Double Top Pattern Meaning

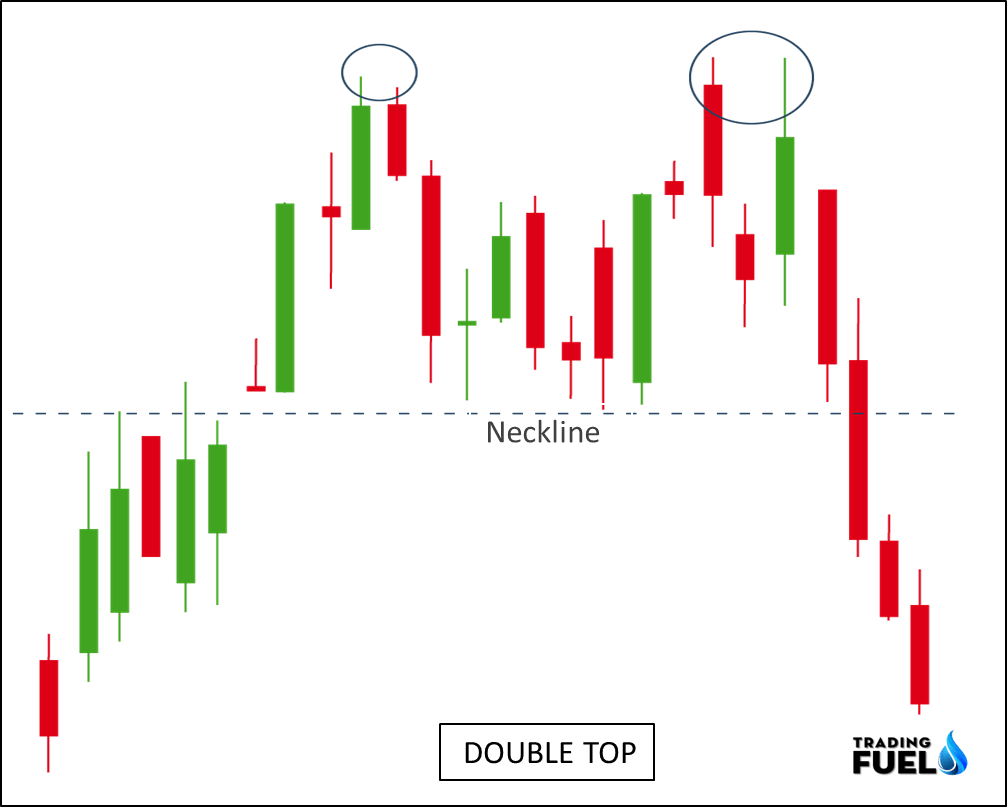

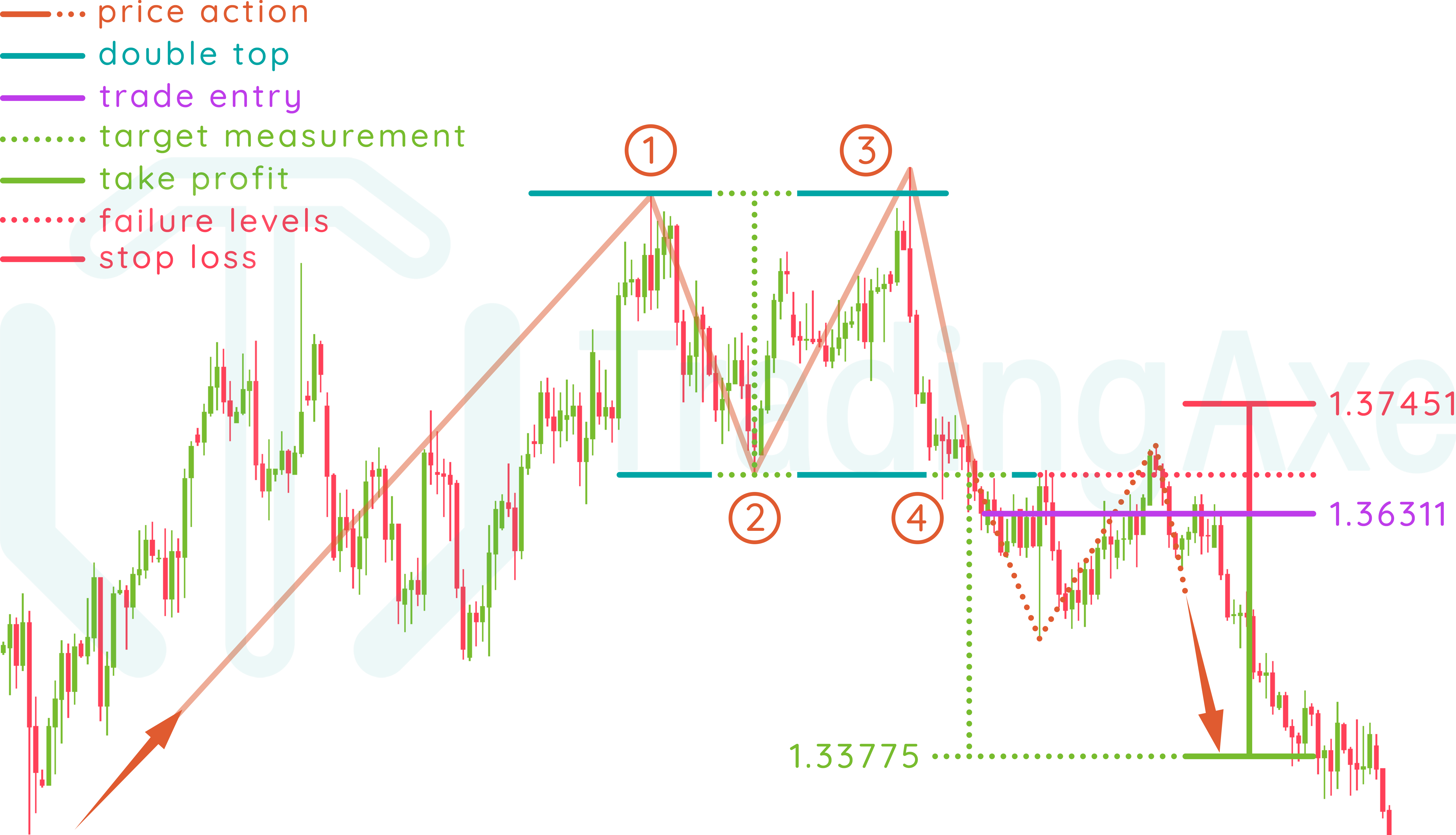

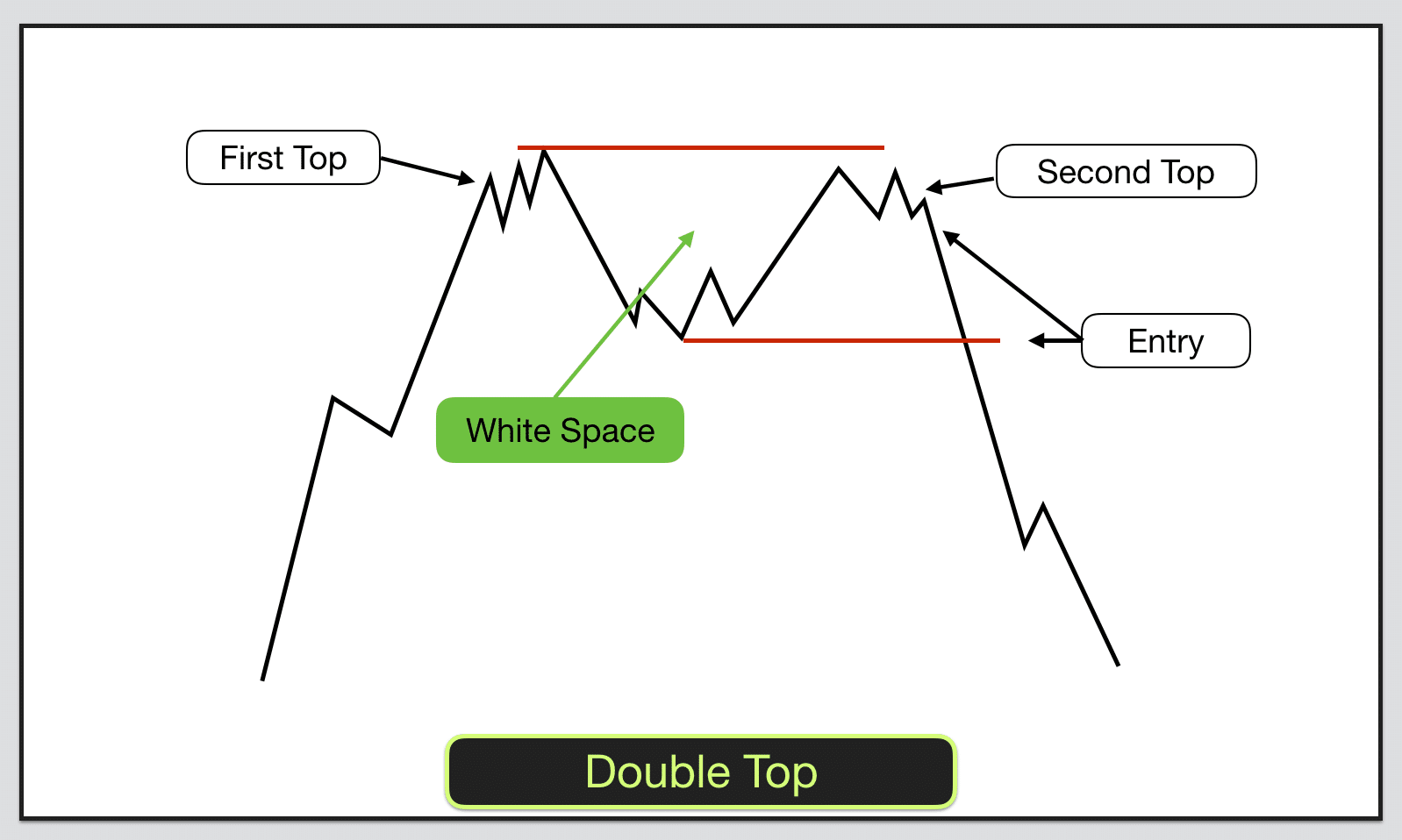

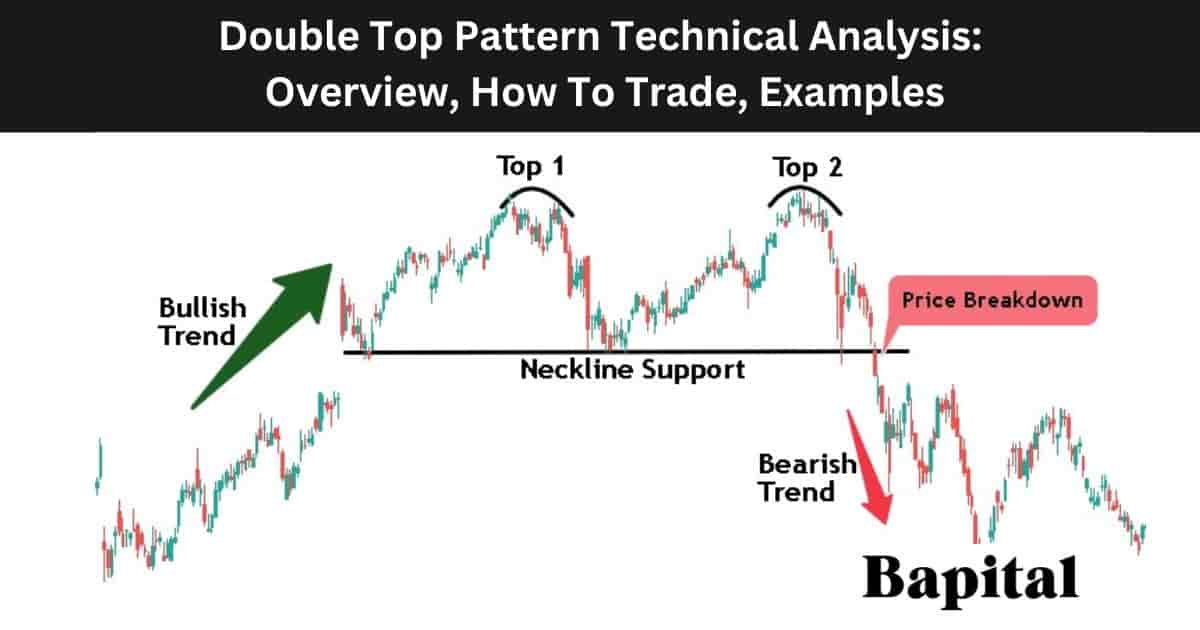

Double Top Pattern Meaning - Traders typically look for the price to close below the confirmation line, accompanied by an increase in volume, before initiating a sell signal. Between these two peaks, the price declines, which creates a support level or neckline. Once it hits this level, the momentum will shift to bullish once again to form the second peak. What does a double top pattern mean in technical analysis? Those two peaks form a key resistance level, whereas the middle trough can be supported. There are a few requirements to classify a chart pattern as a double top: Usually, a double bottom pattern signals a. The “tops” are peaks that are formed when the price hits a certain level that can’t be broken. Web the double top is a very popular trading pattern which generally leads to a bearish reversal after a bullish trend or correction ends. Web a double top is an extremely bearish technical reversal pattern that forms after an asset reaches a high price two consecutive times with a moderate. Equal distance in terms of time between highs; A double bottom has a. Volume decreases on the second top Web a double top pattern is a bearish price reversal that signals the end of a bullish market. It visually represents a period in the market where the price hits a certain high twice, but fails to break through this resistance. A double bottom has a. Web the double top pattern shows that demand is outpacing supply (buyers predominate) up to the first top, causing prices to rise. The double top pattern entails two high points within a market which signifies an impending bearish reversal. Web a double top is a common bearish reversal chart pattern used in technical analysis. Web. Web a double bottom pattern is a stock chart formation used in technical analysis for identifying and executing profitable trades, commonly to trade stocks, forex markets, or cryptocurrencies. A double bottom has a. Web trading double tops and double bottoms is a common strategy in technical analysis used by traders to identify potential trend reversal points in financial markets. Learn. A double top has an 'm' shape and indicates a bearish reversal in trend. Volume decreases on the second top This pattern is formed when the price of an asset reaches a resistance level twice and fails to break above it. It is considered one of the most reliable and widely recognised chart patterns traders and investors. Web a double. The “tops” are peaks that are formed when the price hits a certain level that can’t be broken. Double tops are popular patterns found on all time frames of charts. Web the double top is a chart pattern with two swing highs very close in price. A double bottom has a. Supply outpaces demand (sellers predominate), causing prices to fall. Definition, patterns, and use in trading a double top is an extremely bearish technical reversal pattern that forms after a stock makes two consecutive. Web the double top is a chart pattern with two swing highs very close in price. Web the double top reversal is a bearish reversal pattern typically found on bar charts, line charts, and candlestick charts.. It visually represents a period in the market where the price hits a certain high twice, but fails to break through this resistance level. A double bottom has a. Two peaks that are near equal in price; The “tops” are peaks that are formed when the price hits a certain level that can’t be broken. The double top pattern entails. After hitting this level, the price will bounce off it slightly, but. Web a double top pattern is a technical chart pattern that is commonly used to analyse price movements in the financial markets. Web this pattern, characterized by two consecutive peaks with a trough in between, is a powerful indicator of a potential trend reversal. Web trading double tops. Two peaks that are near equal in price; Web a double top is a frequently occurring chart pattern that signals a bearish trend reversal, usually at the end of an uptrend. What is a double top? Web a double top is a bearish reversal trading pattern. Double tops are popular patterns found on all time frames of charts. Two peaks that are near equal in price; Between these two peaks, the price declines, which creates a support level or neckline. Double tops and bottoms are important technical analysis patterns used by traders. Those two peaks form a key resistance level, whereas the middle trough can be supported. Double top pattern, which looks like the letter ‘m’, is a. It is considered one of the most reliable and widely recognised chart patterns traders and investors. Web a double top pattern is a technical chart pattern that is commonly used to analyse price movements in the financial markets. Between these two peaks, the price declines, which creates a support level or neckline. Web double top is a bearish reversal chart pattern that occurs after a stock reaches similar high prices in two sessions with a drop in price in between. Supply outpaces demand (sellers predominate), causing prices to fall. The first peak will come immediately after a strong bullish trend, and it will retrace to the neckline. A double top has an 'm' shape and indicates a bearish reversal in trend. After hitting this level, the price will bounce off it slightly, but. It visually represents a period in the market where the price hits a certain high twice, but fails to break through this resistance level. By understanding the nuances of the. Double tops are popular patterns found on all time frames of charts. Web a double top is a bearish reversal trading pattern. This pattern is formed when the price of an asset reaches a resistance level twice and fails to break above it. What does a double top pattern mean in technical analysis? Definition, patterns, and use in trading a double top is an extremely bearish technical reversal pattern that forms after a stock makes two consecutive. Once it hits this level, the momentum will shift to bullish once again to form the second peak.

Double Top Pattern A Forex Trader’s Guide

Double Top Pattern Definition How to Trade Double Tops & Bottoms?

Double Top Pattern Definition How to Trade Double Tops & Bottoms?

How To Trade Double Top Chart Pattern TradingAxe

Double Top Pattern Explained for Forex Traders

What Is A Double Top Pattern? How To Trade Effectively With It

Double Top Pattern Meaning, Examples & How To Trade

Double top patterns are some of the most common price patterns that

Double Top Pattern Your Complete Guide To Consistent Profits

Double Top Pattern Your Complete Guide To Consistent Profits

A Double Top Pattern Means That The Market May Reverse From Bullish Price Action To Bearish Price Action.

Web A Double Bottom Pattern Is A Stock Chart Formation Used In Technical Analysis For Identifying And Executing Profitable Trades, Commonly To Trade Stocks, Forex Markets, Or Cryptocurrencies.

Usually, A Double Bottom Pattern Signals A.

The Double Top Pattern Entails Two High Points Within A Market Which Signifies An Impending Bearish Reversal.

Related Post: