Double Top Stock Pattern

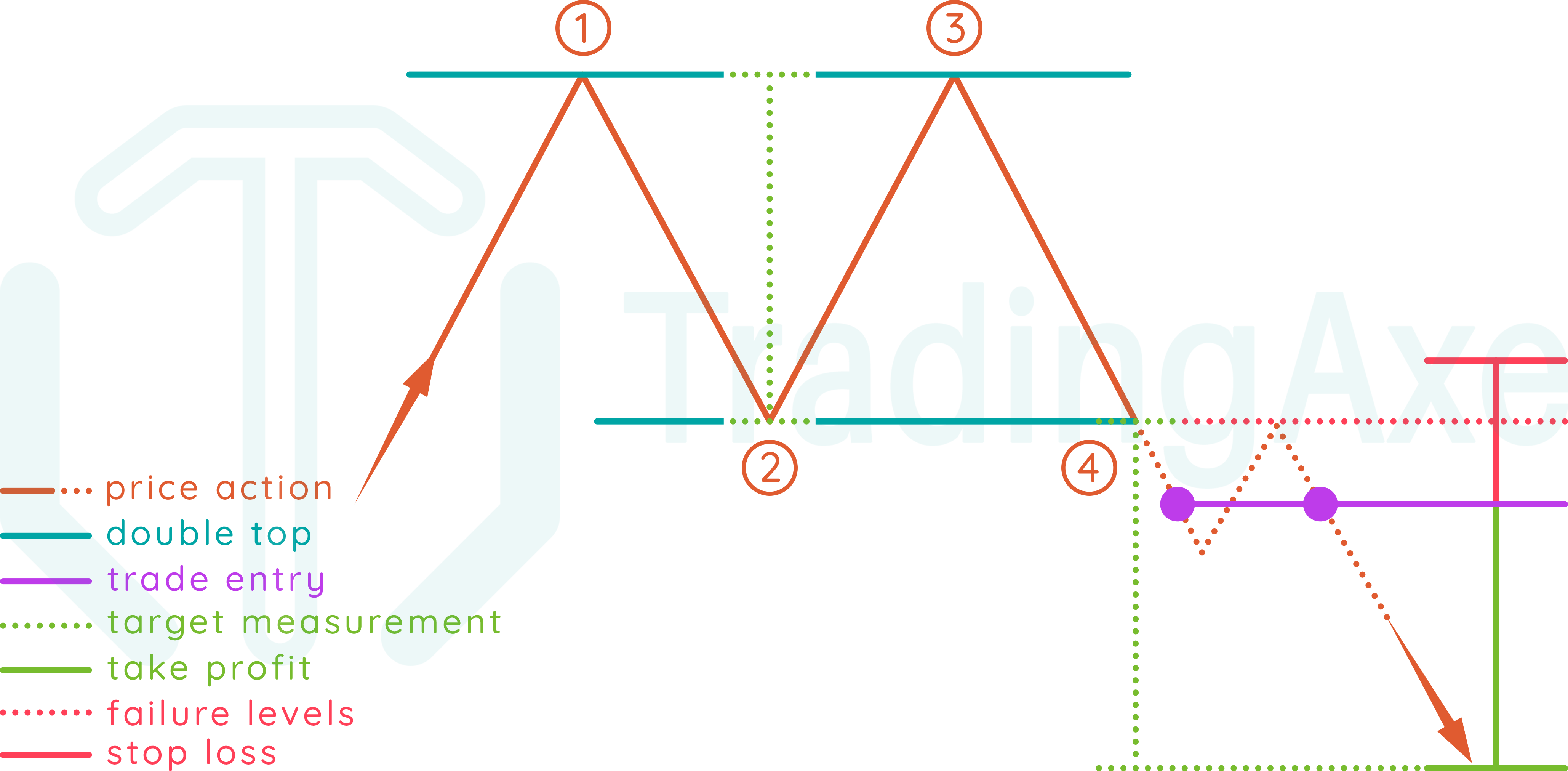

Double Top Stock Pattern - Web explore the mechanics of a stock double top pattern and learn how it can signal potential shifts in market trends for strategic trading decisions. Two bearish patterns within a big structure could signal a big move to the downside. Double top pattern, which looks like the letter ‘m’, is a signal of upcoming prolonged bearish trend. Web double tops a double top is a bearish reversal pattern, typically found when an uptrend returns back to a prior peak. Web a double top pattern consists of several candlesticks that form two peaks or resistance levels that are either equal or near equal height. Typically, when the second peak forms, it can’t break above the first peak and causes a double top failure. Web a double top is a chart pattern characterized by two price highs that are rejected by a resistance level, signaling a potential bearish reversal trend. These levels act as a resistance level. Protradingart updated jul 10, 2023. Remember to check in tomorrow morning for more amazing creations, and be sure to stock up on your favorite patterns during our wedding week sale! Web explore the mechanics of a stock double top pattern and learn how it can signal potential shifts in market trends for strategic trading decisions. Typically, when the second peak forms, it can’t break above the first peak and causes a double top failure. It signifies a potential turning point or resistance level and could potentially reverse in. Any reversal. Web a double top is an extremely bearish technical reversal pattern that forms after a stock makes two consecutive peaks. The formation shows the 2 major high's of the stock over a period, from where it previously saw selling pressure. Two bearish patterns within a big structure could signal a big move to the downside. Web the dual top pattern. Web double top helps to know the immediate resistance level for a stock. Web double top pattern is an bearish signal in technical analysis whereas double bottom is a bullish setup. Web a double top pattern is a bearish pattern in technical analysis that signals a bearish reversal of an uptrend. Web double top is a bearish reversal chart pattern. Web a double bottom pattern consists of three parts: Web the double top is a very popular trading pattern which generally leads to a bearish reversal after a bullish trend or correction ends. A double top or bottom is another reversal pattern, which is common and easily recognized. A measured decline in price will occur between the two high points,.. Uncover the power of trading both double tops and. Web the dual top pattern is a popular technical analysis pattern that can signal a potential trend reversal. The pattern is formed by two price minima separated by local peak defining the neck line. It signifies a potential turning point or resistance level and could potentially reverse in. Entry selection /. Web double tops and bottoms are important technical analysis patterns used by traders. Double top pattern, which looks like the letter ‘m’, is a signal of upcoming prolonged bearish trend. Educational ideas 40 scripts 9. Its formation, characterized by two peaks and a neckline, indicates a potential shift in trend from bullish to bearish. See how to set price targets. Web double tops and bottoms are important technical analysis patterns used by traders. Mara double top + bear flag. These formations consist of two tops at nearly the same level with a valley or through. A measured decline in price will occur between the two high points,. Web a double top pattern consists of several candlesticks that form two peaks. Web a double top pattern is a bearish pattern in technical analysis that signals a bearish reversal of an uptrend. After a strong downtrend, the market bounces higher. Traders typically look for the price to close below the confirmation line, accompanied by an increase in volume, before initiating a sell signal. Web a double bottom pattern consists of three parts:. It signifies a potential turning point or resistance level and could potentially reverse in. Protradingart updated jul 10, 2023. A double bottom has a 'w' shape. Mara double top + bear flag. Web double top pattern is an bearish signal in technical analysis whereas double bottom is a bullish setup. Web a double top is an extremely bearish technical reversal pattern that forms after a stock makes two consecutive peaks. * a prior uptrend sets a new high, usually on increased volume. Usually, a double top pattern indicates a potential reversal in an upward trend. The pattern is formed by two price minima separated by local peak defining the neck. Web a double bottom pattern consists of three parts: These formations consist of two tops at nearly the same level with a valley or through. Mara double top + bear flag. Double top pattern, which looks like the letter ‘m’, is a signal of upcoming prolonged bearish trend. * a prior uptrend sets a new high, usually on increased volume. This chart pattern occurs after an extended price increase in financial markets and consists of two swing high peaks at approximately the same price level, separated by a temporary trough or pullback. Web a double top is a chart pattern characterized by two price highs that are rejected by a resistance level, signaling a potential bearish reversal trend. Web double top helps to know the immediate resistance level for a stock. See how to set price targets and minimize your trade risks with proper stops and money management. It signifies a potential turning point or resistance level and could potentially reverse in. A measured decline in price will occur between the two high points,. Web learn how to identify and trade the double top chart pattern. Uncover the power of trading both double tops and. Web double top is a bearish reversal chart pattern that occurs after a stock reaches similar high prices in two sessions with a drop in price in between. Typically, when the second peak forms, it can’t break above the first peak and causes a double top failure. Traders typically look for the price to close below the confirmation line, accompanied by an increase in volume, before initiating a sell signal.

How to Identify a Double Top Stock Chart Pattern? StockManiacs

Double Top Pattern Definition How to Trade Double Tops & Bottoms?

Double Top Pattern Your Complete Guide To Consistent Profits

Double Top Chart Pattern Profit and Stocks

The Double Top Trading Strategy Guide

:max_bytes(150000):strip_icc()/dotdash_Final_Double_Top_Definition_Oct_2020-02-24bead3ae99c4462b24745f285bb6515.jpg)

Double Top Definition, Patterns, and Use in Trading

What Is A Double Top Pattern? How To Trade Effectively With It

How To Trade Double Top Chart Pattern TradingAxe

What Is A Double Top Pattern? How To Trade Effectively With It

Double Top Pattern A Forex Trader’s Guide

A Double Top Has An 'M' Shape And Indicates A Bearish Reversal In Trend.

A Double Top Or Bottom Is Another Reversal Pattern, Which Is Common And Easily Recognized.

Web Your Ultimate Guide For Double Top Pattern Trading.

Web Double Top Pattern Is An Bearish Signal In Technical Analysis Whereas Double Bottom Is A Bullish Setup.

Related Post: