Web in this guide to understanding the dragonfly doji candlestick pattern, we’ll show you what this technical indicator looks like, explain its components, teach you how to interpret it, and discuss its limitations. This pattern is the most uncommon candlestick. Web a dragonfly doji candlestick pattern is formed when a candlestick has the same high, open, and closing prices. Web the dragonfly doji is a one candle reversal pattern that forms after a bullish or bearish trend. Web in illinois there is one federally endangered dragonfly, the hines emerald (somatochlora hineana), and one state threatened species, the elfin skimmer (nanothemis bella). This pattern resembles the shape of a. A dragonfly doji pattern does not appear constantly. Web a dragonfly doji is a candlestick pattern that signals a possible price reversal. It occurs when the asset’s high, open, and close prices are uniform. Web interpreting the dragonfly doji candlestick pattern. They are also found at support levels signifying a.

Dragonfly Doji Candlestick Pattern What Is And How To Trade Living

Dragonfly Doji Candlestick Pattern, Technical Analysis, Episode 3

Candlestick Patterns The Definitive Guide (2021)

The Complete Guide to Doji Candlestick Pattern

dragonfly doji candlestick patter with real trading examples & charts

:max_bytes(150000):strip_icc()/dotdash_Final_Dragonfly_Doji_Candlestick_Definition_and_Tactics_Nov_2020-01-eb0156a30e9745b687c8a65e93f54b07.jpg)

Dragonfly Doji Candlestick Definition

Dragonfly Doji Candlestick Pattern All You Need to Know About

Dragonfly Doji How to Spot and Trade Candlestick Patterns Freedom

Dragonfly Doji Candlestick Pattern (Explained With Examples)

:max_bytes(150000):strip_icc()/dragonfly-doji.asp-final-c5af384063774dfc96bc4bfdd10089f8.png)

Doji Dragonfly Candlestick What It Is, What It Means, Examples

A Dragonfly Doji Indicates A Potential Price Reversal To The Downside Or Upside, Depending On Previous Price Action.

Web Dragonfly Doji Is A Candle Pattern With No Real Body And A Long Downward Shadow.

The Dragonfly Doji Often Takes Center Stage As A Potent Indicator Of Potential Trend Reversals On Candlestick Charts.

Web A Dragonfly Doji Is A Candlestick Pattern That Appears In Technical Analysis When The Open, High, And Close Prices Are Equal Or Nearly Equal, Creating A Distinct “T” Shape.

Related Post: