Double Tops Pattern

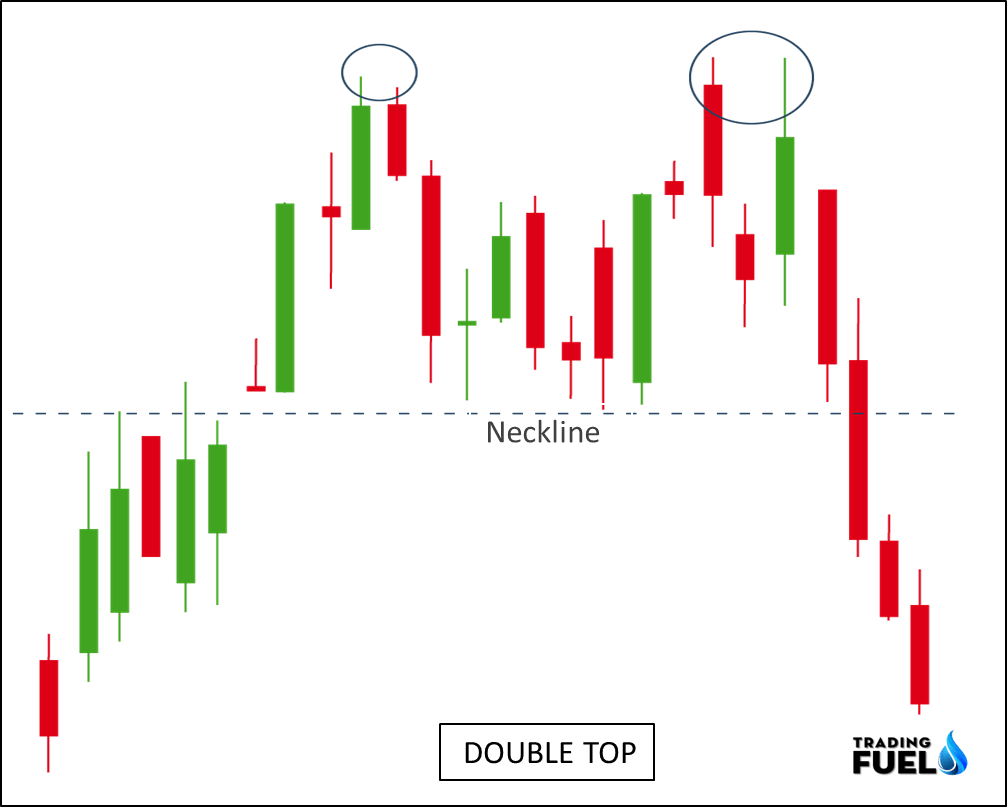

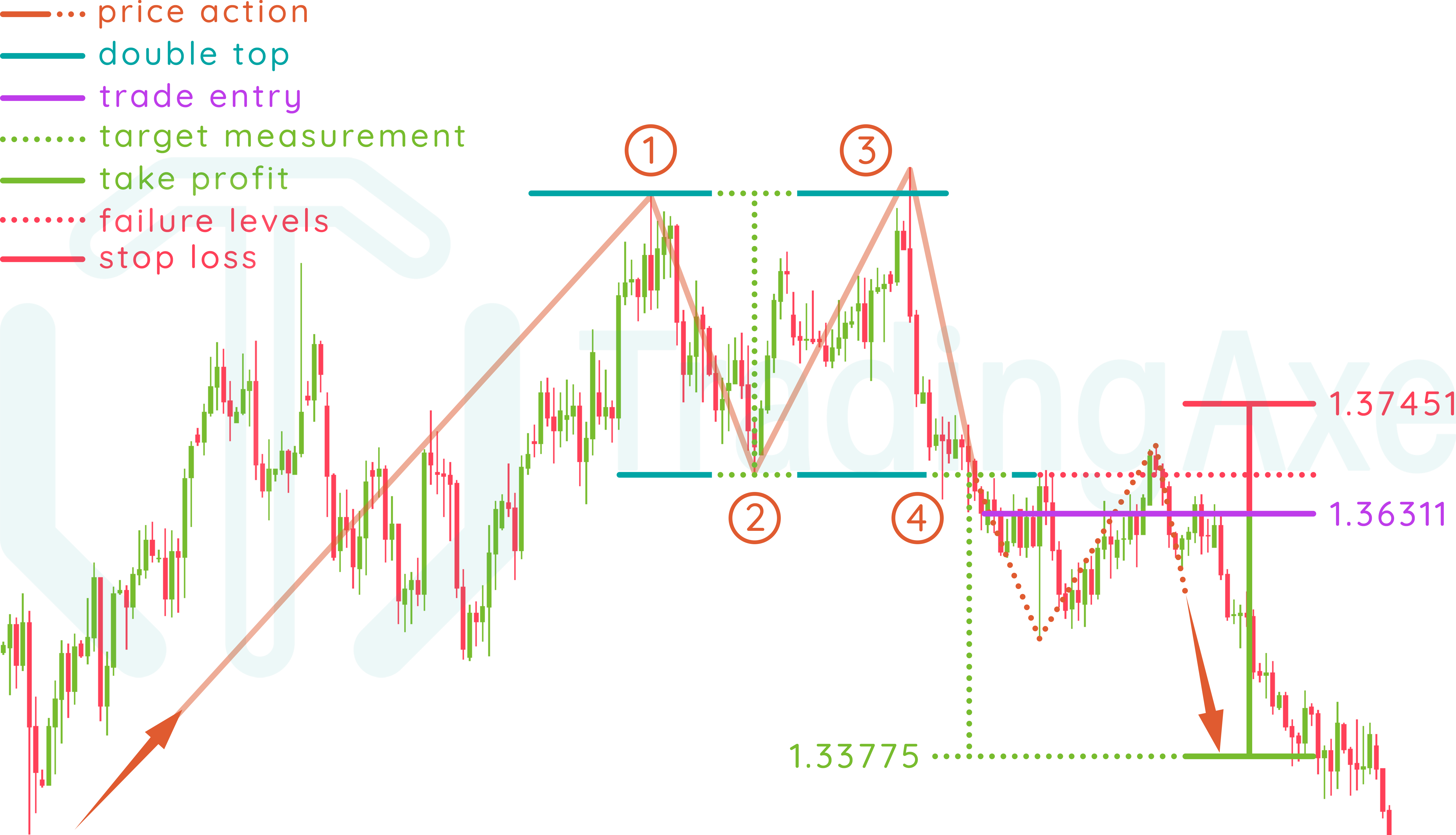

Double Tops Pattern - Rounding tops can often be an indicator for. After hitting this level, the price will bounce off it slightly, but. Once it hits this level, the momentum will shift to bullish once again to form the second peak. Web the double top reversal is a bearish reversal pattern typically found on bar charts, line charts, and candlestick charts. Although these patterns appear almost daily, successfully identifying and trading the patterns is no easy task. Unlike the double bottom formation that looks like the letter “w”, the double top chart pattern. Web a double top is a frequently occurring chart pattern that signals a bearish trend reversal, usually at the end of an uptrend. White bridal satin, pink organza (fabric wholesale direct). The double top pattern is formed when two peaks are formed at approximately the same level and the price closes below this level on two consecutive occasions. Web a double top pattern consists of several candlesticks that form two peaks or resistance levels that are either equal or near equal height. Both consist of three reversal points; This double top pattern is formed with two peaks above a support level which is also known as the neckline. Double top comprises two peaks of nearly the same size and a bottom between them, hence the name of the pattern. White bridal satin, pink organza (fabric wholesale direct). So if you’re ready to. Web double top pattern. There are a few requirements to classify a chart pattern as a double top: Web the double top reversal is a bearish reversal pattern typically found on bar charts, line charts, and candlestick charts. Double top and bottom patterns are chart patterns that occur when the underlying investment moves in a similar pattern to the letter. Web double top and double bottom are reversal chart patterns observed in the technical analysis of financial trading markets of stocks, commodities, currencies, and other assets. There are a few requirements to classify a chart pattern as a double top: Web the double top is a chart pattern with two swing highs very close in price. This pattern is formed. The double top pattern is formed when two peaks are formed at approximately the same level and the price closes below this level on two consecutive occasions. A double top pattern is formed from two consecutive rounding tops. A double top is an extremely bearish technical reversal pattern that forms after an asset reaches a high price two consecutive times.. A double top pattern means that the market may reverse from bullish price action to bearish price action. This double top pattern is formed with two peaks above a support level which is also known as the neckline. Equal distance in terms of time between highs; Typically, when the second peak forms, it can’t break above the first peak and. Double top comprises two peaks of nearly the same size and a bottom between them, hence the name of the pattern. Web trading double tops and double bottoms is a common strategy in technical analysis used by traders to identify potential trend reversal points in financial markets. Web the double top reversal is a bearish reversal pattern typically found on. Double top and bottom patterns are chart patterns that occur when the underlying investment moves in a similar pattern to the letter w. A double top pattern means that the market may reverse from bullish price action to bearish price action. 166k views 2 years ago the moving average. These formations consist of two tops at nearly the same level. Usually, a double top pattern indicates a potential reversal in an upward trend. So if you’re ready to trade double tops like a pro, you’re going to love this post. Both consist of three reversal points; Web a double top is a frequently occurring chart pattern that signals a bearish trend reversal, usually at the end of an uptrend. A. Web a double top pattern is a bearish pattern indicating downward market prices, increasing bearish momentum, and declining bullish momentum. Web a double top is a frequently occurring chart pattern that signals a bearish trend reversal, usually at the end of an uptrend. Web double top patterns are noteworthy technical trading structures to learn and integrate into a trader’s arsenal.. Web double tops and double bottoms are no exception. Once it hits this level, the momentum will shift to bullish once again to form the second peak. Web investopedia / laura porter. What does a double top pattern mean in technical analysis? The double top and its counterpart, double bottom, seem to be the simplest formations. Unlike the double bottom formation that looks like the letter “w”, the double top chart pattern. Double top comprises two peaks of nearly the same size and a bottom between them, hence the name of the pattern. The first peak will come immediately after a strong bullish trend, and it will retrace to the neckline. Two peaks that are near equal in price; Rounding tops can often be an indicator for. The “tops” are peaks that are formed when the price hits a certain level that can’t be broken. Web a double top is a frequently occurring chart pattern that signals a bearish trend reversal, usually at the end of an uptrend. 166k views 2 years ago the moving average. Both consist of three reversal points; There are a few requirements to classify a chart pattern as a double top: Web the double top is a chart pattern with two swing highs very close in price. Web the double top pattern is a bearish reversal pattern that can be observed at the top of an uptrend and signals an impending reversal. Today i’m going to show you exactly how to trade double top chart patterns, including how to determine targets. Web the double top reversal is a bearish reversal pattern typically found on bar charts, line charts, and candlestick charts. Web the double top is a very popular trading pattern which generally leads to a bearish reversal after a bullish trend or correction ends. A double top pattern is formed from two consecutive rounding tops.

The Double Top Trading Strategy Guide

Double Top Pattern A Forex Trader’s Guide

Double Top Pattern Definition How to Trade Double Tops & Bottoms?

Double top patterns are some of the most common price patterns that

Double Top Pattern Definition How to Trade Double Tops & Bottoms?

Double Top Pattern Your Complete Guide To Consistent Profits

Double Top Pattern Your Complete Guide To Consistent Profits

Double Top Pattern Your Complete Guide To Consistent Profits

What Is A Double Top Pattern? How To Trade Effectively With It

How To Trade Double Top Chart Pattern TradingAxe

You’re In The Right Place.

Web Double Top Pattern.

Want To Trade Double Top Patterns For Consistent Profits?

After Hitting This Level, The Price Will Bounce Off It Slightly, But.

Related Post: