Downward Wedge Pattern

Downward Wedge Pattern - Web the falling wedge pattern is characterized by a chart pattern which forms when the market makes lower lows and lower highs with a contracting range. They develop when a narrowing trading range has a downward slope, such that subsequent lows and subsequent highs within the wedge are falling as trading progresses. Wedges can serve as either. The trend lines drawn above the highs and below the lows on the. Web when a security's price has been falling over time, a wedge pattern can occur just as the trend makes its final downward move. By understanding and trading the falling wedge pattern, traders can potentially profit from the subsequent uptrend. It takes at least five reversals (two for one trendline and three for the other). Web the rising wedge is a technical chart pattern used to identify possible trend reversals. Whether the price reverses the prior trend or continues in the same direction depends on the breakout direction from the wedge. This wedge pattern forex traders recognize signals a potential bearish reversal pattern. A rising wedge is a bearish chart pattern that’s found in a downward trend, and the lines slope up. Web downward wedge pattern, technical analysis scanner. Whether you’re a seasoned trader or just starting out, this comprehensive guide will equip you with everything you need to know about this powerful chart pattern. Falling wedges are the inverse of rising wedges. Web a wedge is a common type of trading chart pattern that helps to alert traders to a potential reversal or continuation of price direction. Welcome to the ultimate guide to understanding and trading the “wedge pattern” in stock markets. Web it is characterized by downward sloping support and resistance lines, with lower highs forming faster than lower lows. Web. Web it is characterized by downward sloping support and resistance lines, with lower highs forming faster than lower lows. Wedges can serve as either. Also called the downward or descending wedge, this pattern results in an overall downward price movement. This article provides a technical approach to trading the. When this pattern is found in a downward trend, it is. As outlined earlier, falling wedges can be both a reversal and continuation pattern. Scanner guide scan examples feedback. These are also known as descending wedges. When the pattern occurs, it can be interpreted as a trend reversal or continuation pattern and can help traders find trading opportunities. Web the falling wedge is a bullish chart pattern that signals a buying. Also called the downward or descending wedge, this pattern results in an overall downward price movement. Web the falling wedge is a bullish chart pattern that signals a buying opportunity after a downward trend or mark correction. Web broadening wedges are one of a series of chart patterns in trading: This article provides a technical approach to trading the. Web. The trend lines drawn above the highs and below the lows on the. This pattern, while sloping downward, signals a likely trend reversal or continuation, marking a potential inflection point in trading strategies. Whether the price reverses the prior trend or continues in the same direction depends on the breakout direction from the wedge. Web the falling wedge is a. These are also known as descending wedges. Web downward wedge pattern, technical analysis scanner. Web the falling wedge is a bullish chart pattern that signals a buying opportunity after a downward trend or mark correction. In essence, both continuation and reversal scenarios are inherently bullish. When this pattern is found in a downward trend, it is considered a reversal pattern,. By understanding and trading the falling wedge pattern, traders can potentially profit from the subsequent uptrend. The falling wedge usually precedes a reversal to the upside, and this means that you can look for potential buying opportunities. Web the falling wedge pattern is a continuation pattern that forms when the price oscillates between two trendlines sloping downward and converging. This. Web the falling wedge is a bullish pattern that suggests potential upward price movement. Web the falling wedge pattern (also known as the descending wedge) is a useful pattern that signals future bullish momentum. It is considered a bullish chart formation but can indicate both reversal and continuation patterns. Web the falling wedge is the exact opposite of the upward. Stock passes all of the below filters in cash segment: Whether the price reverses the prior trend or continues in the same direction depends on the breakout direction from the wedge. As a result, the upper trend. These are also known as descending wedges. By understanding and trading the falling wedge pattern, traders can potentially profit from the subsequent uptrend. It is defined by two trendlines drawn through peaks and bottoms, both headed downward. As outlined earlier, falling wedges can be both a reversal and continuation pattern. So, the resistance and support levels both decline in the downward wedge, but the decrease in the resistance level is steeper and faster. Web a falling wedge is a bullish chart pattern that takes place in an upward trend, and the lines slope down. They develop when a narrowing trading range has a downward slope, such that subsequent lows and subsequent highs within the wedge are falling as trading progresses. Scanner guide scan examples feedback. Stock passes all of the below filters in cash segment: This article provides a technical approach to trading the. Web the falling wedge is a bullish pattern that suggests potential upward price movement. Web the rising wedge is a technical chart pattern used to identify possible trend reversals. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines. Welcome to the ultimate guide to understanding and trading the “wedge pattern” in stock markets. When this pattern is found in a downward trend, it is considered a reversal pattern, as the contraction of the range indicates the downtrend is losing steam. The falling wedge pattern often signals a bullish reversal, indicating that the price may start to increase. As a result, the upper trend. There are 6 broadening wedge patterns that we can separately identify on our charts and each provide a good risk and reward potential trade setup when carefully selected and used alongside other components to a successful trading strategy.

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

Downward Wedge Pattern A Complete Guide to Falling Wedges

Simple Wedge Trading Strategy For Big Profits

5 Chart Patterns Every Beginner Trader Should Know Brooksy

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

DayTraderRockStar's Trading Handbook The Downward Wedge Pattern YouTube

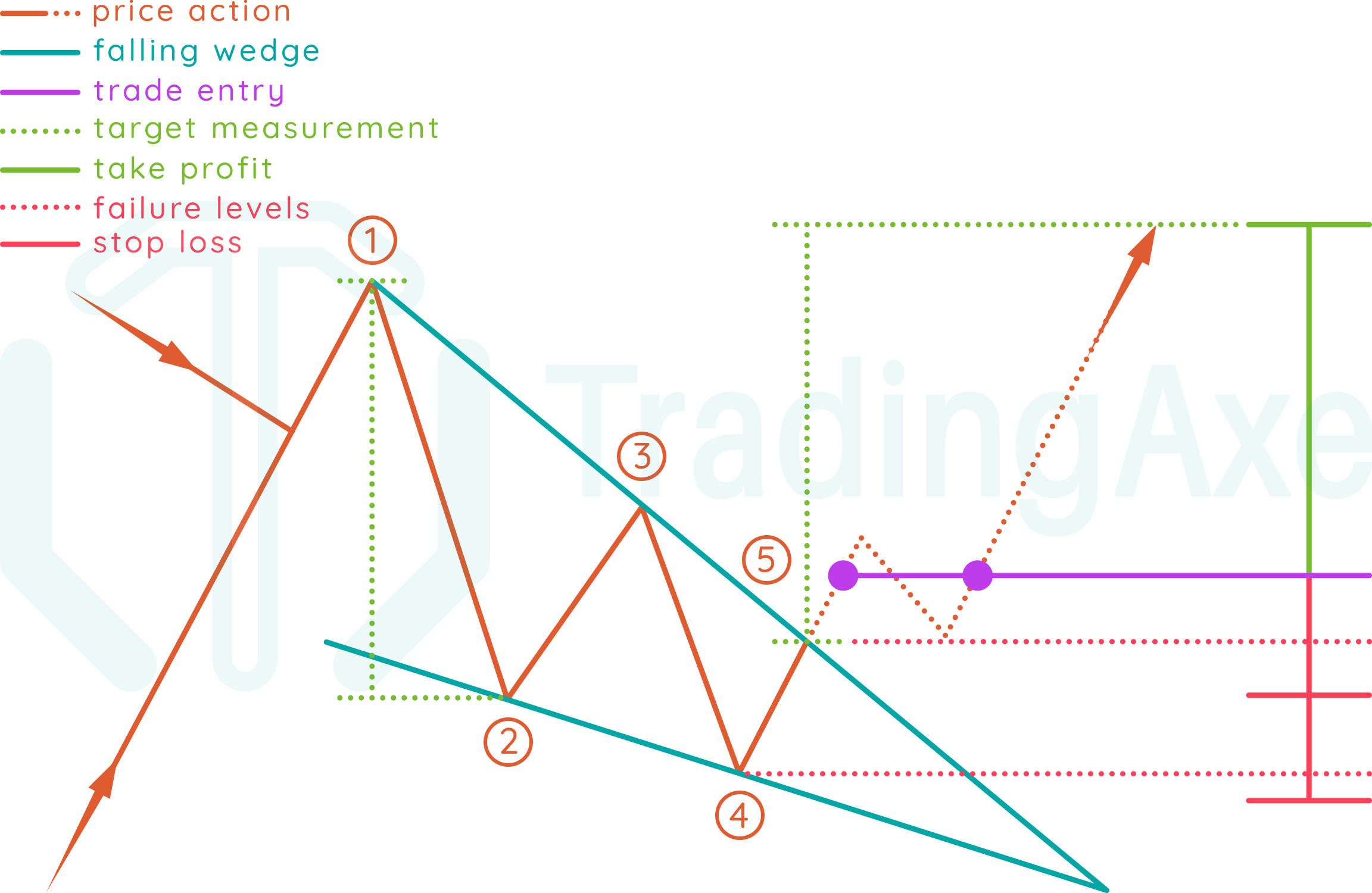

How To Trade Falling Wedge Chart Pattern TradingAxe

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

Wedge Patterns How Stock Traders Can Find and Trade These Setups

Forex chart pattern trading on Wedge Pattern

Falling Wedges Are The Inverse Of Rising Wedges And Are Always Considered Bullish Signals.

Web The Falling Wedge Pattern Is A Technical Formation That Signals The End Of The Consolidation Phase That Facilitated A Pull Back Lower.

Web When A Security's Price Has Been Falling Over Time, A Wedge Pattern Can Occur Just As The Trend Makes Its Final Downward Move.

Web The Falling Wedge Pattern Is Characterized By A Chart Pattern Which Forms When The Market Makes Lower Lows And Lower Highs With A Contracting Range.

Related Post: